Table Of Contents

Backwardation Meaning

Backwardation is a situation when the futures price of a commodity is lower than the spot price today. The commodity's spot price can be high due to the sudden rise in demand for the commodity or due to a disaster that can trigger the demand. It is a rare situation and doesn't last long when the situation occurs.

In a backwardation curve, it is beneficial to hold the commodity since its demand is high physically. As a result, the spot price is high, known as the convenience yield. The convenience yield is a return on inventory stored in the warehouse and is inversely related to the warehouse inventory levels.

Table of contents

- Backwardation arises when the present spot price of a commodity surpasses its future price. This uncommon and fleeting phenomenon can occur due to sudden demand spikes or unforeseen calamities.

- In contrast, contango transpires when the future price exceeds the current commodity price. Over time, as futures contracts mature, spot and futures prices converge in contango, erasing any potential arbitrage chances.

- Backwardation can stem from natural disasters, warfare, or unfavorable conditions. Its influence extends to the commodities market, triggering heightened demand for specific commodities.

Backwardation Explained

Backwardation is a situation when the future price of a commodity is lower than the spot price of the commodity. The opposite of backwardation is contango, in which the future price is higher than the commodity's spot price.

In backwardation, the immediate need to own the commodity outweighs its cost.

As time progresses into the maturity of the futures contract, the spot price and futures price converge, negating any arbitrage opportunities.

Backwardation is not very frequent in the market, and when it occurs, it does not last for a long time since it is a rare event.So, when the warehouse inventory is high, the convenience yield is low, and when the warehouse inventory is low, the convenience yield is high.

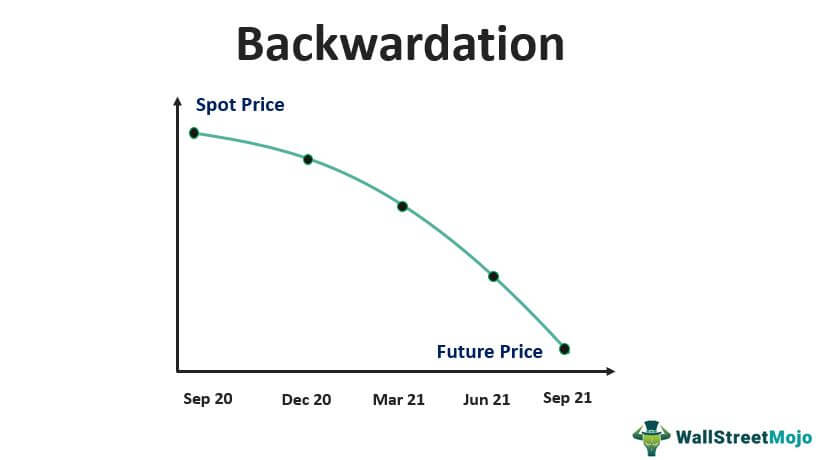

The futures contract is priced lower than the spot price. The chart below explains the backwardation situation where the spot price is higher than the futures price and, as a result, creates a downward, forward curve. On the chart, when backwardation occurs, the slope goes down.

Chart

Let us take a look at the following chart to understand the concept of backwardation.

The blue inverted, downward-sloping curve represents backwardation. It serves as a bearish indicator, signaling traders that it might be the right time for a trader to offload the asset at the spot price. This is because the future contract’s strike price is expected to be lower than the current price. In other words, the spot price could decrease in the future.

One can look at more charts like these on TradingView to thoroughly understand related concepts.

Example

Let us understand the concept of market backwardation with the help of a couple of examples. These examples will help us understand the intricacies of the concept in-depth.

Example #1

The attacks in September 2019 on the world's largest oil production plant operated by Saudi Aramco have resulted in a tense environment in the oil industry and the commodities market. This attack resulted in the temporary closure of the oilfield and impacted nearly 5% of the world's daily oil production. In such a scenario, the demand for oil in the spot market will increase since this is a disaster that can lead to uncertain conditions regarding how soon the situation can be normalized.

As a result, demand for crude oil is currently pretty high, which gives the holder of crude oil the advantage of selling it at a higher price than what the market price was a couple of weeks before. The commodity holder currently has the upper hand and can create more demand by holding the commodity for longer.

Since this news release, the market has been looking much more stable. There have been alternatives that the oil industry is considering, like the oil reserves and increased production by other oilfields, which can cater to the increased demand and relieve the market participants in the commodities market. The above scenario is an apt example of the backwardation situation where the spot prices shoot up due to a sudden increase in the market and, on the other hand, expect the price to normalize when the market conditions get stable.

Example #2

Since 2022, the oil process was at their all-time high after the Russia-Ukraine war. In fact, the prices were on a constant upward trend until April 2023. The Organization for the Petroleum Exporting Countries (OPEC) declared a production cut owing to backwardation-like market indicators.

The international benchmark for oil, the Brent crude futures in this period were up 5.9% to $84.61 per barrel whereas, futures expiring in December 2023 were up by 4.7% at $81.55 per barrel.

Since a backwardation situation was considered a bullish sign in the market, the producers were motivated to not increase their production to maintain the balance in the market. However, since the process in the future was lower than the present prices, it left production giants in splits in terms of their opinions.

Advantages

Let us understand the advantages of making the right calls during the formation of a backwardation curve through the discussion below.

- Creates movement in the market by bringing together buyers, sellers, and investors who are either speculating or are looking to get the physical delivery for the commodity.

- Backwardation benefits the holder of the commodity in the current scenario, making them cover the carry cost.

- Backwardation in the commodities futures market occurs due to the shortage of the commodity in the spot market.

- When the prices rise, more and more investors tend to invest in the commodities market, thereby creating a movement in the market by the inflow of funds.

- It is beneficial for short-term investors and speculators who look to make profits from arbitrage.

- They act as leading indicators for the market to fall short.

Disadvantages

Despite the various advantages mentioned above, there are a few factors from the other end of the spectrum that prove to be a hassle for all parties involved. Let us understand the disadvantages of market backwardation through the explanation below.

- Backwardation can result in a loss of the investment if the future price for the commodity is too low, and the investment made on the commodity might reduce considerably.

- A backwardation situation can result in more and more market participants withdrawing their investment from the market, expecting the commodity's price to fall soon.

- Backwardation can result from a natural calamity, disasters like war, or other hostile conditions. The commodities market can be affected and eventually increase demand for any commodity.

- If the market does not recover or continues to fall, investors can lose their investment from backwardation.

- Trading on backwardation can prove unfruitful if there is a new supplier in the market, and the demand for the commodity in in the spot market reduces.

Backwardation Vs Contango

A backwardation situation is good for an investor holding a short position on that commodity because the investor expects the commodity to fall in value.

Let us understand the differences between the backwardation curve and contango through the comparison below.

- It is the opposite of contango, which occurs when the futures price is above the spot price, which means the spot price is higher than the expected future price of the commodity.

- Backwardation in the futures market is normal because it is a movement consistent with prevailing market conditions.

- A market in backwardation is bearish, and the investors expect the prices of the commodities to fall in the future.

- Backwardation occurs due to a rise in the demand for the commodity currently in the market than the futures contract expiring shortly.

- A futures commodities market can be in either forward action ((contango)) or backwardation, depending on the market conditions and the sentiments and views of the market participants.

Frequently Asked Questions (FAQs)

Backwardation occurs in futures markets when the spot price of a commodity or asset is higher than the futures price. This situation can be caused by factors such as supply shortages, immediate demand, storage costs, or market expectations of future price declines.

Backwardation is generally considered a bullish signal. It implies that the market anticipates a temporary shortage or supply disruption, leading to higher spot prices. This can indicate strong current demand or expectations of future price increases.

Backwardation can be beneficial for certain participants in the market. It can incentivize producers to sell in the spot market rather than store the commodity, potentially alleviating supply shortages. However, it might also indicate potential economic uncertainty or supply disruptions. The impact on the broader market depends on the underlying factors driving the backwardation and the overall economic context.

Recommended Articles

This has been a guide to Backwardation & its meaning. Here we explain its examples in the commodity market along with advantages & disadvantages. You can learn more from the following articles –