Table Of Contents

Billback Meaning

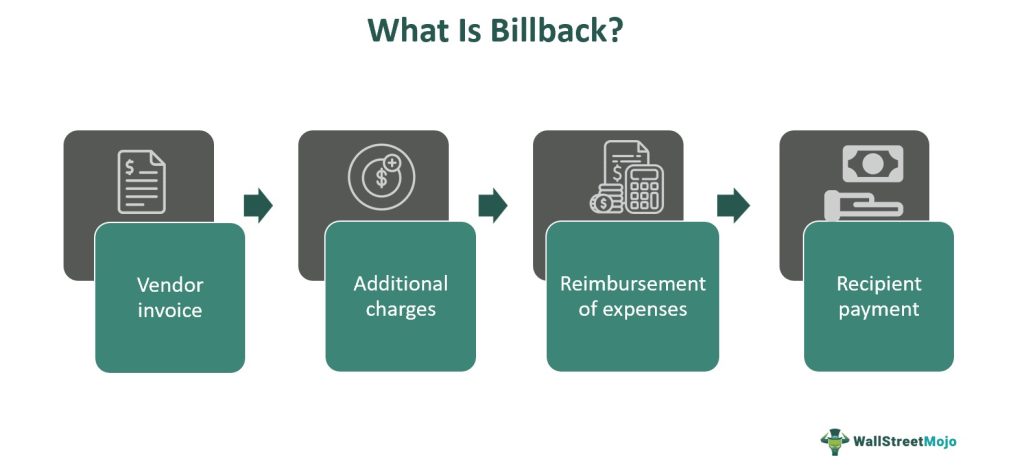

Billback typically refers to a process or transaction where one party incurs an expense on behalf of another party and then seeks reimbursement for that expense. It is commonly used when there is a shared cost or shared service arrangement between two or more entities, known as a billback agreement.

The purpose of this pricing in the context of card transactions is to account for specific circumstances or characteristics of certain transactions that may incur additional costs or risks for the payment processor or merchant. Thus, the additional charges associated with this pricing help offset these costs and risks.

Table of Contents

- Billback refers to a situation where one person or company pays for something on behalf of another person or company and then asks the other party to reimburse them later.

- Multiple parties often use it in situations with shared expenses or benefits. Instead of each person paying separately at the moment of purchase, one person takes care of the payment and later asks others to reimburse them for their share.

- It involves a separate charge billed later for specific expenses, while an off-invoice involves a direct adjustment or reduction on the original invoice. An off-invoice provides discounts or rebates and allocates the shared expenses.

How Does A Billback Work?

Billback pricing applies additional processing charges to specific transactions that meet the predetermined criteria outlined in the merchant agreement. The following steps provide an overview of how it typically operates:

- Merchant Agreement: The merchant agrees with a payment processor or acquiring bank that outlines the terms and conditions of their card processing services. However, this agreement includes provisions related to its pricing, including the circumstances or transaction types that may trigger additional charges.

- Transaction Processing: The customer makes a card payment at the merchant's establishment. The payment processor authorizes and settles the transaction after receiving the payment information from the merchant.

- Transaction Evaluation: After processing the transaction, the payment processor evaluates it against the criteria outlined in the merchant agreement to determine if it qualifies for billback pricing. This evaluation typically involves checking factors such as the card type used (e.g., gift card, rewards card), the entry method (keyed entry instead of swiped or dipped), or if it's a business card purchase.

- Additional Processing Charge: If the transaction meets the criteria for this pricing, the payment processor will apply an additional processing charge. As a result, this charge is typically a fixed amount or a percentage of the transaction value, depending on the terms specified in the merchant agreement.

- Billing Statement: The payment processor charges a processing fee to the merchant, which appears on their billing statement. Typically, billback fees or similar labels do not include regular processing fees in their calculations.

- Reconciliation and Payment: The merchant reconciles their billing statement and pays the total amount due, which includes the regular processing fees and any additional charges incurred during the billing period. Thus, the payment processor, or acquiring bank, typically receives the payment according to the agreed-upon terms.

Examples

Let us look at some examples to understand the concept better:

Example #1

In a hypothetical scenario, a catering company called Delicious Delights caters to a corporate event for a client. As part of the agreement, the client requests that Delicious Delights billback any expenses related to specific items, such as premium alcoholic beverages served during the event. After the event, Delicious Delights includes the cost of the premium alcoholic beverages as an additional processing charge in their bill, which they send to the client for reimbursement. As a result, the client reviews the bill, pays for the catering services provided, and reimburses Delicious Delights separately for the bill-back expense related to the premium alcoholic beverages.

Example #2

Suppose a software company called Tech Solutions partnered with a cloud storage provider to offer customers additional storage options. When a customer signs up for the cloud storage service, Tech Solutions handles the subscription and payment processing. Thus, Tech Solutions incurs a cost for each customer who opts for additional storage as part of their agreement with the cloud storage provider. To recoup this expense, Tech Solutions implements a billback system that charges the customer separately for the additional storage and the regular subscription fee. The customer receives a monthly bill that includes the subscription fee and the billback charge for the extra storage used, and they pay Tech Solutions accordingly to cover both expenses.

Billback vs Off-Invoice

The key differences between both concepts are as follows:

| Basis | Billback | Off-invoice |

|---|---|---|

| Concept | It refers to an additional processing charge or expense billed separately from the initial transaction or invoice. It is usually applied when a specific condition or criteria are met, such as using certain types of cards or incurring additional costs for specific services. | Off-invoice refers to a reduction or adjustment made directly to the original invoice amount. It involves deducting a specific amount or percentage from the total invoice value as a discount, rebate, or adjustment. |

| Timing | It is typically applied after the initial transaction has been processed and invoiced. It is usually billed separately in a subsequent statement or invoice. | These deductions are applied at the time of payment itself and not on the invoice. |

| Purpose | This pricing is often used to account for specific circumstances or costs associated with certain transactions. It helps to allocate expenses accurately and transparently among the parties involved. | Off-invoice adjustments are usually applied to provide incentives, discounts, or rebates to customers. They are commonly used as promotional or negotiation tools to encourage specific purchasing behaviors or reward customer loyalty. |

Frequently Asked Questions (FAQs)

A billback charge is an additional expense or processing fee billed separately from the original transaction or invoice. Typically, what applies are the specific circumstances or criteria outlined in an agreement or contract. Its purpose is to account for additional costs or services associated with a particular transaction.

In real estate, billback refers to allocating and billing shared expenses among tenants in a multi-tenant or commercial building. Thus, it is common in commercial leases where tenants share certain operating expenses or services related to the property.

A billback invoice is a billing statement specifically detailing the charges or expenses associated with a billback transaction. One party uses it to bill and communicate the additional costs incurred and to request reimbursement or payment from another party.

Recommended Articles

This article has been a guide to Billback and its meaning. Here, we explain the concept in detail, along with its examples and differences with off-invoice. You may also find some useful articles here –