Table Of Contents

What Is Blank Check Companies?

Blank check companies (BCCs) refer to publicly traded firms with no specific commercial goal but to merge or acquire undisclosed private businesses to assist them to go public. These firms also raise capital for start-ups whose identity remains hidden until the purpose is accomplished.

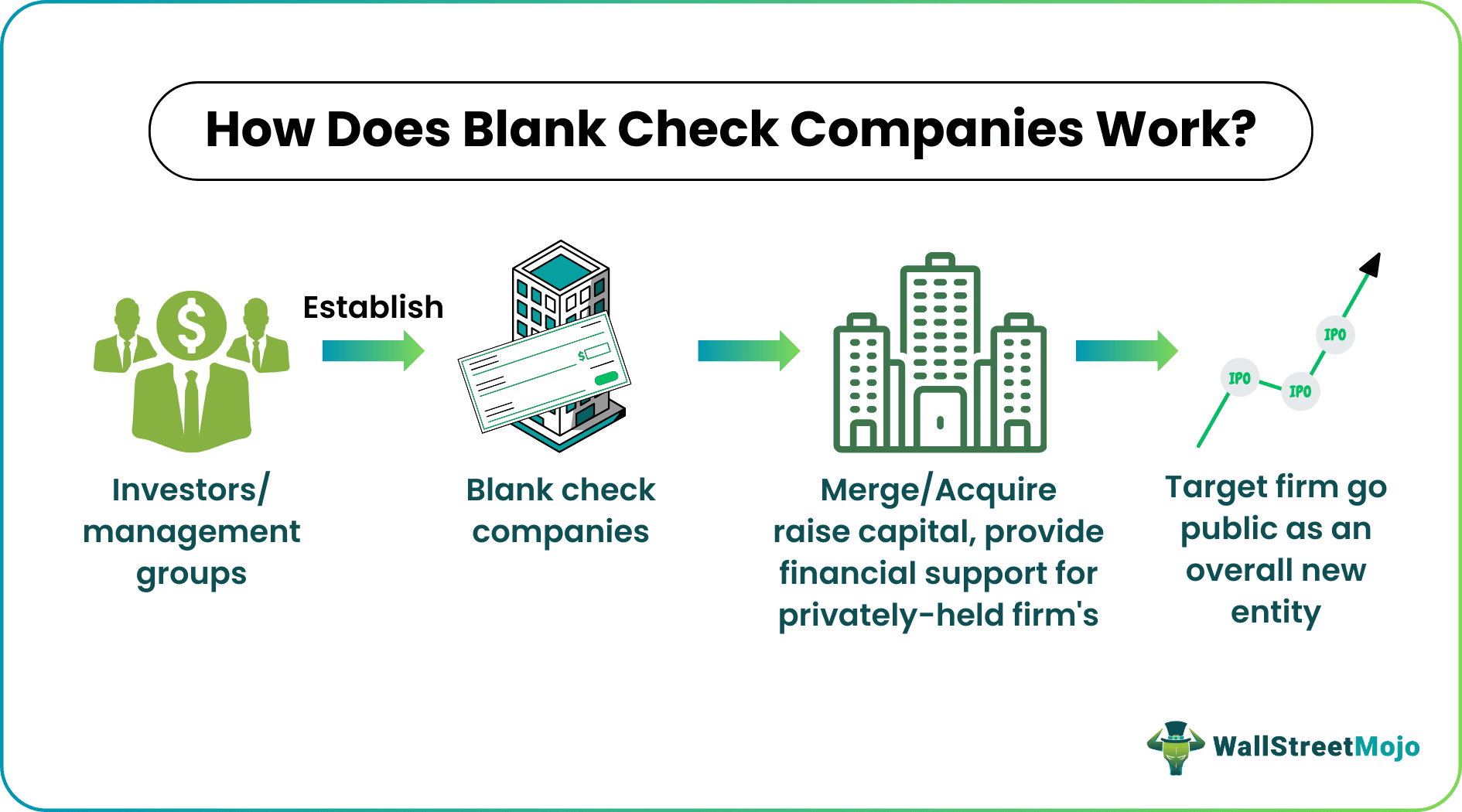

Investors or management groups establish BCCs that seek to protect their interests through mergers or acquisitions. Furthermore, these entities offer financial support to the collaborating companies and share the market experience with them to make them more productive. One of the most common examples of BBCs is a special purpose acquisition company (SPAC).

Table of contents

- What Is Blank Check Companies?

- Blank check companies are entities set up with no specific objective, but they look forward to merging or acquiring undefined companies in the long run.

- These firms raise funds and help private firms to directly go public by easily ignoring the traditional Initial Public Offering (IPO) process.

- The SEC's Rule 419 requires BCCs to protect investors' interests at all costs by putting a part of the funds raised in an escrow or trust account until shareholders approve blank check company mergers or acquisitions.

- SPACs are BCCs that pool funds to provide financial backup to the companies they merge with or acquire.

How Does Blank Check Company Work?

A blank check company enables private firms to go public without going through the lengthy and complicated Initial Public Offering (IPO) process as the former is already public. In addition, it acts as an investment vehicle with the ability to invest in any company and profit. These firms have become recently popular, such as SPAC, due to increased market volatility and liquidity.

The skilled and resourceful investors and managements groups, who lack funds, often create a BCC. It intends nothing but to merge or acquire a private firm. However, they never reveal which company they would be combining with.

The term 'blank check' in BCC refers to both the company and investors remaining unaware of how successful the merger or acquisition will be. For example, if it acquires or merges with a legitimate business, it can turn out to be a profitable decision. But if the company it combines with is a fraud, it will be a bad deal. Hence, they are much like signing a blank check with no knowledge of the outcome. As a result, market experts argue that such an agreement exposes investors to financial risks.

People can invest in a BCC by purchasing its shares once it goes public. The publicly-traded company holds these funds into an escrow account until a merger or acquisition takes place, usually for up to 24 months. After finding a target (private) company, the BCC combines with it or takes it over, forms a new entity, and lists it as a public entity on a stock exchange with a ticker symbol. In the case of a no-deal within the stipulated time frame, the BCC dissolves and returns escrowed funds to investors.

Blank Check Company Facts

- A BCC takes a minimum of six months to help a privately-held firm become a public company with the help of underwriters or investment bankers.

- When the deal closes, investors owning shares in a BCC get an opportunity to own a massive percentage of the new entity. The shares of the BCC are available to founders and big investors, along with individual investors, who hold a tiny portion of it.

- It is a less expensive and faster alternative to traditional IPO for start-ups. In the latter, private firms cannot promote their shares until they start trading officially. However, BCCs can discuss and advertise shares to investors, thereby pooling funds for future M&A deals.

- A black check company considers buying speculative or underperforming companies to improve their management, increase profit margins, and increase productivity. That is why the United States Securities and Exchange Commission (SEC) classifies such companies as penny or microcap stocks and imposes additional regulations.

- The SEC's Rule 419 requires BCCs to protect the interest of investors at any cost. By law, these companies deposit a portion of the funds raised in an escrow or trust account until shareholders approve blank check company mergers or acquisitions.

Examples

Let us look at the following blank check companies list to find the hidden aspects of the concept and decide on investing in blank check companies stock:

#1 - Vertiv Holdings

Recently, Vertiv Holdings Company has reached an acquisition agreement with E&I Engineering Ireland Ltd. plus its subsidiary, Powerbar Gulf LLC. The transaction would include an upfront payment of $1.8 billion and a cash payment of $200 million on meeting set profit targets by 2022.

In 2020, the blank check company merged with GS Acquisition Holdings Corp. following the approval from the shareholders of the latter. As a result, the firm renamed itself Vertiv Holdings Corp. and began trading on the New York Stock Exchange.

The North American BCC came into existence in 2016 with current assets worth over $709 million.

#2 - Tuscan Holdings Corp.

Tuscan Holdings Corp. stated in July 2021 that the anticipated business merger with Microvast Inc. will go ahead. Even though the merger was announced a long time ago, it was never completed because stockholders refused to support it. It was only after getting stockholder approval at a special meeting organized for that purpose that the corporation confirmed it.

Located in North America, the blank check company acquires current assets worth more than $280 million.

#3 - HL Acquisitions

HL Acquisitions is one of the most prominent BCCs, with current assets valued at approximately $56 million. The company made headlines in 2020 after announcing a business combination with Fusion Fuel following the approval by HL shareholders. They accepted the material differences between both parties' charter documents and the issuance of 2,450,000 Class A ordinary shares of Fusion Fuel.

Frequently Asked Questions (FAQs)

Blank check companies are corporations formed with no specified goal but to merge or acquire undefined companies in the future. These publicly traded companies serve as investment vehicles with the ability to invest in any company and profit from it. They are so named because the firms and investors may not know how successful the merger or acquisition would be, akin to signing a blank check with no idea what the outcome will be.

The special purpose acquisition companies (SPACs) are called BCCs as they raise funds to provide financial support to the private businesses they merge with or acquire.

Some of the blank check companies to watch and invest in are as follows:

- Vertiv Holdings

- Jaws Spitfire Acquisition Corp.

- Tuscan Holdings Corp.

- TKK Symphony Acquisition Corp.

- Graf Industrial Corp.

Recommended Articles

This has been a guide to Blank Check Companies (BCCs) and its meaning. Here we explain how BCCs works along with its facts, examples & list. You can learn more about Finance from the following articles –