Table Of Contents

Behavioral Finance Definition

Behavioral finance refers to the study focusing on explaining the influence of psychology in the decision-making process of investors. It explains the occurrence of irrational decision-making in the financial market when it is expected to be a manifestation of rational decisions and an efficient market.

Its prominence was reflected when traditional finance theories failed to explain many economic events like stock market bubbles in the United States. The two main ingredients of the study are cognitive psychology describing how people behave and the limits to arbitrage, explaining the level of effectiveness or ineffectiveness of arbitrage forces in various circumstances.

Key Takeaways

- Behavioral finance is the study of understanding people's irrational financial decisions.

- The two main building blocks are cognitive psychology and the limits to arbitrage.

- Some of the biases affecting financial decisions are confirmation bias, disposition bias, experiential bias, familiarity bias, loss aversion, mental accounting, and overconfidence.

- Understanding the psychological bias influence can help investors understand the market behavior and make better investment decisions.

- Businesses using the combination of traditional and behavioral finance theories to generate effective client management strategies are increasing.

Behavioral Finance Theory Explained

Behavioral finance explores how factors like psychological influences and biases distort the logical reasoning of people. An environment with well-informed investors following rational decisions is always an important constituent for sustainable financial market practices, but different concepts like bounded rationality restrict it from happening.

Traders rely greatly on technical indicators. However, in many cases, it has been noted that investors' behavior in markets is often strange since it may be the opposite of what the technical market indicators may point to. The goals of any investor are to make profits from a market, and the decisions they make to achieve this may not always be rational.

The two main constituents, cognitive psychology and the limits to arbitrage, can interpret diverse market scenarios where the influence of human psychology in financial decisions occurs. Therefore, understanding cognitive bias like overconfidence, herd mentality, and loss aversion is beneficial. Furthermore, the forces of arbitrage may fail, and this limit to the arbitrage process contributes to the persistence of financial market anomalies. Altogether the study explains the investor's irrational decisions and discloses market behavior. However, the problem is that the behaviors of investors combined with their different biases make them difficult to predict.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

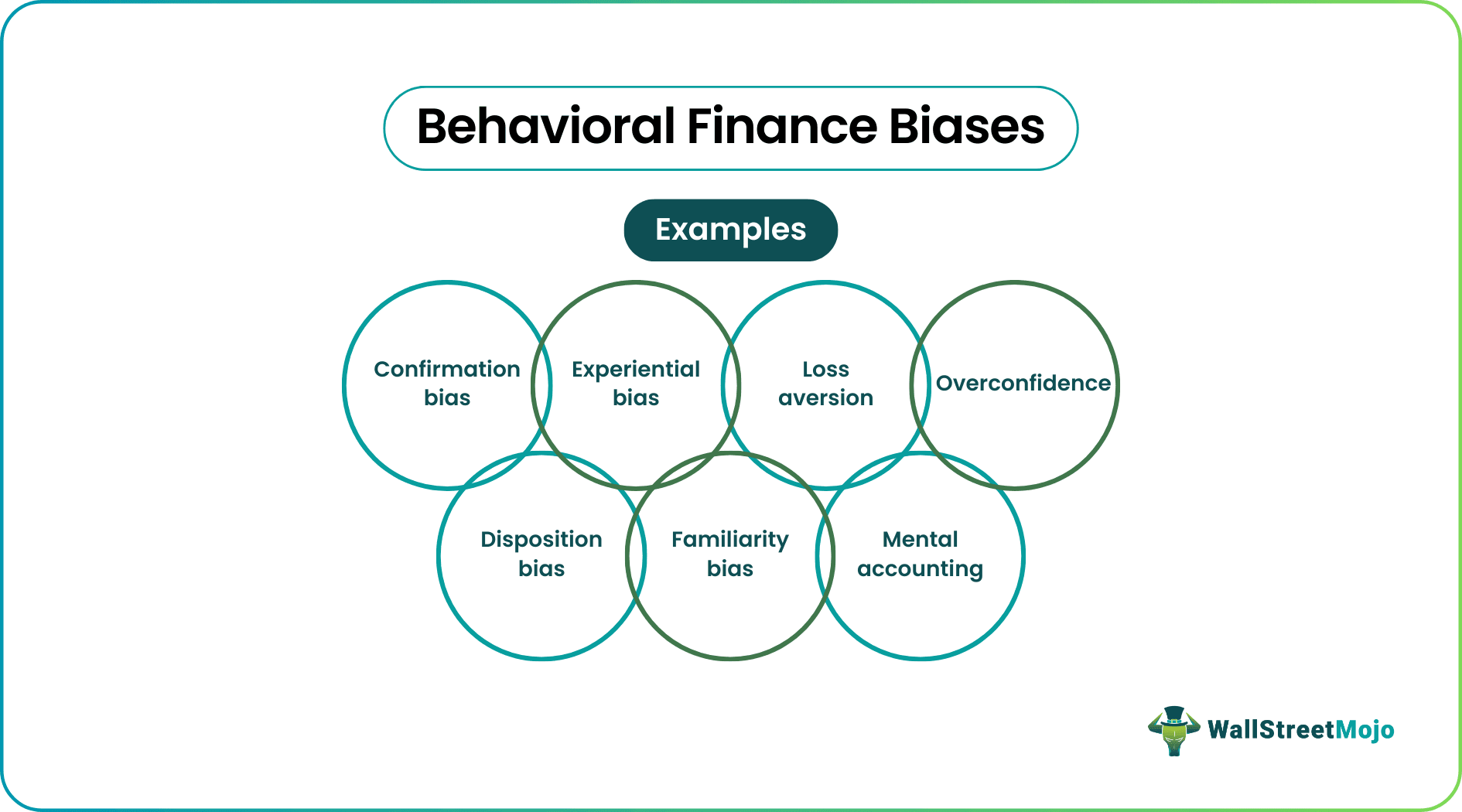

Biases of Behavioral Finance

Biases play a major role in an entity's financial decision-making process. Let's look into a brief description of a few common biases:

- Confirmation bias: The confirmation bias occurs when the investors align to the information that matches with their beliefs. The data could be wrong, but as long as it fits with their views, they end up relying on it.

- Experiential bias: It occurs when an investor's memories or experiences from past events make them choose sides even when such a decision is not rational. For instance, previous or current bad experience leads them to avoid similar positions.

- Loss aversion: Loss aversion makes investors avoid taking a risk even if it earns high returns. They give priority to restraining from experiencing losses rather than experiencing high returns.

- Overconfidence: Overconfidence reflects when investors overestimate their abilities or trading skills and make decisions forgoing factual evidences.

- Disposition bias: It explains the propensity of investors to hold on to the stocks even if the prices are declining, believing that the prices will appreciate in the future and, at the same time, sell the well-performing stocks. Such investors tend to hold on to a stock losing money, hoping that the price will soon increase. In their minds, it's only a matter of time before the tides change for them, and they can then make profits on all their positions in a market.

- Familiarity bias: The familiarity bias is reflected when investors place their investment in the stocks from the industry they know and understand rather than going after securities from an unrelated field. In this process, they may lose new or innovative opportunities that are revolutionary.

- Mental accounting: People's budgeting process or spending habits may vary based on circumstances. That is, they don't maintain a consistent pace. For instance, people may spend for luxury in a mall or while on vacation, and they also possess a modest lifestyle at home or when they are back from vacation.

Many academics have portrayed various biases, classifications, and how the human brain functions in irrational ways. It is evident in many behavioral finance books and behavioral finance journals, which helps researchers understand the impact of human psychology in the financial decision-making process.

Practical Examples of Behavioral Finance

For a better understanding, let's look into the following examples from the stock market scenario.

- An investor in the stock market may opt-out because of the financial crisis affecting the stock market, thinking that the problem will take longer to resolve and recur in the future. If an individual has an experiential bias, the thought of a past crisis may make them see investing in stocks as a bad idea, even if all the evidence points to the opposite. They may then decide to invest in less profitable endeavors.

- Many investors are driven by herding behavior to join the bandwagon to invest in meme stocks like AMC and Gamestop ignoring risk factors.

The relevance of psychology in financial planning is increasing. Financial advisors combine traditional concepts with elements of behavioral finance theory while developing strategies to strengthen the client relationship.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Question (FAQs)

Behavioral finance meaning describes the occurrence of irrational financial decisions of an entity by connecting it to human psychology. The study demonstrates different psychological influences and biases affecting the financial decisions of market players and subsequent market outcomes. Knowledge in this psychological impact help understand different market behavior and make better investment decisions.

Examples include the phenomenon of risk-averse investors preferring going long on a well-performing stock rather than engaging in short selling activities. Another example is when many amateur investors join the meme stock bandwagon without researching about the company's growth or profitability.

The two pillars are cognitive psychology and limits to arbitrage. Cognitive psychology explains how people's subjective thinking distorts rationality in judgment. The limits of arbitrage distinguish the circumstances in which the arbitrage forces will be effective and ineffective.