Table Of Contents

Formula to Calculate Book Value of a Company

The Book Value formula calculates the company's net asset derived by the total assets minus the total liabilities. Alternatively, Book Value can be calculated as the total of the overall Shareholder Equity of the company.

It can be defined as the net asset value of the firm or company that can be calculated as total assets, less intangible assets (goodwill, patents, etc.), and liabilities. Further, Book Value Per Share (BVPS) can be computed based on the equity of the common shareholders in the company.

Book Value = (Total Common Shareholders Equity – Preferred Stock) /Number of Outstanding Common Shares.

How to Calculate Book Value?

The formula states that the numerator part is what the firm receives by the issuance of common equity. That figure increases or decreases depending upon whether the company is making a profit or loss, and then finally, it decreases by issuing dividends and preference stock.

The 1st part will be to find the equity available to its common shareholders. One can question why we’re deducting the preferred stock in the above formula for computing book value per share and average outstanding common stock. The reason for deducting preferred stock from the common equity shareholders is that preferred shareholders are paid before common shareholders, but only after the companies' debts are cleared off.

Book Value for the firm = Shareholders Common Equity – Preference Stock

And on the other hand

Shareholder’s common equity = Total Assets – Total Liabilities;

The 2nd part divides the shareholders' common equity, which is available to the equity shareholders by the unprecedented number of common equity shares.

Book Value Formula Video Explanation

Examples

Example #1

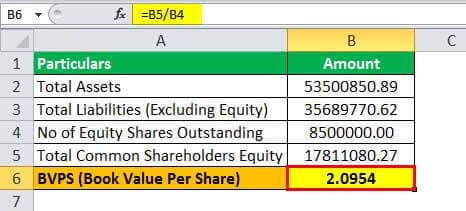

Common Equity ltd reports below the number at the closure of its annual books of account. You are required to compute BVPS.

Solution:

First, we need to find out shareholder's equity which is the difference between Total Assets and Liabilities, which is 53,500,850.89 – 35,689,770.62 = 17,811,080.27

Therefore, the calculation of book value per share is as follows,

BVPS = Total Common shareholders equity – Preferred Stock / Number of outstanding common shares

= 17,811,080.27 /8,500,000.00

BVPS will be –

Example #2 - (SBI BANK)

SBI is one of the leading lenders in India. Vivek, an equity analyst, wants to consider SBI in its portfolio. Suresh recently joined as an intern under Vivek and carried a passion for research. Vivek asks him to compute P/BVPS for SBI and then compare peer-to-peer. The price of its SBI share is 308.

NOTE: Use the BVPS formula and divide the price by this result.

Solution:

First, we need to find out shareholders equity which is difference of Total Assets and Liabilities (borrowings + other liabilities) which is 36,16,433.00 – (30,91,257.62 + 3,19,701.42) = 2,05,473.96 cr

Therefore, the calculation of book value per share will be as follows,

BVPS = Total Common Shareholders Equity – Preferred Stock / Number of Outstanding Common Shares

= 2,05,473.96 cr/ 892.54 cr

BVPS will be -

P/BVPS will be -

Example #3

Shruti has invested all these years in reliance industries, and now after taking over Hamleys, one of the leading toy store chains, she is curious as to what was the purpose behind it. She anticipates that this could reduce the value of Reliance as it completes an unrelated and unanticipated activity that Reliance has done.

Below is the extract from Reliance industries for March 2018, and she wants to calculate the first book value of Reliance to know what impact Hamleys could create?

Solution

First, we need to find out shareholders equity which is difference of Total Assets and Liabilities (borrowings + other liabilities) which is 8,23,907.00 – (2,39,843.00 + 2,90,573.00) = 2,93,491 cr

Also, we can add Equity Share capital and Reserves to get shareholder's equity which is 5,922 cr + 2,87,569 cr, which will sum to 2,93,491 cr.

Therefore, the calculation of book value per share will be as follows,

BVPS= Total Common shareholders equity – Preferred Stock/Number of outstanding common shares

= 2,93,491.00 cr /592.18 cr

Book Value Per Share will be –

BVPS= 495.61

Relevance and Uses

As the accounting value of a company, book value can have two core uses:

- It shall serve as the total value of the firm's or company's assets that stockholders would theoretically receive if the firm or the company were to be liquidated.

- When a comparison is performed to the company's market value or market price, book value can be a good indicator to equity analysts of whether the stock price is overpriced – or underpriced.

Hence, the investor needs to have looked upon both the book value or the book price of the company as well as the market price of the stock and then decide on the company's worthiness.