Table Of Contents

What is Average Total Cost?

The average total cost refers to the cost per unit produced within an organization. This plays an integral role in product pricing. For a company to be profitable, the price of the product must be greater than its average costs. These costs include both fixed costs such as electricity and raw materials, and variable costs such as direct labor.

An average total cost formula economics is considered one of the most detailed calculations of the costs involved in the production of a product. In a modern-day business, marketing, and customer acquisition costs cover a major chunk of the costs and it has been noted with many start-ups spend large sums towards the same resulting in more spending than returns from the product.

Average Total Cost Formula Explained

The average total cost formula shows the cost per unit of the quantity produced and is calculated by taking two figures where the first one is total production cost and the second one is the quantity produced in numbers and then the total cost of production is divided by the total quantity produced in numbers.

It is straightforward, and it is calculated by dividing the total cost of production by the number of goods produced. This calculation gives businesses a clear picture in terms of setting the price for their products. Companies must set a price that is greater than their costs to ensure profitability.

However, newer businesses initially spend a higher amount on marketing their products and customer acquisition. Therefore, it results in losses initially.

It is vital to note that the costs in consideration for the calculation of the minimum total cost formula are both fixed and variable costs. Fixed costs refer to the costs that the business will incur invariably such as rent, raw materials, and electricity. Variable costs refer to the expenses relating to production that might be incurred based on situations such as fluctuations in costs of raw material and direct labor.

Formula

Let us understand the average total cost formula economics which shall act as a basis for all related concepts and help us understand its intricacies in detail.

Average Total Cost = Total Cost of Production / Quantity of Units Produced

However, the total cost is comprised of fixed cost and variable cost of production. Mathematically,

Total Cost of Production = Total Fixed Cost + Total Variable Cost

It can also be calculated by adding up average fixed cost and average variable cost. This average total cost equation is represented as follows-

Average Total Cost = Average Fixed Cost + Average Variable Cost

where,

- Average fixed cost = Total fixed cost/ Quantity of units produced

- Average variable cost = Total variable cost/ Quantity of units produced

How To Find?

Now that we have a basic understanding of the concept and the formula, let us understand how to find the minimum average total cost to ensure pricing the product can be done accordingly. Below is a step-by-step explanation of the same.

- Firstly, the fixed cost of production is collected from the profit and loss account. A few examples of the fixed cost of production are depreciation cost, rent expense, selling expense, etc.

- Next, the variable cost of production is also collected from the profit and loss account. A few examples of the variable cost of production are raw material cost, labor cost, etc.

- Next, the total cost of production is calculated by summing up the total fixed costs and total variable cost. Total Cost of Production = Total Fixed Cost + Total Variable Cost

- Now, the quantity of units that has been produced has to be determined.

- Finally, the average total cost of production is calculated by dividing the total cost of production calculated in step 3 by the number of units produced determined in step 4. Average Total Cost = Total Cost of Production / Quantity of Units Produced

Examples

Let us understand the concept of average total cost formula economics with the help of a couple of examples. These examples shall give us a practical overview of the concept and its ebbs and flows.

Example #1

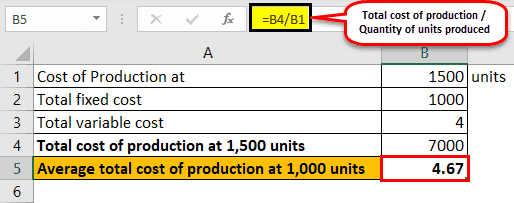

Let us consider an example where the total fixed cost of production of a company stood at $1,000, and the variable cost of production is $4 per unit. Now, let us do the calculation of the average total cost when the quantity of production is:

- 1,000 units

- 1,500 units

- 3,000 units

In the below template, we have done the calculation of the Total Cost of Production using the given data.

- Hence, the total cost of production at 1,000 units will be calculated as:

Therefore, from the above calculation, the Total Cost of Production for 1000 units will be:

= $1,000 + $4 * 1,000

Now, at 1,000 units, it will be calculated as:

= $5,000 / 1,000

- Total Cost of Production for 1500 units

= $1,000 + $4 * 1,500

So, for 15000 units it will be –

$7,000 / 1,500

- Total Cost of Production for 3000 units

= $1,000 + $4 * 3,000

So, for 3000 units, it will be –

= $13,000 / 3,000

In this case, it can be seen that the average total cost decreases with the increase in the production quantity, which is the major inference from the above cost analysis.

Example #2

Let us consider another example where the total fixed cost of production of a company stood at $1,500 while the variable cost of production per unit varies with production quantity. Now, let us calculate the average total cost when:

- Variable cost is $5.00 per unit from 0-500 units

- Variable cost is $7.50 per unit from 501-1,000 units

- And variable cost is $9.00 per unit from 1,001-1,500 units

Therefore,

- Total cost of production at 500 units = Total fixed cost + Total variable cost

= $1,500 + $5 * 500

For 500 units, it will be = $4,000 / 500

Again,

- Total cost of production at 1,000 units = Total fixed cost + Total variable cost

= $1,500 + $5 * 500 + $7.5 * 500

At 1,000 units = $7,750 / 1,000

Again,

- Total cost of production at 1,500 units = Total fixed cost + Total variable cost

= $1,500 + $5 * 500 + $7.5 * 500 + $9 * 500

At 1,500 units = $12,250 / 1,500

In this case, it can be seen that the average total cost initially decreases with the increase in the production quantity till 1,000 units. But then the trend reverses beyond that production level due to an increase in the average variable cost. The detailed excel calculation is presented in tabular format in the later section.

Use and Relevance

It is vital to understand the concept of minimum average total cost formula since it helps a production manager to figure out till what level the production can be increased profitably. Usually, the total fixed cost doesn't change, and as such, the change in average total cost is primarily driven by the change in average variable cost.

In cases where the average total cost breaches the permissible limit, then the production manager should either halt the incremental production or try to negotiate the variable cost.

Example with Excel Template

The following table gives a detailed calculation of the case discussed in example 2 and shows how the average total cost varies with the change in quantity produced. Here, it reverses trend after a certain point, which indicates that at that level of production, the cost of production starts to increase after the initial phase of moderation.

In the below given excel template, we have used the equation to find the Average Total Cost for certain units produced.

So the Average Total Cost Calculation will be:-

The below-given graph shows the Average Total Cost of the Company.