Table Of Contents

Black Swan Event Meaning

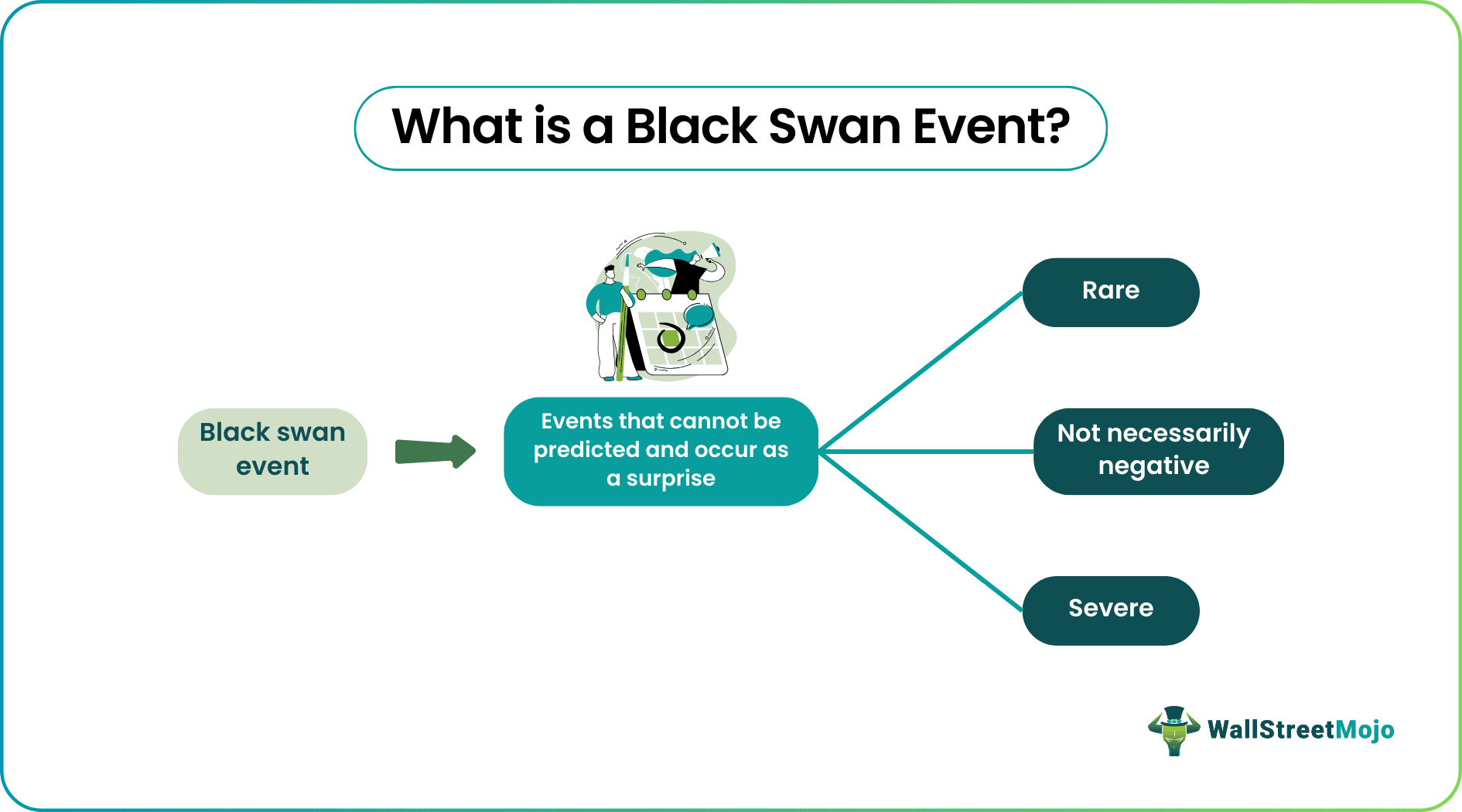

A black swan event refers to unpredictable incidents that occur beyond what is predicted or expected. These events are too rare to be identified, and when the patterns are studied to make predictions, they do not even form a part of the list of predicted incidents.

Though these events occur unknowingly and without warning, they significantly affect the society, the community, and the economy as a whole. Thus, the authorities and analysts need to keep room for solutions to be implemented in case such events occur as a surprise.

Key Takeaways

- A black swan event refers to unpredictable incidents that occur as a surprise or shock, given their positive or negative consequences.

- Nassim Nicholas Taleb coined and elaborated the term in “The Black Swan: The Impact of the Highly Improbable” in 2007.

- Such events are rare, but when they occur, they have a significant impact.

- Risk management becomes important with barbell strategy and maintaining diverse portfolios being the two most effective ways of doing so for investors.

Understanding Black Swan Events

Black swan event is a phrase that is widely used in finance. The term was coined and popularized by a finance professor at New York University and an ex-Wall Street trader Nassim Nicholas Taleb through his book “Fooled by Randomness” in 2001, which he elaborated on in “The Black Swan: The Impact of the Highly Improbable” in 2007.

People worldwide had always believed that swans were only white in color until 1697 when a Dutch explorer, Willem de Vlamingh, came across the black swans. It was surprising to them as the Europeans never knew black swans even existed. Through the term black swan event, Taleb tried to convey to the people around the globe how likely it is for an unpredictable event to occur at any time.

Taleb listed the attributes that help identify such events. The first is that these incidents or occurrences are completely unpredictable, but when they occur, they lead to severe effects, which could be both positive and negative. A black swan event does not signify or symbolize negative consequences only. When such improbable incidents occur, it makes people have plans to deal with even the worst possible outcomes.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features of Black Swan Event

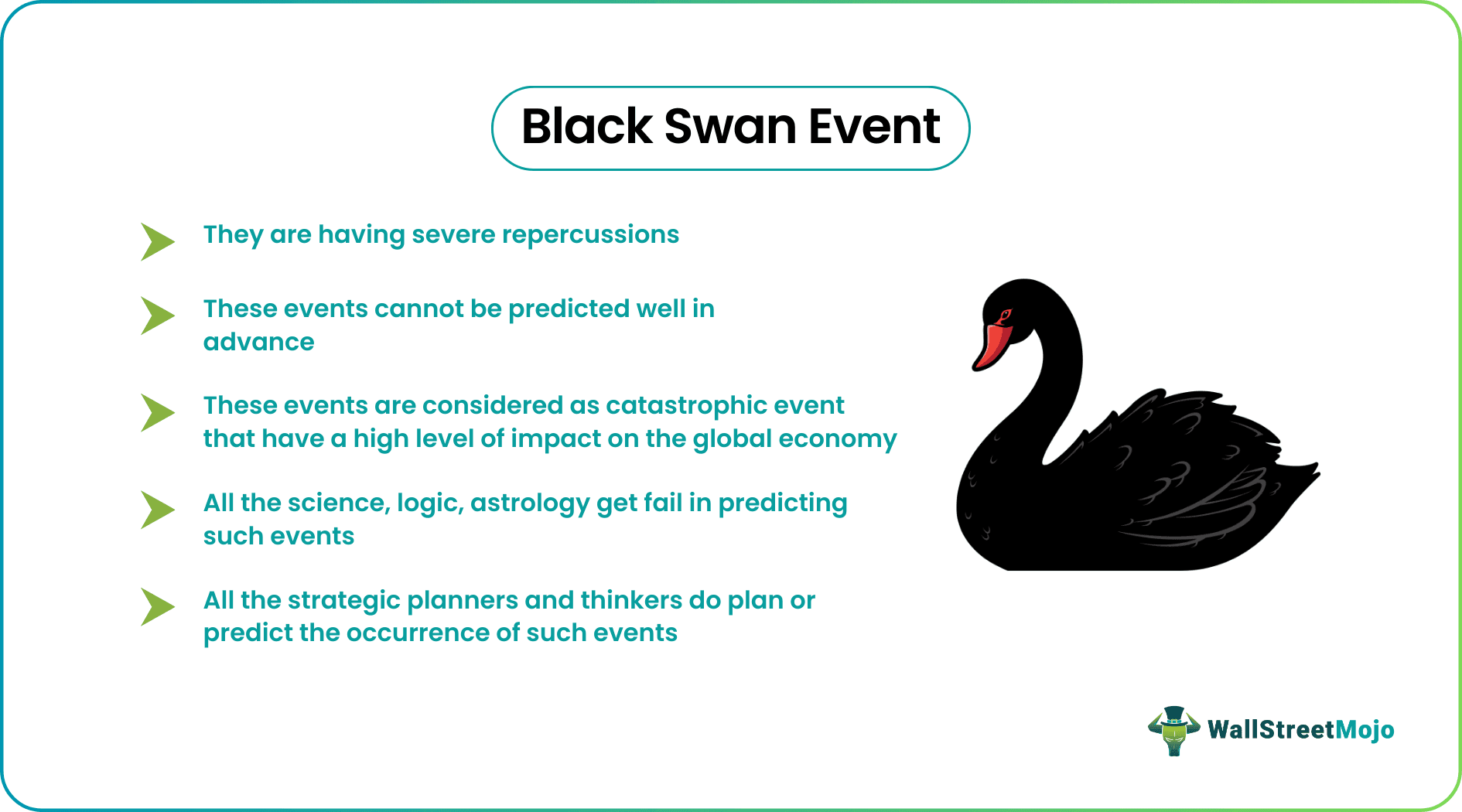

Such events are highly rare, with severe repercussions. They are unpredictable, and one cannot imagine such possibilities. These events are considered catastrophic, have a high impact on the global economy, and must be handled with great caution. They require highly potential skills to be tackled.

Science, logic, and astrology fail to predict such events. It also requires a massive management stimulus from the governments of countries. Such events show that possibilities always exist despite advancements in science, technology, research, etc. Many such events have occurred and have proven the above fact.

All the strategic planners and thinkers predict such events. However, they get mistaken about the scale of their occurrence. At times, the scale is so massive that it ends up creating havoc in society.

Examples

The black swan event examples below indicate what type of incidents can be identified as so:

#1. Global Financial Crisis

The lenient and not-so-strict lending options offered by banks led to the rise in the number of borrowings and, likewise, more defaults. The misbalance caused led to the 2008 market crash, collapsing the whole of the Wall Street. The period witnessed one of the largest investment US banks, Lehman Bros, filing for Chapter 11 Bankruptcy.

The event emerged as a black swan event of the stock market, given one of the most prestigious financial institutes of the US economy with such a golden history reaching the point of bankruptcy. It imposed an adverse impact on the US stock exchange, thereby affecting the stock exchanges across the globe, causing a huge stock market crash.

#2. COVID – 19

COVID -19, claimed to be a black swan event of 2020-2021, might have been a sudden misfortune, but Taleb did not identify it as one. The pandemics do not have a specific pattern that could be studied to predict the next outbreak. It cannot be predicted in any manner by any individual. Though the shortage of healthcare facilities was observed, creating chaos all over, it could have been handled in a better way, Taleb criticized.

Risk Management Strategies

When a black swan event occurs, the target markets must be prepared to handle the turmoil effectively. Hence, risk management becomes the foremost focus. Taleb jots down two strategies investors can adopt to ensure they are least affected by any unpredictable crash or turmoil. One is the barbell strategy, and the other is maintaining a diverse portfolio.

The barbell strategy is where investors invest in the safest financial products and keep a small portion for speculative investments. No investments in moderate-risk instruments are encouraged. In addition, the risk-bearing part of the portfolio must not be more than 10%. This ensures the investors lose as little as possible in negative financial occurrences in the market.

Having diverse portfolios is highly recommended to investors as it ensures that even if one of the investments does not do well in the market, the loss could be covered using the profits generated from the other investments.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is a metaphor for events, transactions, or specific activities that cannot be predicted or expected. The term was coined by finance professor and trader Nassim Nicholas Taleb, who authored “The Black Swan: The Impact of the Highly Improbable.” A black swan event in crypto also has a similar definition, which refers to the rare occurrences leading to an adverse impact on the value of the cryptocurrency.

A black swan event is so called because there was a time when the world only knew about the existence of white swans until Dutch explorer Willem de Vlamingh discovered a black swan, which came as a surprise to not only the Europeans but also to the rest of the globe. Through the term “black swan,” Taleb tried to convey to investors and others the likelihood of any unpredictable events occurring at any time.

Yes, 9/11 is considered a black swan occurrence that led to the immediate closure of the New York Stock Exchange (NYSE) and NASDAQ on Sep 11, 2011. This happened following the attack on New York’s Twin Towers of the World Trade Center the same morning.