Table Of Contents

What Are Back Taxes?

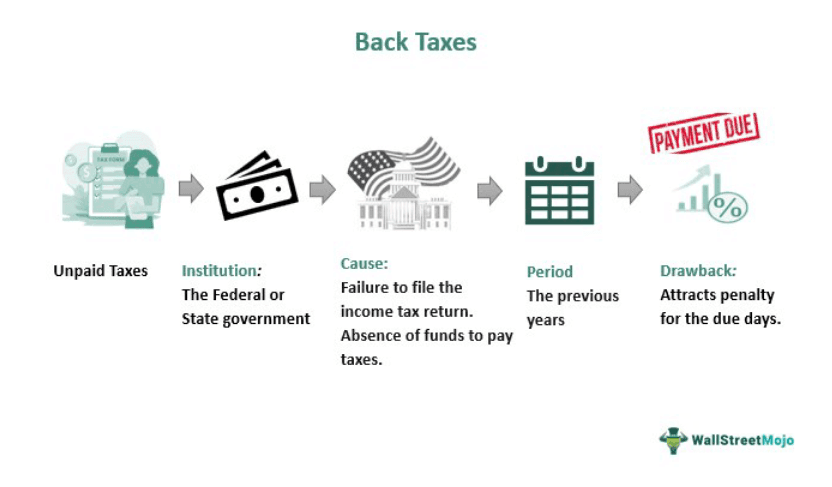

Back Taxes are outstanding taxes of an individual that are unpaid in any year. These taxes occur because people either forget to file their tax liability on income tax returns or lack funds to pay taxes. They act as a reminder for defaulters to pay taxes on time.

The Internal Revenue Service (IRS) originally proposed a due levy. They give an incentive to an individual to pay this levy on time. Also, payers get an extended time of 10 years for filing back taxes. However, delinquent (late) levies attract interest, penalty, or tax lien.

Key Takeaways

- Back taxes are unpaid tax amounts by an individual to the government in a particular year. It happens due to failure to file tax returns, avoid tax liability, or insufficient funds.

- The interest rate on defaulters is the federal short-term rate of 1% plus 3%. This rate compounds daily.

- The United States was the first country to start in the 20th century. In 1931, "Al Capone" was the first person to have a fine of $50,000 plus interest of $215000.

- If an individual lacks funds, they get additional 60-120 days to pay the due amount.

Back Taxes Explained

Back Taxes (levies) are initially known as unpaid dues that an individual has yet to pay to the State or Federal government. It can happen due to various reasons like insufficient funds to pay these levies and to fail or avoid paying taxes that year. This system got started in the United States. Later, Canada, Australia, the United Kingdom, and other nations adopted this model.

The history of back taxes travels back to the 18th century in the United States. After major events like the Civil war and the American revolution, Congress formed new levy laws governing the system. On February 25, 1913, the 16th Amendment allowed Congress to levy (impose) levies on citizens. A year later, they levied Form 1040, where individuals could easily file their income levy returns. However, the IRS imposed a penalty charge on that person in case of due. As a result, in 1931, the IRS charged Gangster "Alphonse Capone" a fine of $50,000 plus interest of $215000 on back taxes.

In the later years, other nations also started charging penalties and interest on individuals who failed to pay levies on time. Likewise, in 2011, the IRS launched the Fresh Start program to help taxpayers pay their due taxes accordingly. As a result, according to Statista, in 2021, 42.9% of the population paid levies among all income groups. In contrast, the rest, 57.1%, fail to do so. As a result, the latter started owing back taxes to the government.

Reasons

Various reasons lead to owing back taxes to the government. Let us look at them:

- Failure to pay levy liability while filing the tax return.

- Avoiding or neglecting the levies applicable to an individual.

- Lack of funds to pay the tax liability.

- Deliberately or falsely reporting personal income.

How To File Back Taxes?

Individuals can use the IRS back taxes to help pay levies to the federal government over 10 years. But first, let us look at the steps on how to file unpaid levies at the federal or state government:

#1 - Terms and Conditions

If individuals have an outstanding balance, they can file the income levy return in the present. Thus, they will attract limited interest and penalties on it. In some cases, if you have paid more levies than you owe, the IRS might refund some of the difference. In contrast, if self-employed individuals fail to report income, they would not receive any benefits or credits under the back taxes relief.

#2 - Procedure

For paying back taxes, visit the previous year's IRS Form from the IRS portal. Next, to file the past levy return, fill in the "Form 4506-T Request for Transcript of Tax Return". If the taxpayer needs the prior year's details, they get a request for "Get Transcript." Once they receive notice from the IRS, individuals can send their due levy details. However, if the levy amount is more than the income available to pay, they can request 60-120 days through an "Online Payment Agreement." Also, there is no additional charge for it. Similarly, if the taxpayer needs more time, they can request an installment agreement or qualify for an offer in compromise.

Examples

Let us look at the examples of back taxes to comprehend the concept better:

Example #1

Suppose Alan is a United States citizen earning $40,000 annually. Due to some reasons, he failed to file the income tax return in the past two years. Thus, Alan can either voluntarily file the previous tax returns or wait for IRS notice. After a few weeks, he received an IRS notice regarding levy payment failure in 2020 and 2021. As a result, Alan owed a levy amount of $3850 for the respective years. According to the IRS back taxes help, they will charge interest and a late filing penalty of 0.5% (19.25), which keeps increasing until he makes full payment. Also, the interest rate will be 4% of the due amount. And this amount will get compounded daily in this case.

Example #2

According to Forbes news, American mobility and service provider Uber has decided to pay back taxes of $100 million to the New Jersey Department of Labor and Workforce Development (NJDOL). It is an Unemployment Trust Fund. Additionally, in October 2022, the largest machinery provider, Caterpillar Inc, stated the unpaid levies dispute with the IRS was settled at $2 billion. This dispute arose as a result of false and misleading reports of income tax returns.

Back Tax Interest Rate

Let us look at the interest rate and penalty levied by the IRS as per the back taxes relief:

#1 - Interest

The IRS will charge interest and a penalty despite any amount owed. In addition, they charge an interest rate on the unpaid amount from the due date to the payment date. The federal government sets a different interest rate every three months. As per the recent IRS updates, the interest rate is the federal short-term rate (1%) plus 3%, giving a total of 4%. In addition, the interest compounds daily.

#2 - Late Filing Penalty

If the taxpayer fails or files on time but does not pay the taxes, it will attract a penalty of 0.5% of the actual back levy owed per month. Or else every month until the person pays the due in full. Failure to pay taxes can attract a penalty of 25% of the levy due. However, the time limit is within ten days of receiving the failure of the notice letter. If it exceeds this, the interest will rise to 1%.

#3 - Accuracy-Related Penalty

Individuals who claim deductions but fail to report their income tax return to attract a penalty. For example, during an understatement of income tax, a penalty of 10% or $5000, whichever is larger.

#4 - Dishonored Penalty

In case the payment check provided by the taxpayer gets dishonored, the IRS will charge a penalty to them. If the unpaid tax amount is below $1250, the penalty will be $25. If the due l exceeds $1250, the penalty will be 2% of the payment amount.