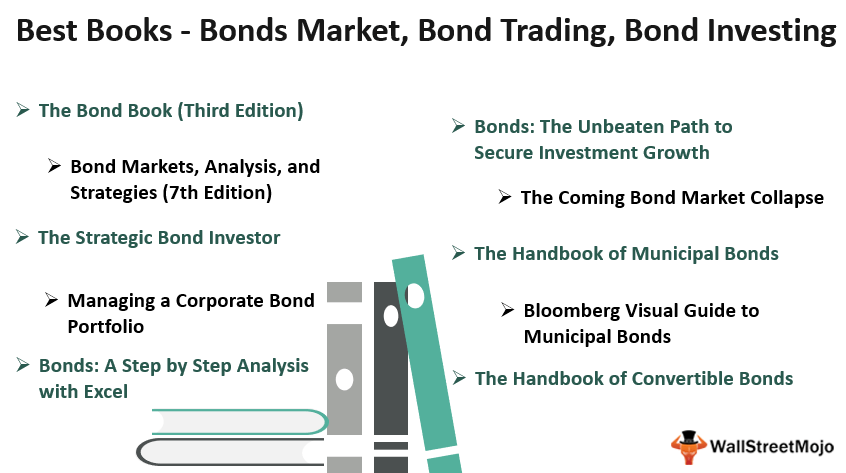

Best Books on Bonds Market, Bond Trading, Bond Investing

List of Top Books on Bonds Market, Trading and Investing

Here is the list of the top 10 best books on bond investing, bond markets, and trading.

- The Bond Book (Third Edition) ( Get this book )

- Bond Markets, Analysis, and Strategies (7th Edition) ( Get this book )

- The Strategic Bond Investor ( Get this book )

- Managing a Corporate Bond Portfolio ( Get this book )

- Bonds: A Step by Step Analysis with Excel ( Get this book )

- Bonds: The Unbeaten Path to Secure Investment Growth ( Get this book )

- The Handbook of Municipal Bonds ( Get this book )

- The Coming Bond Market Collapse ( Get this book )

- Bloomberg Visual Guide to Municipal Bonds ( Get this book )

- The Handbook of Convertible Bonds ( Get this book )

Let us discuss each of the bonds market, bond trading, and bond investing books in detail, along with its key takeaways and reviews.

#1 - The Bond Book (Third Edition)

by Annette Thau

Bond Trading Book Review

The infamous Global Financial Crisis of 2008 had caused widespread disruptions to every sector of the bond market and had left even the most enthusiastic investor in a spot of bother concerning the safety of their investment. To serve investors and anyone looking to explore opportunities in fixed-income investing, the author, with this guide's help, created this one-stop resource for seasoned bond investors wanting the latest information on the fixed income market and equities investors planning to diversify their holdings.

Also, have a look at What are Bonds?

Key Takeaways from this Top Bond Trading Book

This edition is a must-read for financial advisors who want to enhance the allocation of fixed-income components in their portfolios. It offers cutting-edge strategies for making the best bond investing decisions while explaining how to assess risks and opportunities. In addition, the guide offers vital information on critical topics such as:

- Purchase of individual bonds or bond funds

- Buying of treasuries without the involvement of any commission

- How to tackle the timing of open-end funds, close-ended funds, and ETFs

- The Safest Bond Funds

- The modified landscape for Municipal bonds, the changing rating scales, the downfall of bond insurance and Build America Bonds (BABs)

#2 - Bond Markets, Analysis, and Strategies (7th Edition)

by Frank J. Fabozzi

Bond Market Book Review

This book on the bond market prepares various students to analyze the bond markets and manage bond portfolios without getting impacted by the volatility existing in the bond market. The author has conducted several discussions and conversations with portfolio managers and analysts to ensure the latest information and observations have been covered in this edition.

It includes a detailed analysis of various bonds traded in the market and other essential information on the functioning of such bonds. This guide also exhibits a comprehensive and concise discussion of the instruments involved and their investment characteristics, portfolio strategies for using them, and state-of-art technology for valuation.

Key Takeaways from this Top Bond Market Book

Some of the key topics covered are-

- Detailed coverage of various markets, including MBS (Mortgage-backed securities) and ABS (Asset-backed securities)

- Technologies for valuing complex bond structures.

- Actual bond portfolio management strategies

- Interest Rate Derivatives and their functioning.

- New coverage on the measurement and evaluation of bond performance and valuation of options and swaps.

It explains the latest analytical techniques for the valuation of complex bond structures, bridging theoretical and practical aspects at the trading desks. The objective is to allow the readers and the investors to feel how professional money managers employ strategies with the use of bonds.

#3 - The Strategic Bond Investor

by Anthony Crescenzi

Bond Trading Investing Review

This guide explains how one can maximize their returns with bonds, considered one of the few stable and reliable investments after the Financial crisis. It provides a complete round of education on bond investing, providing the readers with the know-how for safe and dependable investments.

Key Takeaways from this Top Bond Investing Book

Some of the important highlighted contents of this bond investing book are:

- A detailed description of various types of bonds.

- Factual data on how each bond category performs under various environments and circumstances.

- Key economic reports highlighting how market factors can have an impact on the prices of bonds

- Techniques on forecasting the possible moves the Central Bank could take and the impact it could have on bonds, especially government bonds.

- Different ways of using the yield curve and other indicators to predict the market and economy direction.

This book on bond investing describes every tool an investor must know to participate in present bond market extremes, analyze volumes and liquidity, and utilize other techniques restricted to equity and institutional investors.

#4 - Managing a Corporate Bond Portfolio

by Leland E. Crabbe & Frank J. Fabozzi

Bond Trading Book Review

Corporate bond portfolio management is a very dynamic and continuous process. It requires the investors to monitor various market sectors continuously, offering an attractive balance between risk and expected return. Since it's a complex process, the authors have attempted to simplify the same by giving a basic overview of Corporate bond features, including provisions contained in bond indentures, secured and unsecured bonds, and associated interest payments. They also offer a strong foundation for various corporate debt structures of corporate bonds.

Key Takeaways from this Top Bond Trading Book

Some of the benefits offered through an in-depth discussion of corporate bond valuation are:

- A valuation framework and various measures of corporate bond yields and spreads.

- The most current measures of interest rate risk

- Handy formulas display the relationship between spreads and excess returns.

- Strategies that can improve performance by the anticipation of the change in yield spreads and curves.

- A complete, robust understanding of the fundamental factors that drive corporate spreads.

The guide continues its comprehensive treatment of corporate bond portfolio management. In addition, it discusses corporate credit risk issues such as micro fundamentals of credit risk and credit analysis, measuring expected excess returns based on credit rating transition probabilities, and valuing subordinated securities.

#5 - Bonds: A Step by Step Analysis with Excel

by Guillermo L. Dumrauf

Bond Investing Book Review

This book on bond investing is classified into two chapters. The first section describes how to price a bond and calculate various return measures, working with real bond examples and Excel spreadsheets. It describes a step-by-step procedure for designing a cash flow in a spreadsheet to calculate the Yield to Maturity (YTM) and other measures of return as per the bond indenture. One will be able to understand the following aspects:

- Designing the cash flow for a specific investment amount.

- Pricing a real bond to calculate its YTM with the help of Excel.

- Calculate the total return of an investment horizon.

- Perform a sensitivity analysis of Price, Yield, and Total Return

The second section describes two measurements for estimating the volatility of a bond price: duration and convexity.

Key Takeaways from this Top Bond Investing Book

The readers will be able to understand the following:

- A clear understanding of the price-yield relationship of an option-free bond.

- Calculation of Duration, Modified Duration, and convexity of real bonds.

- Comprehend why the duration measures the bond's sensitivity to yield changes.

- Understanding the limitations of using duration as a measure of price volatility and how one can adjust its estimation for the convexity of the bond.

#6 - Bonds: The Unbeaten Path to Secure Investment Growth

by Hildy Richelson and Stan Richelson

Bond Market Book Review

This guide is a must-have for anyone seeking to understand the investment opportunities available to them. The author, a couple in real life, has demystified the stocks' superior investment returns and proposes an all-bond portfolio as a solid strategy ensuring positive returns. Of course, it will only sometimes offer supernormal returns if circumstances offer but will focus on the consistency of returns.

Practical and detailed case studies, in-depth strategies for bond management, and a financial planning overview are exhibited, which can design the timely achievement of financial goals.

Key Takeaways from this Top Bond Market Book

The tactics presented here help the reader determine how bonds can take control of their own financial destiny.

- This edition includes information on corporate bonds, emerging market bonds, municipal bonds, the impact of global ratings, and how to protect against the default of municipal bonds.

- The survival of bonds posts the global financial crisis and how they can protect themselves from such potential threats in the future.

- The suggestions and strategies by established and successful investors to maximize the return on their portfolios while offering the security of the principal.

Thus, it offers a wide spectrum of investment opportunities of bond-investment options and how to get the best of bonds at the most attractive rates, thereby enhancing the performance of a portfolio..

#7 - The Handbook of Municipal Bonds

by Sylvan G. Feldstein and Frank J. Fabozzi

Bond Trading Book Review

The Editors, through this version, provide bankers, traders and advisors, and other industry participants with a well-rounded look at the industry of tax-exempt municipal bonds. These bonds offer attractive opportunities for both institutional and retail investors. First, however, one needs a firm understanding of multiple elements that make up this market to make the most of them.

Key Takeaways from this Top Bond Trading Book

With seven comprehensive parts, this book on bond trading provides detailed explanations and a variety of relevant examples which illuminate crucial components and areas such as:

- The sell-side involves deals, distribution, and market-making roles

- The Buy-Side specific to institutional investors

- Credit Analysis

- Compliance issues

- Fixed income analysis of municipal products

- Special security structures and their analysis

- Bond insurers

In addition to a comprehensive glossary of Municipal bond terminologies, this book on bond trading also includes an extensive array of case studies that offer information on some of these bonds' most essential and innovative aspects. The cases include topics on the 9/11 catastrophe, subprime loans, bankruptcy of a major airline, etc. It also covers other products like CDS, derivatives, tender option bonds, CDO, etc.

#8 - The Coming Bond Market Collapse

by Michael Pento

Bond Market Book Review

The controversial bond market book of 2013 describes how the United States is rapidly approaching the end stage of the biggest asset bubble in history, how it can cause a massive interest rate shock that will send the US consumer economy and the US government (riding on a massive treasury debt) towards bankruptcy sending shockwaves throughout the global economy. This bond market book examines how policies followed by the Federal Reserve and private industries have contributed to the existing interest rate disasters and similarities between the US and European debt crises. The author also provides well-reasoned solutions that the government, industry, and individuals can take to prevent themselves from the impending crisis.

Key Takeaways from this Top Bond Market Book

It explains why retirees, in particular, will be at risk with the decline of real estate prices, weakening of pensions, and burst of the bond bubble. This book offers smooth, necessary information with tested strategies for insulating oneself and tools for thriving financially against a disaster worse than the Great Depression.

#9 - Bloomberg Visual Guide to Municipal Bonds

by Robert Duty

Bond Trading Book Review

This book offers a step-by-step guide to the nature and diversity of municipal securities credit structures. It is a very engaging and informative resource on the "how-to" guide toward municipal securities that will help create more effective investment strategies. There is also a demonstration of the overwhelming dependence on municipal securities pointing to a particular market sector, which can yield fruitful rewards with the proportionate existence of risks. Valuable insights offer to pertain to the differences between corporate and municipal debt. The author has clarified all the miscommunication about muni bond risk while walking through the features of a tax-exempt market.

Key Takeaways from this Top Bond Trading Book

It is a valuable addition to the new Bloomberg visual series directing the readers and offering up-to-date information and new market tools, a by-product of recent market enhancements.

Widely appreciated by the readers, this flow of information is very smooth, permitting the investors to have complete knowledge before progressing to the next topic. In addition, the author has also included many colorful illustrations, including screenshots from a professional Bloomberg financial information system, which all the readers may need access to.

#10 - The Handbook of Convertible Bonds

by Wim Schoutens & Jan De Spiegeleer

Bond Investing Book Review

The authors of one of the most appreciated reading materials in the financial fraternity have magnificently described the pricing techniques and risk management process attached to convertible bonds and portfolios involving them through this book. Of course, these bonds can be complex since they include debt and equity features. However, the book is practical with real-life examples, and the numbers used are not restricted to hypothetical situations. This book is classified into 4 parts.

Key Takeaways from this Top Bond Investing Book

- The primary part covers the impact of the 2007-2008 credit and financial crunch on the markets. It further enhances how to build a convertible bond and introduces readers to various terminologies relating to options and Option Greeks. The market for stock borrowing and lending is also expressed in detail. Further, there is a complete explanation of the different features one can embed in convertible bonds.

- The second section focuses on aspects to consider for the pricing of convertible bonds and the parameters used in valuation models: interest rate, credit spreads, volatility, and maturity.

- The third part highlights the investment strategies for equity, fixed-income, and hedge fund investors, including dynamic hedging and convertible arbitrage.

- The fourth part details all aspects of the risk management process, which is also very critical.