Table of contents

Free Billing Statement Template

Billing statement templates to record the list of all the debit and credit transactions made during a particular period are available in Excel, which can be printed easily and emailed to the customer at any time. One could implement it for billing invoices and customer account relationship management, including general invoicing.

It is beneficial for those who have a transactional relationship with their customers and receive payment regularly or regularly. For instance, in the landlord and tenant relationship, the landlord sends a sample billing statement template every month to their tenant in case of rental properties. Therefore, it is very much similar to the invoice template.

Billing Statement Template Explained

A free billing statement template is created on spreadsheet excel templates intending to send a summary of sales made to a client or customer. We can create and send the billing statement template of the overdue amount to the customer per the agreed schedule, like weekly, monthly, or quarterly.

One may use these by vendors and their respective customers with the pre-defined agreement concerning the frequency of sending the billing to the customers. Even if there are no overdue balances, the vendor can send the billing statement template to their respective clients for bookkeeping or recording purposes.

In this template, we have used a single-entry system using a bookkeeping method, which can also be used by a business that has just started or set up a business and has a lower volume of business transactions.

For instance, in credit card statements, credit institutions send a credit card bill to the customer every month with the details of the transactions incurred during a given month and the outstanding amount due to the credit institutions. It may include columns for the invoice number, customer details, amount to be received or due from the customer, description of the items, and other charges, including a discount.

Purpose

While it is not compulsory, let us understand why it is highly recommended for businesses to have a sample billing statement template in place through the explanation below.

- Professionalism: A billing statement template adds a touch of professionalism to a business’s financial interactions by presenting a transparent and standardized summary of charges, payments, and balances.

- Clarity for Clients: The template serves as a transparent communication tool for clients, offering a detailed breakdown of services rendered and associated costs. This clarity reduces the likelihood of disputes and fosters trust between the business and its clients.

- Tracking Transactions: Businesses can utilize the template to systematically track all transactions over a specific period, simplifying financial record-keeping. This aids in maintaining accurate accounting records for future reference and auditing purposes.

- Payment Reminders: Billing statement templates often include due dates and outstanding balances, serving as a gentle reminder to clients about upcoming payments. This proactive approach can enhance timely payments and improve cash flow.

- Financial Planning: The template provides a snapshot of a client’s financial relationship with the business, enabling better financial planning and decision-making. It assists businesses in forecasting revenue, managing cash flow, and setting realistic financial goals.

- Customization: Tailoring a billing statement template to specific business needs allows for branding elements, reinforcing brand consistency and identity in financial communications.

- Compliance: Having a standardized billing statement template ensures that the business complies with industry standards and regulatory requirements, contributing to a smooth and organized financial workflow.

How to Create This Template?

Let us understand the intricacies of creating a free billing statement template through the points below.

- It is an alternative to expensive software used to create a billing statement. It is straightforward to use and create. Customers can easily understand with a billing statement template the amount due and the charges that are applicable on the same.

- It can be easily downloaded and printed if required. These are user-friendly, and the vendor and customer can customize the billing statement template according to their requirement. These are also automated to generate the billing statement automatically.

- With the help of this statement, one can easily recognize the complicated task of segregating the stocks from the vast inventory. The statement provides detailed information about the goods ordered and shipped simultaneously and goods ordered and yet to be shipped. These Excel-based templates are considered budget-friendly, and one can use them by small or medium-sized enterprises with a low volume of business transactions.

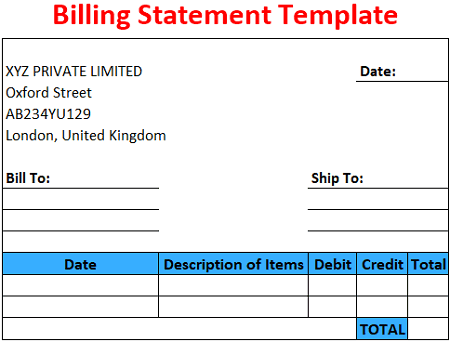

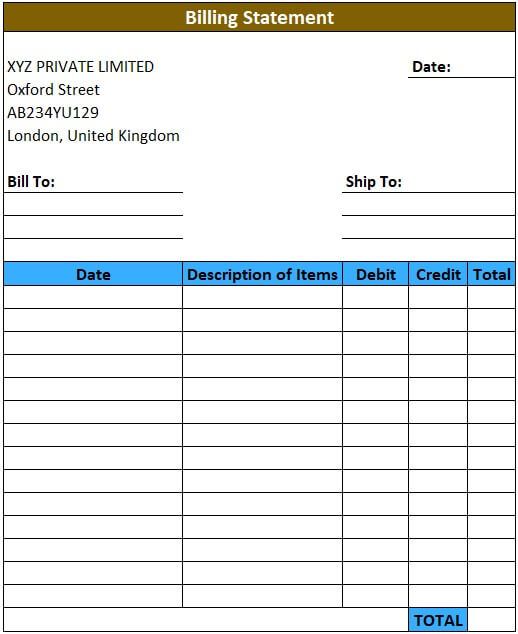

- It can be created by merely inserting basic details in the template, like the company name, address, the logo of the company. In the software-based template, there are default options like a currency that one can select by drop-down in the template. One can format it in any desired way.

- Once the basic details about the company are inserted, the next section must have a list of business transactions initiated with any beginning balance, if any, or carried forward from the previous balance. If no prior balances were being carried forward, the billing statement could start with zero balance.

- After the initial balance, the next transactions can be recorded based on the transaction date and other charges if incurred. One could make two columns to report the transactions. One column should have a debit in which all the expenses include charges incurred by the customers, and other columns should have a credit which includes the customer’s amount.

- Anyone running a business can generate the billing statement template. You need not be an Excel expert to generate the same. However, some points need to be considered while creating the billing statement template.

The following are the factors that require due consideration while creating this template.

- One should mention an adequate date in the billing statement template.

- The current balance of the billing statement should arrive in the template by deducting the sum of payments from the received amount.

- Make sure one writes the payment in negative numbers, and the amount received should be in positive numbers.

- The customer’s name, including the billing address, should be provided in the billing statement template.

Why we need this template?

The above question can be answered with the following section.

- Let’s assume you are a landlord, and your tenant does not pay your rent on time. A professional way to remind him monthly about the rent due is to send him a billing statement template. The same concept applies to banks and credit institutions giving customers loans or credit cards and paying EMIs monthly to their respective banks.

- With this billing statement, both banks, and customers, can track the transactions and charges, including any fees levied by the bank. They can be printed and recorded for future reference at the same time. One can customize these with the help of spreadsheet tools to include or remove any things.

- These statements include all the possible details like payments received from the customer, late payments charged or fees, payment due date, total outstanding amount, total credit available, date of generating the billing, etc.

- In the case of the landlord and tenant relationship, one can customize the billing statement to include a list of properties lent out, including the furnished materials to keep a record.

- If the landlord has multiple properties lent out to several tenants, one can save the billing statement, and a copy of the same can be created and sent to every tenant through email.

- Suppose you desired that the billing statement should not include initial payments in the statement. In that case, you could include only current month transactions in the billing statement to be sent to your customers.

Billing Statement Vs Invoice

Throughout this article, there might be a lingering question as to how it is different than an invoice or a bill that we generally acquire from a shop or store. Let us understand the differences between a free billing statement template and an invoice through the comparison below.

Billing Statement

- A billing statement, on the other hand, offers a comprehensive overview of a customer’s account. It summarizes all transactions, payments, and outstanding balances, providing a holistic view of the financial relationship.

- Billing statements are typically generated periodically, summarizing all transactions within a specific billing cycle. This cycle could be monthly or as agreed upon between the business and the customer.

- Billing statements provide a broader perspective, including a summary of all transactions, payments, and any additional charges accrued during the billing period.

- The primary purpose of a billing statement is ongoing account management, tracking outstanding balances, and fostering transparent communication about the customer’s financial activity with the business.

- Billing statements are generated regularly, offering a consolidated view of multiple transactions over a set timeframe.

Invoice

- An invoice primarily serves as a request for payment, delineating the specific amount owed by a customer for goods or services rendered. It is a transaction-specific document.

- Invoices are issued at the time of a particular transaction, typically associated with a single sale of goods or services.

- Invoices focus on the granular details of a single transaction, providing itemized charges, quantities, and the total amount due.

- The main objective of an invoice is to prompt timely payment for a specific transaction, ensuring that the customer is aware of the charges and due dates.

- Invoices are generally issued on a per-transaction basis.