Table Of Contents

What Is A Block Trade?

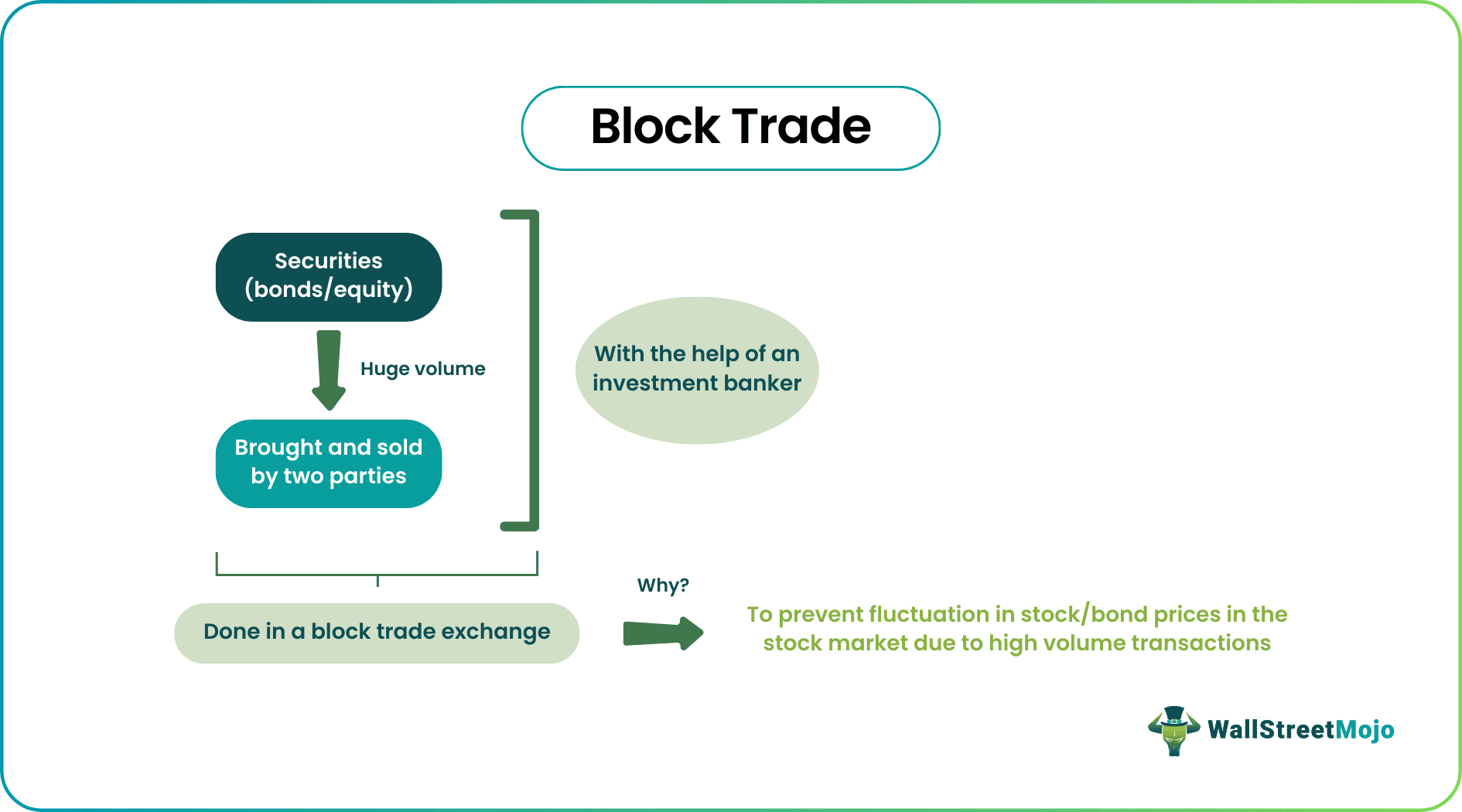

A block trade happens when securities are bought and sold by an investor in bulk quantities. Such business involves negotiations of a huge number of equity and bonds sold among two parties, usually with the help of an investment banker, at an appropriately arranged price and outside of the stock market to reduce the effect on the security price.

Block trade involves trading in a notably high number of bonds and equity by two parties at a price appropriately arranged. Often, investors prefer to make such trades to escape the price cut because, in that case, one may mutually decide the price favorably to the seller. Generally, it involves the minimum quantity of 10,000 securities, excluding penny stocks or bonds worth $200,000. In the practical world, block trading involves much more than 10,000 shares.

Key Takeaways

- An investor purchases and sells securities in bulk in a block trade exchange. It entails talks of a sizeable amount of equity and bonds sold between two parties, typically with the assistance of the investment banker at an adequately set price and outside of the stock market to minimize the impact on the security price.

- It is a valuable means by which analysts can assess where institutional investors perform the stock pricing.

- One must carry out the block deal privately over a phone call, chat session, or another technological medium.

- It must be a direct transaction between the parties or the brokers. As a result, they conduct their business outside the public auction market.

Block Trade Explained

Block trades are the large trades made by institutional investors, which are generally broken into smaller orders and then executed through the different brokers to mask true sizes. Through a private purchase agreement, one can make these trades outside the open market. It can be more difficult than the other trade and expose the broker-dealer to more risk. It is useful for analysts to assess where institutional investors do stock pricing.

It is a legal way of trading in securities and this market has grown considerably in recent times. Each trade is a single transaction in itself. According to the New York Stock Exchange (NYSE), the minimum volume will be 10000 shares of a company.

This process of transacting in stocks help portfolio managers buy a large volume of shares of an entity and divide or distribute them among many clients, which increases market efficiency and reduces cost.

Traders use block trading to buy or sell huge volumes of cryptocurrencies through private price negotiation. There are many platforms that allow block transactions of Bitcoins and other cryptos. But the trade quantity should meet the criteria of block trading for carrying out the transaction outside the crypto market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Rules

- The block trade agreement must be made privately, such as over private chat, telephone, or other electronic means. It must be a transaction through the parties or the brokers directly. So, they execute apart from the public auction market.

- These trades generally are conducted through intermediaries known as the blockhouse. These are the firms that specialize in large businesses. These firms are well-versed in a in this concept and know how to initiate the transaction carefully so that there is no volatile fall or rise in shares or bonds price.

- As such trades are huge in the equity and the debt markets, individual investors rarely make any such trades. In the practical world, these trades are made when the institutional investors and the hedge funds buy or sell the large size or amount of shares and bonds in the trade via intermediaries such as investment banks, etc.

- The traders in the market must be careful while doing the transactions in case the trade is made on the open market. In that case, there will be large fluctuations in the transaction volume. The same can cause an impact on the market value of bonds or shares purchased. Thus, generally, these trades are conducted through intermediaries rather than an investment bank or hedge funds purchasing securities normally because they normally do it for smaller amounts.

Examples

Let us understand the concept with the help of some examples.

Example #1

Let us take an example of a hedge fund that wants to sell 200,000 shares of a small company having $20 as the current market price. The transaction involving the 4 million dollars on the company might be worth only some hundred million. Now, if this enters as the single market order, it probably would lead to the a fall in the overall market price. Also, because the transaction size is large , one will execute the order at progressively worse prices. Due to this, the hedge would observe slippage on demand, and at the same, other participants would take advantage of the situation and short the market based on price action. It would force the stock price down further.

So, to avoid the same, hedge funds generally take the help of the block trade exchange, where the blockhouse helps break up a large amount of trade into some manageable block trade size. For instance, in the present case, the 100 smaller blocks can be made with 2,000 shares each at $20 per share. The separate broker will initiate each divided block to keep the market volatility low. In addition, any broker, through the purchase agreement instead of the above option, can arrange with any buyer who can take all the 200,000 shares outside the open market. Generally, the buyer is another institutional investor in this case, as the capital involved in these transactions is high.

Example #2

Wall Street is under heavy scrutiny regarding block trading because the Securities and Exchange Commission (SEC) has noticed that many traders in hedge fund and banks are earning considerable amount of profit which is proving detrimental to retail and institutional investors. SEC has been in constant touch with Morgan Stanley and Goldman Sachs who are the biggest players in block trading services.

Advantages

- Block trade indicator is a useful means by which the analysts can assess where institutional investors do the stock pricing.

- It is helpful in the merger or acquisitions as the bid requires a “clear market,” so the prices at which the large block of stocks are trading can be seen. Moreover, these prices show at what rate the company's largest shareholders are ready to sell their owned shares. Thus, in the case of the trading analysis, mostly the small trades are considered to avoid data skewing.

Disadvantages

- The block trade agreement is more difficult than the other trades because the broker-dealer commits to a price. Any adverse movement in the market for a large amount of the securities can saddle the broker-dealer with a huge amount of loss (if the position is being held and has not been sold). So, engaging in block trading can lead to a tie-up of the broker-dealer's capital. Thus, due to this, broker-dealers are often exposed to more risk.

- There are situations where the well-informed large money managers want to buy or sell the large stock position of the particular stock, which may connote the price movements in the future by performing the opposite of the broker-dealer transaction. In this kind of block trade size, the money managers have an information advantage, and the broker-dealer will have an adverse selection risk.

Block Trade Vs Bulk Deal

| Block Trade | Bulk Deal |

|---|---|

| They are executed during a separate trading window. | They are executed during usual trading time. |

| Orders are place as per the rreference price. | It does not have any such preference price. |

| Retail investors cannot see it. | It is visible to retail investors. |

| It does not get displayed in trading platforms. | It gets displayed in various trading platforms. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

These trades may increase turbulence in the market. Massive, abrupt movements of a particular asset can bring sudden price swings. When market volatility grows, it isn't very pleasant. The worst-case scenario is when the price movement and asset value may diverge.

One must pull up the Signals tool and verify the Signal. Then, one can easily view these type of trade's time, ticker, and description. Moreover, some Signals will display at the ask, above the ask, below the bid, or at the bid.

One may pick up to 10 items from the available requests and choose how many of each thing they want to sell. Note: The order fulfillment will be fully posted once the player confirms by selecting the post. More than just selecting an item amount is required.

The Block Trades Indicator shows large quantity trades, affecting market liquidity. One can define the minimum block size they wish to be notified about and the minimum and maximum stock prices to display.