Table Of Contents

Bid Price Meaning

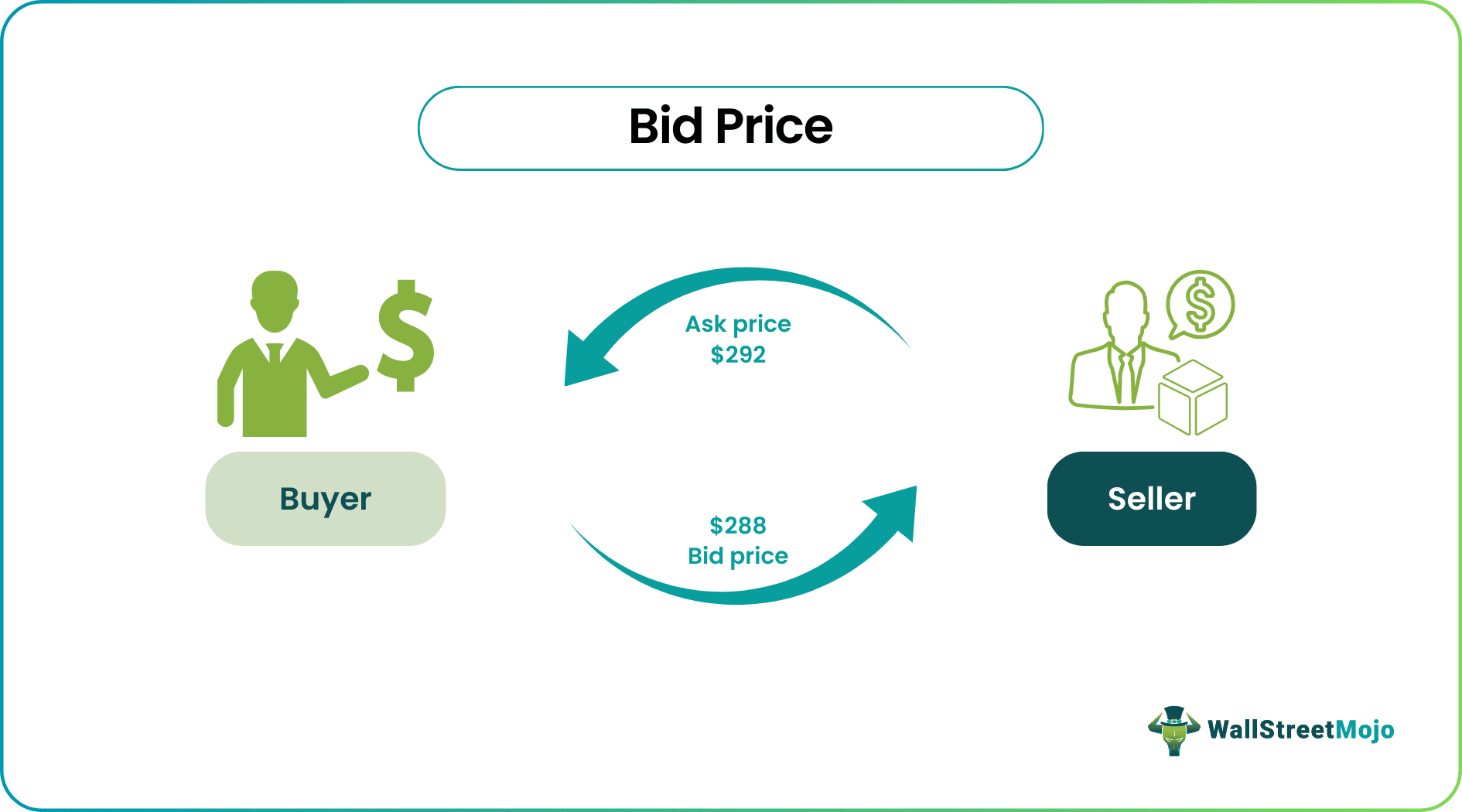

Bid Price refers to the the price quoted by a buyer for a particular stock or security or any financial instrument. It is placed against the askprice quoted by a particular seller selling that particular stock or security or financial instrument. The difference between this bid price and ask price becomes the profit for the market makers.

For successful bidding, the ecosystem requires a seller, a buyer, a stock, and an ask price. The ecosystem of trading requires a buyer to place their price. Then, depending upon the ask price, the buyer places the order. It is the maximum value that a buyer is willing to pay for a security.

Key Takeaways

- The Bid Price is the initial price quoted by a buyer for the purchase of goods or services against the asking price of the respective seller for the same goods or services.

- The Bid Price also functions in the share markets similarly, wherein people can place a bid order for a particular share and experience the share's movement based on the general bid offers.

- Bid Price can create a sense of the buying capacity for the buyer, as well as the selling capacity of the seller. A Bid Price and the subsequent offers can give an idea of how high or low the asset's value can go.

- While Bid Price can create a sense of the market dynamics, it cannot be the most accurate estimate of the asset's real value and is bound to fluctuate.

Bid Price Explained

The bid price is the price that the buyers put forth based on how much they are willing to pay for a particular security, commodity, or contract. This price is different from the ask price or offer price which signifies the amount that the sellers are willing to accept from the buyers. The bid price remains below the offer or ask price.

The difference between the bid and ask prices is referred to as spread. This spread becomes the earning for brokers or market makers, who help match buyers and sellers for the securities involved. The more the difference is, the higher the profits are, and vice-versa.

In modern days, the electronic trading platform has replaced the age-old cry trading system. Both the bid and ask price comes in front of the screen, and traders can trade accordingly. In the process, the seller does not meet buyers physically.

The marker makers keep putting forth bids for a security, and the market ends up getting multiple bids for the same security, commodity, or contract. Competing over a particular security, the bidders place a higher bid than each other to ensure they gain the right to the asset or security in question.

For example, bidder 1 places a bid worth $5,000 for security, while bidder 2 places a bid worth $7,500 for the same security. As a result, the seller looks for more profits on the transaction and hence selects the bidder with the highest bid. This is how the bid pricing in stock market dealings works.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us consider the following instances to understand what is a bid price and how it works:

Example #1 - A Bull Market Scenario

Suppose Mr. X wants to buy a stock of ABC limited for $20 per share. However, the prevailing rate is $22.5, and it is coming to $21.70, and the price is not sustaining at that rate. At the same time, Mr. X wants to take exposure to the company. Thus, the asking price at which the seller wants to sell is $22.5 and a low of $21.70. Thus, to make the transaction happen, Mr. X can revise its rate to $21.7 and can observe if the transaction happens or not? Maybe he has placed an order at $21.7, but the price shoots up to $23 per share due to a sudden increase in demand. Now, the asking price has become $23 per share, and to match the asking price, Mr. X has to place the bid higher than its last bid price.

Example #2 - A Bear Market Scenario

Mr. Joseph wants to buy shares of Netflix @ $288 per share. At the same time, the prevailing rate of Netflix is $ 292. Mr. Joseph would test by placing the bid quote at $285 per share. Whereas, due to bear market dynamics, other bidders will place the bid quote at $286-288 per share. Thus, the lower bidding will allow the price to be an inch below $290/ share and break down the $290 price range. The seller might experience that the price did not come to the desired levels. Due to bearish market dynamics, the seller would be forced to sell the security at $286-288 levels or may be lower than that.

Advantages

The bid price is the maximum price that a buyer is ready to pay for an asset. It gives buyers a chance to have sellers on board who are willing to accept that price. Besides this, there are many other benefits of such a price. Let us have a look at them:

- It helps to quote the price the buyer is willing to pay for a particular security or stock.

- The seller would be informed about the security value held by him. A higher bid price than the asking price indicates good stock and vice versa. However, in the real situation, the asking price always stays above the bid quote as the seller's expectation from his stock is always more while the buyer always quotes a lower price for the particular stock.

- The intrinsic value of the security can be determined. However, the general sentiment during the bull market remains positive as the buyer is ready to purchase at a higher price as they know the particular stock can be sold at a further higher price.

- In the case of the bear market, the general perception of the buyers remains low while the seller is willing to sell the security at a lower price. Thus, the buyer can find the seller easily. While in the real market condition, the perception remains so low that the bid price tends to lower.

- When a bid quote matches with the ask quote, the transaction happens. In most cases, they remain low unless a bunch of buyers is willing to buy the stock at a given point in time. Thus, in other words, the bid and ask price depends on the demand-supply theory. The higher the demand, the higher the bid.

Disadvantages

Apart from the advantages that bid prices have, they also have limitations. Some of these disadvantages are as follows:

- This price is lower than the asking price, and sometimes it hinders the transaction as the seller is not willing to sell the security as quoted in the bid price.

- Through the bid quote, the real value of the securities cannot be determined. Due to market dynamics, investor sentiment, and fear of the bear market, they tend to lower. However, the stock's actual price might be quite high, and the seller is forced to sell its security at a lower price due to a liquidity crunch.

- In modern-day trading, the bidding is placed through electronic systems. There are millions of transactions occurring each day. Thus, it is impossible to contact the bidder or the buyer. The seller and the buyer can't meet each other.

- The buyer wants to purchase the specific security through bid, while the real value might not be the same. Due to a liquidity crunch, the bidding price of the stock or the security has gone down, and it might not reflect the actual fundamentals of the stock.

- The bidder places the price below the price quoted by the seller through the asking price. However, it always remains below the asking price. The psychology behind the mechanism is that the purchase rate should be lower than the asking rate.

- They do not replicate the actual value of the security. It is just the scenario of market dynamics.

- The bidder will always bargain; the seller may sell at a lower price due to lower demand.

- The difference between the bid and the ask quote is called the spread. The higher the spread, the higher the bargaining power of the bidder.

- However, as per the market perception, It is taken as the benchmark, while in many cases, the price might be lower than the intrinsic value of the security.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The Bid Price is not the final price that is decided upon in a transaction. It is merely the initial offer by the buyer that is quoted against the offer price offered by the seller.

Generally, the Bid Price is lower than the Offer Price, as the buyer wants to buy the good or service at the lowest price possible, a likely turnout of the negotiations. However, the Bid Price can also exceed the Offer Price due to market fluctuations.

A bid is a price a buyer chooses to pay for a share of stock, whereas an offer is a price a seller proposes to sell that share of stock for.

The asking price is the amount a trader is currently ready to spend to go long (purchase a stock to wait for a higher price). The asking price is the lowest price at which someone is now willing to sell a stock. Most charts are built using the most recent pricing.