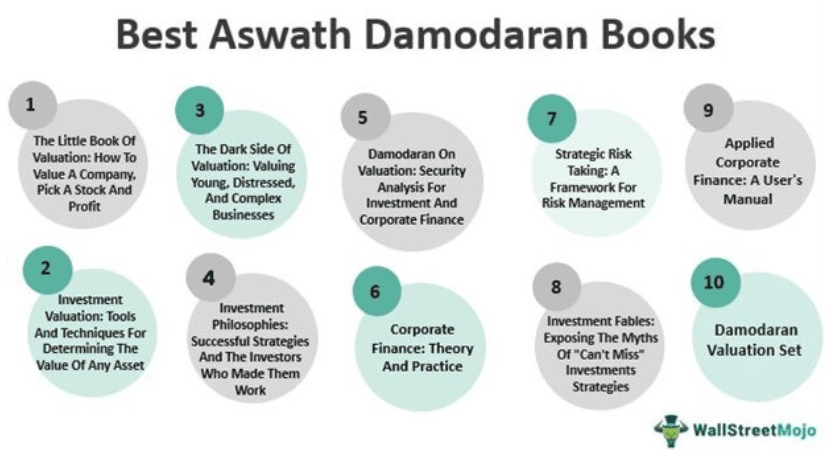

Top 10 Aswath Damodaran Books

Aswath Damodaran is a Professor of Finance at the Stern School of Business at New York University. He is famous for his books and sheer knowledge in the various fields of finances. Aswath describes himself as a person who likes to unravel the puzzles of valuation and corporate finance. He also offers tailor-made programs and classes on the same, including investment philosophies. Damodaran’s knowledge on these subjects is impeccable, and over the years, he has written many books to help students and investors gain the same insights and learning.

- The Little Book Of Valuation: How To Value A Company, Pick A Stock And Profit ( Get this book )

- Investment Valuation: Tools And Techniques For Determining The Value Of Any Asset ( Get this book )

- The Dark Side Of Valuation: Valuing Young, Distressed, And Complex Businesses ( Get this book )

- Investment Philosophies: Successful Strategies And The Investors Who Made Them Work ( Get this book )

- Damodaran On Valuation: Security Analysis For Investment And Corporate Finance ( Get this book )

- Corporate Finance: Theory And Practice ( Get this book )

- Strategic Risk Taking: A Framework For Risk Management ( Get this book )

- Investment Fables: Exposing The Myths Of “Can’t Miss” Investments Strategies ( Get this book )

- Applied Corporate Finance: A User’s Manual ( Get this book )

- Damodaran Valuation Set ( Get this book )

Let us go through each Aswath Damodaran book briefly to understand the learnings and knowledge it provides –

#1 – The Little Book Of Valuation: How To Value A Company, Pick A Stock And Profit

Aswath Damodaran has been a pioneer in corporate finance and valuation; his insights have helped many people come across crucial topics in a more understandable format and examples.

Book Review

Any investment decision is majorly based on valuation. The final call of selling, buying, or holding any asset comes from valuation, which plays a pivotal role in finance. This book explains the terms for investors in an easy-to-understand way so that any new investor can also relate to it. It is one thing to read valuations and another to make sense of it. This book helps in both parts equally. The book also covers multiple valuation approaches with crucial techniques.

Key Takeaways

- The book comprises case studies and examples.

- It comes with an iPhone application for making book lessons immediately useful.

- The book serves as a guide for stock valuation.

#2 – Investment Valuation: Tools And Techniques For Determining The Value Of Any Asset

There are many processes and techniques to understand the stock valuation or determine the valuation of a company. But, Aswath Damodaran as an educator, helps students learn it swiftly.

Book Review

The book provides a detailed explanation of valuation techniques followed in financial markets and investors in general. It also explains critical market variations and sheds light on selecting the right model for any valuation scenario. The book covers topics like start-up firms, real estate, assets distribution, private equity with properly updated examples for readers to learn easily.

Key Takeaways

- Comes along with updated online databases, spreadsheets, and other support tools

- Talks about the market crisis and emerging markets and types of equity investments.

- Holds high rank among Aswath Damodaran books on valuation.

- It becomes a must-read book for students to gain insights and learn the valuation process.

#3 – The Dark Side Of Valuation: Valuing Young, Distressed, And Complex Businesses

This book came out in the year 2009 and is written to understand the other side of the valuation process. As the name suggests, it gives an exhaustive idea of complex businesses.

Book Review

The author offers a perspective towards resisting easy valuation. The book, in all its content, highlights hard-to-value firms. The author particularly targets the corporate sector in this book and marks outs the various downsides of it. Students may also read it to understand human capital, technology, cyclical firms, and commodity.

Key Takeaways

- The book wants the reader to identify the temptation to use unrealistic valuation techniques.

- The author talks about risk premiums and risk-free rates.

- It offers an intelligent analysis for angel and early venture capital investing.

- The book explains several stages of the corporate lifecycle.

#4 – Investment Philosophies: Successful Strategies And The Investors Who Made Them Work

The book serves as a compilation of investment philosophies along with investor stories. The book initially came out in 2012 and is one of the most important books on the topic.

Book Review

The book deals with the actual results of different investment strategies and philosophies applied. Hence it serves as a guide for investors to know about the pros and cons of varying levels of investment applications and how they stand in the market on a practical level. In addition, the book covers market timing, value investing, technical analysis, indexing, and what investors should do.

Key Takeaways

- The book is a major source of resources and tools.

- It helps comprehend portfolio management and the variety of strategies.

- The book defines the creating and managing of a portfolio process.

- It shows readers how to register profit.

#5 – Damodaran On Valuation: Security Analysis For Investment And Corporate Finance

The book was released in 1994 and has been updated multiple times to meet the current market trends and explanations.

Book Review

For people interested in the theory or practice of valuation, this book must always be on their reading list, and in fact, it should always be present with them. Many CEOs worldwide state that it is important to grow in company valuation and process to become a successful CEO or business professional. This book particularly is suggested by many readers as one of the most reliable books on the topic.

Key Takeaways

- The book answers many critical questions on valuation and is a must-have, must-read book for students looking for information on the valuation process.

- This book has its reputation and following among the Aswath Damodaran books on valuation.

- Students and many investors follow this book to understand the terms and concepts of valuation.

#6 – Corporate Finance - Theory And Practice

This book has been a long-time favorite of people. Many editions of this book have been published with a huge following of students and professionals.

Book Review

The book deals with the subject of corporate finance and attracts a lot of readers given the author’s reputation as a well-known academic and professor of the subject. Moreover, some new chapters are incorporated with every edition, which again works in the weightage of the book’s knowledge. In addition, it makes financial concepts easy to understand that are quite complex.

Key Takeaways

- The book has a perfect blend of theory and practical financial concepts.

- It offers exhaustive preparation for working on corporate finance productively.

- The author, through this book, helps students learn essential concepts and techniques for real-world applications.

- The book contains data, quizzes, case studies, lecture notes, and other important information.

#7 – Strategic Risk Taking: A Framework For Risk Management

The book came out in 2007 and has been a great resource for people looking to understand risk management in finance and master its practice strategically.

Book Review

Aswath Damodaran has been a personality of pure financial knowledge. So when he wrote this book, it became adamant that he could share his insights with people. Still, if followed in the right way, his teachings can help people understand the risk factors and aid investors in different sets of assets management and financial markets.

Key Takeaways

- The author explains financial tools for evaluating risk.

- The book offers a detailed perspective on risk management in finance.

- It draws a line between good and bad investments.

- The book covers traditional finance, uses risk strategically, and encourages people to take calculated risks.

#8 – Investment Fables: Exposing The Myths Of “Can’t Miss” Investments Strategies

The book was originally published in 2004, in which Aswath Damodaran shares some of the most interesting investment fables and strategies to look at.

Book Review

This book talks about debunking myths of the market and how to make smart investments. It provides a specific definition of the stock market and its terms, like blue-chip stocks, high dividend stocks, bonds, debentures, momentum, etc. The author wants people to understand the importance of investing in the stock market and making long-term profits. That is why the book comprises many encouraging investment stories in it.

Key Takeaways

- The book discusses the 13 truths of today’s most widely trending investment strategies.

- It argues if it is okay to follow what big investors do and answers the same.

- The author shares 10 powerful lessons for every individual looking forward to investing.

- This book is good for anyone’s smart investment decisions.

#9 – Applied Corporate Finance: A User’s Manual

The book was released in 1998, and Aswath Damodaran explained the various tactics and theories regarding applied corporate finance and its environment.

Book Review

The book discusses various applied corporate finance theories and applications to provide the readers with the big picture that many of them do not see at first glance. In addition, the book has its way of telling students about the assumptions, models, and debate theories around corporate finance.

Key Takeaways

- The book has six core and real-world companies to follow and study.

- The author divides the business decision into three types – financing, investment, and dividend.

- Apart from the valuation topic and process, the book explains various factors and the flip side of corporate finance applications and practices.

#10 - Damodaran Valuation Set

The book with the author's name came out in the year 2007. The book is a compilation of all the author's knowledge and shared with its readers.

Book Review

Over the years, the author gathered the knowledge of being a scholar and a famous professor. As a result, this book comprises all the information to share with people interested in financial markets, valuation processes, stocks, assets, making a long-term profit, and commerce. This particular trait makes this book one of the best Aswath Damodaran books on valuation.

Key Takeaways

- The book has everything one wants to know and study the valuation process.

- Anyone from students to investors can read the book.

- It serves as an encyclopedia of valuation and other financial terms.