Table Of Contents

What is a Balance Sheet?

A balance sheet is a financial document or statement that provides a complete overview of a firm's assets, liabilities, and shareholders' equity for a particular period. Preparing this document helps people understand the current capital structure of a firm. In addition, the clear information from the balance sheet lets investors decide whether to spend on the company's assets.

It is one of the three primary financial statements a company prepares – the other two being the income statement and the statement of cash flows. The balance sheet allows information readers to be aware of how much a company owns and owes.

Table of contents

- The balance sheet is one of the financial statements through which a company presents the shareholders’ equity, liabilities, and assets at a particular time.

- It is based on an accounting equation stating that the total liabilities and the owner’s capital equal the company’s total assets.

- The most common format companies use to present data on the balance sheet is horizontal or T-shaped and vertical.

- The data presented in this financial statement helps investors decide whether to trust the firms for further investment. It also lets lenders check if the firms can repay if the required loans are approved.

Balance Sheet Explained

A balance sheet keeps the details of the assets and liabilities and presents the company's financial details in a proper format. The details in statements help firms understand their financial progress and accordingly make business decisions to improve and excel in the future. Plus, the companies can check their finances and frame strategies with respect to the available resources.

The investors who invest in the firms consider these sheets as an important credential as they reflect the company's economic position. The statement helps them decide whether it would be fruitful to continue investing in the venture or they should withdraw the backing. In short, these financial documents intend to guide investors and help them make better and more informed investment decisions.

The recorded asset, liability, and equity details let the information readers find out multiple ratios to check where the firm stands in the market. For example, investors and lenders can easily calculate the debt-to-equity ratio using the information, making them aware of what the firms own and how much they are liable to repay.

Components

The balance sheet accounts that constitute the major elements of the financial document are – assets, liabilities, and shareholders' equity.

#1 - Assets

These components can be current or long-term. The firms list the current assets in order of liquidity. They are likely to get consumed, sold, or converted into cash either in one year or in the operating cycle, whichever is longer. An operating cycle is the average time it takes to convert an investment in inventory into cash.

Some such assets include cash and cash equivalents, inventory, etc.

Long-term assets are physical assets that the company owns and utilizes for the firm's production process. It helps companies have a useful life of greater than one year. Long-term assets are not for sale to the firm's customers. These assets can be tangible assets with a physical existence and intangible assets with no physical existence.

Some examples of tangible assets are real estate, furniture, etc., and intangible ones are goodwill, copyright, etc.

#2 - Liabilities

These are also classified as current and long term liabilities.

Current Liabilities are probable future payments of assets or services that a firm has to continue to make for previous operations. These obligations require the use of existing assets or the creation of other current liabilities. These include accounts payable, short-term debt, etc.

Long-term liabilities are obligations that do not require the use of current assets or the creation of current liabilities. Some examples of such liabilities include long-term debts, bonds, etc.

#3 - Shareholders' Equity

This is the portion of the returns that shareholders of a company are likely to receive.

It is the difference between a firm's total assets and its total liabilities. The result shows how fruitful the investment could be for investors, indicating the potential for the returns to multiply in the future. Accordingly, they decide whether to invest, reinvest, or withdraw their financial backing.

Format

Different companies follow different balance sheet formats. Traditionally, the companies used a T-shaped arrangement, which organized the data horizontally. Here, the list of assets is on one side under one column, and the liabilities and shareholders' equity are on another side under another column. This format has been the most popular of all.

With time, a new balance sheet template came into existence that presented the same details vertically. Here, the equities and liabilities are at the top, while the assets are at the bottom.

Balance Sheet Video Explanation

Example

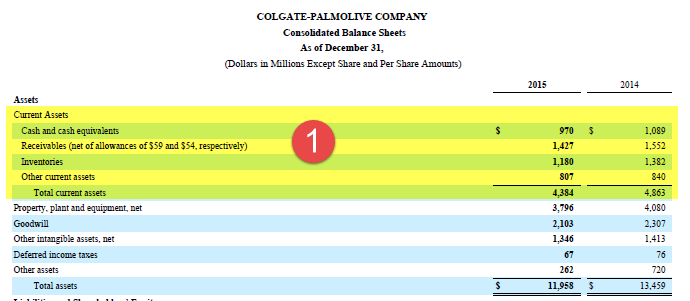

Let us check out the template of Colgate below to find the details of its assets and liabilities for a specific period:

Current Assets

Current Liabilities

Long-term Assets

Long-term Liabilities

Shareholder's Equity

Uses

A balance sheet is an important credential of a company. It gives a clear picture of a firm's financial position. The preparation of this statement allows companies to serve various purposes. Some of them include the following:

- It helps companies assess their market position at a given point in time. While detailing the assets and liabilities, the information reader gets a clear view of the values. If the value of the assets is more than that of the liabilities, it indicates the company's growth. On the other hand, if the liabilities are more than the assets, it indicates a loss.

- The details help people compare firms through the debt-to-equity ratio, which helps assess the companies' financial leverage. Depending on the values, it compares the progress of the firms.

- Based on the growth or retardation over a specific period, the financial document assesses the company's financial health.

- As the balance sheet gives a thorough view of every company's financial aspect, it becomes easier for investors to review the details and decide whether to continue investing in it.

Balance Sheet vs Income Statement

A balance sheet and income statement are two major financial statements that a company prepares. Both help firms give information seekers an overview of their financial aspects. Still, there are a few differences that define the purpose they serve:

| Category | Balance Sheet | Income Statement |

|---|---|---|

| Assessment | Financial position at a given point in time | Also known as a profit and loss statement, it assesses the performance over a specific period of time. |

| Components | Assets (current and long-term), liabilities (current and long-term), and shareholders’ equity | Revenues, expenses, realized gains, and losses |

| Financial analysis | Helps calculate the debt-to-equity ratio, current ratio, return on shareholders’ equity, etc. | Help figure out the gross margins, price-to-earnings ratio, etc. |

| Users | Investors and lenders while making investment and lending decisions | Management, shareholders, investors, etc. |

Frequently Asked Questions (FAQs)

The first thing to consider to prepare it is the time range. Most companies opt for either quarterly or annual financial statements. Based on the requirement, the details of the assets and liabilities are arranged, organized, and presented. Then, the firms compile the information to calculate the shareholders’ equity. The data, however, can be arranged horizontally with assets on the left and liabilities and shareholders’ equity on the right-hand side or vertically with liabilities and shareholders’ equity on top and assets at the bottom.

Firms list the assets and liabilities to check if the total number of assets equals the sum of liabilities and shareholders’ equity. If not, it shows an imbalance. As a result, the firms must find out the error to tally the sheet for an accurate snapshot of the company’s finances.

It is the process to verify how accurate the balance sheet is. This is done by tallying the figures presented on the general ledger and other financial documents. If discrepancies are found, the sheet proves to be showing inaccurate data.

Recommended Articles

This has been a guide to what is a Balance Sheet. Here we explain its components, format, uses, examples, and differences with income statements. You may learn more about accounting from the following articles –