Table Of Contents

What Is The Average Payment Period?

Average payment period refers to the average time period taken by an organization for paying off its dues with respect to purchases of materials that are bought on the credit basis from the suppliers of the company, and the same doesn't necessarily have any impact on the company's working capital.

It also tells about the different information of the company such as the cash flow position of the company and its creditworthiness, etc., which is useful for many of the stakeholders of the company, especially the investors, creditors, management, and the analysts, etc. to make the informed decision with respect to the company.

Average Payment Period Explained

Average Payment Period is one of the important solvency ratios of the company and helps a company track and know its ability to pay the amount payable to its creditors.

However, its calculation only considers the financial figures and ignores the non-financial aspects such as the relationship of the company with its customers.

The different important points related to the Average Payment period are as follows:

- In order to calculate the average payment period ratio of the company, first of all, the figures pertaining to the average accounts payable by the company is required. This information is present in the balance sheet of the company under the head current liabilities.

- In case the payment period calculated is short, then it shows that the company is making the prompt payment to its customers. On the other hand, if the payment period calculated is large, then it shows that the company is no making the prompt payment to its customers. However, if the payment period is very short, then it shows that the company is not able to take full advantage of the facility of credit terms as allowed by the suppliers of the company.

- As per the average payment period interpretation, many times, discounts are offered by the suppliers to the companies who make the early payment against their dues. For this, managers of the company try to make the due payments promptly to avail the facility of such a discount as offered by the suppliers. In case the facility of discount is available, then the amount of discount given and the benefit of credit length offered should be compared to choose between the two.

Formula

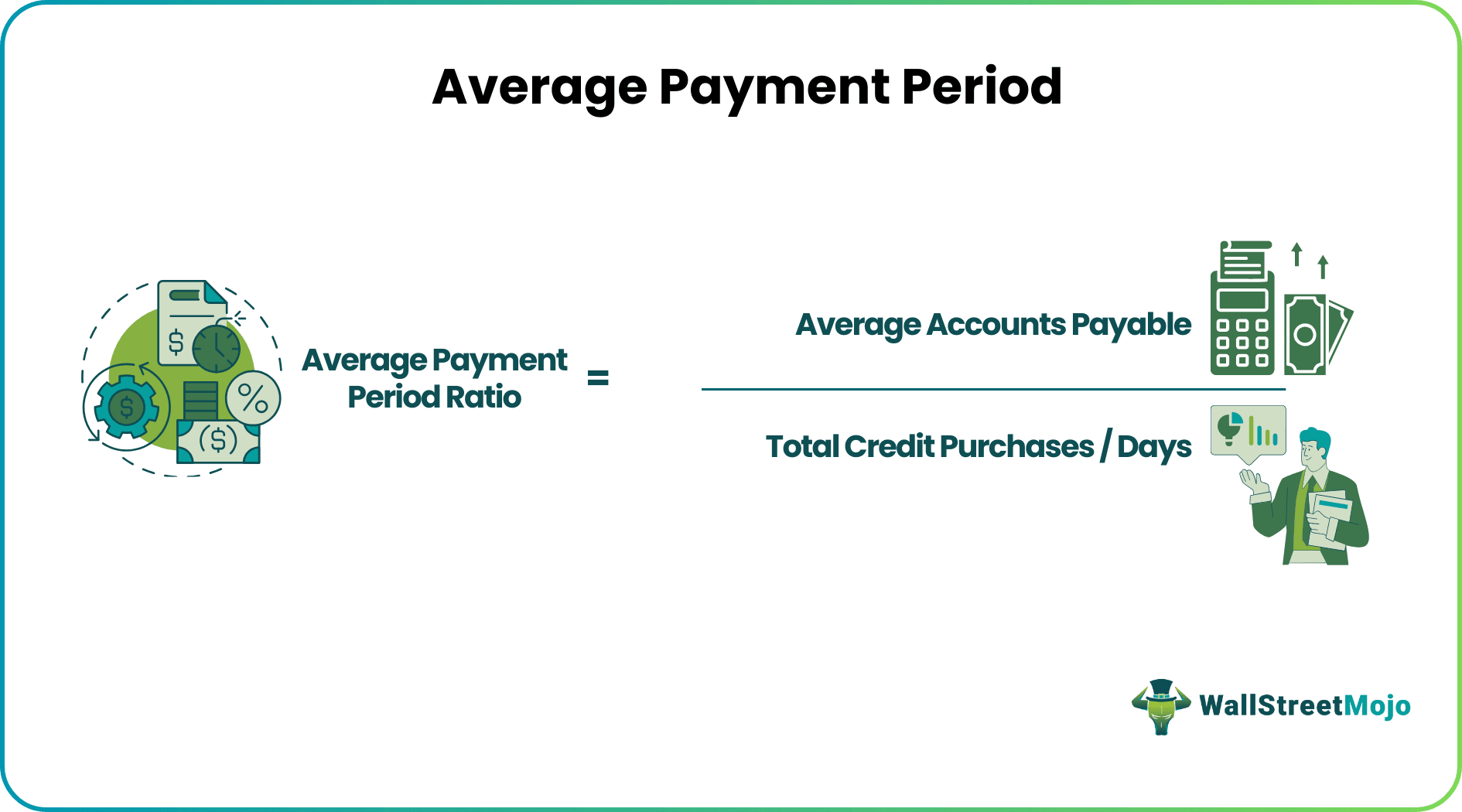

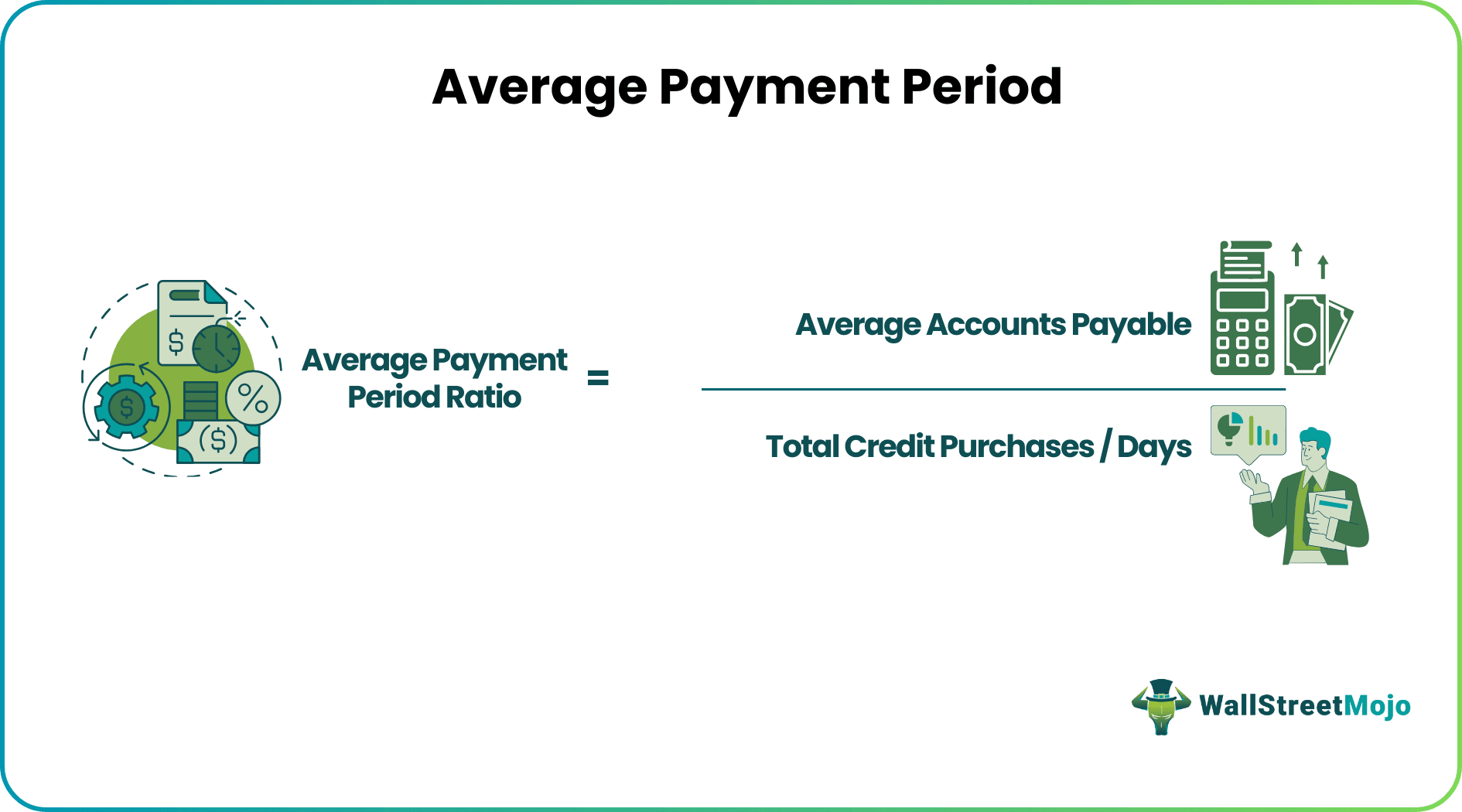

The average payment period ratio can be calculated using the below-mentioned formula.

Average Payment Period Ratio = Average Accounts Payable / (Total Credit Purchases / Days)

Where,

- Average Accounts Payable = It is calculated by firstly adding the beginning balance of the accounts payable in the company with its ending balance of the accounts payable and then diving by 2.

- Total Credit Purchases = It refers to the total amount of credit purchases made by the company during the period under consideration.

- Days = Number of days in the period. In the case of a year, generally, 360 days are considered.

Example

Below is an example of the average payment period ratio

During the accounting year 2018, Company A ltd, made the total credit purchases worth $ 1,000,000. For the accounting year 2018, the beginning balance of the accounts payable of the company was $350,000, and the ending balance of the accounts payable of the company was $390,000. Using the information, calculate the Average Payment period of the company. Consider 360 days in a year for the calculation.

Solution

- Beginning balance of the accounts payable of the company: $350,000

- Ending balance of the accounts payable of the company: $390,000

- Total credit purchases during the year: $1,000,000

- Several days in a period: 360 days.

Now in order to calculate the average payment period, firstly the Average Accounts Payable will be calculated as below:

Average Accounts Payable = (Beginning balance of the accounts payable + Ending balance of the accounts payable) / 2

- = ($350,000 + $390,000) / 2

- = $370,000

Calculation of the Average Payment Period

- = $370,000 / ($1,000,000/ 360)

- = $370,000 / ($1,000,000/ 360)

- = 133.20 days

Thus the average payment period of the company for the accounting year 2018 is 133.20 days.

What Is A Good Average Payment Period?

Ideally, as per the average payment period interpretation, the more creditworthy the customer is and lots of suppliers depend on such customers, the more is the opportunity of the customer to negotiate the payment period. The time lag between the credit purchase made and the actual date of payment is often used by customers who are in a strong position to negotiate.

So it is necessary to have a strong payment history and good cash flow position for the same, which can be used for bargaining. Typically, the situation is such that a business which has less free cash flow will have low power to bargain and thus has to repay early, making the average period of payment less than the situation where the cash flow is more, and the business has more bargaining power.

Therefore, a good average payment period will depend on things like a huge volume of order, orders are placed very frequently and the customer and supplier have good relation with each other. Since the purchase is in large quantity, a lot of money is blocks for the supplier, and thus this will compel the supplier to wait patiently. If the number of customers in the market are less, then also the customer is at an advantageous position to negotiate because the supplier has less option of customers to sell their products.

So, it can be rightly pointed out that while we calculate average payment period, a good period is the one that are the result of all the above characteristics and, customer gets more time in hand to pay back, which allows them to use that cash for the time being in the business for more useful purpose.

Advantages

Below are some of the advantages which are as follows,

- There are various times when the company makes the purchases in bulk or normally as per its requirement. For the payment against this, credit arrangements facilities, as given by the suppliers, are used, which gives some days period to the buyer for making the payment for the purchase made by them. So, we calculate average payment period and it helps to know the average number of days taken by the company during the period under consideration to repay the suppliers against their dues.

- The calculation of the average payment period by the company can tell about the different information of the company such as the cash flow position of the company and its creditworthiness, etc., which is useful for many of the stakeholders of the company, especially the investors, creditors, management, and the analysts, etc. to make the informed decision with respect to the company.

Disadvantages

Below are some of the disadvantages of of average payment period days formula which are as follows,

- The average payment period calculation only considers the financial figures. It ignores the non-financial aspects such as the relationship of the company with its customers, which may be useful for the analysis of the creditworthiness of the company by its stakeholders.

- The information on the average payment period days formula is useful for the business. Still, at the same time, it is not sufficient to make the decision about the matters of cash management and credit worthiness of the company. For this, other information such as the average collection period and inventory processing period, etc. are also required.