Table Of Contents

What Is Asymmetric Information?

Asymmetric Information is concerned with studying various types of decisions regarding transactions where a party is well informed compared to another. Examples of such a problem could be a moral hazard, monopolies of knowledge, and adverse selection. Therefore, it usually extends to non-economical behavior.

Thus, in it one party is better informed than the other. In various professions like medical or teaching, this process, if used positively, may lead to quality improvement and innovation. If used negatively, it may lead to wastage resources and mis-selling. It causes failure in the market and price fluctuations.

Key Takeaways

- Asymmetric information analyzes different transaction decisions where one party is more well-informed than another. Such a problem involves a moral hazard, knowledge monopolies, and adverse selection. Thus, it generally expands to non-economical behavior.

- Adverse selection and moral hazards are the types of asymmetric information.

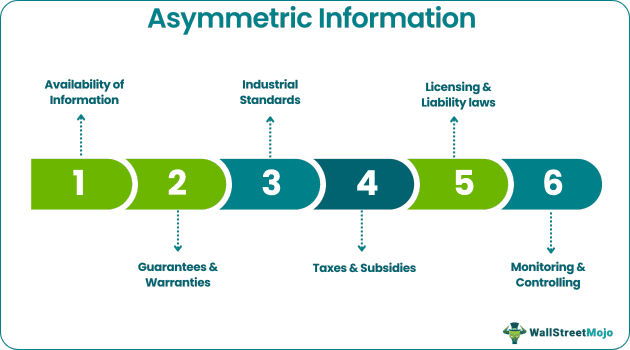

- Availability of information, guarantees & warranties, taxes & subsidies, industrial standards, monitoring & controlling, and licensing & liability laws are the solutions to the asymmetric information problem. Government interference may also be required as these circumstances can influence the economy.

Asymmetric Information Explained

Asymmetric information theory is a situation whereby unequal knowledge between the parties of a transaction results in a unique advantage with additional knowledge.

It occurs primarily before the transaction/pre-contractual problem. Adverse selection and Moral hazard can result from severe asymmetric information problems.

The problem of asymmetric information in financial markets is a long-standing phenomenon expected to prevail due to a difference in perception and a lack of smooth communication. There requires a two-way dialogue between interested parties and the availability of sufficient information to ensure correct decisions are taken. Government intervention can also be necessary as this situation can impact the economic scenario. Still, it can be restricted if some of the above mentioned solutions are successfully implemented.

Types

The types of asymmetric information theory can be classified as follows:

#1 - Adverse Selection

It refers to the process whereby undesired results occur when buyers and sellers access different or asymmetric information. It leads to an imbalance in the price and quantity of goods and services. E.g., if a bank sets a fixed price for all its checking account, the low balance and high activity customers

#2 - Moral Hazards

A situation in which a party will take risks because the cost incurred will not be felt by the party taking the risk. The hazard can occur when the actions of one party may change to the detriment of another after a financial transaction. Regarding asymmetric information in financial markets, moral hazards may occur if one party is insulated from risk and holds more asymmetric information about its actions and intentions than the party paying for adverse consequences of risk. E.g., moral hazards occur in employment relationships between employees and management in which there is a strong possibility of selfish decision-making taking place.

These imbalances can further cause market failures due to inefficient results.

Example

For example, used car owners possess more asymmetric information than they disclose while selling their cars. It can create an element of suspicion for the buyers and make it difficult for sellers who want to sell good-quality second-hand cars. Sellers of high-quality goods would gradually exit the market, leaving only an adverse selection of low-quality goods. Gradually, the market for second-hand cars will disappear.

Another instance can be while opting for health insurance. It causes asymmetric information problems in the contract. The insured party may not disclose information about past health ailments (if any), which causes a gap in the information between the insurer and the insured.

How To Reduce?

Below are the Solutions to the asymmetric information problem.

#1 - Availability of Information

This solution is of paramount importance, which involves creating greater consumer access to information. It is almost impossible to provide all the information, but sufficient information should be available for the user to make an educated decision. As a result, along with improved customer satisfaction, the overall quality of the product of the commodity can be improved. It paves the way for seamless communication and resolves many problems before they arise.

#2 - Guarantees & Warranties

These benefits offer a cushion to consumers against faulty products. It offers them the security that a particular product is of superior quality. It is useful in negotiating the prices as well. In case of any defects, the seller's option of return/replacement is available for a given period.

#3 - Taxes & Subsidies

Government intervention through policies is very common in case of market imperfection. E.g., the healthcare market is not fully competitive as someone may be more beneficial, and someone can be worse off. The doctor (principle) benefits the most due to their asymmetric information, thereby controlling the health care labor market. Through monopolistic practices, many doctors or health specialists become better off by taking additional payments from the patients. The government completes the market or balances the gainers and losers. Normally, this is executed by imposing higher taxes on the doctor and subsidies to health care receivers.

#4 - Industrial Standards

Industries may set a few pre-conditions to be met for providing the goods and services. It ensures offering high-quality products and services in the market. Information asymmetry can be more harmful in adverse selection in the market. For instance, a person with good health conditions is less likely to opt for life insurance than someone who does not have optimum health conditions. A person can behave immorally before the transaction in the markets with asymmetric information, due to the information asymmetry problem. The health insurance company is empowered to increase all their premiums to compensate for the unavailable information and offset the risk of uncertainty. It means the riskiest people price out the less risky customers. Since health care markets are also a part of markets with asymmetric information, it’s essential to provide complete and true information to patients and vice-versa.

#5 - Monitoring & Controlling

Sufficient control and monitoring are other big challenges for the government. The government should assume responsibilities for intervening in all sectors with information gap problems. Without proper monitoring and controlling, firms may be impacted by various problems executed by illegal beneficiaries. Government regulations have to be structured and updated to minimize gaps, and one party is not taking advantage of the other. It has to be combined with strict monitoring and controlling processes.

#6 - Licensing & Liability Laws

These are part of consumer protection regulations requiring certain licenses/permits to sell goods and services. This law must be carefully set and regularly monitored. If licenses are not procured or cause an unacceptable increase in prices, it may lead to hoarding or black marketing practices. Firms can be subject to severe penalties if minimum industry standards are not set.

Asymmetric Information Vs Adverse Selection

Asymmetric information is the situation where two or more parties do some transaction where one party has more knowledge about the process than the other whereas adverse selection is the process where information is hidden to gain some advantage.

In the former’s case, there is an unequal level of information; in the latter's case, information asymmetry is used to gain an advantage.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

In any transaction, asymmetric information prevails when a party has information that the other does not. This situation may lead to market failure. That is why the accurate price cannot be fixed per the law of supply and demand.

Information asymmetry in the lending market compares to other financial intermediaries. Banks are treated as insiders because they can gather proprietary information about firms through screening and monitoring, which discards the information asymmetry between the transaction parties.

Asymmetric information is a problem in financial markets like borrowing and lending. In these markets, the borrower possesses better information about the financial state than the lender. As a result, the lender requires help knowing whether the borrower will likely default.

Governments and regulatory bodies may implement various measures to mitigate the effects of asymmetric information. Examples include mandatory disclosure requirements, consumer protection laws, licensing and certification processes, and standardized reporting practices.