Table Of Contents

What Is An Auto Refinance Calculator?

An Auto Refinance Calculator is a tool designed to calculate the new monthly installment for an earlier borrowed loan, which was at a higher rate, is refinanced at a lower rate. The calculator lets individuals and entities check the modified and decreased monthly payments applicable after refinancing cat loans.

With the refinancing options being available for car loans, borrowers get a chance to reduce their monthly payments, including the interest payments. In short, the amount saved in the process could be utilized to serve other requirements.

How Does An Auto Refinance Calculator Work?

An auto refinance calculator can be used to calculate the savings that the borrowers make while they refinance their auto loan at a lower rate of interest either due to improved credibility or borrower’s request for such provision. In case, the credibility of the borrowers has improved , the dealer provides them option after charging a commission. On the contrary, if it’s a special request from the borrowers to reduce their monthly installments, the loan might not be necessary at a lower rate of interest, but the tenure of the loan gets increased.

In the process of refinancing an auto loan, borrowers can apply for a new loan with lower interest rate. However, not every borrower is eligible to refinance their auto loan. The lenders require them to fulfill certain criteria to grab this lower-interest rate loan options. For a borrower to qualify, a lender might assess their repayment history, credit score, vehicle life and usefulness, distance travelled, and current loan meets minimum refinance figure. The lenders, in some cases, might offer lower interest rate for a loan, but then the duration or maturity date extends to more number of years. Based on the options available to respective borrowers, the auto refinance calculators compute the amount borrowers save when they switch to refinancing alternative.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Elements

When the auto refinance calculator works, the calculation is performed depending on multiple components. These components are the details that the calculator asks for to carry out the computation. Listed below are some of the components that a standard auto refinance calculator requires to work on calculations efficiently. Let us have a quick look at the factors below:

- Current loan balance: This is the amount that borrowers still owe to lenders at the time of considering or opting for the refinancing option.

- Current monthly payment: A borrower needs to pay a monthly amount towards the loan that they take up from lenders. Hence, providing the details of the current monthly payment towards the existing loan.

- Current interest rate: The current interest rate for the current existing loan is yet another component. The calculator asks for this to help borrowers compare the difference between what they used to pay earlier and what they would be paying after refinancing a car. It is printed on the loan statement of the car.

- Refinance loan balance: This is the amount that borrowers plan to borrow to get rid of their current loan to ensure they save something in the principal or interest payment they have been making. This does not necessarily equals the amount taken earlier as many borrowers try to make a portion of payment in cash to make sure their refinance loan amount is lower and easier to handle.

- Refinance loan term: This is the duration for which borrowers take up the auto refinance loan. If the loan term is shorter, the total interest payment for the period is significantly less. However, in most cases, the lenders extend the loan term, thereby lowering the interest. The total interest paid to lenders is directly affected by the loan term.

- Refinance interest rate: The interest rate here is expected to be considerably lower than the existing loan that one has. However, it is determined on the basis of the credit records, repayment history, the current market scenario, etc.

Formula

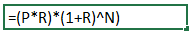

The formula on which the auto refinance calculator works is mentioned below:

First, we need to find out the outstanding principal balance just before the rate changes.

Wherein,

- P is the loan amount

- R is the rate of interest per annum

- N is the number of period or frequency wherein the loan amount is to be paid

Most of the auto loans are initially financed at a higher rate due to the nature of the product and due to the credibility of the borrower. The loans are generally financed for 1 year to 5 years. If the borrower pays his installments timely, say for 10 to 12 installments, then he might be eligible to refinance the loan at a lower rate of interest as his credibility might have improved.

Either the dealer offers to refinance the same by charging some commission or the borrower wishes to lower his periodical installment or, as discussed, credit score has improved.

How To Calculate?

One needs to follow the below steps in order to calculate the Mortgage Points

benefits.

- First of all, find out the existing installment, the existing rate of interest, and an outstanding period of the loan.

- Either the dealer or the bank would have offered to refinance the auto loan at a lower rate of interest. Calculate the outstanding principal balance just before the new installment will begin.

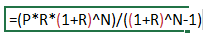

- Beginning with the 3rd step, one needs to enter the outstanding loan amount, which is the outstanding principal amount:

- Multiply the principal by the new lower rate of interest.

- Now, we need to compound the same by rate until the loan period.

- We now need to discount the above result obtained in step 5 by the following:

Example

Let us consider the following instance to understand how these calculators work:

Mr. Jain had purchased a luxury bike around 3 years ago for $45,000. The loan financed for 90%, and the rate of interest that was applicable initially was 9.00%, and he had taken the loan for 5 years. His monthly installment was $840.71, and he repaid his installments without making any default and on a timely basis. The dealer offered Mr. Jain that his loan can be refinanced at a lower rate of interest, which shall reduce his interest outgo and also his monthly installments amount. He was ready to do that and was told that the new rate of interest would be 7.5% for the remaining period.

On the basis of the given information, you are required to calculate the new installment amount for the rest of the loan period and what would be his savings be.

Solution:

We will see the summary as to what information we are given here.

| Sr No | Particulars | Amount |

|---|---|---|

| 1 | Loan Amount Approved | $40,500.00 |

| 2 | Number of Years | 5 |

| 3 | Rate of Interest per annum | 9.00% |

| 4 | Frequency of payment | 12.00 |

| 5 | Monthly Rate | 0.75% |

| 6 | Total number of payments | 60 |

| 7 | Monthly Existing Installment | $840.71 |

Now we will first calculate the outstanding principal balance or the loan amount per below:

Mr. Jain has repaid installments until the end of 3 years, and hence the outstanding balance shall be:

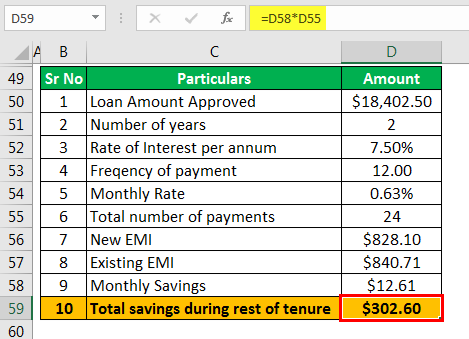

The new monthly rate of interest will be 7.50%/12, which is 0.63%, and the outstanding principal balance is 18,402.50 with a loan tenure of 2 years remaining, which is 24 months.

| Sr no | Particulars | Amount |

|---|---|---|

| 1 | Loan Amount Approved | $18,402.50 |

| 2 | Number of Years | 2 |

| 3 | Rate of Interest per annum | 7.50% |

| 4 | Frequency of payment | 12.00 |

| 5 | Monthly Rate | 0.63% |

| 6 | Total number of payments | 24 |

At end of 3 years

= /

= $828.10

Monthly Savings

- Savings monthly = Existing EMI – New EMI

- = $840.71 – $828.10

- = $12.61 per month

Total Savings During Rest of Tenure

- Total savings during rest of tenure = savings per month x remaining loan tenure in months

- = $12.61 x 24

- = $302.60

As the dealer stated, he is saving in interest, and his monthly installment amount has been reduced.

Benefits

Using this auto refinance calculator allows borrowers to have a clear idea on the amount they would be likely to pay and save at the same time by converting to refinancing auto loans. Let us check the benefits of using these calculators, which become the major reasons for lenders and borrowers to compute with the tool rather than relying on manual computations:

- It reveals how much one saves when they convert to a refinancing option once found eligible for the same.

- The new monthly payment valid for refinancing period is accurately calculated. Hence, decision-making and planning becomes easier for them.

- It helps borrowers check how the changed duration would impact the monthly payment and their budget overall.

- The calculator allows borrowers to calculate per the offers from different lenders. As a result, they can easily compare between the lending options and choose the one that best suits them.

- They allow users to enter the details and calculate automatically. The user do not need to take the hassle of finding out the values separately.

- The figures generated by the calculator might make one get a preapproved refinancing loan to check how well it works. In case they do, the individuals can further opt for advanced options.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.