How to Avoid Common Financial Mistakes as a College Student?

Table of Contents

Introduction

Usually, it is in college where individuals have their first experience in managing finances. That said, a lot of students do not have the know-how to manage their money effectively. As a result, they end up making mistakes, which impact their savings.

Awareness is the key for persons who wish to avoid the common financial mistakes of college students. If you are an individual who wants to make sound financial decisions that can have a positive effect on your finances, at least in the near future, we have got you covered. This article dives into some of the most common financial mistakes that college students make. Moreover, it provides some tips that can help individuals avoid such mistakes and manage their finances better.

What Not to Do: Students' Basic Financial Mistakes

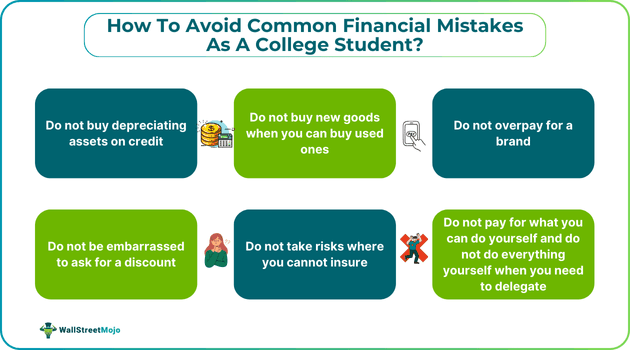

Here are the six most common and basic financial mistakes college students make:

Mistake #1: Buying Depreciating Assets on Credit

Remember, do not try to live a lavish life in college. It can lead to a financial crunch for some time in the future after you are done with college. We know it looks cool to wear fancy clothes and shoes, keep an expensive smartphone in your pocket, and flaunt all the cool gadgets. That said, all of these items are depreciating assets which soon will have little to no value over time.

Moreover, in case you are buying all these products on credit, remember that you need to pay equated monthly installments or EMIs on them, which may last for a couple of years and may even stretch beyond your college life. These payments might drain you financially without you even realizing it until it is too late to rectify the mistake. Even worse, you might fall into a debt trap at an early age if you fail to conduct effective credit management.

Try spending your money in meaningful areas that can have a positive impact. For example, you can seek essay writers for hire and pay them if you are struggling with your college assignments. Also, try to save as much as possible and start investing your money to make financial gains. You can use the money earned via investments to fulfill certain objectives; for example, you can fund higher education with the gains.

Mistake #2: Buying New Goods When You Can Buy Used Ones

Whenever we talk about financial mistakes college students make, this mistake is just an extension of the first one. We see thousands of college students making the same mistake again and again. Remember one thing: your college days are for you to prove that you can manage multiple things and manage your finances judiciously. Do not overspend and, most importantly, make do with a shoestring budget. One way to save money and spend judiciously is to purchase used items.

If every time you are going to buy new things simply because you do not like to use second-hand things or books and are not a fan of thrifting, it not only influences your whole lifestyle but costs you financially. Think about it; you can get access to the same books by paying a significantly lower price. Yes, the condition might not be as good as a new one. However, it will get the job done.

Mistake #3: Overpaying For A Brand

Chasing a brand is one of the most common financial mistakes college students make. Remember, in college, you have limited resources, and you must allocate them prudently to meet different financial requirements, for example, tuition fees, laundry expenses, etc. The premium you pay for a top smartphone is just not worth it, given the limited funds.

As a college student, budgeting should be your focus. If you think you have a friend circle that gives huge importance to brands and extravagant lifestyles, we would suggest you do not get influenced. Instead, focus on improving your money management skills.

Mistake #4: Being Embarrassed To Ask For A Discount

When you are in college, you do not have to worry about your social status. In fact, this is the time when you can save money by bargaining. Do not hesitate or feel ashamed to ask for a discount; ensure to bargain and negotiate. In fact, you need to understand that bargaining and negotiation are also key skills you must learn.

Mistake #5: Taking Risks Where You Can Insure

When you are in college, you really don't have to worry about anything else other than your studies. You have time to lose, try new things, explore and figure out your true calling, passion and interest that you can really like and turn into your profession.

You are allowed to take risks, but make sure they are well calculated and insured. In other words, do not bite more than you can swallow; only take risks when you have an appetite for it. Start exploring student financial planning and restrict yourself from taking huge risks that can lead to serious financial loss.

Mistake #6: Paying For What You Can Do Yourself And Doing Everything Yourself When You Need To Delegate

Never pay for something that you can do yourself; this is not only a big financial mistake but also defines you as a lazy and irresponsible person. There are many things that you will come across in your college life that you won't like to do, but you must do it to prove your worth. At the same time, we would also advise you to delegate any work that you think will consume a significant amount of your time. For example, if you get an assignment suddenly with a tight deadline and you have other obligations, you can take the help of online platforms like Do My Assignment to complete it on time. So you see, we never asked you to be frugal; just invest the money judiciously to fulfill the right purpose.

Conclusion

Finally, we believe we have covered all noteworthy financial mistakes college students make. We can only conclude by encouraging you to manage money smartly. Simply avoid the above mistakes in your college life.

Remember, a few years of enjoying an extravagant lifestyle can cause financial struggles in the future. In other words, if you end up making some serious financial mistakes in your college days, you may have to pay for it beyond your college term. We expect you to become smart and wise with the money management tips provided in the article.