Table Of Contents

What Is A Bandwagon Effect?

The bandwagon effect is the concept used to explain how individuals follow the majority's decisions, behaviors, or styles. The result can be observed in nearly every aspect of our everyday lives, from purchase decisions to voting preferences.

The effect of this bias can suppress the outcome of rational thinking. This cognitive bias influencing public opinion is very much expected in the political field. The results of a public opinion poll before the election have the power to manipulate the voting preference of the voters. Hence, poll results before the election are restricted in countries like Brazil and France.

Key Takeaways

- The bandwagon effect reflects the phenomenon of individuals adopting decisions or conduct just because everyone else is doing it.

- People's day-to-day activities are influenced by the effect, like the selection of movies to watch, the clothes to wear, and the goods purchased.

- It profoundly impacts specific social sciences such as economics, psychology, and politics that influence and shape the world around us.

- Understanding this cognitive bias's influence may help people make efficient decisions by sticking to rational choices.

Bandwagon Effect Explained

The bandwagon effect in economics refers to the situation where individual do what others are doing. It refers to the phenomenon of more and more people joining the trending practice is coined by the phrase "Jump on the Bandwagon." Bandwagon indicates the decorated wagon used in circus or entertainment events to carry the performing band. The term originated around the mid-19th century in America. Later, using the bandwagon to carry politicians during political campaigns increased since it created an environment where people wanted to join. Using the bandwagon for the presidential campaign of Zachary Taylor for the first time publicized the phrase "Jump on the bandwagon."

The reason why this bias is so prevalent is simple. People feel safe when they adopt what the majority does. It represents a situation of impersonal influence. People like to win and be on the winning side. They believe that winning is high by following what the majority of winners do. It also emerges when people try to avoid the situations leading to social exclusion. The bandwagon bias influences people regardless of the importance of the decision. Consider the following scenarios:

- Movies: Many people will watch specific movies even if they are not interested only because of their popularity. It also points to the influence created by the hype culture.

- Social networks: When a new social network app becomes a buzzword, more and more people will start using it. The same can be said for apps that get the highest rating in the app store.

- Stock market: In the stock market, the effect is distinguishable in the case of meme stocks. Its popularity often leads to price bubbles.

The impact of this phenomenon of following the majority can be negative or positive. Sometimes it leads people into selecting prolific investment options. But, on the other hand, it also persuades people to use expensive products due to their popularity.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

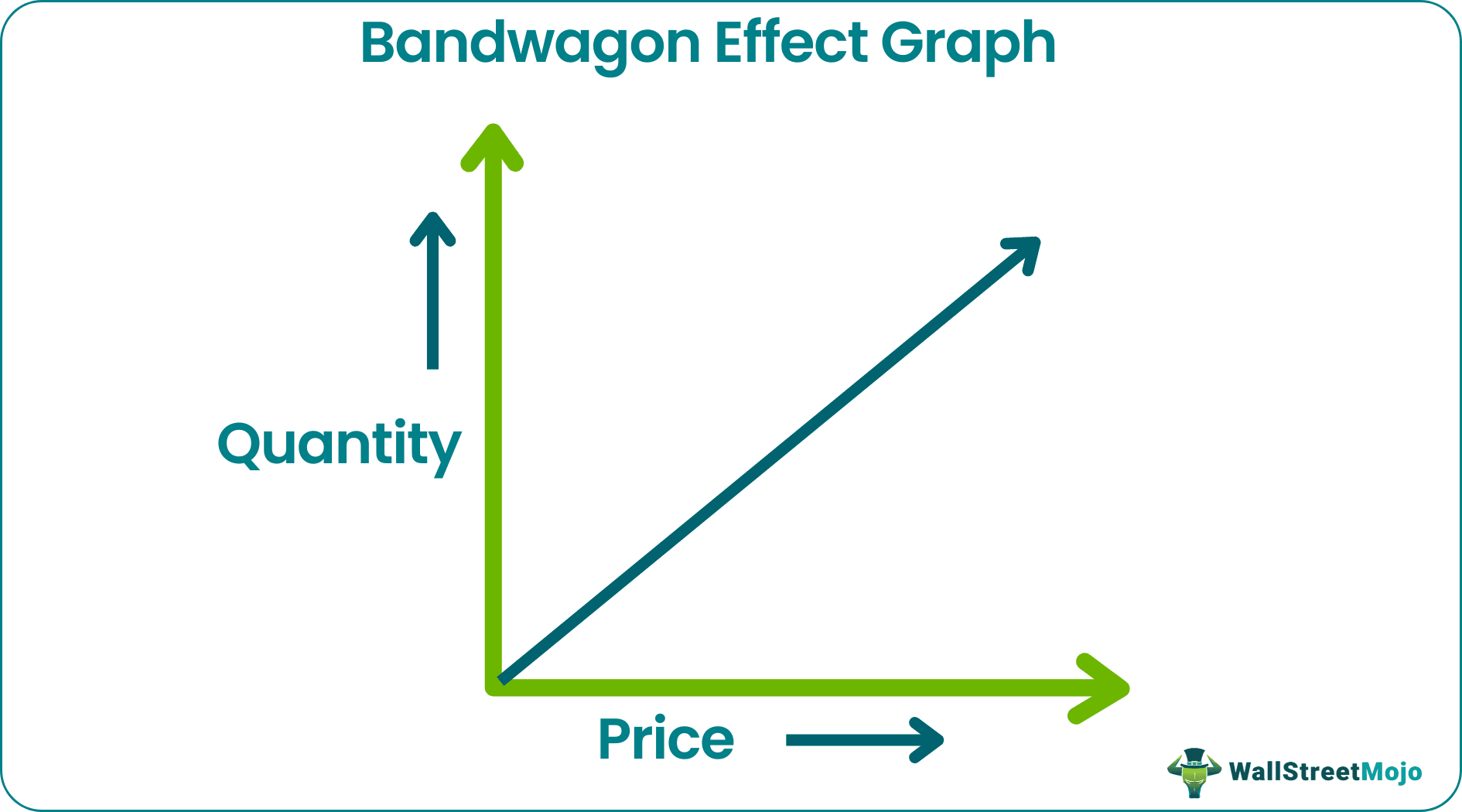

Demand Curve

Let us try to understand the concept of bandwagon effect in economics with the help of demand curve. A normal demand curve in the market is downward sloping because as price rises, the demand for goods fall. However, it is seen that when the effect happens, the demand for good rise inspite of rise in price, as shown in the demand curve. As a product gains importance and positive feedback, people start buying it just because others possess it, which is a herd mentality, , thus taking the bandwagon effect graph upwards.

Example

Bandwagon effect psychology in economics, finance, politics, medical science, and psychology is common. Let's look into an example associated with the stock market.

Stock Market – GameStop (GME)

The bandwagon effect bias is often visible in investors' approach towards meme stock. A recent example that profoundly impacted amateur investors and short-sellers took place in January 2021. GameStop's stock price (GME) trading around a range between $17 to $19 per share at the beginning of January 2021 escalated to $347.51 on January 27. Very soon, the share price dropped below $100 by February 2021.

Short sellers were utilizing the GameStop stock to gain from its declining stock price trend. However, the scenario changed when the retail investors started buying the low-priced shares and excited them through the Reddit platform. The rising demand created a challenging environment for short-sellers, and they began to collect the stocks back. As a result, it further increased the demand and resulted in a price rise.

Retail investors decided to buy shares deviating from the rational investment decisions and jump on the bandwagon, bidding the price up. Unfortunately, the inexperienced investors followed the hype propagated in the online platform without conducting studies about the stock, the company's performance, and lack of awareness about the short-selling or short squeeze process. Soon, the short squeeze affected the investors engaged in the short-selling of GameStop's stock, and the price drop impacted the amateur investors who bought the shares with long-term planning.

Importance

The bandwagon effect bias plays a critical role in human psychology and decision-making. To better understand human psychology and its effects on society, we need to understand the bandwagon effect graph and why humans tend to have these herd-like tendencies. Here are a few examples of why it's essential in today's society.

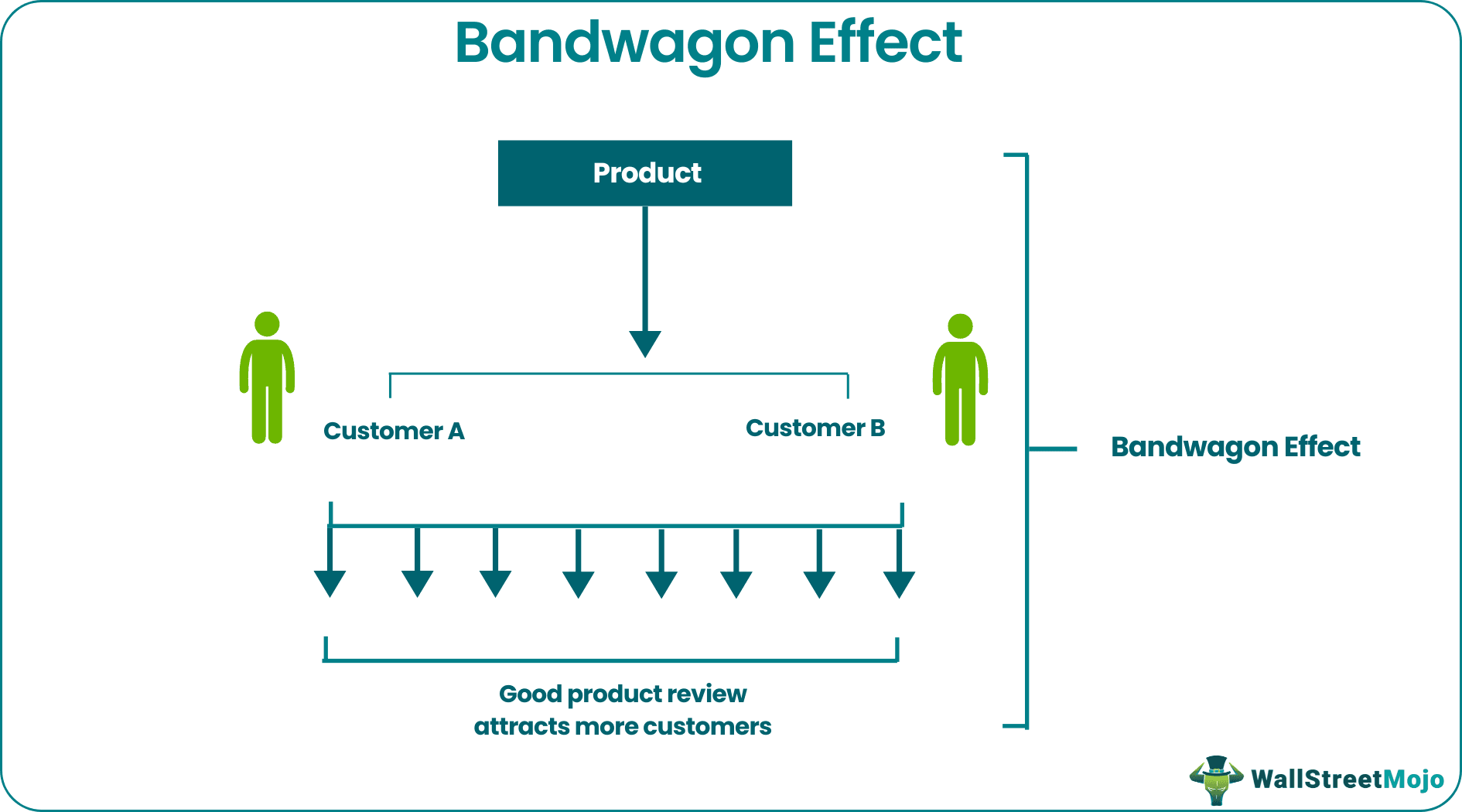

- Helps consumers: Public opinion about goods and services is significant in the decision-making process. When comparing two different products or services, many people will choose the better reviews without researching any other information.

- Helps businesses: The bandwagon effect psychology also extensively influences supply and demand. Economists will look to the bandwagon effect when extreme shifts occur in the demand curve. It's also crucial for businesses to understand this concept to prepare for these events.

- Investment decisions: The bandwagon effect has been chronic in investments and financial markets. It helps drive bull markets and occasionally results in a stock market bubble. One of the main reasons the effect occurs with investments is that people love to win, especially when it comes to finances. So when someone sees other individuals making money through stocks or other assets, they want to get in and start making money too.

Bandwagon Effect Vs Snob Effect

Bandwagon effect encourages people to buy a good where as snob effect discourages people to buy a good. The differences between them are as follows:

| Bandwagon Effect | Snob Effect |

|---|---|

| It has a positive effect on people. | It has a negative effect on people. |

| It makes people buy something which is easily available. | It makes people buy something which less available. |

| Due to high demand more people buy it. | Due to high demand, less people buy it. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The effect explains the phenomenon when an individual is exposed to popular views or actions. They are stimulated to adapt to the perceived trend. When people start rallying to the trend or dominant practices in society, more and more people will join it. This practice is mentioned using the phrase 'jump on the bandwagon.'

One of the examples is the consumer trusting the online stores following the influence exerted by collective opinion. Shopping through online stores is riskier compared to brick-and-mortar shops. The information available about the product is limited, and shoppers cannot touch or check the product. So, shoppers depend on the consumer reviews and shops if the majority review is positive.

Media presents collective opinion information to the public, and people perceive it as credible sources. Hence the media coverage can alter people's attitudes towards many things.