Table of Contents

What Is Automated Reporting?

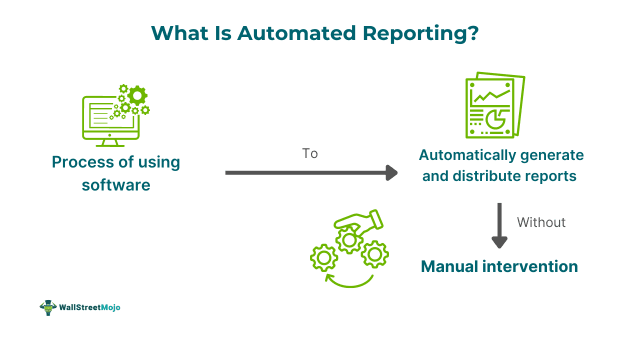

Automated reporting refers to using automation tools, analytics, and business intelligence to simplify various steps of report generation and data evaluation, including process automation. It enhances businesses' overall productivity allowing them to spend more time on insights obtained by automation of various stages of reporting procedure.

It also helps in transforming raw data into insights and factual information. Initially, it can generate reports under certain schedules, metrics, and criteria, but later on can be duplicated or customized to fit the entire company's needs. It fixes the errors and pain points in manual report generation.

Key Takeaways

- Automated reporting explains the use of automation technologies, analytics, and business intelligence to streamline the creation of reports and the examination of data, including process automation.

- It aims to increase overall productivity by freeing up time for insights obtained via the automation of several reporting method phases for a company.

- It offers benefits like reducing labor, human error risk, costs, and time, standardizing reporting, providing insights, bypassing unprofitable activities, and eliminating information silos.

- Its best practices include maintaining human contribution, training stakeholders, defining business challenges, ensuring data quality, setting up governance protocols, strengthening domain expertise, and offering consistent design.

Automated Reporting Explained

Automated reporting in finance represents the use of technology and software to align the generation of financial statements. It involves automated data gathering, evaluation, and presentation that reduces human efforts and errors significantly. Its main aim has been to increase accuracy and efficiency, offering help to organizations in making wise decisions as on reliable & real-time data.

Such an automated system of reporting extracts data from different sources, such as legacy systems, to generate financial reports immediately. Moreover, it can execute actions like data entry and account reconciliation without human intervention. More importantly, companies can decrease the time required to create reports in minutes instead of weeks while maintaining data integrity by using inbuilt validation checks.

It comes with a variety of implications, like reduced operational costs, enhanced adherence to regulatory standards, and more efficiency. It also makes the whole reporting system transparent for the benefit of stakeholders by giving access to live insights into financial performance, making it highly vital for strategic decision-making.

It also has wide usage, such as easy to use, allowing finance teams to handle data more efficiently. Such an automated system of reporting also has a better user interface, helping users to create reports in the absence of any need to have complex technical training. Hence it makes the reports easily available for a broader range of finance experts.

Additionally, the rise of automated systems of reporting, like Ohio's automated reporting system, has transformed the financial landscape as it –

- Allows organizations to act swiftly against market changes.

- Adds an extra layer of accuracy in financial reporting.

- Helps in abiding by the regulations, leading to transparency and compliance.

Examples

Let us use a few examples to understand the topic.

Example #1

An online article published on July 24, 2024, discusses the vitality of formulating an automated, accurate reporting system concerning Environmental, Social, and Governance (ESG) criteria. The report highlights about disclosure of ESG data to 63% of organizations in 2023 from 56% in 2022, stressing the transparency of ESG. Recent legislation like the US SEC's regulations, march 2024, and the Corporate Sustainability Reporting Directive (CSRD), January 2023, require detailed disclosures of climate-related entries in public filings.

As such, it has led to the use of automated ESG reporting software necessary to reduce manual errors, increase transparency, and enable accurate and timely data aligning with regulatory needs. The article has also emphasized the value of technology infrastructure, data collection, continuous review, and validation in ESG reporting. Moreover, it also noted that ESG reporting automation supports regulatory adherence, gives invaluable insights, plus improves decision-making for clients and investors. As a result, has the potential to aid businesses in sustaining a responsible business structure.

Example #2

Let us assume that a retail company named Greeny, located in Old York City, has 150 stores throughout the eastern coast of America, having annual sales of $600 million. Since its network is huge, it often comes across various human errors leading to delivery issues and customer dissatisfaction. Hence, it decides to automate all its reporting systems with the help of automated reporting tools or Excel. As a result, it contacts software provider that provides automated reporting for clients, for buying and installing its system of reporting that haze automation into it. Hence, after due deliberation and putting proper infrastructure in place, it implements the automated system of reporting for inventory management, customer feedback, and tracking sales.

Furthermore, the system can pull data from its 150 stores every day and consolidate sales figures, inventory levels, and product returns into a centralized dashboard. Hence, the system automatically generates reorders about vendors and flags all stockouts. Therefore, based on real-time insights given by the automated system of reporting, Greeny focuses on sustainable products and adjusts its marketing plan. Consequently, it has seen a rise in sales of eco-friendly products by 20%, determined top-performing employees, and located areas for improvement in its operations.

Benefits

For various sectors, it has multiple benefits like:

- It reduces labor or manual-intensive jobs like recovering data sets, permitting staff to concentrate on their main responsibilities.

- It also decreases the human error risk by providing consistent data out of the same place in a similar manner every time while improving trust in the data regarding increased confident decision-making.

- It cuts costs and saves money and time, increasing business capacity by minimizing the time consumed on reporting every week.

- It removes barriers from the technical team to dedicate more to creative tasks, allowing them to center on data projects having higher business value.

- It automates and standardizes reporting, creating insights and data more easily available and providing enhanced traceable Key Performance Indicators (KPIs) throughout the business.

- It also helps companies bypass costly or unprofitable activities.

- It gives a competitive edge and insights to a firm.

- It eliminates information silos.

Best Practices

Every reporting system that is automated must carry on the below best practices:

- Goals must be defined outlining challenges of business to be addressed by the report, and insights need to be generated, and responsibilities and roles of stakeholders involved.

- Ascertain data quality using data validation and preparation methods to retain consistency and accuracy while bias testing continues.

- Set up governance and security protocols to handle sensitive information, enabling adherence to regulations and executing access controls and procedures to monitor and audit compliance.

- Strengthen domain expertise with the help of relevant specialists and stakeholders in report generation to utilize the accurate data origin and inference data in the correct context.

- Offer consistent design by making templates and frameworks for visual data, written summaries, and elements to aid in quickly locating and interpreting vital insights.

- Trains stakeholders, empowering them to use automated reporting techniques and understand KPIs and data analysis, enhancing adoption, efficiency, and productivity.

- Maximizes insight generation and automation advantages by balancing artificial intelligence and machine learning across the report creation process.

- Maintains human contribution by setting review procedures and asking end-users, stakeholders, and domain experts for feedback. It offers avenues to improve or customize and ensures quality and relevance.