Best Investment Strategies for a Secure Retirement

Table of Contents

Introduction

For individuals looking to lead a financially secure life following retirement, wisely investing is crucial. Indeed, without building a substantial corpus, it may become difficult to meet different types of expenses, for example, entertainment, medical, and utilities expenses.

Moreover, without sufficient funds, you may even find it challenging to get access to reliable hospitals or long-term care facilities that are free from nursing home abuse. Considering that eight facilities (38%) are rated poorly in quality measures in Augusta, Georgia, United States, investing judiciously to have the necessary funds to afford well-equipped and safe facilities becomes all the more essential.

In this article, we will discuss some of the most effective investment strategies for retirement.

Top Investment Strategies

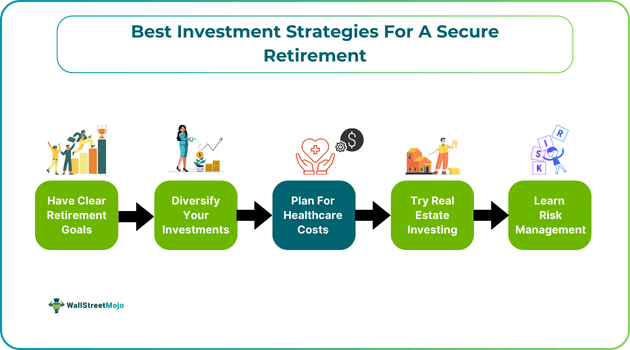

Here are the top investment strategies for retirement that you can consider implementing:

#1 - Be Clear With Your Retirement Goals

First things first, have a clear understanding and detailed picture of your retirement objectives. Set your goals and then work accordingly to ensure that you are moving in the right direction. Everybody wants to be financially stable, that's obvious; think about what exactly you want to do in your retirement days. Think of a number or figure that should be there in your bank account, and then make a plan regarding savings and investments that can help you achieve that figure.

Think of your lifestyle expenses and how much you'll need for your fixed and variable expenses, for example, housing costs, taxes, debt repayments, and personal expenses. Be crystal clear about your retirement goals. Only then can you actually work towards secure retirement investments.

#2 - Diversifying Your Investments

We have actually lost count of how many times we have talked about portfolio diversification as a benefit, advice, or just as a pointer while teaching financial discipline. You must ensure to always diversify your investments across asset classes and sub-classes; never rely on any particular asset class, like equity or debt.

When you start planning for your retirement early in your twenties, it means you have time of more than 30 years. Explore the financial markets, research different financial instruments or securities, and start distributing your capital across different investment avenues, such as mutual funds, bonds, debt securities, and the stock market.

In fact, if you have the knowledge, try allocating funds to other types of assets, for example, commodities and cryptocurrencies. You can try real estate investing, too. This way, you not only gather knowledge about different markets and asset classes but, with time, you will learn to manage your portfolio across different markets and platforms. In case you do not have any knowledge regarding these financial instruments, you may consider getting the help of a dependable financial advisor who can guide you and help you make prudent decisions.

#3 - Planning for Healthcare Costs

Retirement comes with old age, and so do illness and chronic sicknesses. Today, people usually suffer from multiple diseases, such as diabetes, high blood pressure, and obesity, let alone other critical illnesses like cancer. It may sound negative at first, but to be prepaid for it is the most practical thing you can do.

Serious illnesses involve clinical trials, tests, medicines, and long-term treatments, which are, needless to say, expensive. Having said that, when you plan well and execute investment strategies for retirement effectively, take good care of yourself, and purchase a medical and health insurance policy with significant financial coverage, you can cover a major portion of your healthcare costs post-retirement easily.

#4 - Managing Risks in Retirement Planning

Learn to manage financial risk. This is literally one of the best retirement planning tips. As an individual, you cannot just depend on savings and investments. Markets are dynamic, and they can actually eat up your gains earned over a long period because of a market downturn. Learn about effective risk management strategies, and make yourself aware and knowledgeable regarding the potential risks associated with different kinds of investments.

Educate yourself about markets, stay updated with industry news and new retirement plans, and regularly monitor your portfolio across different markets. Check for suitable entry and exit points and make shifts in positions accordingly when you think the time is right.

Many people think that just because they are making monthly contributions to a mutual fund or their stock portfolio, by the time they retire, they will have enough money. However, this is not entirely true. For long-term wealth building, you simply cannot rely on this strategy. You must ensure to make the right adjustments on time not only to mitigate the risks but also to maximize your returns.

#5 - Real Estate as a Retirement Strategy

One of the best investment strategies for retirement is allocating funds to real estate properties. If individuals choose the right asset, they can enjoy various benefits, for example, cash flow stability, high returns, and tax advantages. Moreover, individuals can diversify their portfolios by getting exposure to real estate. This, in turn, can help mitigate financial risk and increase portfolio value.

Also, note that real estate has the ability to hedge inflation. This is because the rate of increase in the value of a real estate property can be higher than the inflation rate. This enables investors to sell the asset and earn capital gains. Moreover, even rents can go up because of inflation, resulting in passive income for the property owners. If one does not have the funds to purchase real estate properties, one can consider investing in real estate investment trusts or REITs. One can buy and sell REITs that are publicly traded on stock exchanges.

Final Thoughts

In the end, we encourage you to incorporate all the above-discussed investment strategies for retirement from today to leverage the time available and reach your retirement goals as early and as smoothly as possible. Financial independence is essential, especially from a retirement perspective. The earlier you begin, the further ahead you will be.

Focus on your goals, diversify your investments, plan for healthcare costs, learn to manage risks, and try to explore and invest in the real estate market. We truly believe that if you follow these retirement planning tips, you will reap maximum returns from your investments and ensure a financially stable retirement for yourself.