Table Of Contents

What Is Barron's Confidence Index?

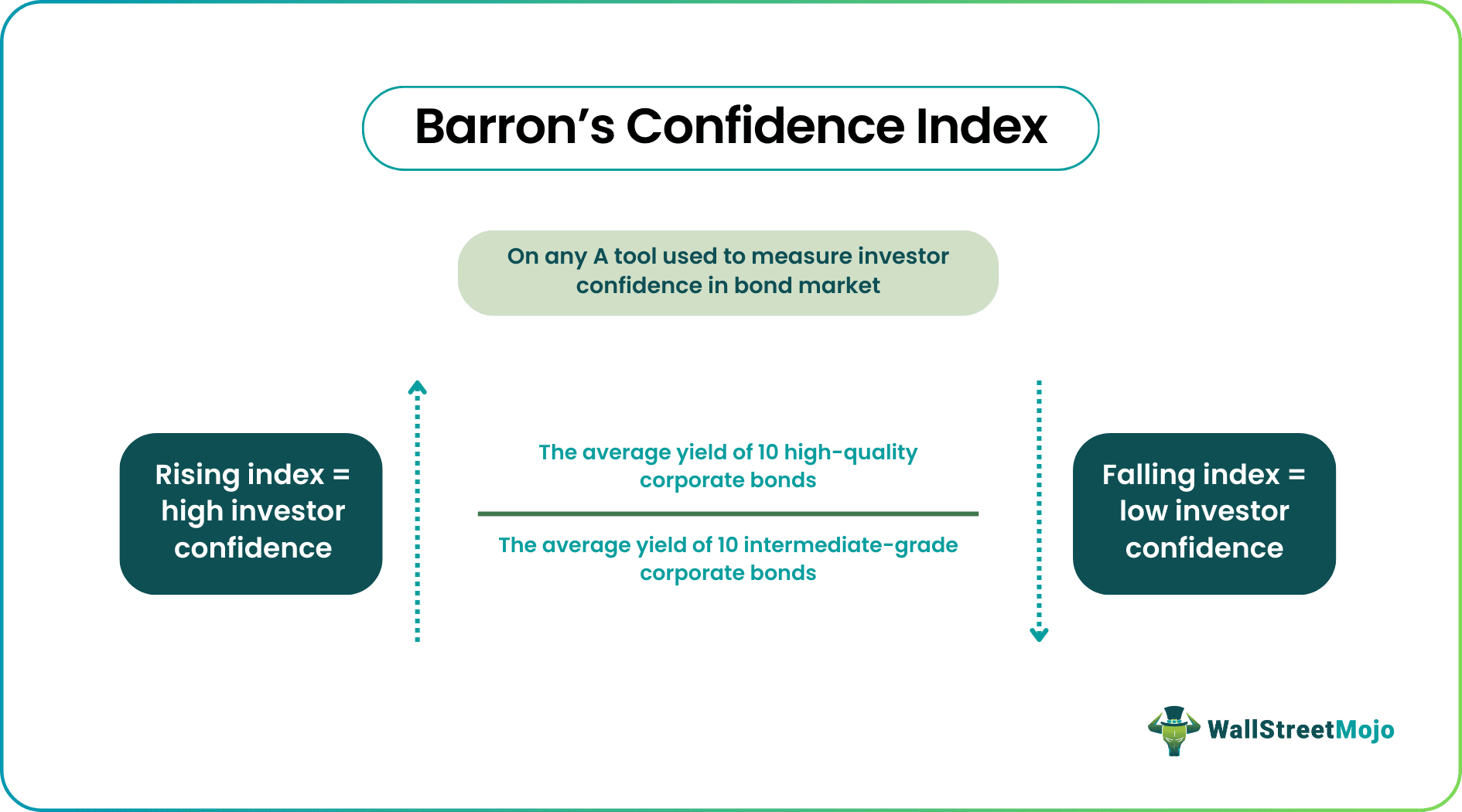

Barron's Confidence Index (BCI) is a financial indicator that measures investor confidence in the bond market. It is computed by dividing the average yield on top-grade bonds by the average yield on intermediate-grade bonds. It provides insights into the broader economic and financial landscape, as changes in investor confidence can be indicative of shifts in market conditions.

This index is named after Barron's, a financial publication known for providing market insights and analysis. The index provides insight into market sentiment and investor behavior. It helps us understand whether investors are more risk-averse or risk-tolerant in a given period. This sentiment can influence market dynamics and asset prices.

Key Takeaways

- Barron's Confidence Index estimates the level of investor confidence in the bond market by studying the yields on high-quality (top-grade) bonds against those on intermediate-grade bonds, offering insights into investor sentiment.

- Investors can use this index to make sound investment decisions. For instance, they might adjust their bond portfolios based on the level of confidence in the market. If the index suggests high confidence, investors might favor safer, lower-yield bonds. Conversely, in times of low confidence, they may opt for higher-yield, riskier bonds.

- It can be a useful tool for diversification. It provides a broader perspective on market trends and complements individual stock analysis. This diversification can help manage risk, especially in volatile market conditions.

Barron's Confidence Index Explained

Barron's Confidence Index quantifies investor confidence by referring to and dividing the average yields of high-quality bonds by the average yields of low-quality bonds.

It is calculated using the following formula:

Barron's Confidence Index formula = (Average yield on 10 top-grade bonds ÷ Average yield on 10 intermediate-grade bonds) x 100

This index is grounded in the belief that bond traders offer insights into future market trends that are more predictive than those indicated by stock investors.

Here is an explanation of the types of bonds that the index considers.

- Top-Grade Bonds: These are high-quality bonds with low credit risk. They are issued by governments or highly reputable corporations. The yields on top-grade bonds are generally lower because they are considered safer investments.

- Intermediate-Grade Bonds: These bonds have a slightly higher level of credit risk compared to top-grade bonds. They might be issued by corporations with a slightly lower credit rating. As a result, the yields on intermediate-grade bonds are usually higher to compensate investors for taking on more risk.

Barron's Confidence Index calculates the ratio of the average yield on the top-grade bonds to the average yield on the intermediate-grade bonds. When the index is high, it indicates that investors have a high level of confidence in the bond market. This confidence is reflected in the fact that they are willing to accept lower yields on safer bonds, which drives up the prices of those bonds.

Conversely, when the index is low, it suggests that investor confidence is low. In this scenario, investors demand higher yields on intermediate-grade bonds, likely due to concerns about credit risk or economic conditions.

Though this index is a useful and reliable tool for gauging and outlining investor sentiment, investors must remember that it is not a perfect predictor or reviewer of future market movements. Hence, they should consider other metrics or indicators before making investment decisions.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us study a few examples to understand the concept better.

Example #1

Suppose Laura is an investor who is interested in bonds. She wants to gauge investor confidence in the bond market using the Barron's Confidence Index. To do this, she collects data on the average yield of high-grade bonds and intermediate-grade bonds. The data collected is as follows:

- Average Yield of High-Grade Bonds (e.g., Barron's best-grade bonds) = 5%

- Average Yield of Intermediate-Grade Bonds = 4%

Now, Laura wants to calculate the Barron's Confidence Index using the formula:

Barron's Confidence Index = (Average yield on top-grade bonds / Average yield on intermediate-grade bonds) x 100

Therefore,

Barron's Confidence Index = (5% / 4%) x 100

= 125.0

The Barron's Confidence Index is 125%. Based on the yields of these bonds, she concluded that investors are relatively confident in the bond market. The higher the index value, the more confident investors are. In this case, it suggests that they are willing to accept lower yields on high-grade bonds compared to intermediate-grade bonds, indicating a higher level of confidence in the safety of these investments. Hence, Laura can consider investing in bonds in the present circumstances.

Example #2

A June 2023 article sheds light on how investor sentiment is affected or influenced by changes that bring in significant opportunities for financial prosperity in a given period. The rise in the US stock futures market is a testament to the impetus the market received riding on the back of China’s promise to extend financial support to the US. The Barron's Confidence Index showed a higher index figure signifying the sense of optimism and safety people expect in the bond market.

Importance

Let us discuss the importance of this metric in various areas of investment decision-making and market movement analysis.

#1 - Investment decision-making

The Barron's Confidence Index serves as a valuable asset for investors and traders, aiding them in making well-informed decisions in the financial market. It is significant since it offers insights based on the analysis of the sentiments of prominent Wall Street strategists, presenting a distinctive viewpoint on market trends and potential investment prospects.

Barron's Confidence Index chart offers insights into the overall sentiment in the bond market. High index values may indicate a bullish or optimistic market sentiment, while low values might suggest a bearish or pessimistic sentiment.

#2 - Market sentiment indicator

One of the primary attributes of the Barron's Confidence Index is its reliability as a market sentiment indicator. This index has demonstrated its effectiveness in gauging market sentiment over the years, establishing itself as a trusted tool among investors. By keeping a close watch on this index, traders can gain valuable insights into the prevailing market mood and adjust their strategies accordingly.

#3 - Diversification

This index can also be employed as a tool for diversification, serving as an additional layer of analysis. By incorporating Barron's Confidence Index into their research, investors gain a broader view of market trends, reducing the risk of relying solely on individual stock analysis. This is particularly beneficial during periods of heightened market volatility, as the index offers a macro-level perspective that complements individual stock assessments.

#4 - Usefulness in conjunction with other tools

While Barron's Confidence Index is undoubtedly valuable, investors should not rely on it in isolation. It is vital to cross-reference its insights with other market indicators and fundamental analysis. Combining it with technical indicators such as moving averages or the Relative Strength Index (RSI) can result in a more comprehensive understanding of market trends.

To maximize the utility of the index, a multi-factor approach is advisable, which integrates fundamental analysis, technical analysis, and sentiment indicators like this index. By adopting such a holistic approach, investors can make more well-rounded and informed decisions, enhancing their ability to navigate the ever-changing landscape of financial markets. The Barron's Confidence Index offers profound insights into market sentiment and can prove a useful tool for investors and traders when used in conjunction with other indicators and analytical methods.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A low Barron's Confidence Index generally indicates a lack of confidence or pessimism among investors in the bond market. When the index is low, it suggests that the yields on top-grade bonds (considered safer) are not significantly lower than the yields on intermediate-grade bonds (considered riskier).

Yes. It can be employed as a tool to measure market overreactions in the form of overbuying or overselling. Sudden changes in this index typically indicate irrational market behavior. This is because bond traders and investors are not affected easily by short-term market volatility. Hence, when there is contrarian evidence, it may be due to market overreactions.

Yes, this chart can be used to determine the market outlook to a certain extent. While it offers a fairly reliable indication of investor sentiment, it is important to remember that the BCI is a single indicator, and it should not be used in isolation.