Table of Contents

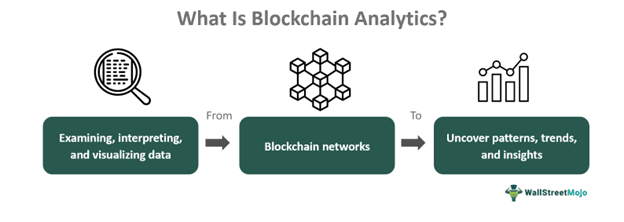

What Is Blockchain Analytics?

Blockchain analytics refers to a process of identifying, observing, and analyzing the data that is present on the blockchain. It is a crucial tool for inspecting data available on this platform. It aims to scan the public ledger and wallets for any illegal activity and make them error-free.

According to the Federal Deposit Insurance Corporation (FDIC), underbanked people maintain a checking or savings account but do not benefit from the wide range of services offered to them or applicable to their account. Although it takes time, banks and financial institutions encourage their customers to fully acknowledge and utilize the services as it can lift financial pressure from themselves.

Key Takeaways

- Blockchain analytics is a process of identifying data or illegal activities faced on the blockchain. It tries to protect customers from malicious actors.

- It involves scraping publicly available transactional data to detect and analyze potential fraudulent activities in cryptocurrency transactions.

- By assigning risk scores and employing heuristics, these companies collaborate with crypto firms to identify suspicious behavior, potentially creating Suspicious Activity Reports (SAR) for law enforcement agencies.

- The use cases of this analytics are visible in financial institutions, supply chain management, regulatory bodies, and crypto exchanges.

How Does Blockchain Analytics Work?

Blockchain analytics is a standard process of analyzing the data available on the blockchain network. It is akin to the audit done in the businesses to detect any flaws within the system. However, there is a minor difference in this case. As the crypto transactions are anonymous, blockchain analytics companies cannot access the data directly. Instead, they use the process of "scraping." In simpler words, scrape refers to the process of accessing the publicly available transactional data for analysis. Later, models are prepared to represent the data in a visual format. However, it is the last stage of this process.

The procedure or mechanism of blockchain analytics begins with the scrapers themselves. They dig into the scattered data on the public ledger to link crypto holdings to any fraudulent activity. Crypto wallets also play a significant role. While transactions are majorly done through these wallets, data gets stored permanently on the blockchain or in the case of cross-chain swaps, on multiple blockchains. Thus, with the scraping method, the blockchain analytics software assigns a risk score to each crypto transaction. This happens with the collaborative effort of crypto firms and blockchain analytics companies.

During this entire process, if the analytics provider suspects or detects any illegal activity, they can forward the details to law enforcement agencies. A Suspicious Activity Report (SAR) was created to match some identities with an anonymous wallet. If it turns true, an end-to-end trace gets curated. This trace ensures that the crypto wallet receives a typology (category name) that specifies the illegal activities conducted in it.

In addition, the provider also assigns a heuristic that identifies transactions with the same typologies. So, if the same individual creates multiple wallets, the blockchain analytics tools will automatically detect it in advance.

Use Cases

As blockchain analytics helps in detecting malicious actors present in the blockchain, there are other use cases for the concept. Let us look at them:

- Financial Institutions - Since blockchain also forms a crucial element of financial institutions, illegal activities are also present. With the use of analytics, it is possible to safeguard the interests of the customers and their respective funds.

- Supply Chain Management - At times, businesses have to face many fraudulent activities while delivering goods to customers. However, with blockchain analytics platforms, firms can ensure the authenticity of their products. Also, they can detect any fraud or counterfeit goods evolving in the logistics.

- Cryptocurrency Exchanges - In addition, even cryptocurrency exchanges find such valuable analytics in their operations. Since significant work has evolved around crypto coins, hackers are trying to exploit the platform. Thus, with these tools, it is possible to reduce such attacks.

- Regulatory Bodies - Apart from the financial institutions and crypto exchanges, blockchain analytics platforms also act essential to the regulatory bodies. In recent eras, even blockchain has acted as a secure database for governments. It is helpful in analyzing tax evasions, national security, and other digital assets.

Examples

Let us look at some examples of blockchain analytics to comprehend the concept better.

Example #1

Suppose Kevin, a firm with over a decade of experience in selling goods and services, recently integrated blockchain technology into their operations. Over the past months, they encountered customer complaints regarding delayed deliveries and suspected counterfeit orders. To address these issues, Kevin decided to leverage blockchain analytics to scrutinize their supply chain.

Kevin consulted with Ellipsis, a blockchain analytics provider, to analyze transactions and identify any irregularities or illegal activities within their blockchain records. After thorough analysis, it was discovered that specific delivery agents were involved in counterfeiting orders, leading to customer dissatisfaction and business losses.

In response, Kevin promptly terminated the involved employees, implemented stricter supply chain protocols, and improved oversight mechanisms. These actions were aimed at restoring customer trust and optimizing their business operations.

Example #2

As of February 2024, Crystal, a blockchain analytics firm and subsidiary of Bitfury Group, has appointed Navin Gupta as its new CEO. Formerly with Ripple, Gupta succeeds Marina Khaustova in this role. The firm aims to broaden its blockchain intelligence solutions to cater to a global audience, including regulators, virtual asset service providers (VASPs), and traditional finance sectors. Gupta highlighted the importance of enhancing their intelligence products to align with evolving financial regulations amidst the growing adoption of digital assets.

Crystal, founded in 2018, specializes in providing tools and services for tracking and analyzing blockchain transactions, focusing mainly on compliance and anti-money laundering efforts. Brian Brooks, a former head of the Office of the Comptroller of the Currency and current Bitfury Board member, praised Gupta's appointment, viewing it as strategically addressing the increasing demand for compliance tools.

Importance

Blockchain analytics is widely used in the crypto market. However, a significant importance is also visible in business models and among investors. Let us understand them in detail:

- It helps in fraud and the detection of illegal activities: The prime need to include these analytics is for fraud prevention. Since there are different use cases of blockchain, data leaks are the most likely. Therefore, blockchain analytics can identify traces of hackers and illegal activities. It further protects the interests of the customers.

- Enables transparency and accountability in the transactions: With the help of analysis, blockchain-based firms can verify the transactions and track the flow of funds in and out of the business. So, if there is any node acting maliciously in the process, it is quickly visible and transparent in the blockchain.

- Creates adherence to the regulations: Likewise, the blockchain analytics provider allows businesses to identify such illegal activities. As a result, they can also adhere to the regulations imposed by the governments.