Table Of Contents

What Is Average Variable Cost?

Average variable cost refers to the variable cost per unit of goods or services. The variable cost is the cost that directly varies with the output and is calculated by dividing the total variable cost during the period by the number of units.

It is widely used in business and economics for the purpose of analyzing the relationship between the output and the cost associated with the production process of the company. This cost varies with the output level and is directly proportionate to it. Cost related to raw materials or direct labor can be identified as some examples of such a cost.

Key Takeaways

- Average variable cost is the cost per unit of variable inputs used to produce goods or services.

- It varies directly with the output level and is derived by dividing the total variable cost during a period by the number of units produced.

- The average variable cost declines as output increases, reaching a minimum point. After the minimum point, the average variable cost rises as production increases.

- Its curve is U-shaped, as it initially slopes downwards due to the spreading of fixed costs over larger units but then slopes upward as output increases.

Average Variable Cost Explained

The average variable cost is the cost that can be used for analysis in business and corporates and establish a relation between the variable cost levels and the production or output of goods and services. It rises with rise in putput and falls with reduction in output levels.

The average variable cost of production is calculated by dividing the total variable cost by the total output of the business. The management as well as stakeholders who are interested in finding out more about the cost structure of the company, can use this metric for assessment of the same.

It helps in decision making based the cost incurred, its fluctuations and the effect on overall financial health of the organization. The company management calculate average variable cost so that they can decide the highest level of output that can be achieved by keeping the variable cost at its minimum and accordingly set the prices of goods and services. This makes the entire system cost effective and efficient.

The business should ensure that the average cost is always lower than the prices so that the revenue earned is able to cover the cost or production, leading to profits. In the long run, however, the business tries to achieve the revenue level, which covers both average variable cost and fixed cost.

Formula

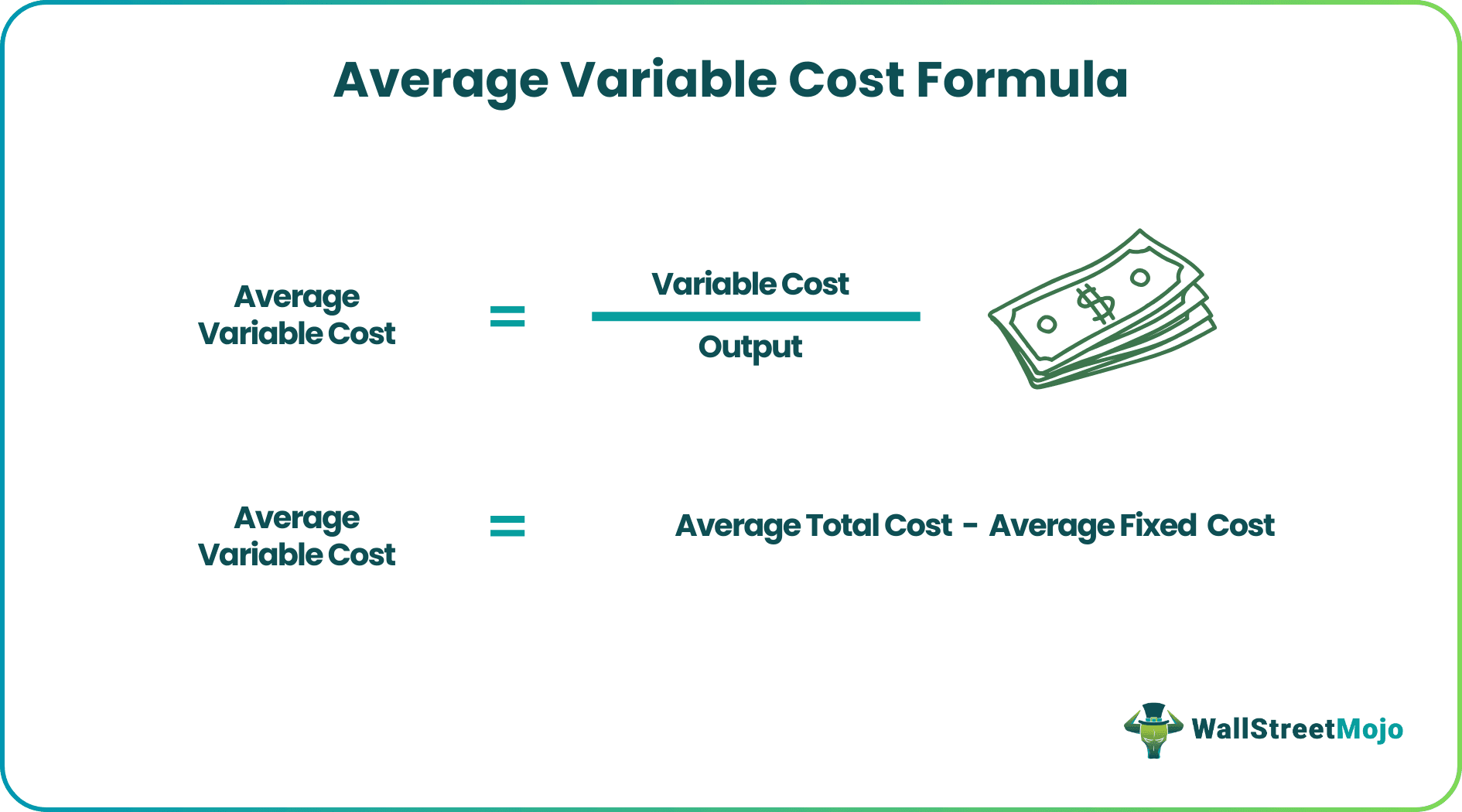

Let us learn how to calculate average variable cost, using a formula.

The formula for average variable cost equation is as follows:

Average Variable Cost (AVC)= VC/Q

Where,

- VC is the Variable Cost,

- Q is the quantity of output produced

The AVC can also be calculated based on the average total cost and the average fixed cost. It is represented as follows,

AVC = ATC – AFC

Where,

- ATC is Average Total Cost

- AFC is Average Fixed Cost

How To Calculate?

For calculation of AVC, the steps are as follows:

- Step 1: Calculate the total variable cost

- Step 2: Calculate the quantity of output produced

- Step 3: Calculate the average variable cost using the equation

- AVC = VC/Q

- Where VC is variable cost and Q is the quantity of output produced

In certain cases, average total costs and average fixed costs are given. In such cases, follow the given steps

- Step 1: Calculate the average total costs

- Step 2: Calculate the average fixed costs

- Step 3: Calculate the average variable costs using the equation

- AVC = ATC – AFC

- Where ATC is Average Total Cost, and AFC is Average Fixed Cost

Examples

Let us try to understand the concept of average variable cost equation with the help of some suitable examples as given below.

Example #1

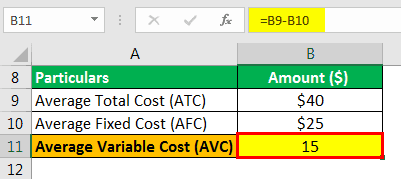

The total variable cost of a firm is $50,000 in a year. The number of units produced is 10,000. The average total cost is $40, while the average fixed cost is $25. Calculate the average variable cost.

Solution

Use below given data for the calculation.

- Variable Cost: $5,000

- Quantity (Q): $10,000

- Average Total Cost (ATC): $40

- Average Fixed Cost (AFC): $25

The calculation can be done as follows-

- = $50000/10000

The calculation can be done as follows:

- = $40 - $25

- The AVC is $15 per unit.

Example #2

An Economist in Bradleys Inc. is looking at the cost data of the company. First, calculate the average variable cost for each output level.

Here is the cost data

| Output | Total Variable Cost ($) |

|---|---|

| 1 | 40 |

| 2 | 70 |

| 3 | 95 |

| 4 | 110 |

| 5 | 145 |

| 6 | 200 |

| 7 | 300 |

Solution

The AVC is calculated in the following table for each output level using AVC = VC/Q.

The calculation can be done as follows-

- =40/1

Similarly, we can calculate the AVC as follows

Example #3

George's Inc. has the following cost data. First, calculate the average variable cost for each output level. Also, determine the output level where the average cost is the minimum.

| Output | Total Variable Cost ($) |

|---|---|

| 1 | 50 |

| 2 | 75 |

| 3 | 95 |

| 4 | 110 |

| 5 | 125 |

| 6 | 145 |

| 7 | 175 |

| 8 | 225 |

| 9 | 300 |

| 10 | 420 |

Solution

The AVC is calculated in the following table for each output level using AVC = VC/Q.

The calculation can be done as follows-

=50/1

- Similarly, we can calculate the AVC as follows

The lowest AVC is 24.17 per unit. It corresponds to an output level of 6 units.

Hence, the output at which the average variable cost is the minimum is six units.

Example #4

Lincoln Inc. gives you the following financial information. You are required to calculate the average variable cost for each output level.

| Output | Total Variable Cost ($) |

|---|---|

| 1 | 5 |

| 2 | 7 |

| 3 | 10 |

| 4 | 12 |

| 5 | 14 |

| 6 | 17 |

| 7 | 22 |

| 8 | 30 |

| 9 | 50 |

Solution:

Step 1: We have to use the AVC Formula, i.e., = Variable Cost/Output.

For this purpose, insert =B2/A2 in cell C2.

Step 2:

Drag from cell C2 up to cell C10

The above examples not only help us in understanding financial concept of average variable cost in economics in a better way but also guides regarding how to identify and calculate it in various scenarios.

Relevance And Uses

Initially, as output increases, the average variable cost reduces. Once the low point is initially, the average variable cost reduces as output increases. Once the low point is reached, the AVC rises with rising output. Hence, the of average variable cost in economics curve turns out to be a U-shaped curve. It implies that it slopes down from left to right and then reaches the minimum point. Once it reaches the minimum mark, it starts rising again. Therefore, AVC is always a positive number. At the minimum risk, the AVC is equal to the marginal cost. Let us use an illustration to find out the behavior of the AVC.

| Output | Average Variable Cost ($) |

|---|---|

| 1 | 5000 |

| 2 | 3800 |

| 3 | 3200 |

| 4 | 2750 |

| 5 | 2550 |

| 6 | 2400 |

| 7 | 2500 |

| 8 | 2800 |

| 9 | 3350 |

| 10 | 4300 |

In the above illustration, the average variable cost is $5,000 per unit if only 1 unit is produced. Then it is on a declining trend up to the production of 6 units. Finally, it reaches its lowest point at $2,400 per unit when six units are produced. Then, it is on an increasing trend, making it a U-shaped curve.

The AVC is used to decide when to shut down production in the short run. For example, a firm can continue its production if the price exceeds AVC and covers some fixed costs. Conversely, a firm would shut down its production in the short run if the price is less than AVC. Shutting down production will ensure that additional variable costs are avoided.

Average Variable Cost Vs Marginal Cost

Both the above cost measures have great importance in the world of economics and business and is extremely useful in making price related decisions. However, some differences between them are as follows:

- The former represents the variable cost per unit of production, whereas the latter represents the cost of producing one additional unit of output.

- Finding average variable cost is useful because it shows the cost of predicting each unit and the latter show the cost of producing extra unit.

- The former is calculated by dividing the total variable cost by total output whereas the latter is calculated by dividing the total cost by total output.

- The former provides insight into the cost structure where as the latter determines the profit maximising output level.

- The former evaluates how efficiently the company is able to manage or control the variable cost of production, whereas the latter helps in deciding whether the is best to raise the production level or reduce it.

Thus, both the above concepts finding average variable cost and marginal cost is useful because they play an important role in cost analysis, planning the pricing or goods and output levels so as to optimise the business process and achieve profits.