Table Of Contents

What Is Billing Invoice Template?

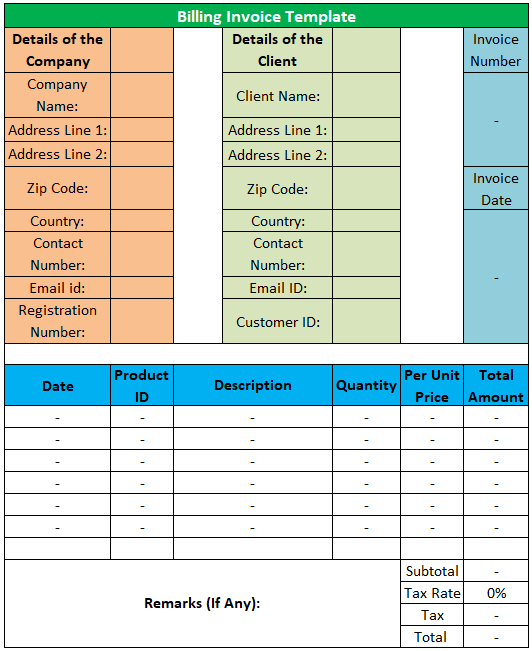

One may use a billing invoice template upon any sales made the transaction between a buyer and a seller or a dealer and a purchaser. The seller issues it to the buyer. A standard billing invoice records all the details concerning the seller and buyer company, along with the date and invoice number.

The details of the seller company that one must provide in the billing invoice are its name, official address, contact numbers, email ID, fax, and registration number. The buyer company's details must include its name, corporate address, contact numbers, and email ID. In addition, they must mandatorily mention the invoice number and dates in the billing invoice. The issuing company must also provide a unique reference number in the billing invoice.

Billing Invoice Template Explained

A billing invoice template is a formal document issued by the seller to the buyer. It signifies the actual amount the seller needs to pay the buyer against the products or services they have purchased from the former. A billing invoice is also necessary for the buyers since it acts as documented proof of the services they have availed or products they purchased from the buyer. The buyer can use an invoice if the products or services he purchased from the buyer were not up to the market or have failed to meet expectations. The buyer can use this simple billing invoice template if the products are in the warranty period and in cases of getting them exchanged or repaired, or sometimes in cases of claiming refunds. A standard template will have all the necessary details that are concerning to the buyer and the seller. The following are the common details:

- Heading in the template will remain intact. It will give the user an idea about the template's nature.

- In the template, one must provide the seller's company name, full address, contact numbers, email id, fax, and registration number.

- One must also provide the company's details against whoever raises the invoice. One should note the details of the buyer company, like its name, address, contact numbers, and email id in the invoice. In some cases, the buyer company can also be an individual customer. In that case, the name, mobile number, and address would be sufficient.

- The invoice must also infuse with the date, invoice number, and a unique reference number.

- Once providing all these details, the seller company must come to the main segment, the billing part. Here it will need to provide all the necessary information regarding the dates of purchase, description of the products or services, quantity, and per unit price, and then calculate the line total (multiplying quantity with per unit price).

- One must then add the line totals in a simple billing invoice template to ascertain the sub-total. The invoice must be cross-verified before being issued to the client and duly authorized by the seller. Once payments are clear, the seller must mention paid on the invoice to keep track of the received payments.

How To Use?

One must follow the following steps to use this blank billing invoice template:

- First, the person using the billing invoice template has to enter all the details as required in the fields that are not already pre-filled.

- Firstly, one must mention the details about name, address, zip code, country, contact numbers, email id, and registration number along with the invoice number and the date of invoice.

- Once filling in all these details, he must fill in his customer's or client's details like name, address, zip code, country, contact numbers, and email id.

- Once all these details are provided adequately in a progress billing invoice template and cross-examined, the user must forward them to the billing segment. Here, he will need to mention the date on which the transactions took place, a description along with the number of products or services and price per unit, and evaluate the line total for each transaction.

- One can ascertain the line total by multiplying the price per unit by the number of products and services. Once all inputs are provided, one can calculate the line total automatically, but the user must cross-verify all these details and calculations.

- One must add all the line totals to arrive at the subtotal. Then, one must add the taxes to arrive at the final amount. Finally, the invoice must be duly authorized and provided to the client. Once clearing the payments, the seller must mention paid in the same.

Once provided these details in a blank billing invoice template, the seller company must start the billing mechanism in the invoice. For example, they can mention the serial number, date, description of the products or services offered to the client, a quantity of these products or services, per unit price, and then accordingly calculate the total for each line that is products or services.

Once all entries pass in the progress billing invoice template, the company must add all the line totals to arrive at the sub-total. Then subtract the discount and advance payments and add applicable taxes and dues from previous transactions made with the same client to arrive at the net total. Once the net total ascertains, the company must cross-check the invoice to confirm that the same is free of any errors.

Example

Let us understand the concept with the help of a suitable example as given below:

We assume that ABC Ltd is selling the service of providing help regarding setting assembling of laptop parts and through its expert people who are very knowledgeable about the procedure. They provide this service to mainly corporates and sometimes individuals. Currently they have entered into a contract for the next 3 months with CK Corporation who are renovating their systems department with the latest computers.

So, ABC Ltd as prepared a billing invoice for this service which will contain all details about the entire process like, how many laptops, type of procedure and cost, their own contact details, client’s contact details, invoice number, date, and all the other details required for the document as already mentioned in the article above. This will ensure that both the parties will have all the information necessary to undergo the process and there is clarity. The invoice is then signed by the authorized officer and sent to the authorized person of CK Corporation.

Thus, we see that this proves to be a great document for reference and information during sales.

Billing Invoice Template Vs Sales Invoice Template

Even though the above are sales related documents, there are some differences between the two concepts. Let us point them out.

- The primary difference is that the former is mainly used during sale of services like leasing of a property, but the excel billing invoice template is commonly used for sale of goods, which may be either in cash or on credit.

- Another point of difference is that if the transaction is in cash, then the seller may not opt for issue of billing invoice but the latter has to be issued.

- The former is considered to be a supplementary document, not a primary document like the latter.

- From the above point, it can be derived that the former is not considered to be a legal proof of sale but the latter is a legal proof.

- Since the former is not a legal proof, it may or may not be registered with the Bureau of Internal Revenue (BIR). But it is necessary to register the latter with BIR, which is also a proof that the sale has actually happened.

- Both the documents have some categories in the business world. If we consider the former, there can be both cash and credit sale but for billing the clients, the former can also be referred to as a Statement of Account and also a Service Invoice. All three are considered the same thing. However, for the latter, the case is different. For cash sales, the document is often referred to as a Cash Invoice, and for credit, it becomes a Charge Invoice.

- Another important point of difference is that the former do not have the status of being provided as a document for claiming input tax, which is the tax collected from the registered purchaser of goods and services. In contrast, the excel billing invoice template has that status and can be used for claiming the input tax.

- It is not necessary to record the former in the books of accounts, whereas the latter has to be recorded because it is considered to be a primary proof of sale.

- It is to be noted that the former does not prove that the sale has actually occurred. It is a document that does not guarantee at all whether the sale has actually taken place of was later cancelled. But the latter is a proof of actual sale.

Thus, the above are some important points of differences between the two concepts. It is necessary to understand them in details so that the sales processes can be easily identified and interpreted.