Table Of Contents

What Is Beneficiary Designation?

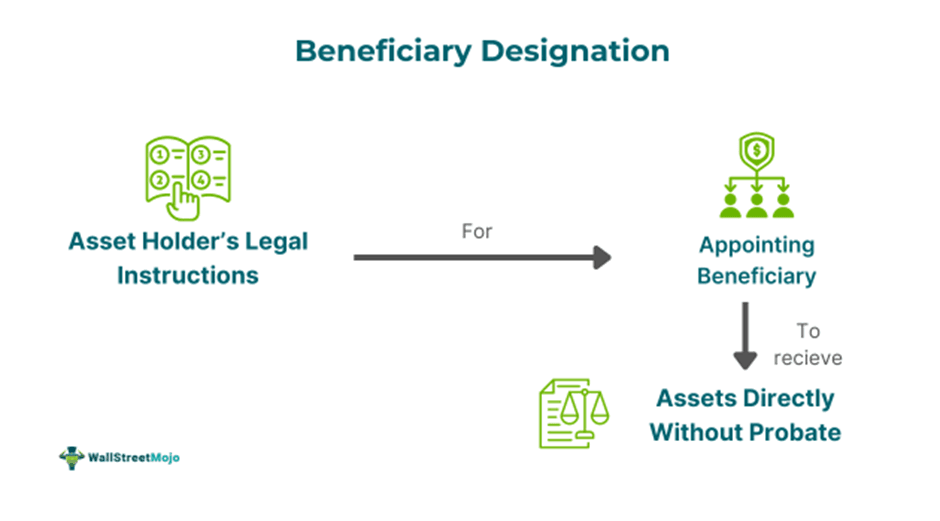

Beneficiary designation is a crucial element of estate planning. It refers to the process of naming a person or entity to receive one's assets after one's passing. This designation helps an asset owner transfer any asset to primary or secondary (contingent) beneficiaries without court-supervised probate proceedings.

It forms part of several types of estate planning, such as will, checking and savings accounts, non-qualified accounts, and life insurance policies. Furthermore, it makes it easier for the heir or the beneficiary to get the inheritance without any issues or legal hassles.

Key Takeaways

- A beneficiary designation represents an essential element of estate planning that identifies any individual or organization to inherit an asset from a deceased holder of the asset.

- There are six types of beneficiaries- primary, secondary, specific, revocable, irrevocable, per stirpes capita, and per capita.

- To add beneficiaries, one has to add and name living persons, charities, or trusts and update significant life events.

- In addition, they must follow instructions, coordinate trusts and wills, distribute assets evenly, keep the estate out, and consider tax consequences.

- Its importance lies in simplifying inheritance, allowing easy access, changing beneficiaries without legal advice, and specifying multiple beneficiaries.

Beneficiary Designation In Estate Planning Explained

Beneficiary designation meaning can be understood as legal instructions allowing asset holders to specify individuals to receive certain assets like bank accounts, insurance payouts and retirement benefits directly after the holder's death. The whole exercise avoids the probate, ensuring that all the assets are divided as per the holder's wishes independently of one's will.

The process of designating beneficiaries, whether an individual or an entity, involves several steps and can take various forms. This designation has significant implications, such as allowing assets to pass directly to beneficiaries without the need for expensive probate, facilitating faster and easier access to funds or assets, as seen with beneficiary designation IRAs, and offering tax advantages to beneficiaries under certain conditions.

Designated beneficiaries are used in various financial contexts, including:

- Life insurance policies

- Retirement accounts and annuities

- Transfer on Death (TOD) or Payable on Death (POD) accounts

It is crucial to complete and update the designated beneficiary form, such as the TIAA beneficiary designation form, correctly and review it after major life events, as this is an essential part of estate planning. Financial institutions play a key role in managing and executing designated beneficiaries and disbursing assets accordingly.

Types

It usually has six types of beneficiaries:

- Primary beneficiaries are individuals or entities that have the first right to claim an asset after the holder's death.

- Secondary (or contingent) beneficiaries are the second in line to claim and inherit the asset if there exists no refusal by the primary beneficiary.

- A specific beneficiary is a single named individual, such as Mr. X, who is designated as the claimant of an asset.

- Revocable Beneficiaries can be changed at any time by the policyholder.

- Irrevocable Beneficiaries cannot be changed from being designated beneficiaries without their consent.

- Per Stirpes Capita Beneficiaries, assets are distributed to a specific branch of the holder's family equally among every branch.

- Per Capita Beneficiaries distribute only the assets of the holder equitably between each one of the living heirs.

How To Designate Beneficiaries?

Before designating someone as a beneficiary, one must follow the process below:

- Add and name beneficiaries to avoid probate costs and delays in the form, such as the Charles Schwab beneficiary designation form.

- As a backup, primary and contingent beneficiaries must be named.

- All designated beneficiaries must be living persons or charities or trusts.

- All major life events must be updated regularly.

- All instructions on the form concerning the designation of beneficiaries must be carefully read and followed.

- One must coordinate their trust and will with the designated beneficiaries.

- Distribute assets evenly amongst individually named beneficiaries.

- The estate must be kept out of the named beneficiary.

- Certain assets require experts' help to be named as beneficiaries.

- Consider the tax consequences while designating beneficiaries.

Mistakes To Avoid

As designated beneficiaries can’t be rectified after the holder's demise, they must avoid the following mistakes:

- Asset distribution must not be unevenly done.

- The estate must never be named as a designated beneficiary so as to avoid probate.

- Disclaimers must be used cautiously.

- Forgetting to update beneficiaries with events like relatives' deaths, children's births, marriages, and divorces.

- Adding minors without including their custodian or guardian.

- Naming a person of spendthrift nature or minor instead of trust as designated.

- Proper distribution of assets must be done percentage-wise if one has multiple designated beneficiaries.

- One must not name a special needs person or one receiving government help as a beneficiary.

- Failing to review designated beneficiary after occurrence of significant life event.

- Not able to consider the harmful impact on the finances of a named beneficiary, like increased tax burden or hampering their avenue of government aid.

Importance

It has importance in asset transfer in the following ways:

- One can quickly and directly understand the concept.

- Access the form for the naming of the beneficiaries easily.

- It enables the change in beneficiary at any time one wants without the help of legal counsel.

- One can specify numerous beneficiaries and assign various percentages for distributions for every beneficiary.

- One can name a variety of beneficiaries for an asset, such as an estate, a charity, or a trust, to benefit the disabled or minor beneficiary.

- It enables the bypassing of assets from probate, saving the money and time of the beneficiary.

- Beneficiaries can claim and own the assets faster upon submitting the claim form, along with the death certificate of the holder and their identification proof.

- It offers flexibility for various assets, such as bank accounts, life insurance, and investment accounts, to customize their inheritance.

- They may offer tax benefits to the beneficiaries, like retirement accounts.

- Provides access to funds to designated beneficiaries as no probate is needed.

Beneficiary Designation Vs. Will Vs. Trust

All these help in the transfer of estate or asset from their holder to the beneficiaries or their heir after their death, but all differ from each other as per the table given below:

| Beneficiary Designation | Will | Trust |

|---|---|---|

| It designates the person receiving assets after one’s death. | Represents a legal paper describing the manner in which one's property has to be divided after the holder's demise. | A legal structure is looking after one's assets in a lifetime and after the death of the holder under the supervision of a trustee. |

| Has a limited scope, like bank accounts, life insurance policies, or retirement plans. | Covers every type of asset. | Applicable over all varieties of assets during lifetime and post-death. |

| It may contain tax rules related to retirement accounts. | Estate taxes are applicable after probate. | Acts as a catalyst to minimize taxes and protect assets. |

| Bypass probate is used to direct the passage of assets and estate to the beneficiaries. | Going through probate is mandatory here | Conventionally avoids probate, adds privacy, and quicker distributions |

| Every account or policy needs to be updated regularly. | A single legal process can update the will just before the death of the holder. | All except revocable trust can be modified during a lifetime. |