Table Of Contents

What Is Bargain Purchase?

Bargain purchase happens when a company acquires another company at a price less than the fair market value of its assets. The difference between the purchase value and the market value is recorded as a profit that is earned due to the target company’s lack of goodwill.

In this arrangement, a business is sold at a price less than the fair market value of its asset as it was dealing with a financial or liquidity crisis or no competitive bidding was available for the business in the market before the sale and sometimes due to a very rapid sale. It is a rare phenomenon that happens in the case of business combinations.

Key Takeaways

- Bargain Purchase refers to an acquisition of a company by another company at a valuation less than the market valuation of the company.

- Bargain Purchase happens because of a liquidity crisis, or very few investors are interested in competitive bidding for the company.

- In the accounting books, the difference in the acquisition value and the fair value of the assets is recorded as negative goodwill.

- Bargain Purchase is calculated by: Bargain Purchase Gain= Fair Value of Net Assets - Non-Controlling Interest - Consideration.

Bargain Purchase Explained

Bargain purchase in business combination happens when the company generally deals with the liquidity crunch. To escape the situation, distressed businesses offer discounted prices to the acquirer to quickly sell off the company. The difference between the selling price and fair market value of the assets is recorded as a one-time gain on bargain purchase due to negative goodwill on the acquirer’s income statement.

In the 2008 financial crisis, many financial firms were offering a huge discount at their fair market value as they were dealing with financial distress. This situation presented a lot of opportunities for bargain purchases in the market. In addition, other companies who could take advantage of this situation could add on to their asset base at a comparatively lesser cost than they would have paid in normal scenarios.

In the 2008 crisis, many distressed companies opted to sell their assets at less than their book value due to a liquidity crunch. Other companies took advantage of this opportunity. On the whole, an acquirer company should take the utmost care while evaluating the distressed companies’ assets and liabilities to support their bargain purchase in business combination valuation.

How To Calculate?

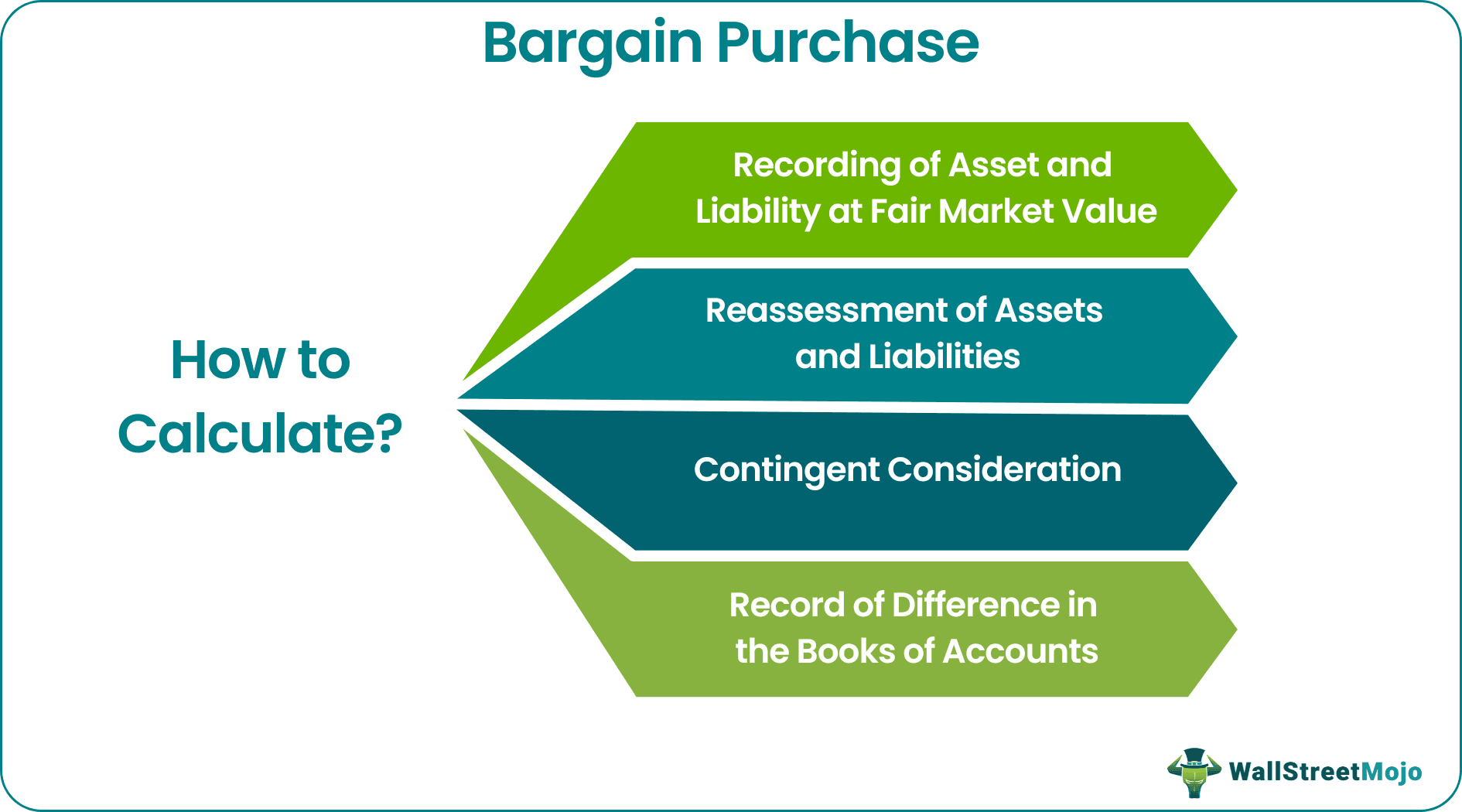

Following are the details of steps taken in such an arrangement by the acquirer company regarding bargain purchase accounting:

- Recording of Asset and Liability at Fair Market Value: The acquirer company would record asset and liability at its fair market value before invoking the process of the bargain purchase. Fair market value is the price that a buyer and seller agree to pay and receive against the property.

- Reassessment of Assets and Liabilities: After the above step, the acquirer company would reassess to check whether all the assets and liabilities are properly recorded at their fair market value, and nothing has been left out.

- Contingent Consideration: In this step, the acquirer company would analyze and determine the fair value of any contingent consideration payable to the owner company. Contingent consideration is the amount relating to the additional asset or equity interest, payable back to the owner company.

- Record of Difference in the Books of Accounts: In the last step, the acquirer company will record the difference between the consideration paid to the owner company and the fair market value of their asset as a one-time gain on bargain purchase in its income statement due to negative goodwill.

Thus, the above steps are followed in case of bargain purchase accounting.

Example

An XYZ company is dealing with a liquidity crunch and paying all its taxes; it decided to sell off 80% of its share to ABC Company at a price below fair market value at $6,500,000 in cash. ABC company appointed a valuation agency to determine the value of the assets and liabilities of the XYZ company. Valuation agencies confirm the fair value of net assets as $9,000,000 (Assets $12,000,000 and liabilities $3,000,000). The fair value of non-controlling interest of 20% is $2,000,000.

Solution:

Now, as per our discussion in earlier headings, gain on bargain purchase price will be calculated as follows:

Gain on Bargain Purchase = Fair Value of Net Assets – Consideration/ Selling Price – Non-Controlling Interest

- = $9,000,000 - $6,500,000 - $2,000,000

- = $500,000

Therefore, from the above calculation, it can be concluded that the gain on the bargain purchase deal was $500,000, which will be recorded as gain due to negative goodwill in ABC’s income statement.

Bargain Purchase Vs Goodwill

To understand the role of goodwill in the bargain purchase price, we will first have to understand the concept of goodwill. Goodwill is the amount by which the selling price or consideration paid to the owner company by the acquirer company exceeds the fair market value of its asset. It is recorded on the balance sheet of the acquirer’s company as goodwill from the business combination.

In the case of a bargain purchase, which is a rarity in business combinations, the consideration paid to the owner company is less than the fair market value of its assets. And this difference is recorded as a one-time gain in the books of the acquirer’s company due to negative goodwill.

So, in a way, it can be said that negative goodwill is the opposite of goodwill. Negative goodwill generally indicates that the selling party was distressed and therefore sold its assets below their actual worth.