Table of Contents

What Is A Blue Bond?

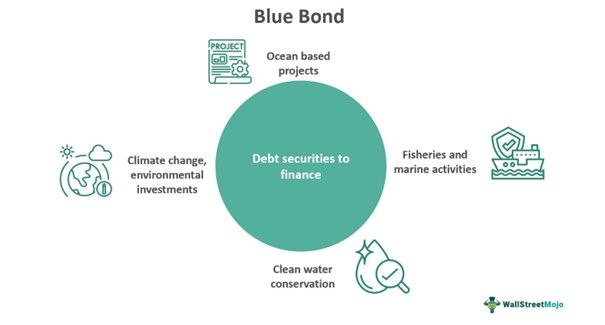

Blue bonds are debt securities that are financial instruments specifically designed to support and encourage water, ocean, marine and fisheries projects. Governments and development banks issue these bonds to raise capital to finance related projects, promoting economic and positive environmental growth.

Such bonds are a very new concept in the financial markets, particularly launched to make a positive impact in addressing sustainability issues and acknowledging climate change conditions. The issuance of such bonds is majorly restricted to sovereign and development banks. Still, since their inception, they have become quite popular and created their own space and identity among other financial products.

Key Takeaways

- Blue bonds are financial instruments issued to raise capital, which is used to finance and support marine investments, including fisheries and ocean-based projects.

- The first blue bond was issued in 2018 by the Republic of Seychelles, which raised $15 million, and in September 2023, ICMA published the first blue bond guidance.

- There have been a total of 26 blue bonds issued from 2018 to 2022, making it's market capitalization $5 billion. However, it only represents 0.5% of the sustainable debt market.

- Along with a financial return, blue bonds help protect oceans, ecosystems, and livelihoods of millions of people who depend on them for income, food and other resources.

How Does Blue Bond Work?

Blue bonds are a category of debt instruments that are issued by corporations, developing banks and governments to gather funds for projects that primarily focus on water and ocean conservation, fisheries projects, marine resources and other water-related climate change issues. These are similar to green bonds but have a different market altogether, yet ultimately, they are designed to bring positive environmental changes. In 2018, the Republic of Seychelles introduced the world’s first sovereign blue bond; It raised around $15 million from international investors.

In September 2023, the International Capital Markets Association (ICMA) published its first guidance on blue bonds along with the World Bank. It was a quintessential milestone for Blue Bonds. These bonds operate like other debt securities, but interestingly, investors can promote and contribute to global protection and ocean conservation while earning a financial return at the same time. Blue bonds are innovative tools to bridge the gap between financing requirements and supporting social and environmental causes, especially related to the ocean and its ecosystems.

From an environmental perspective, blue bonds assist in implementing marine spatial planning and fisheries management. In contrast, from a social point of view, they fund the livelihoods of millions of people who are dependent on oceans, rivers, and other water bodies for income, food, culture and residence, particularly the local communities. They highlight the protection of the rights and interests of traditions and indigenous people who value knowledge and give great importance to oceans.

Examples

Below are two examples of blue bonds -

Example #1

Suppose a small town that is situated by a river bank. Over the years, the river has been contaminated by industrial waste, domestic garbage and other waste materials. The town council wants to clean the river but is short of funds. The council heads come up with the idea of blue bonds. They issue blue bonds to raise capital from town citizens to finance the river cleaning projects. In return, the citizen who invested will receive interest payments based on their level of investment, and the whole financial instrument will work like debt securities.

Although the town council was concerned about other environmental problems, its focus was the river; with time, the council again issued another blue bond to finance a fisheries project in the same river. Now, this is a very straightforward example of blue bonds but gives a brief understanding of them, whereas in real bond markets, many factors play a crucial role.

Example #2

The Latin American Stock Exchange, also referred to as Latinex, has announced its plans to launch the first regional blue bond. The deadline they have preset for it is before the end of first quarter. The executive president of Latinex said that we already have issuers that are interested in social, green and sustainable transition and are very close to listing blue bonds.

These regional blue bonds will originate from Panama and will be the first to contemplate the Central America and Caribbean locations collectively. The stock exchange is currently in talks with a European company whose details are not known and which is expected to have experience in ocean financing projects.

Advantages and Disadvantages

The advantages of blue bond are -

- It supports different water-based projects across various asset classes, sectors and regions.

- The financial instrument helps in creating fixed-income diversification, including portfolio investments.

- Some people are more concerned about marine and ocean-based projects and were willing to invest but did not get the right opportunity; blue bonds fascinate them.

- Ultimately, the whole financial instrument has the objective of bringing positive change with good returns.

The disadvantages of blue bond are -

- It is a relatively new concept; people do not like to invest in such financial instruments.

- The market share is slow, and the number of bonds to invest in is very few, so there are not many options.

- Blue bonds have eligibility criteria on which projects are picked; the projects must fulfill all the requirements.

- Not many people believe in such bonds, making it difficult to raise capital using such bonds.

Blue Bond vs Green Bond

The main differences between blue and green bonds are -

- Blue bonds specifically target marine investments and ocean and fisheries-based projects. In comparison, green bonds focus on promoting climate change and environmental investments.

- Blue bonds debuted in 2018, approximately 11 years after the World Bank issued the first green bond to raise funds for climate-related projects in 2008.

- The blue bond market is somewhere around $5 billion, but green bonds have a market capitalization of approximately $2 trillion.

- Blue bonds are only a few, maybe close to around 30. In contrast, green bonds are in the thousands.