Table Of Contents

What Are Banking Certifications?

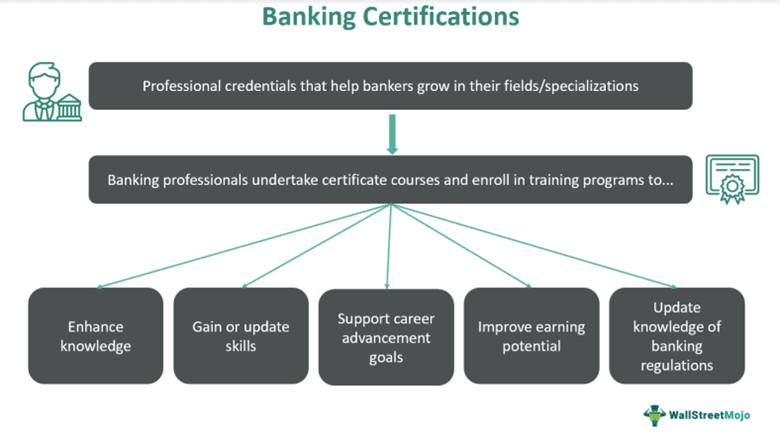

Banking Certifications refer to credentials that help professionals in the banking sector enhance their knowledge and skills. These courses cover concepts like risk management, financial analysis, wealth management, compliance, anti-money laundering, and commercial lending, among many others. These certifications boost professional credibility and demonstrate an individual’s commitment to continuous learning.

They provide specialized knowledge, preparing professionals for real-world banking challenges, enhancing job performance, and boosting efficiency. They also improve career prospects by increasing job opportunities and earning potential. Additionally, such certifications offer networking opportunities and access to a community of bankers, promoting collaboration and knowledge sharing. Such certifications may also be useful to aspirants who wish to build a career in the banking industry.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Key Takeaways

- Banking certifications are professional credentials that help bankers and banking aspirants gain knowledge, update their skills, and grow their careers.

- Completing the required coursework, gaining relevant work experience, and clearing exams are crucial steps in getting duly certified.

- The curriculum developed for these certifications revolves around building expertise, acquiring qualifications, and securing comprehensive knowledge about the banking industry.

- Technology, artificial intelligence, process automation, and machine learning have resulted in rapid growth of the banking sector.

- Hence, the demand for skilled personnel has increased over the years.

- Certified Fund Specialist, Certified Public Accountant, Commercial Banking & Credit Analyst, and Certified Government Financial Manager are a few noteworthy certifications.

Banking Certifications Explained

Banking certificates are certifications that ratify an individual’s professional expertise. Awarded by professional organizations and educational institutions upon the completion of specific coursework and training, these certifications validate an individual's proficiency in specific sectors. They are intended to improve the level of expertise, qualifications, and subject matter knowledge of individuals working in the banking industry or keen to join it.

The subjects and fields they cover are diverse and include investment banking, retail banking, risk management, compliance, and financial analysis, among others. These credentials offer certificate holders in-depth exposure to specific banking functions, boosting proficiency in a field of their choice. Banking certifications empower professionals to navigate the banking sector and handle its complexities with confidence.

Technology breakthroughs, process automation, and artificial intelligence have caused the banking sector to change quickly, resulting in a demand for skilled workers and resources. Entry level banking certifications can help individuals secure jobs. However, advanced certifications, such as investment banking certifications, help professionals progress in this sector by boosting their knowledge of banking regulations and guidelines. They also give participants insights into how businesses operate and how the economy functions.

These certifications enable individuals to cope with risks and uncertainties associated with a career in the banking sector. Getting certified can improve a candidate’s profile and offer professionals a competitive edge in the job market. Banking companies and financial institutions value professionals who exhibit dedication toward lifelong learning and seek professional growth.

In a resume, if banking professionals have a section titled Continuing Education, it usually draws the attention of employers and recruiters in the banking sector. Furthermore, obtaining a certification can boost work stability, raise earning potential, and create new professional prospects.

Obtaining these qualifications often entails completing coursework, clearing exams, and accruing work experience in the banking & finance sector. Certifications are not mandatory, but they can boost a professional's reputation and prospects of advancement by attesting to high professional standards.

Accreditation is not always needed, but knowledgeable investors and consumers respect those who obtain it because it is a sign of their work ethic and professional standards. As many online banking certifications are available today, enrolling in the right course is fairly simple based on an individual’s professional areas of interest.

Top 7 Banking Certifications

Banking certifications are dynamic. They change with changing industry preferences, banking sector developments, and market demand. These certifications typically require candidates from specific education backgrounds, usually accounting and finance, to complete coursework, gather industry experience, and clear tests and exams. Some popular certifications are listed below.

#1 - Certified Financial Planner (CFP)

Professionals working in accounting, banking, and finance fields greatly value the Certified Public Accountant (CPA) certification. It is provided by the American Institute of Certified Public Accountants (AICPA). It calls for at least 150 hours of exam study in addition to a mix of classroom and real-world experience. Auditing, taxation, business law, financial reporting, management accounting, and risk management are a few of the subjects covered as part of the certification curriculum.

#2 - Certified Fund Specialist (CFS)

The Institute of Business and Finance offers the Certified Fund Specialist certification. It requires a bachelor's degree and a year of work experience in financial services. The certification aims to provide a solid practical understanding of advanced fund analysis and selection, mutual funds, and Exchange-traded Funds (ETFs). They also extend to closed-end funds and similar investments, asset allocation, and portfolio construction.

#3 - Certified Public Accountant (CPA)

A financial specialist who clears the CPA exam is known as a Certified Public Accountant (CPA). For this, they must have an accounting education, undertake the specified coursework, and gain professional experience. CPAs support individuals, companies, and organizations in interpreting, capturing, and presenting their financial information. In order to audit public corporations, sign tax reports of returns, and submit reports to the Securities and Exchange Commission (SEC), CPAs provide taxation and auditing services. A CPA license is widely sought after and provides a range of professional opportunities, such as serving as the chief financial officer or working for corporations, governments, businesses, industries, or non-profit organizations.

#4 - Commercial Banking & Credit Analyst (CBCA)

The Commercial Banking & Credit Analyst Certification Program offers skills in financial analysis, credit structuring, loan security, credit evaluation, documentation, and industry analysis, among others—all of which are critical for those wishing to enter or progress in the commercial banking field. It helps enhance professional abilities in commercial banking, credit analysis, risk management, private lending, equipment finance, and commercial real estate, among others. Credit writing, best practices for sales and customer management, and producing qualified leads are also included in the course's prospects.

#5 - Certified Government Financial Manager (CGFM)

The Certified Government Financial Manager professional certification is for those who have demonstrated proficiency in federal, state, and local government accounting. The areas of work include auditing, internal controls, financial reporting systems, and budgeting. The prestigious CGFM accreditation acknowledges the specific training and expertise required to function as an efficient government finance manager

#6 - Certified Investment Management Analyst (CIMA)

Investments & Wealth Institute provides the CIMA or the Certified Investment Management Analyst certification. It requires three years of experience in financial services. Investment professionals who complete the CIMA program gain a thorough understanding of risk management and investment management, including asset allocation strategies. CIMAs may assist clients in navigating the complex world of investing and establishing a plan that matches their particular scenario by providing individualized investment solutions that cater to a client's needs and goals.

#7 - Certified International Investment Analyst (CIIA)

Professionals with knowledge of economics, equity valuation, corporate finance, fixed-income valuation, portfolio management, and derivative valuation can showcase their expertise by earning the Certified International Investment Analyst (CIIA) certification. Membership in a participating regional or national society and three years of professional experience are prerequisites. With two final-level tests covering more complex topics, the certification covers key subjects such as economics, corporate finance, and portfolio management.

Some other banking certifications in the US that carry weight in the banking and finance industry include Financial Risk Manager Certification (FRM), Certified Management Accountant (CMA), Certified Bank Auditor (CBA), Certified Private Wealth Advisor (CPWA), Chartered Alternative Investment Analyst (CAIA), and Financial Modeling & Valuation Analyst (FMVA).

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.