A transferable and back-to-back Letter of Credit are two different financial instruments used in international trade. Below are the key differences between these two LC structures and their usage:

Table Of Contents

What Is a Back-to-Back Letter Of Credit?

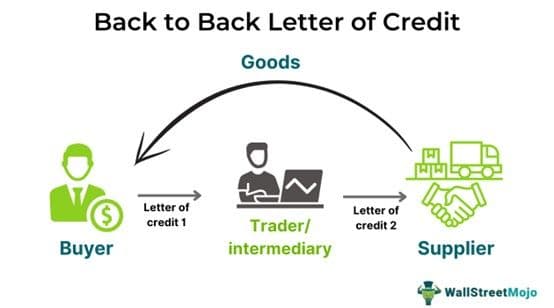

A back-to-back Letter of Credit refers to two consecutive Letter of Credit documents issued for a single financial transaction to ensure higher security. Here, the first LC (master LC) serves as collateral for the second one when an international transaction between the buyer and seller is facilitated through an intermediary like an agent or broker.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

The parties often encounter trust issues and perceive high risk in import-export transactions. Therefore, a back-to-back LC assures the contracting parties a free flow of payment and goods. Indeed, it is a critical payment medium when the parties are doubtful of each other's creditworthiness, or the seller needs to source the ordered goods or services from a third party.

Key Takeaways

- A back-to-back Letter of Credit is a second Letter of Credit issued based on the principal or master Letter of Credit in a financial transaction.

- Its core purpose is to provide higher security in international trade, particularly when intermediaries like brokers, traders, and agents are involved.

- The parties involved in such a financial transaction are the buyer, seller, intermediary or broker, buyer's bank, supplier's bank, and intermediary's bank.

- A primary condition in a back-to-back LC is that it should not have any discrepancies in the order details, including product quantity, description, and price.

Back-To-Back Letter Of Credit Explained

A back-to-back Letter of Credit is an arrangement whereby two Letters of Credit are issued consecutively for one financial transaction, with the second one intending to hedge the first one by offering enhanced security in international trade and exchange. It is common in international transactions involving a third party or intermediary. These transactions involve parties like the buyer, seller, intermediary, and their respective banks.

The second Letter of Credit that is issued based on the principal or master LC is termed a back-to-back LC. It includes the following information and documents, similar to a commercial LC:

- Beneficiary details

- Supplier's bank details

- Amount of order

- Documents list

- Payment period for compensating the bank

- Payment mode

- Goods description

- Notifying address

- Local bank's confirmation order

Also, such an LC includes specific terms and conditions as outlined below:

- A back-to-back LC's issuance can be requested only by the intermediary or the secondary beneficiary.

- Both LCs should precisely represent the transaction's exact details, such as product quantity, price, description, terms and conditions, etc.

- The banks must conduct due diligence carefully to assess the applicant's creditworthiness before issuing the LCs.

- The expiration of the back-to-back LC should always be prior to the expiration of the master LC.

- The principal LC should contain the date of payment, which is later than the date of shipping, to ensure that the cargo is delivered to the buyer before making the payment.

- The highest possible margin or value in a back-to-back LC is 90% of the master LC.

Notably, the bank will only be responsible for the documentation work and cannot be held liable for the product's defect or quality concerns, while parties need to pay the bank in any such condition.

Process Steps

Now, the question is: How does a back-to-back Letter of Credit work? Below is a systematic process providing back-to-back Letter of Credit sample steps:

- The buyer approaches their bank (issuing bank) to get the master LC created and issued to the intermediary's bank.

- The intermediary's bank receives the LC (taken as collateral) and issues another LC to the original supplier, which is termed the back-to-back LC.

- The supplier ships the goods to the buyer and provides all the relevant documents along with the bill of lading to their bank.

- The supplier's bank then shares these documents with the intermediary's bank, where the bundle undergoes due diligence and verification. After that, on being satisfied that everything is appropriate, the intermediary's bank disburses the payment in favor of the supplier's bank.

- The supplier's bank then makes the payment to the supplier for settlement against the secondary LC.

- Meanwhile, the intermediary's bank presents all the relevant documents to the buyer's bank, where these documents are duly verified. Then, the buyer's bank makes the payment to the intermediary's bank according to the specified sum in the master LC.

- As the goods reach the buyer, they deposit the order value at their bank, thus closing the deal.

Examples

The back-to-back LC is a complex process. However, the users can first draw a back-to-back letter of credit flow chart to understand how it works. Let us consider the following examples to contemplate its structure in a real-world scenario:

Example #1

Suppose M/s ABC and LMN Ltd. entered into a contract whereby the former (buyer) is to procure digital calculators from the latter (seller) worth $10,000. The PQR Logistics mediates the transaction. M/s ABC gets a master LC issued by their bank in favor of the PQR Logistics bank. PQR Logistics' bank receives the LC and keeps it as collateral to issue a back-to-back LC to the LMN Ltd.'s bank.

LMN Ltd. transfers the digital calculator consignment to M/s ABC and submits the bill of lading and other crucial documents to their bank. LMN Ltd's bank provides the submitted documents to PQR Logistics' bank. The latter verifies and scrutinizes these documents and then disburses the payment to LMN Ltd's bank. The bank credits that Amount to LMN Ltd. Simultaneously, PQR Logistics' bank presents all the required documents to M/s ABC's bank for verification. After that, M/s ABC's bank releases the LC-specified payment in favor of PQR Logistics' bank. Finally, on receiving the delivery of the consignment, M/s ABC deposits the payment at their bank.

Example #2

Back-to-back letters of credit (LCs) are valid in South Korea. They are used in international trade transactions, but their application must comply with relevant legal standards and regulations. FIM Bank v. Woori Bank and Kwangju Bank (2017) exemplify key legal issues related to back-to-back letters of credit (LCs). The associated verdict confirmed the legal framework and handling of such LCs in South Korea, reinforcing their validity and the importance of adhering to proper terms and conditions.

Advantages And Disadvantages

Every type of LC plays a different role in diverse financial transactions, and so does the back-to-back letter of credit, which has its unique implication in import-export transactions. Given below are the various pros and cons of such an LC:

Advantages:

- Back-to-back LCs help sellers and buyers mitigate the risk of limited creditworthiness in international transactions.

- It provides additional security to suppliers and buyers when financial transactions involve intermediaries such as agents, traders, and brokers.

- This type of LC makes the payment process more seamless, uniform, and less financially complex in export-import trade.

- The BBLC facilitates the sourcing of goods or services by suppliers (to be delivered) from a mediator or secondary beneficiary, making the process more flexible.

- It can open up new opportunities for trade and business for secondary beneficiaries or parties that mediate such transactions.

- This payment mode protects the crucial information of the supplier and buyer while not disclosing commission income.

Disadvantages:

- In a back-to-back LC, the terms and conditions and other relevant information may not be identical between the primary and secondary LCs, which can cause discrepancies.

- Suppose the master LC's expiration date doesn't allow for sufficient margin. In that case, the settlement process can become complex if the LC expires before the receipt of relevant documents from the intermediary's bank.

- Although more protected, it doesn’t completely eliminate credit or financial risk, especially given the intermediary's credibility and the possibility of default.

- Such an LC must comply with all applicable international trade laws and regulations, which may complicate the closing process.

- The involvement of intermediaries increases transaction costs, making such transactions more expensive and potentially less profitable.

- Intermediaries are exposed to interest rate risk due to fluctuations in financing costs, which may reduce their profitability.

Back-To-Back Letter Of Credit Vs. Transferable Letter Of Credit

| Basis | Back-To-Back Letter Of Credit | Transferrable Letter Of Credit |

|---|---|---|

| 1. Definition | An arrangement where two LCs are issued for a single financial transaction, with the second LC hedging the first one to provide greater security. | A negotiable instrument where the first beneficiary or seller can transfer all or some of their credit to a third party or secondary beneficiary. |

| 2. Nature | A non-transferable document that serves as an alternative to a Transferable LC. | Fully or partially transferable to one or more secondary beneficiaries. |

| 3. Number of LCs | 2 | 1 |

| 4. Parties Involved | Buyer, seller, seller's supplier, buyer’s bank, supplier’s bank, and intermediary's bank. | Buyer, seller, secondary beneficiary (or multiple beneficiaries), and their respective banks. |

| 5. Documentation | Both LCs require separate documentation and fees. | Involves documents stating the terms and conditions of transferability, with additional paperwork as needed for the transfer. |

| 6. Use | Effective when the seller needs to procure goods or services from a third party or intermediary to fulfill the order. | Used when the seller needs to include various subcontractors or suppliers in the transaction to meet the original sales contract. |

| 7. Risk Involved | Lower risk | Comparatively higher risk |

| 8. Flexibility | Provides sufficient flexibility to suppliers | Comparatively higher flexibility |