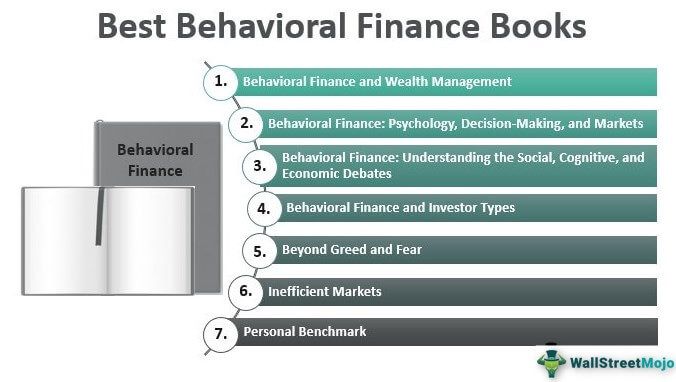

List of Top 15 Behavioral Finance Books [2025]

Here is the list of books on behavioral finance so that you don’t need to spend hours and hours at stores to find out the best ones.

- Predictably Irrational ( Get this book )

- Thinking, Fast and Slow ( Get this book )

- Misbehaving: The Making of Behavioral Economics ( Get this book )

- The Little Book of Behavioral Investing ( Get this book )

- Behavioral Finance: Insights Into Irrational Minds and Markets ( Get this book )

- Behavioral Finance and Wealth Management ( Get this book )

- Behavioral Finance: Psychology, Decision-Making, and Markets ( Get this book )

- Behavioral Finance: Understanding the Social, Cognitive, and Economic Debates (Wiley Finance) ( Get this book )

- Behavioral Finance and Investor Types ( Get this book )

- Beyond Greed and Fear ( Get this book )

- Inefficient Markets ( Get this book )

- Personal Benchmark ( Get this book )

- Handbook of Behavioral Finance ( Get this book )

- Advances in Behavioral Finance (Roundtable Series in Behavioral Economics) ( Get this book )

- Advances in Behavioral Finance, Volume II ( Get this book )

Let us discuss each behavioral finance book in detail, along with its key takeaways and reviews.

#1 - Predictably Irrational

by Dan Ariely

This book gives a very interesting perspective on how the human brain functions in the most irrational way, even when we deliberately try to make the best and most rational decision.

Book Review

The placebo effect is one of the classic examples of how our brain functions. This book introduces you to many similar examples from different walks of life. The author has blended commonplace experiences with innovative research experiments to counter the common belief that humans usually behave in rational ways. While reading, you will realize how emotions, expectations, social norms, and other unseen forces make us commit the same daily mistakes. However, this irresponsible behavior is neither senseless nor random but systematic and predictable. In short, the book states how unknown hidden forces control our predictably irrational minds during decision-making.

Best takeaway from this book

- The commonplace examples back the behavioral science concept, making it easier for us to understand what the author intends to convey through the text.

- This book can be an interesting read and academically useful for students pursuing behavioral finance.

#2 - Thinking, Fast and Slow

by Daniel Kahneman

As the name suggests, this book primarily explains how our minds behave in a fast, spontaneous, and emotional way or deliberately slow and logical way. In addition, it discusses the pros and cons of both ways of thinking.

Book Review

This book is very insightful and lucid, continuously throwing intellectually surprising elements at you. Hence, we find it entertaining and, at times, touching. It engages us in a lively conversation with the author while he reveals the various secrets of our minds. The book guides us in understanding which of our intuitions can be trusted and in what scenario slow thinking is the best option. There are multiple practical and informative insights provided in the book based on both professional and personal experiences. If we follow some of the techniques offered by the author, we will realize that we can avoid mental glitches that usually get us into trouble.

Best takeaway from this book

- The book analyses the two ways of thinking in a very detailed way with some interesting and quirky examples.

- It can help us unearth many of our cognitive biases and fallacies, which have otherwise become part of our everyday lives.

#3 - Misbehaving: The Making of Behavioral Economics

by Richard H. Thaler

This book is Nobel laureate Richard Thaler’s autobiography, covering the core concepts of behavioral economics.

Book Review

The book gracefully presents a wealth of evidence to demonstrate how the human mind misbehaves. The illustrations are engaging and frequently hilarious as they attempt to explain things we usually don’t intend to discuss. It can potentially change your perception of economics and the world. The book reveals that we often succumb to our cognitive biases and make decisions that are considered aberrations to rational thinking. This book is what has been termed as misbehaving in the text.

What is more important to know is that these misbehaviors usually have serious consequences. Moreover, most of the misbehaving acts illustrated in the book are based on the author’s personal experience. Hence, he can offer useful tips to the readers on how to make better decisions in the mysterious world in which we live.

Best takeaway from this book

- This book highlights that a common person usually misbehaves due to cognitive biases.

- It states how behavioral economic analysis can open up new ways of looking at things.

- It offers a firsthand account of a prominent economist's entire illustrious professional career.

#4 - The Little Book of Behavioral Investing:

How Not to Be Your Own Worst Enemy

by James Montier

The book discusses some of the most common behavioral challenges investors face and explains how these can impact investment decision-making.

Book Review

This book describes many time-tested ways of identifying and avoiding the pitfalls of investor bias. One of its most important messages is that we should learn from our past investment mistakes, so we don't repeat them in the future. Furthermore, it explains in a straightforward style the various behavioral principles that can help us maintain a successful investment portfolio and realize superior returns. Hence, it is an easy and entertaining read for individual investors with little or no background in behavioral finance. In short, this book can offer you a solid foundation to dive into the fascinating world of investing.

Best takeaway from this book

- It can help you understand how human behavior interacts with the financial markets.

- It can also help you realize your biases and overcome them.

- It describes the major fallacies associated with investment decision-making, such as loss aversion, over-optimism, hindsight bias, etc.

#5 - Behavioural Finance: Insights Into Irrational Minds and Markets

by James Montier

The book tends to build a relationship between the financial products available in the market and behavioral finance theories, a field of study that has been gaining ground during the last few decades.

Book Review

The book conveys the simple belief that investors in the real world are fundamentally not rational. The author provides many practical examples to explain the various theories of this emerging field of study, which eventually indicate that most investment decisions are irrational. It can be useful for institutional investors to identify the key psychologically-induced errors and biases in their process and mitigate them. Fund managers, asset allocators, strategists, corporate financiers, etc., must read this book. It can be equally helpful for students pursuing MBA or other finance and investment-related disciplines.

Best takeaway from this book

- The book links the financial products available in the market with behavioral finance theories.

- It can be useful for both established investors and aspiring finance professionals.

#6 - Behavioral Finance and Wealth Management

How to Build Optimal Portfolios That Account for Investor Biases (Wiley Finance)

by Michael M. Pompeian

Biases are your enemy. You want your limited beliefs to help the right choice you could have made. If so, have a look at the review and the best takeaways.

Book Review

Review: If you want to pinpoint your biases and want research to support the statements, this is the right book for you. You will get a lot of information about investment biases, and as you become more aware of them, it will be easier to eliminate them. In addition, this book applies not only to you; it would help you with your clients to identify and correct the flaws of your clients so that you can add tremendous value to them and their investment decisions.

The best takeaway from this best behavioral finance book

- The best part of the book is it is very relevant and professionals (who help investors) and people who invest for themselves. It points out all the biases and helps you overcome them.

- It is very short, lucid, and comprehensive to understand and take action.

#7 - Behavioral Finance: Psychology, Decision-Making, and Markets

by Lucy Ackert & Richard Deaves

This best behavioral finance book will illustrate three separate things to you in a weaving form – the psychology of investors, how their psychology affects their decision-making, and at the same time, how the market gets affected.

Book Review

Review: This behavioral finance book is a great resource for anyone who likes investing or helps in investing. This book results from a lot of market research and surveys of how things work for retail investors, professional managers, traders, analysts, etc. And whatever the authors collected, they presented all the materials in the most structured manner for the consumption of the investors who would like to improve their investment decisions and, as a result, ensure maximum wealth.

Best takeaway from this best behavioral finance book

- If you need proof of "why" to illustrate what psychology is responsible for the erratic behaviors of investors, you will find all the answers in this book. They are not made up or not the figment of the author's imagination. They are practical and collected.

- The materials are structured so well that you can use them as a reference book for your class (if you are a student) or for helping any clients grow wealth.

#8 - Behavioral Finance:

Understanding the Social, Cognitive, and Economic Debates (Wiley Finance)

by Edwin Burton & Sunit Shah

This book is a big-picture book on much broader aspects of the spectrum. It will talk about the social, economic, and cognitive issues responsible for the psychology of finance.

Book Review

Review: This top behavioral finance book is great for discussing value. But it could be a bit overpriced in terms of being 200 pages long. However, this book does justice to whatever it has mentioned delivering. If we divide the book into useful sections, it would be this – 90 pages on the psychology of finance; and 130 pages on finance and empirical tests done on "value" and "reversal effects." This book is easy to understand, especially for students bored with behavioral finance classes.

Best takeaway from this top behavioral finance book

- You will find a lot of information on an efficient market hypothesis (EMH) and how it evolved. It also covers anomalies and serial correlation.

- This book can be called an advanced book on behavioral finance without the vanity of language.

#9 - Behavioral Finance and Investor Types:

Managing Behavior to Make Better Investment Decisions (Wiley Finance)

by Michael Pompeian

Here, the author goes beyond the usual clichés of behavioral finance and looks at it from a completely different perspective.

Book Review

Review: Once you pick up this behavioral finance book, you will learn about four types of investors and how they make decisions. The first type of investor is a preserver who preserves wealth rather than taking risks to enhance their wealth. The second kind of investor is a follower who takes other people's help to make important investment decisions. Moreover, the third sort of investor is an individualist who is always involved in the financial market and has an unconventional way of looking at investments. And the last type of investor is those who are called accumulators and who love to accumulate wealth and confidence that they will become successful investors shortly.

The best takeaway from this top behavioral finance book

- This behavioral finance book has distilled everything into four types so investors can recognize themselves and act accordingly.

- This book also cites years of academic research, which would help the average investors make significant decisions about their investments.

#10 - Beyond Greed and Fear:

Understanding Behavioral Finance and the Psychology of Investing (Financial Management Association Survey and Synthesis)

by Hersh Shefrin

Mistakes push us to fear, and the more mistakes we make instead of learning from them, we get into more and more fear. As a result, when some lucrative opportunities arise, we jump in to get in, and greed enters our lives. But what if you can go beyond fear and greed? This book will show you how.

Book Review

Review: You will feel entertained reading this behavioral finance book. At the same time, you would learn the nitty-gritty of behavioral finance. According to the book, investors learn slowly and make mistakes. This book will help you curb those mistakes and find a solution for yourself and your clients. But in a few places, the author is contradictory; sometimes, there are just too many words. Overall, a good read for people who are indirectly related to trading (meaning this book is not for a full-time trader but is useful to investors).

Best takeaway from this best book on behavioral finance

- Three concepts are explained greatly: heuristic biases, market inefficiency, and frame dependence.

- The author goes into great detail about human behaviors and does justice to his explanations.

#11 - Inefficient Markets:

An Introduction to Behavioral Finance (Clarendon Lectures in Economics)

by Andrei Shleifer

It is original. It is different. Moreover, it makes you think about behavioral finance in a new way.

Book Review

Review: This top book on behavioral finance is the most suitable for those tired of reading old, rugged stuff on behavioral finance. This book presents a great way to look at behavioral finance. The author has put a lot of thinking into this book before writing, and the writing reflects that. First, the author describes the foundation of the Efficient Market Hypothesis (EMH) and then presents his thinking.

Best takeaway from this best book on behavioral finance

- This book is value for money. If you want to understand the psychology behind behavioral finance, this book is for you.

- This book is the best introductory book ever on behavioral finance.

#12 - Personal Benchmark:

Integrating Behavioral Finance and Investment Management

by Charles Widger & Daniel Crosby

This book can be divided into three-two letters: PB (Personal Benchmark), BF Behavioral Finance) & IM (Investment Management). This book details these three terms in great detail.

Book Review

Review: It is the most personal book on behavioral finance you would ever read. Why? Because this book's authors took a different approach to explaining risk! Risk is a very personal thing. And no matter how many statistical models we use to quantify risk, the risk would still be very personal. That's why a personal benchmark is important, and after reading this book, you can integrate three concepts in a single string. That's why this book is so important to read. Behavioral finance is evolving, and only quantifying statements won't justify its scope and objective.

Best takeaway from this top book on behavioral finance

- This book on behavioral finance contains not only all the psychological biases but also all the tangible solutions for these biases. Thus, readers can work on their biases.

- It's important to know your emotional direction before entering the investing field. And this book will show you how to give your mind an emotional direction to think well before you ever get into the investment field.

#13 - Handbook of Behavioral Finance

by Brian Bruce

This book has been shaped and written very well. Read the review and the best takeaways to know more.

Book Review

Review: As mentioned, this book is a handbook of behavioral finance. If you are wondering why this book must be highly technical, you are wrong. This book is not technical; rather, this book presents simple econometric modeling and discusses experimental, survey, or revealed preference data. Moreover, this book also talks about recent developments in the industry concerning behavioral finance. You would also learn to appreciate the recent research presented within the book's premises. In simple terms, if you read this book, you will sharpen your investment; if you do, you may miss something great if you want to get into the investment world anytime soon.

Best takeaway from this top book on behavioral finance

- This book is comprehensive and a perfect book for beginners. If you are starting, you can read this book. This book is lucid, and the chapters are short. At the same time, each chapter weaved coherently to provide the maximum benefit to the readers.

- If you are a finance student, this is an un-put-down-able book.

#14 - Advances in Behavioral Finance (Roundtable Series in Behavioral Economics)

by Richard H. Thaler

Leave the trail behind, and if you know enough about behavioral finance, welcome to the advanced world.

Book Review

Review: This book is a nice collection of articles designed to wow its readers. But you need to remember that if you are an average investor, you may need help appreciating the value it provides. So it would help if you did your homework before diving into this book. There are loads of statistics, and academic language is used prudently throughout this book. If you consider reading this book, from which you would get multiple perspectives on behavioral finance, you at least need to know the fundamentals of behavioral finance in the first place.

Best takeaway from this book

- If you are a student of finance, you will be able to appreciate this nice collection.

- This collection may be old, but it can easily be called a bible for any research scholar interested in behavioral finance.

#15 - Advances in Behavioral Finance, Volume II:

(The Roundtable Series in Behavioral Economics)

by Richard H. Thaler

There was a need for volume two as the first volume was too old. So the editor needed to add the recent developments in this volume.

Book Review

Review: This book updates from the previous volume, and there are loads of things to learn in this recent volume. People who complained about the sanity of an old paperback would find great value in this book as every recent development is in this section. However, as published in 2005, it still would be considered old if we compare it from the perspective of the present time. This book is for those interested in pursuing higher studies in behavioral finance.

Best takeaway from this book

- This book is updated and comprehensive, 744 pages long.

- This book presents twenty recent papers to understand how behavioral finance has evolved. It is not for beginners, but this would be an invaluable resource if you want to pursue behavioral finance.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com