Table Of Contents

Base Rate Fallacy Definition

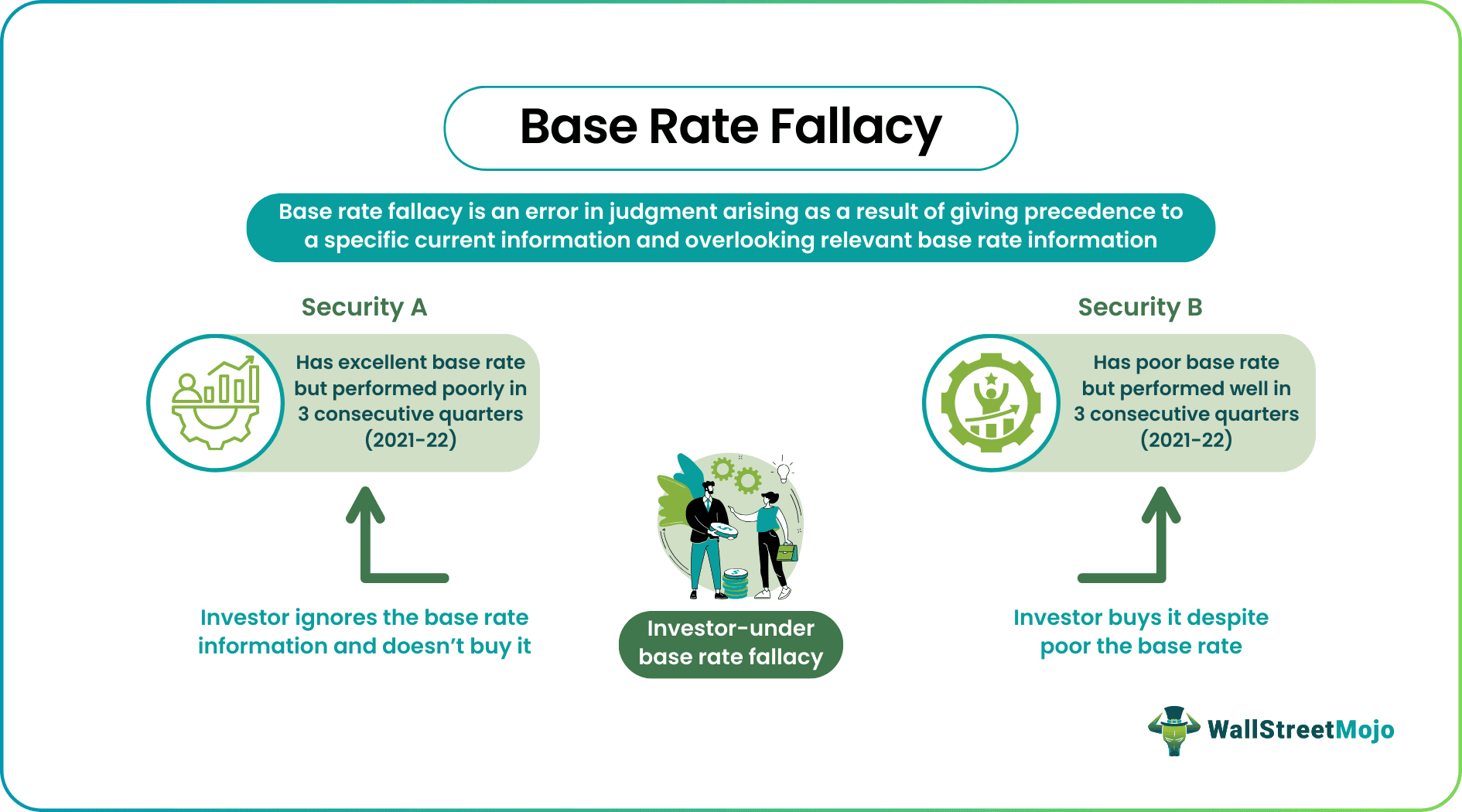

The base rate fallacy (BRF) refers to the human tendency to prioritize a particular set of data over the base rate or general information of a larger collection of data. This results in an error of judgment. This fallacy explains why investors make unsound investment decisions and incur huge losses in the stock markets.

The base rate fallacy, also known as base rate neglect or bias, is a key concept in behavioral finance. An investor’s erroneous or irrational thinking leads to this fallacy. For example, the security market investors believe that the group base rate is inapplicable to their case. As a result, they overreact to market happenings and suffer losses. Israeli psychologists Daniel Kahneman and Amos Tversky Psychologists pioneered the concept of base rate neglect.

Key Takeaways

- Base rate fallacy is an error in judgment arising as a result of giving precedence to specific current information and overlooking relevant base rate information.

- People focus on the new, readily available information to make decisions and ignore important and relevant background information.

- Emphasis on information for decision-making depends on its relevance in the minds of people.

- Investors, under the influence of base-rate neglect, base their investing decisions on recent stock market events ignoring the security’s past base rates.

- The best way to avoid it is to be vigilant, collect ample information and analyze it, and minimize hastiness in decision making.

Base Rate Fallacy Explained

The base rate fallacy refers to misjudging an event by focusing on specific information and ignoring highly relevant generic or base rate information. This concept has important implications in business, finance, legal, and medical setting. This is because it explains how people arrive at certain conclusions.

People judge events on the basis of available information and their relevance. Usually, information that is new or specific to a case in hand dominates people's senses. As a result, they give it greater weightage. Whereas background information though important, may seem irrelevant and fade into obscurity. Thus, base rate neglect explains this error in judgment.

In finance, the fallacy has its roots in the varying data investors receive regarding a security over a period. Investors have access to all the past records of a security's performance. This forms the base rate data of the security.

Besides, they also receive recent information about the security like the company's quarterly results, etc. Therefore, they have two sets of data to predict the future performance of the security. The importance they give to each while making decisions will impact their investment outcome.

If the current information is in sync with the base rate data, the investors' decisions will not be affected. However, if the new information contradicts the base rate information, investors get into a dilemma. In such a case, they ignore the established base rate data and rely upon the company's new data in the form of quarterly results.

They believe that the latest information is more updated and reliable, and the base rate is irrelevant. Thus, the base rate bias influences their investment decisions. As a result, they invest in the wrong security and face losses.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

The base rate neglect assumes significance in the wake of weakening economies due to the coronavirus pandemic. Investors are more likely to fall into the base rate neglect trap when markets are uncertain, and firms are facing losses at faster rates. Hence, here are a few base rate fallacy examples to understand the concept.

Example #1

Let us assume company XYZ had good business in 2021-22. It earned excellent revenues in the first two quarters of the financial year. As a result, its security performed exceptionally well in the aforesaid quarters.

However, the base rate or the historical data present an entirely different picture of its security. It had never performed well, and investors never gained from investing in it. Nevertheless, its excellent back-to-back performance recently influenced the investors' decision. So, they chose to ignore the base rate data of the security and continued to invest in it. As a result, they become the victim of base rate neglect.

Example #2

Imagine a jury is deciding a hit-and-run case. It involves a cyclist run down by a taxi late at night in a city. The two taxi companies operate in the city. The first one with green taxis runs 90% of the taxis in the city, while the second one with blue taxis runs the other 10%. As per an eyewitness, the blue taxi was responsible for the accident.

Since the accident happened at night and it was hard to identify the color of the taxi. So, the witness was tested for his ability to identify the colors of the taxi at night. He correctly identified 80% of the time. However, he was wrong 20% of the time.

The jury held up the eye-witness version and considered the blue taxi responsible. This is because the jury members overlooked the base rate information, which stated that the city has 90% green taxis. With a high percentage of green taxis in the city, the possibility of a green taxi hitting the cyclist was more.

However, due to the base rate fallacy, the jury members emphasize the specific information of this case, ignoring the base rate information.

Base Rate Fallacy Video Explanation

How To Overcome?

The most common cause of the base rate bias is the inbuilt nature of the individuals to make decisions hastily without thinking deeply. Hence, the following steps must be followed by the investor:

- Investors must eliminate the habit of deciding the investment based on the latest piece of information about a security. Instead, they must analyze the new information with respect to the old base rate data of the security before investing.

- The investor must consult a good knowledgeable person with ample security knowledge prior to making investment decisions.

- Every investment into security should be carried out with a long-term perspective instead of investing with a short-term motive.

- The investors must analyze the performance of a security over the years before zeroing in on it for investment.

Thus, base-rate bias is a notorious creeping weakness of the human mind. However, it can be thwarted by making informed, long-term, and guided investment decisions.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Base rate fallacy occurs when people ignore general information and base their judgment solely on specific data related to the target case. This happens because people consider base rate data to be less relevant as compared to situational information. As a result, neglecting the base rate leads to inaccurate conclusions.

Suppose the base fact is that 80% of the males in a city are non-engineers while only 20% are engineers. The specific information is that the person selected loves to read, works in a multi-national company, and likes to solve math puzzles in free time. Thus, to say that the chosen person is an engineer based on only the specific fact and ignoring the base fact is base rate neglect.

The base rate bias in psychology is the trait of making error-prone decisions as a result of neglecting the general occurrence in a larger population in favor of the specific incidence in a particular case. For example, suppose the base fact that 90% of the US population is white is ignored. The specific information that the researcher has selected twice as many African-Americans as white is used to arrive at a conclusion. In that case, base rate fallacy is committed.