Table Of Contents

Meaning of Bankruptcy

Bankruptcy refers to the legal procedure of declaring an individual or a business as bankrupt. This legal provision helps entities with no way to move forward with existing liabilities to deal with debts and start again.

The word bankruptcy comes from the Italian phrase "Banca rotta," meaning "broken bench," referring to broken banks. If an entity is defeated by its liabilities, it can take the tag of "bankrupt" legally but for a duration stipulated by law. It can be voluntary, involuntary, or technical.

Table of contents

- Meaning of Bankruptcy

- Bankruptcy refers to a legal procedure helping entities discharge their liabilities by granting them a “bankrupt” status.

- The two main procedures are liquidation and reorganization. Dealing with the debt can be done through assets sale or formulating a reorganization or debt restructuring plan.

- Countries usually develop their bankruptcy law, and they may vary by country.

- For example, in countries like Canada, an individual can be declared bankrupt, whereas most places in China do not have legal provisions to declare an individual bankrupt.

Bankruptcy Explained

Bankruptcy is one of the legal methods entities can choose to deal with debts that they cannot pay and begin again by completing procedures like liquidating assets or repayment plans. It paves the way for the disposition of the debtor’s assets in a regulated and organized manner, and creditors are compensated first to get fair treatment.

It can be used as a legal tool to eliminate financially troubled entities and channel the available resources of such entities into a prolific activity. These entities can initiate the process by filing a petition with the bankruptcy court. If the court grants it, the entity should be careful not to incur additional debt, specifically the period before exit.

Most Recent Bankruptcy Examples

Let’s look into two recent cases from the retail sector.

#1 - J.C. Penney

J.C. Penney is an American department store chain. The company filed for Chapter 11 bankruptcy protection in May 2020. Even though the company was struggling before the Covid period, the Covid crisis intensified the situation. As a result, Penney has closed many locations out of 846 stores since its bankruptcy filing resulting in the total number of stores falling below 700.

Brookfield Asset Management and Simon Property Group purchased JCPenney for around $800 million in cash and debt. The court approved the deal, and as an impact of the agreement, 60000 jobs were saved.

#2 -Neiman Marcus

Neiman Marcus is an American luxury department stores chain. They applied for Chapter 11 in May 2020 due to enormous debt and economic impact from the Covid 19 pandemic and got released by September 2020.

Advantages and Disadvantages of Bankruptcy

Below are some of the advantages -

- It helps alleviate pressure and stress since it removes most debts, including specific old tax liabilities.

- It helps to forgo unnecessary lawsuits and aggressive action from creditors' end.

Below are some of the disadvantages -

- Most tax liabilities are not dischargeable.

- It affects the credit score.

- Results in loss of a significant portion of assets.

- The trustee controls assets.

Bankruptcy Laws by Country (US, Canada, UK, China, India)

Countries usually develop their bankruptcy law, and they may vary by country. Let’s look into the US, Canada, UK, China, and India scenarios.

United States

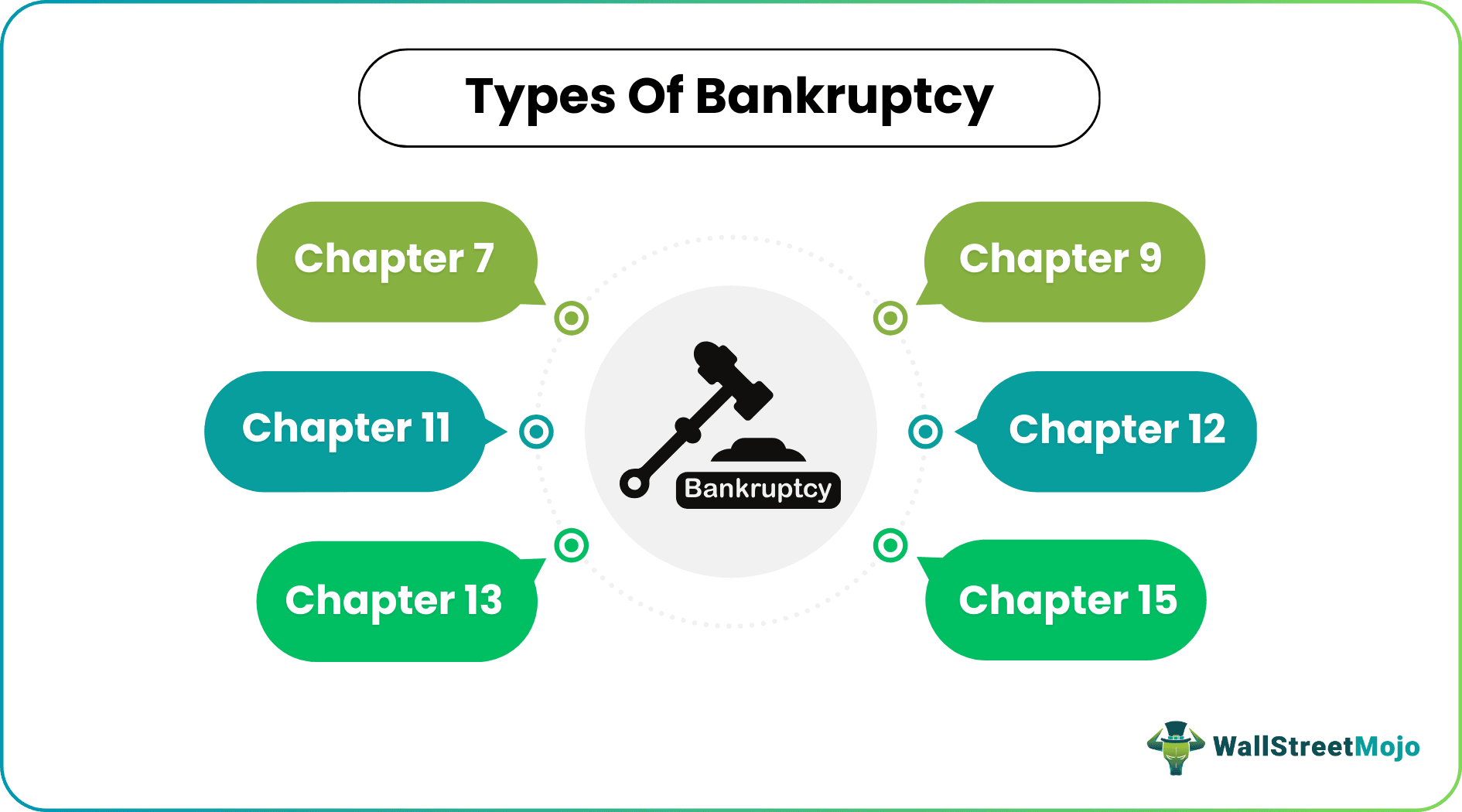

Federal courts control the bankruptcy cases in the United States. In general, there are six basic types of Bankruptcy in the USA:

- Chapter 7: Chapter 7 is known as the Liquidation. Trustee sells the debtor's assets and distributes them to creditors. Individuals, Businesses, Corporations, Partnerships can file.

- Chapter 9: Adjustment of Debts of a financially distressed municipality.

- Chapter 11: It allows reorganization. Debtors can pay a reduced amount to creditors and may continue the business. Individuals, corporations, and partnerships can file.

- Chapter 12: It includes the adjustment of debts. Trustee passing debtor payments to creditors are based on seasonal income. Family, farming, and fishing operations-related entities can apply.

- Chapter 13: Chapter 13 includes the adjustment of debts. It is only available to wage earners, the self-employed and sole proprietors having a regular income.Trustee passes debtor payments to creditors. Only individuals can file.

- Chapter 15: Preferred when it involves parties from different countries.

Canada

The bankrupt declaration process usually begins with a company’s discretion or its creditors. In the process, the company makes an assignment of its property for the benefit of its creditors, or creditors may proceed with an application to the court to have the company declared Bankrupt. The Licensed Insolvency Trustee (LIT) is authorized to administer the bankruptcies.

All debtor property passes to the LIT at the initial phase, including property located outside Canada and the debtor's property in possession of third parties. The proceeds from the sale of assets are distributed to the creditors. Furthermore, if the entity is going through the bankruptcy declaration process for the first time and no duties from his side are pending, the duration of being bankrupt will be nine months.

United Kingdom

In the U.K., the term bankrupt is associated with individuals. Whereas companies do not go bankrupt, they enter liquidation. If an individual fails to meet the liabilities and finds no other legal way to solve the issues, they can apply for liquidation.

The mode of furnishing the application is solely online. An adjudicator from the Insolvency Service will review the application and contribute to the decision on whether or not to accept it. Once it is accepted, the release from the bankrupt tag is met after 12 months. It is possible to cancel the bankrupt tag before completing the release period.

China

Bankruptcy legislation was enacted for the first time in China in 1906, but it was short-lived and was repealed in 1911. The legislation reappeared in 1915 and 1935 and was revoked in 1949. Finally, in 1986 the first bankruptcy legislation for state-owned enterprises came into existence.

Historically, China lacks a national law governing personal bankruptcy. Furthermore, people who cannot repay their liabilities will be blacklisted in China's personal credit system. However, the Shenzhen court allowed China's first personal bankruptcy case in 2021, stating that the corresponding legislation offers genuine cases a chance. Presently, the protection rule is only available to Shenzhen residents, but officials have promised to enhance the protection across the country.

India

In India, the Insolvency and Bankruptcy Code, 2016, covers the legislation about the timely restructuring and insolvency resolution of corporate persons, partnership businesses, and individuals. It also strives to maximize the value of such people's assets, foster entrepreneurship, increase credit availability, and balance the interests of all related parties.

Frequently Asked Questions (FAQs)

Once an entity files a petition with the court for declaring bankrupt, the court will decide on whether to grant the status or not. The entity will be discharged of a significant portion of liabilities when declared. The trustee will act on behalf of the debtor to maintain the interest of the creditors and debtor.

Chapter 7 is known as the Liquidation, and the trustee sells the debtor's assets and distributes them to creditors. Individuals, Businesses, Corporations, Partnerships can file. A discharge is given to individuals only. Partnerships, Limited Liability Companies, and corporations do not receive a release in Chapter 7 under IRS.

Chapter 13 includes the adjustment of debts. It is only available to wage earners, the self-employed and sole proprietors having a regular income. Trustee passes debtor payments to creditors. Only individuals can file.

Recommended Articles

This has been a guide to Bankruptcy and its meaning. Here we explain how bankruptcy works along with its examples and laws like the US, UK, China, India, and Canada. You can learn more from the following articles -