Table Of Contents

What Is Board Diversity?

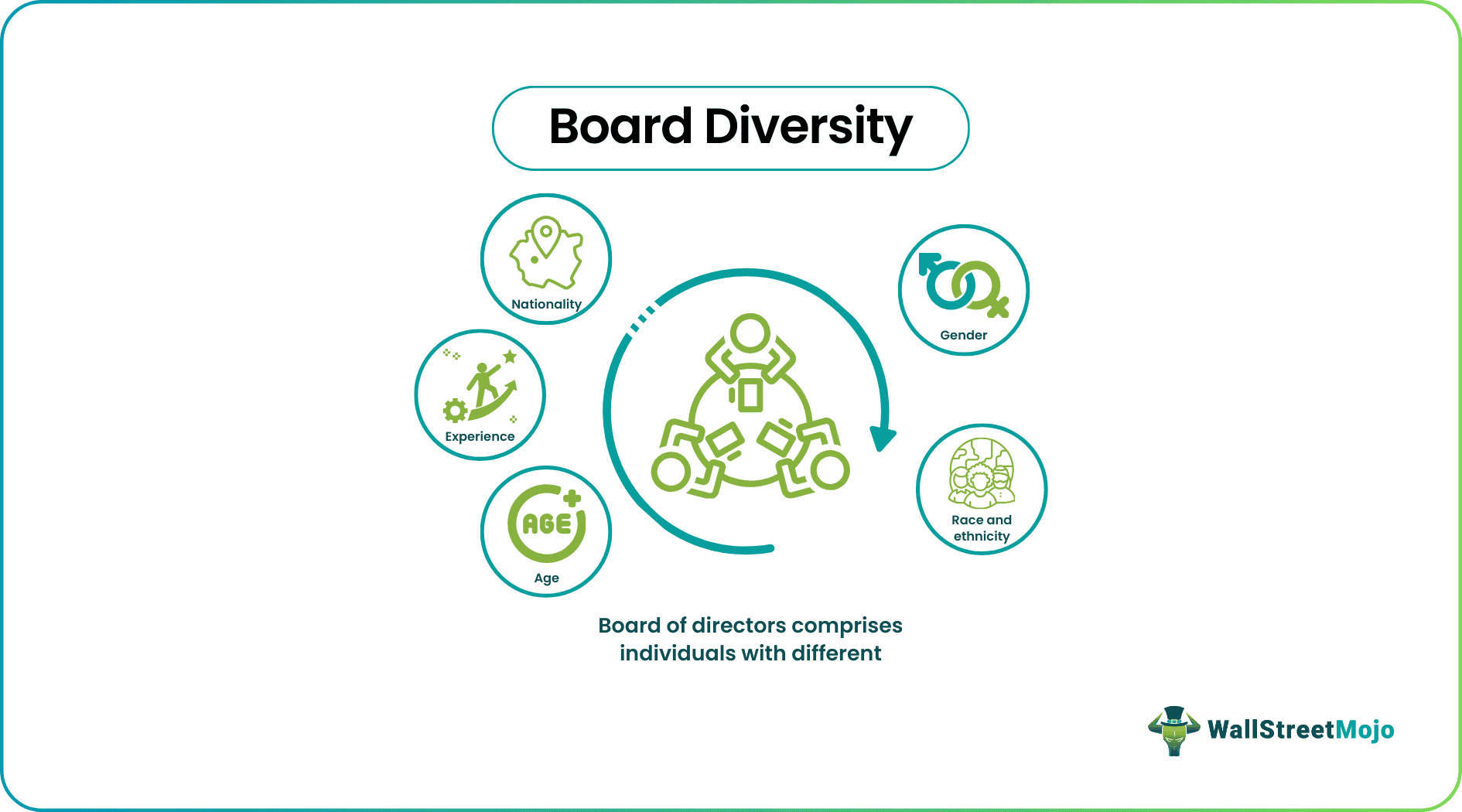

Board diversity refers to the inclusion of individuals from various backgrounds, experiences, demographics, competencies, and skills on a company's board of directors. Therefore, board diversity aims to create governance structures that reflect the diversity of the world in which organizations operate.

Further, it breaks the stereotypes of who can be on the board. It emphasizes a blend of different perspectives based on factors such as age, ethnicity, race, gender, characteristics, nationality, personality, and professional expertise for effective decision-making. Because diverse boards are more representative of society as a whole, they are likely to make better and more informed choices.

Key Takeaways

- Board diversity refers to the composition of a company's board of directors by including a variety of individuals with different perspectives, backgrounds, skills, and experiences to ensure impactful decision-making at the top level.

- The companies diversify their boards in various ways based on gender, age, race, ethnicity, experiences, skills, nationality, and personality traits.

- Moreover, the governments in various nations have imposed various regulations and guidelines for the companies to have a board diversity policy and its inclusion.

- Thus, organizations may actively work towards board diversity through intentional efforts in recruitment, selection, and governance practices.

Board Diversity Explained

Board diversity refers to the presence of individuals from a variety of backgrounds, experiences, and demographics on the governing board of an organization. The concept emphasizes the importance of having a board that is representative of the broader population. Moreover, that reflects the diversity of stakeholders involved with or affected by the organization. The shareholders, especially institutional investors, can drive change in board composition, encouraging diversity using their voting rights.

A board diversity policy outlines a set of guidelines that organizations adopt to promote blended composition within their board of directors. That comprises individuals from various backgrounds, experiences, and perspectives and belonging to different genders, races, ethnicities, and skills. These policies often include specific targets for underrepresented groups, inclusive recruitment practices, and equal opportunities for all candidates. Hence, the primary objective is to enhance decision-making processes, improve corporate governance, and mirror the diversity of the company's stakeholders.

Some of the common diversities in the company's board include:

- Gender Diversity: Many companies are striving to increase the number of women on their boards. Achieving gender diversity on boards is a specific focus within the broader context of board diversity.

- Age Diversity: It ensures a mix of experiences and perspectives by including people of different age groups on the board.

- Ethnic and Racial Diversity: Individuals from different ethnic and racial backgrounds must be represented on companies' boards to reflect a diverse customer base and society at large.

- International Diversity: Global businesses often include board members from various countries, thus providing a comprehensive perspective and understanding of international markets.

- Skills and Expertise: Boards comprise members with new skills and expertise. Companies in technology may include board members with backgrounds in cybersecurity, artificial intelligence, or data analytics to stay ahead in their industry.

Requirements

Board diversity requirements can vary depending on the country, industry, and organization. Many companies voluntarily adopt diversity policies and targets to promote a diverse and inclusive boardroom environment.

- Legal Mandates: In certain countries, legal requirements mandate diversity on corporate boards. These laws may specify a minimum percentage of women and individuals from underrepresented groups. It also specifies the combination of various demographic factors that must be represented on boards.

- Stock Exchange Listing Rules: Stock exchanges often have listing rules or guidelines related to board diversity. Companies listed on these exchanges may be required to disclose information about their board composition and diversity policies or take specific actions to promote diversity.

- Corporate Governance Codes: Many countries have corporate governance codes that provide recommendations or principles for good governance practices.

- Voluntary Targets and Initiatives: Some jurisdictions and industry groups encourage companies to set targets for this diversity voluntarily. These targets may be related to gender board diversity, ethnic diversity, or other factors.

- Shareholder Resolutions: Shareholders may propose resolutions related to board diversity during annual meetings. While these resolutions are often non-binding, they can signal shareholder expectations and concerns about diversity issues.

- Board Nomination Processes: Board nomination processes may be subject to scrutiny regarding the consideration of diverse candidates. Companies should actively seek out and consider candidates from diverse backgrounds during the nomination process.

Examples

Let us understand the concept better with the help of examples.

Example #1

Suppose Intuit is a leading tech company In the US that is committed to diversity and inclusion. The company's board of directors (BOD) reflects a wide range of backgrounds, experiences, and perspectives as below:

- Mrs. A - Chairperson of the Board: She holds 20 years of experience in finance and has a background in investment banking. She has served many global firms in her career.

- Mr. B - Vice Chairperson: He is a renowned scientist and professor with expertise in artificial intelligence and machine learning. His research background provides valuable insights into emerging technologies.

- Miss. C - Chief Executive Officer: C is an entrepreneurship graduate. She provides innovative thinking and a strong vision for the company's future.

- Mr. D - CFO and Treasurer: D is a finance expert with a strong background in mergers and acquisitions. He ensures the company's financial strategies align with its diverse business initiatives.

- Mr. E - Chief Technology Officer: He is a computer science professor and AI researcher. His expertise in algorithm development and software engineering drives the company's technological advancements.

- Mrs. F - Chief Marketing Officer: She is a marketing expert with a focus on digital and social media strategies. Her creative approaches have contributed significantly to the company's brand visibility.

Hence, the diverse board of the firm strengthens its decision-making ability and fosters creativity and innovation while respecting different perspectives and experiences within the organization.

Example #2

A recent analysis from The Conference Board and ESGAUGE claims that during the last five years, corporate boards have dramatically increased in diversity. While the reported share of directors who are racially or ethnically diverse climbed from 20% in 2018 to 25% in 2023, the share of female directors in the S&P 500 jumped from 23% in 2018 to 32% in 2023.

However, as the research notes, there has been a slowdown in the year 2022 in the reported development of both racial and gender diversity. From 31% in 2022 to 32% in 2023, there was a one percentage point increase in the reported percentage of female directors. Also, the percentage of directors who reported being of different races or ethnic backgrounds increased from 24% in 2022 to 25% in 2023, almost staying the same.

The 2023 class of new corporate directors is less diverse than the 2022 class in terms of gender and ethnicity, which the report sees as a major contributing cause to the slowdown. 38% of the new directors in 2023 were women, down from 43% in 2022. An even more dramatic reduction occurred in the proportion of racially/ethnically diverse directors among newly appointed board members, which fell from 45% in 2022 to 36% in 2023.

How To Increase?

While increasing board diversity requires a long-term commitment and consistent efforts from everyone involved, here are some suggested strategies:

- Define Diversity Goals: Clearly define what diversity means for the organization pertaining to members' gender, race, ethnicity, age, skills, experiences, etc.

- Conduct Diversity Audit: The best way is to monitor or audit the composition of the company's board, examining the members' social, personal, and professional competencies.

- Inclusive Culture: Only having the board diversity policy on paper is not enough. Fostering an inclusive culture within the organization is critical to making people from diverse backgrounds feel valued and included in decision-making processes.

- Recruitment and Nomination: Actively seek out diverse candidates for vacant board positions. Hence, by ensuring that the recruitment and nomination processes are transparent and unbiased.

- Training and Education: Provide training to current board members about the benefits of diversity and inclusion, thus seeking their approval and commitment towards a more inclusive board culture.

- Partnerships and Networks: Collaborate with organizations and networks that specialize in promoting diversity. They can provide resources and facilitate the company to reach out to potential candidates.

- Evaluate and Revise Policies: Regularly review the organization's policies and approaches to recognize and remove any barriers that might hinder diversity.

- Measure Progress: Collect data on the diversity of the board and analyze it regularly. Therefore, this will help in tracking progress and identifying areas that need improvement.

Advantages And Disadvantages

The impact of board diversity can vary from organization to organization and industry to industry. However, it is essential to consider the following pros and cons of diversifying the board before implementing the related strategies:

Advantages

Diversifying the board panel can offer the following benefits to the company:

- Diverse Perspectives: A diverse board brings together individuals from different backgrounds, cultures, and experiences, which can lead to a variety of perspectives and innovative ideas.

- Effective Decision-Making: Various studies suggest that diverse groups make better decisions as they consider broader viewpoints and ideologies, leading to comprehensive and thoughtful conclusions.

- Fosters Creativity and Innovation: Diversity enhances creativity and innovation since such individuals bring unique solutions to problems and can drive new ideas within the organization.

- Adaptability: As the world is growing into a global marketplace, adapting to this cultural shift requires a blend of different individuals on the board.

- Strengthens Reputation: Companies with diverse boards often have a better reputation in the market. It shows that the company values inclusivity and equality, which can enhance its brand image.

- Better Market Understanding: A diverse board can have a robust knowledge of a dynamic customer base to implement more competent marketing strategies and products.

- Reflects Stakeholder Diversity: Companies operate in diverse markets with customers, employees, and stakeholders from various backgrounds. Having a diverse board allows the company to understand better and serve the needs of its diverse stakeholders.

- Improves Corporate Governance: Board diversity in corporate governance challenges the status quo, leading to increased accountability and transparency within the organization.

- Higher Profitability: Diverse organizations often exhibit superior work culture and competitiveness, thus increasing the customer base, sales, and profits.

Disadvantages

- Interpersonal Dynamics Issues: Diverse groups may face challenges in communication and understanding due to cultural and language differences, leading to potential conflicts and misunderstandings.

- Resistance to Change: Existing board members might resist changes brought about by new members from diverse backgrounds, hindering the implementation of innovative ideas.

- Difficulty in Decision-Making: Decision-making processes can become slower and more complex in diverse boards due to the need to consider various perspectives, potentially leading to delays in crucial matters.

- Trust Issues: When the board members belong to different cultures and backgrounds, they are unable to build trust and cordial relations with one another, resulting in conflicts and disagreements.

- Team Building Challenges: Forming a cohesive team can be more challenging when team members from different backgrounds find it harder to relate to one another, potentially affecting teamwork and collaboration.

- Tokenism: Sometimes, companies may appoint diverse members to fulfill quotas, leading to tokenism, where these members might not be given equal opportunities to voice their opinions and influence decisions.