Both these trading strategies are two different models of trading, which can be differentiated as follows:

Table Of Contents

What Is Black-Box Trading?

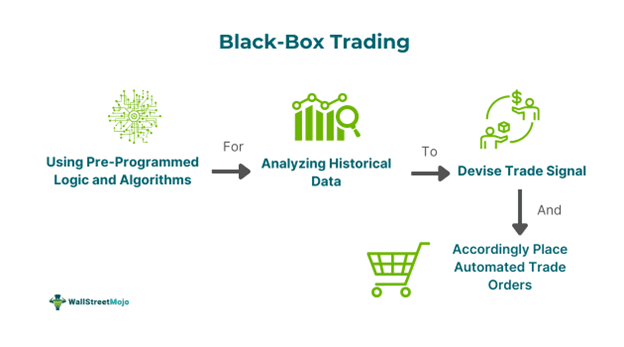

Black-Box Trading refers to a computerized or automated trading system that generates buy or sell signals based on a specific algorithm, pre-programmed logic, or fixed rules for individual investors. Thus, the software program provides trade strategies after analyzing market trends and data effectively.

Such a trading mechanism facilitates investors and traders' employing machine learning (ML) techniques for making more efficient, quick, and accurate trading decisions. This is especially beneficial for pension funds and mutual funds. This algorithm-based mechanism interprets future possibilities or trends by studying historical data and patterns. Moreover, due to the lack of human intervention, the outcomes are usually error-free.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Key Takeaways

- Black-box trading is a computerized trading mechanism in which the system applies a specific set of pre-programmed logic or rules to develop algorithms.

- One can easily identify it by observing the four points and three significant price swings.

- Also, it is a totally automatic system that eliminates human involvement in investment decision-making, assuring zero human errors.

- Black-box trading logic is hidden and is fully automated. In comparison, white-box trading is fully visible and allows human input.

How Does Black-Box Trading Work?

Black-box trading system is an approach where the internal trading system is based upon specific algorithms, pre-set rules, and pre-programmed logic, which are kept secret by the creator. The workings of such a system are complex. However, they are initiated with the establishment of a trading strategy. Based on this strategy, the algorithm processes a considerable volume of market data to quickly devise the trading signals and execute the stock buy and sell orders within minutes.

Indeed, achieving such efficiency and speed isn’t possible through the traditional trading system. Moreover, it is a fully automated process that constantly monitors the market trends to generate real-time trading signals. As the system provides a buy or sell signal, the computerized mechanism immediately performs the relevant action, independent of any human involvement. Hence, it reduces the chances of manual errors in calculation or analysis. Also, the model’s accuracy and reliability usually rely upon the input data, employed algorithms, and the current market scenario.

How To Trade With A Black Box?

There are three prominent black-box trading strategies in the investment market, including:

1. Using the Existing Strategy: One common method is to employ the automatic trading strategy already available in the market. This strategy should align with the investors' pre-defined criteria.

2. Leveraging the System Created By Others: Another cost-effective strategy is replicating the publicly available system formulated by someone else. However, such a strategy doesn’t guarantee success and involves high risk.

3. Developing a Whole New System: Investors and traders may formulate their trading algorithm with the help of a programmer. However, if it works, it is one of the most complex but winning strategies. Moreover, it is costly, but it may reap high profits for traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Examples

The automatic trading system has been the latest trend in investments. It is now powered by artificial intelligence to prove a greater degree of accuracy in trading signals. Below are some of the underlying examples:

Example #1

Suppose Arnold, a trader, invests in a particular stock based on the traditional trading strategy since the investment advisor suggested that the company has offered 43% returns in the past three years. However, another institutional investor holding the same stock used the black-box trading system to execute trade orders.

According to the algorithm, the stock has been able to provide high returns due to the funding it secured three years ago, while the company has been at a loss for the last seven years. Therefore, the automated system processed the sell order of the stock at an overall profit of 57%.

Example #2

The black-box or algorithmic trading market is forecasted to achieve a valuation of $41.9 billion by 2030, thus indicating a phenomenal compounded annual growth rate (CAGR) of 12.9% between 2022 and 2030. Currently, North America leads the market share, followed closely by Europe, with the Asia-Pacific region anticipated to experience the most rapid growth.

This expansion is propelled by factors such as the advancement of AI and ML technologies, the surge in high-frequency trading, and the escalating demand for automation within financial markets. Meanwhile, the key industry players include Jane Street, Citadel Securities, Two Sigma Investments, and Quasar Capital Management.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Advantages And Disadvantages

Advantages

- This system is more accurate and efficient in executing trades at the best possible price than traditional trading techniques.

- The algorithm trading is based upon real-time and historical data, making it more reliable and easier for traders to back-test.

- It is time-efficient as it ensures quick or immediate order placement.

- Since everything is automated and performed through machine learning methods, there is no chance of human error in calculation or analysis.

- Such trades have low maintenance and transaction costs.

Disadvantages

- If the algorithms or pre-programmed logic is incorrect, it may provide an inefficient outcome, resulting in loss to the traders.

- Black-box trading algorithms may fail to account for the sudden market fluctuations or events that human intuition can judge.

- Moreover, such a system is prone to technical failure or network problems, which may hinder its functioning and efficiency.

- It may encounter regulatory compliance issues in various nations, restricting its usage by traders.

- Algorithm trading leads to significant market volatility, which increases the potential risk for investors and traders.

Black-Box Trading vs White-Box Trading

| Basis | Black-Box Trading | White-Box Trading |

|---|---|---|

| 1. Definition | It is an automated trading mechanism in which trade signals are processed using pre-programmed logic, and trade orders are executed automatically by the computerized system. | It is a trading method where the humans have a complete knowledge of the trading model logic that determines the trade signals and can also control the investment decisions. |

| 2. Objective | Taking quick and informed investment decisions based on real-time computerized market data analysis. | Using visible model logic to make trading decisions in a controlled environment |

| 3. Model | Based upon machine learning algorithms | Relies upon traditional statistics |

| 4. Human Intervention | Humans are not involved since algorithm trading is completely automated, thus eliminating the chances of human errors. | In such a system, human intervention plays an equal role in investment decision-making alongside automation. |

| 5. Accuracy and Efficiency | It is based on extensive historical and real-time data analyzed through a pre-programmed logical system, which provides more reliable and efficient results. | It is comparatively less accurate and efficient in booking profitable trades due to the possibility of human error. |