Table Of Contents

What Is Belief Bias?

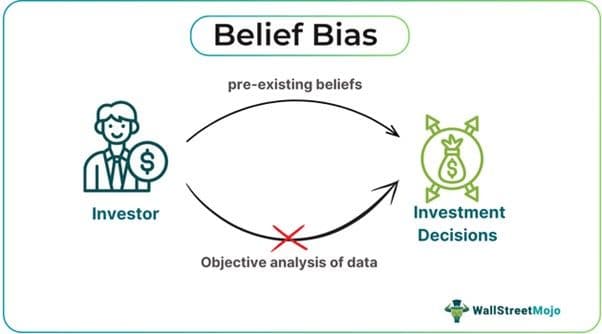

Belief bias refers to the tendency for people’s prior beliefs to influence their reasoning and decision-making. In psychology, it means that individuals are more likely to accept arguments and conclusions that align with their existing beliefs, even if those conclusions are not logically sound.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

In investment or decision-making contexts, belief bias is an unconscious shortcut affecting how investors evaluate information. This bias can simplify decision-making by allowing individuals to rely on quick, intuitive judgments rather than thorough analysis. Recognizing belief bias helps individuals make more informed decisions by encouraging a more objective assessment of all available information.

Key Takeaways

- Belief bias in psychology refers to the tendency for existing beliefs to influence individual deductive reasoning, simplifying decisions and facilitating information processing.

- It arises from personal beliefs, cognitive heuristics, emotional attachment, difficulty separating emotional reactions from logical evaluation, and the inability to accept contradictory evidence.

Belief Bias In Finance Explained

Belief bias refers to the tendency to evaluate financial conclusions and information based on existing beliefs rather than through objective analysis. This bias leads to an overestimation of the validity of a conclusion simply because it aligns with one’s financial expectations, regardless of its actual logical soundness.

Belief bias in finance often occurs when analysts or investors prefer conclusions that match their pre-existing views. For example, they may accept a premise as credible or familiar without scrutinizing the underlying logic, even if it is flawed.

The effects of belief bias can significantly influence financial decisions and investment opportunities. It can lead to poor financial judgments, such as overlooking alternative investment strategies, misinterpreting data, or displaying over- or under-confidence in market forecasting. Investors might also dismiss sound advice or opportunities contradicting their beliefs.

By becoming aware of belief bias, investors can adopt strategies like double-checking their reasoning processes and questioning the validity of outcomes, even when those outcomes align with their beliefs. This awareness can help prevent skewed market perceptions and reduce the risk of being influenced by belief bias rather than logical evaluation.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Causes

The causes of belief bias arise from the following:

- Personal belief systems influence decision-making rather than objective probabilities.

- Inability to accept evidence that contradicts pre-existing beliefs.

- Reliance on cognitive heuristics that align with individual beliefs.

- Emotional attachment to one’s beliefs impacts logical reasoning.

- Difficulty in separating emotional reactions from logical evaluation.

- The use of heuristic procedures to speed up information processing.

- The brain's failure to engage in slower, more deliberate reasoning.

Examples

Let us look into a few examples:

Example #1

Alex has invested in a company’s stock that has been steadily increasing. He believes the stock will continue to rise because he has heard positive news about the company’s new investment. When the stock price starts to drop, he dismisses the decline as a temporary setback, convinced that the positive news will eventually drive the price back up. His belief bias leads him to hold onto the stock longer than he should, ignoring other market signals that suggest a deeper issue.

Example #2

Another example pertains to the 2016 United States Presidential election. In this election, many of Donald Trump's supporters displayed belief bias by focusing on positive aspects of his campaign and dismissing or minimizing criticisms and controversies surrounding him. Simultaneously, they were more likely to accept and emphasize negative information about his opponent, Hillary Clinton, which aligned with their pre-existing beliefs and contributed to their voting decisions. This behavior is supported by research on related cognitive biases, such as confirmation bias, which shows how individuals filter information through pre-existing beliefs, as discussed in the article "The Role of Belief Bias in Political Decision Making".

Impact On Investment Decisions

Many investors are influenced by inherent biases that affect their investment decisions, as outlined below:

- It can lead investors to make poor investment choices.

- Investors may ignore negative data about an asset, relying on their belief in its good performance due to belief bias.

- Investors tend to dismiss new information that contradicts their preconceived notions, reducing their flexibility to adapt to market changes.

- Beliefs in long-term performance can cause investors to hold onto underperforming investments despite a lack of empirical evidence.

- It limits the potential for diversifying investments and increasing returns.

How To Avoid?

Some of the strategies to avoid belief bias are the following:

- Acknowledge that belief biases can cloud judgment.

- Seek out alternative opinions that challenge your beliefs and understand the complexity of financial issues.

- Assess all arguments rationally, focusing on evidence and logic rather than aligning with personal beliefs.

- Slow down decision-making to thoroughly evaluate data, avoiding reliance on gut feelings influenced by bias.

- Create a comprehensive investment plan with clear financial goals to reduce emotional influence and guide decisions.

- Regularly reassess investment objectives in light of new data to counteract confirmation bias.

- Consult financial experts for insights and minimize cognitive biases' impact on investment decisions.

- Be aware of the human tendency to confuse believability with temptation.

- Question results that seem too believable.

- Focus on the validity of the thesis.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.