Table Of Contents

What Is A Balloon Mortgage Calculator?

The Balloon Mortgage Calculator is a mathematical tool that helps calculate the amount of balloon balance due at the end of the term of the loan. The formula to calculate a balloon balance is similar to that used to calculate the outstanding balance on a mortgage loan.

The balloon mortgage is a type of mortgage finance in which borrowers are allowed to make small or no payments towards the lent amount for several years, thereby ending up making lump sum payment at once for the balloon mortgage balance.

How Does A Balloon Mortgage Calculator Work?

A balloon mortgage calculator is a tool that helps borrowers calculate the repayments expected in balloon mortgage loan structure. This calculator, based on the inputs from the users, computes the small amount to be paid for a couple of years and the remaining lumpsum as well.

A balloon mortgage calculator in the mortgage market calculates the most lenient lower payments acceptable by lenders. Balloon mortgages are preferred when people or firms with cash flow issues in the near term, and further, they expect higher cash flows later somewhere in the future when the balloon payment is near. The borrower must be prepared at the end of the loan term to make their balloon payment.

Along with the actual payments toward the mortgage loan, the borrowers can also compute the monthly or annual balances at the end of the repayment term per the balloon loan structure. One must identify the loan amount first to calculate the regular payments as determined, and then subtract the sum of the regular payments from the original loan amount.

The amount that remains at the end is the balloon mortgage payment that one requires to make. When one has an interactive calculator to use, they are quite relieved as these calculators run on the collected details as per the current conditions. Thus, they can be completely trusted with their approximate or accurate figures.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Elements

The components that become the major players in calculating the balloon mortgage calculator have been listed below. Let us have a look at them in brief:

- Loan amount: It is the expected or the original balance for the mortgage loan one applies or has applied for.

- Amortization period: This is the period that marks the beginning of the repayments for this loan with the amount to be paid monthly and the interest rate being the same for those many years.

- Loan tenure: This is the time period from which the balloon mortgage repayments become due. Before that the borrowers do not have to pay anything toward the mortgage loan.

- Interest rate: This is the annual rate of interest applicable on the amount taken as mortgage finance.

As the tenure gets over, borrowers have to either refinance the loan or pay off the remaining balance in lump sum.

Formula

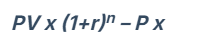

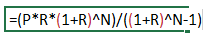

The formula on which the balloon mortgage calculators operate is mentioned below:

Wherein,

- PV is the present value of Original Balance

- P is the Payment

- r is the rate of interest

- n is the frequency of payments

How to Calculate?

One needs to follow the below steps in order to calculate the monthly installment amounts.

1. First, we will calculate the equal periodical installments assuming no balloon repayment, and we shall begin with the principal amount.

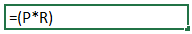

2. Multiply the principal amount or the loan amount by a rate of interest.

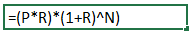

3. We need to compound the same by rate until the loan period.

4. We now need to discount the above result obtained in step 3 by the following:

5. After entering the above formula in excel, we shall obtain periodically installments, which are mostly monthly repayments.

Now, there would be a term wherein the loan must be paid in full. Take the Loan amount as Principal Value, the installment amount as the payment, and the rate of interest, and insert the same in the above mentioned equation.

The resultant figure would be the balloon payment required to be made.

Balloon Mortgage Examples

Below are a few examples of the Balloon Mortgage Calculator.

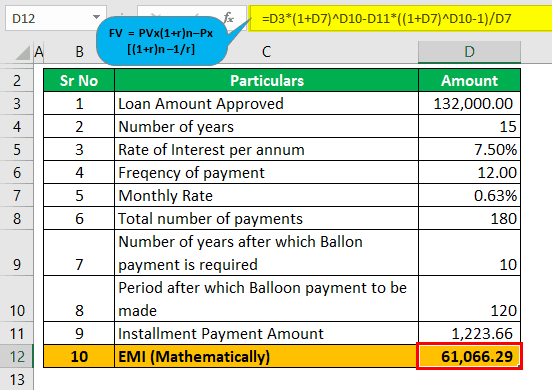

Example #1

Mr. Zee has taken a Balloon Mortgage loan, which states its term as 10/15, with an annual rate of 7.5% compounded monthly. The loan amount that was borrowed was $132,000. The monthly installment amount that Mr. Zee is supposed to pay comes to around $1,223.66

Based on the above information, you must calculate the Balloon mortgage amount required to be paid at the end of the term.

Solution:

- The term structure is that the loan will be amortized for 15 years, and we need to find out what amount it shall pay at the end of 10 years as a lump sum payment.

- We can use the below formula to calculate the future value of the balloon payment to be made at the end of 10 years: FV = PV*(1+r)n–P*

- The rate of interest per annum is 7.5%, and monthly it shall be 7.5%/12, which is 0.50%.

= 100,000*(1+0.50%)120–1,223.66 x

= 61,066.29

- The remaining balance that shall be paid with the final payment will be $61,066.29, which is the balloon payment and has to be paid at the end of 10 years.

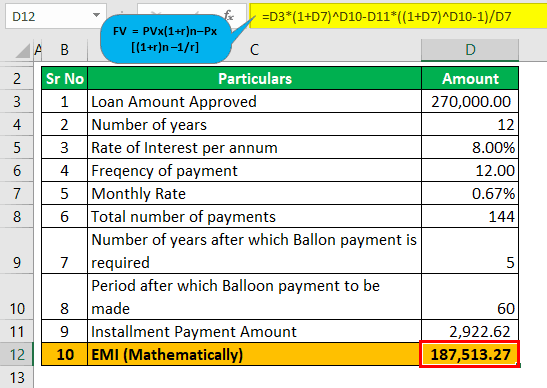

Example #2

Company X wanted to buy new properties in a posh area in their city. But due to the recent hike in property prices, they are unwilling to invest a large amount. Hence, they opt for hiring the properties at lease. They knew that if they hired property on lease, the cash outflow would be too high for them. The market rate of interest at which they can borrow is 8%.

Further, they are anticipating higher cash flowers shortly, say in the next five years, and they would be able to purchase the property. Henceforth, they decide to take it on lease and purchase it after five years. The term structure of the loan is 5/12, and the property's value is $270,000. Since the background of the company and directors is too good, they have been offered 100% financing. The monthly installment amount shall be 2,922.62 You must calculate the balloon payment that the company shall be required to make at the end of 5 years, whereas a loan is amortized for 12 years.

Solution:

- The term structure is the loan will be amortized for 12 years, and we need to find out what amount it shall pay at the end of 5 years as a lumpsum payment.

- We can use the below formula to calculate the future value of the balloon payment to be made at the end of 5 years: FV = PV x (1+r)n – P x

- The rate of interest per annum is 8.00%, and monthly it shall be 8.00%/12, which is 0.67%.

= 270,000 x (1+0.67%)60 – 2,922.62 x

= 187,513.27

- The remaining balance that shall be paid with the final payment will be $187,513.27, which is the balloon payment and has to be paid at the end of 5 years.

Uses

Using the balloon mortgage calculators comes with a number of benefits as one can calculate multiple things at a time using the tool. Let us have a look at the calculation advantages that this tool offers:

- It helps obtain the monthly payments that one is supposed to make towards the loan.

- The remaining amount for the balloon mortgage repayment can easily be figured out once the details asked are entered.

- The total payments that borrowers need to make before the actual balloon mortgage tenure begins.

- The mortgage interest that one has to pay in total.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.