Table Of Contents

Average Down Meaning

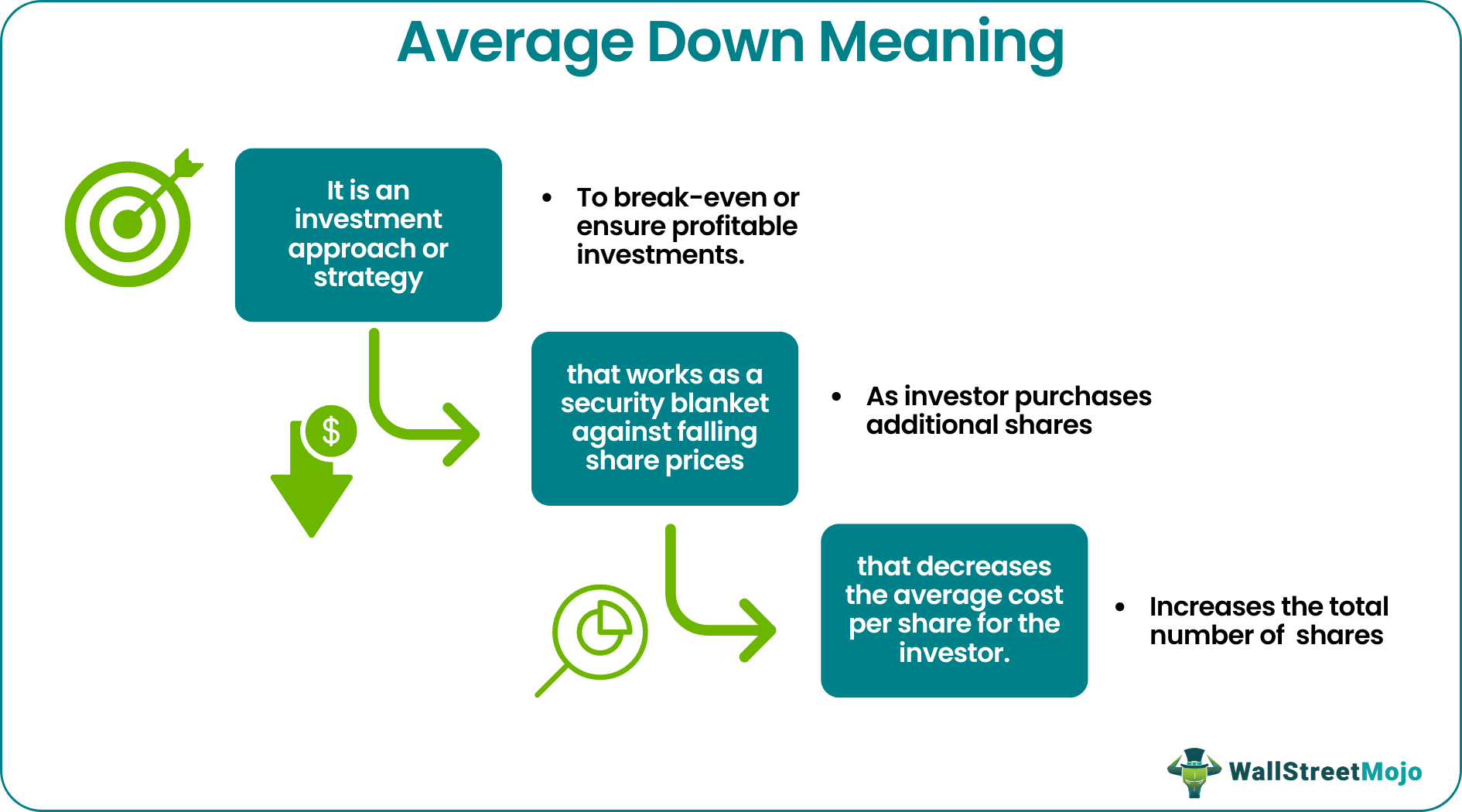

Average down refers to an investor’s approach while investing in stocks or shares to maintain a sustainable portfolio. Under this approach, an investor buys additional shares or doubles the number of shares purchased previously in their stock to decrease the average purchase price of the investor.

Averaging down is done to follow a value-driven investing strategy and usually requires a lot of capital to continue investing for the long term. Thus, through this method, investors try to decrease their cost per share when the prices of the shares drop. Thus, a drop in the share prices over time might reduce the overall returns if stocks remain limited.

Key Takeaways

- Average down explains the long-term investing pattern of an investor to hedge risks and keep their portfolio value over time.

- It is a strategy that requires an investor to continue investing in a stock even when its prices fall. As a result, the average per-share price for the investor reduces and reaches closer to the market per-share price.

- Over time the investor owns a higher number of shares, and the average price per share remains close to market prices. So when the market prices rise, investors can quickly break even and turn the investment profitable.

- This investment strategy is not risk-free. The market ups and downs might reverse the game plan completely for an investor.

Average Down Explained

Average down explains the long-term investing pattern of an investor to hedge risks and keep their portfolio value over time. Thus, such investors continuously put money in certain stocks to keep their average price per share stable and closer to market prices even after a fall in share prices. Consequently, they might even decide to purchase double the number of their existing shares.

Although, such an investment strategy is not risk-free. Its ups and downs might reverse the game plan completely for an investor. For instance, a professional investor can determine when to average down trading by differentiating between the comparable decrease in share prices and be cautious when the share prices might fall lower than expected.

However, an average investor who resorts to averaging share prices in their stocks needs to be more familiar with market patterns and indicators. Thus, an average investor can also become extremely wealthy by continuing to invest in such a manner. But interpreting the market signals accurately is necessary to determine loss or gain from average down trading. In the case of a market failure situation, the prices can go so low that purchasing shares of such stocks might lead to investors bearing huge losses in the future.

Sometimes even a slight hint of a recession-like situation hitting an economy leads to investors pulling out capital. While some might be able to read and predict what the falling prices indicate, others could be making risky investments.

One of the fundamental reasons for the average down strategy is to keep the stock of shares close to the average prices. Thus, an investor resorts to averaging down strategy to make adequate profits and minimize the losses when they decide to sell these shares in the future.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

How And When To Average Down Stocks?

Averaging down for investors works more on mathematical equations and estimation than any cognitive or emotional bias dictating actions when the share prices drop. But a fall in the value of stocks in any investor’s portfolio is a matter of concern and requires research and action to help the investor lower risks.

For instance, the dollar cost average down strategy involves investing a fixed amount of money in the same stock or fund over time. An investor may continue to do so even when the prices of mutual funds or stock exchange indexes go up and down.

Thus, many investors continue to average down even without realizing the fall in share prices. Such investors have their accounts set up in a manner that automatically invests money in their chosen asset on time. As a result, such investors make considerably higher profits during boom periods.

Some investors resort to manual investing regularly and closely look at the fall and rise of share prices. These investors curate their estimation through mathematical means or make a reason-based judgment before each investing cycle. Simultaneously, these investors also purchase the same number or value of shares to average down on their share prices when prices fall.

An alternate scenario to averaging down thus could be an emotional bias that pushes a fearful customer to sell their share when the prices drop or the market turns volatile. Thus, such investors might return only when the market stabilizes, a common mistake many investors make. While on the contrary, large institutional investors book tremendous profits by buying these volatile shares and waiting for their prices to recover and rise higher.

Thus, this method allows investors with high-risk appetites and large capital sizes to overcome emotional biases and profit during both turmoil and boom times.

Formula

Let us now understand the formula for the average down in stocks to calculate the break-even price for an investor,

The equation explains that investors can break even or book profits more quickly by using an average down strategy than they would otherwise. Thus, when stock prices rise average down approach will earn large profits for the investor as the investor purchases additional shares at a lower price. Thus, the investor or trader average down trading on their original position or first purchase and also touch the break-even point for additional shares purchased.

How To Calculate?

For example, an investor purchases 50 shares on the ABZ-100 index for $1000 in January of 2022. Thus, the initial per-share price will be $20. The table below mentions the changes in the monthly price per share and shares bought by the investor:

| Month | Number of shares bought | Price per share | Total money invested |

| January | 50 | $20 | $1000 |

| February | 45 | $18.20 | $819 |

| March | 55 | $18.03 | $991.65 |

| April | 60.5 | $17.54 | $1061.17 |

| May | 58.2 | $18 | $1047.6 |

| June | 48.5 | $22 | $1067 |

| Total | 317.2 | $ 5986.42 |

Thus, by applying the average down strategy, the investor purchases 317.2 shares on the ABZ-100 index with a total investment worth $5986.42.

Now, let us calculate the break-even price per share to see if the investment is profitable for the investor,

Thus, the average down investment strategy was profitable for the investor after comparing the break-even price per share ($18.87) and the latest price per share ($22).

Additionally, per the average down stock calculator, the investor owns 317.2 shares with an initial investment worth $ 5986.42 that turned into a profitable investment worth $ 6,978.4 at a $22 price per share. The average price per share in the investor’s stockholdings remained at $18.87 compared to the initial $20 per share price.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Averaging down for investors and traders works more on mathematical equations and estimation than the cognitive or emotional bias dictating actions when asset prices drop. Thus, when a currency value or exchange rate falls, a trader may buy more to average the cost per unit and wait for the currency value to increase. Thus, when currency prices rise, a large holding will yield profitable returns for the trader.

Yes. Averaging down assists an investor or trader reduce cost per share as the share price drops. Thus, for a good investment strategy in normal times, an investor can break even and book high profits by using an average down investment strategy. However, in case of share prices fall during a recession, the investor will require a large pool of capital to buy more shares and break even once the economy recovers.

Many investors continue to average down even without realizing the fall in share prices. It is because such investors have their accounts set up in a manner that automatically deducts and invests money in their chosen asset on time. As a result, such investors make considerably higher profits during boom periods.