Table Of Contents

Types

Let us look at the different types of bonus issues.

- Partly paid – There are some types of shares for which the investors make a partial payment. Then, they can pay the remaining amount in installments after the company calls for it. However, bonus shares are applied to such partly paid claims by converting them into fully paid. Such bonus shares are issued from general reserve, investment allowance reserve and development rebate reserve.

- Fully paid – They are give to existing shareholders in proportion to their holdings without any extra cost. They are issued from the investment allowance reserve, capital redemption reserve and profit and loss account.

Examples

Below are examples of bonus shares.

Example #1

Suppose a company equity account in balance sheet looks like this before bonus issue:

- Ordinary Shares 1,000,000 at $1 each = $1,000,000

- Share Premium Account = $500,000

- Retained Profit = $1,500,000

Let us understand the bonus share calculation in such a case. The company decided to give a 1:5 bonus, meaning shareholders will receive 1 share out of 5. So, in total new bonus shares issues will be 1,000,000/5 = 200,000

Total new share capital = 200,000*1 = $200,000

This $200,000 would be deducted from the Share Premium Account.

So new equity account after the bonus issue will look like below:

- Ordinary Shares 1,200,000 at $1 each = $1,200,000

- Share Premium Account = $300,000

- Retained Profit = $1,500,000

Example #2

Here is another example to understand the bonus share calculation.

Suppose company A’s equity account in balance Sheet looks like below before issuing bonus:

- Ordinary Shares 1,000,000 at $1 each = $1,000,000

- Share Premium Account = $500,000

- Retained Profit = $1,500,000

The company decided to give a 1:1 bonus, which means shareholders will receive one share out of each share held. So, in total new bonus issues will be 1,000,000

Total new share capital = 1,000,000*1 = $1,000,000

This $1,000,000 would be deducted from the Share Premium account and retained earnings.

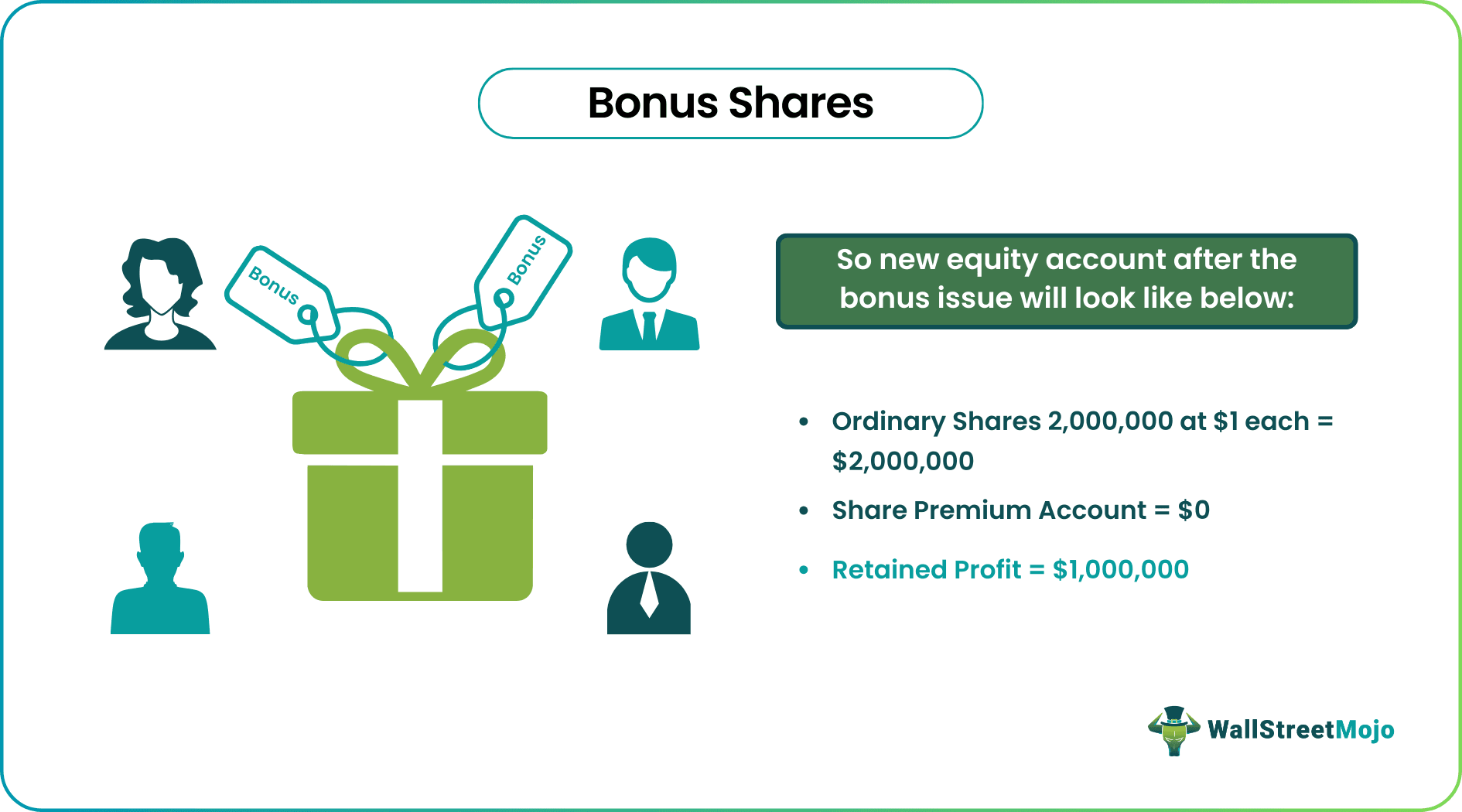

So new equity account after the issue on the bonus share record date will look like the below:

- Ordinary Shares 2,000,000 at $1 each = $2,000,000

- Share Premium Account = $0

- Retained Profit = $1,000,000

Journal Entries

The Company announces bonus share issue in the form of a ratio, i.e., 1:2, this means every Shareholder who has 2 Shares. Hence if a Shareholder has 1,00,000 shares in his account, the Bonus = 1,00,000*1/2 = 50,000. So his total Holding would be 1,00,000 + 50,000 = 1,50,000 of which 50,000 Shares are allotted free of Charge.

In the above case, Let's say if the first 1,00,000 shares have been bought at $10 = 1,00,000*$10 = $1,000,000. Cost of 50,000 Shares = Nil. So Total Cost of 1,50,000 Shares = $10,00,000 thereby reducing the average cost to ~6-6.5 per share.

Below mentioned are some of the Journal Entries that need to be passed after issuing Bonus Shares:

- If the Issue is out of Retained Earnings (Face Value = $1)

- If the issue is out of Security Premium A/c

- Entries to be passed by the Shareholders in their Books of Accounts:

No Entries need to be passed. Just increase in the Holdings of the Shares with a Nil Costing. The Investor will show his Investments at the same value, but his average Cost of the Acquisition will decrease drastically since the Bonus shares are allotted free of charge.

Advantages

Here are some bonus share benefits for the company and shareholders.

- Companies with low cash also can issue bonus shares instead of cash dividends.

- Company’s share capital size increases by issuing bonuses.

- It reduces the risk of allocating the retained profit into some loss-making projects.

- It increases liquidity, and thus shares price may increase following bonus issues.

- It boosts confidence among investors.

- If companies issue dividends, shareholders will have to pay tax on those dividends, but they need not pay tax on the bonus shares until they sell them.

Disadvantages

Apart from bonus share benefits, let us look at its disadvantages.

- This does not generate any cash, but a total number of outstanding share capital increases; thus, if the company issues dividends in the future, then the dividend per share reduces.

- There can be the issue of overcapitalization because of a greater number of shares.

- This is taken out of retained earnings. This retained earnings could be used for any new acquisition or a profit-making project, which could increase shareholders’ wealth.

Bonus Issue Vs Right Issue

- Right issues are for existing shareholders by raising additional capital by a corporation. These are to be issued from additional reserves and retained earnings.

- The right issue is issued to pump up additional capital, while bonus shares are issued as a gift to shareholders.

- Right shares are usually issued at a lower rate than the market, while bonus shares are issued at a proportion of originally issued shares and are free of cost.

Recommended Articles

This has a guide to what are Bonus Shares. We explain them with examples, journal entries, advantages, disadvantages & differences with right shares. You can learn more about from the following articles –