Association Of Certified Fraud Examiners (ACFE)

Table of Contents

What Is The Association Of Certified Fraud Examiners (ACFE)?

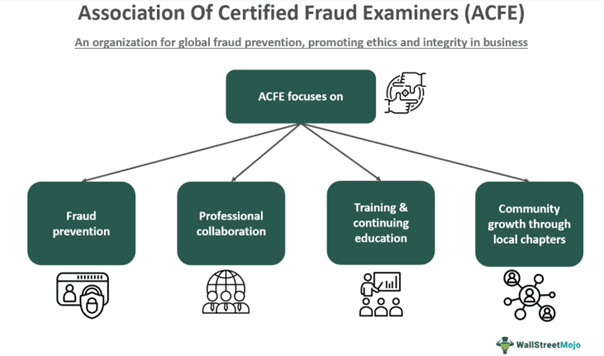

The Association of Certified Fraud Examiners (ACFE) is an organization founded in 1988 whose primary goal is to prevent fraud and unethical business practices through comprehensive anti-fraud training. It is headquartered in Austin, Texas, and serves as the accrediting authority for professionals who hold the Certified Fraud Examiner (CFE) designation.

As the global governing authority for Certified Fraud Examiners, ACFE plays an important role in providing its members with the training they require, including tools and resources. These resources have been created to help members detect and prevent fraud, which aligns with the organization's general objective.

Key Takeaways

- The Association of Certified Fraud Examiners (ACFE) is a professional organization established in 1988, focusing on the prevention of fraud and unethical business practices.

- It is an accreditation body for Certified Fraud Examiners (CFEs).

- ACFE, the largest organization of Certified Fraud Examiners in the world, aims to reduce fraud and white-collar crime.

- Local chapters include networking and training centers, supporting the goals of disseminating information, providing mentoring and leadership, and ensuring community outreach.

- According to the rules of the Certified Fraud Examiner (CFE), one must be an ACFE member, have at least 40 eligibility points, have two years of relevant experience, pass the CFE Exam, and follow ethical standards.

- Participation in local chapters and continuing education both support continued professional growth.

Association Of Certified Fraud Examiners Explained

Association of Certified Fraud Examiners (ACFE)'s chief objective is to reduce fraud and white-collar crime. Members receive assistance to make these objectives achievable. This mission is accomplished via a diversified method, such as training, awareness, certification, and resources, which facilitate fraud detection and deterrent efforts.

First, the ACFE administers the relevant Certified Fraud Examiner (CFE) exam, which is held in high regard in terms of credible certifications for professionals in the industry. Through this exam, individuals are awarded a valid certification that declares them qualified for fraud examination.

Apart from adherence to strict qualifications when hiring, the ACFE demands that candidates keep advancing professionally. To ensure that Certified Fraud Examiners (CFEs) stay abreast of new developments, technologies, and applications in fraud detection and prevention, mandatory continuing professional education is necessary.

ACFE requires Certified Fraud Examiners to abide by the highest levels of ethical consideration and follow a strict code of ethics and professional conduct. Maintaining objectivity, integrity, and professionalism are three important goals that the ACFE has set for its members.

Further, the ACFE is the global representative of Certified Fraud Examiners, and hence, it continues to build its presence through relationships with businesses, governments, and academic institutions globally. From this perspective, it is a valuable resource and advocate for the industry, promoting ethical business conduct worldwide.

History

The history of the Association of Certified Fraud Examiners (ACFE) was initiated through a chance discussion that took place on an office porch in 1985 in Austin, Texas. Dr. Joseph T. Wells, CFE, Certified Public Accountant (CPA), a former accountant who became an FBI agent, discussed accounting and fraud detection with Dr. Donald Cressey, the foremost criminologist of that decade. The ACFE was founded as a result of this exchange because they saw the necessity of combining these disciplines to combat financial crimes.

In the mid-1980s, the field of fraud detection and deterrence faced considerable issues as a divide emerged between investigators with insufficient accounting training and accountants with inadequate experience in the field. This hampered fraud detection. To increase their effectiveness, Dr. Cressey made suggestions to combine these disciplines.

A few years later, Dr. Wells brought this realization into reality, which led to the creation of a cohesive body of knowledge that is currently referred to as fraud examination. This multidisciplinary strategy effectively closed the knowledge gap between fraud investigation and accounting.

The ACFE still has its original headquarters in Austin, Texas, but it is now a global organization that serves over 90,000 members in more than 180 nations. Members include a broad spectrum of professionals, such as auditors, Certified Public Accountants (CPAs), attorneys, police officers, detectives, security experts, executives, and managers. All of these professionals have a shared interest in identifying, curbing, or discouraging fraud in their respective fields.

Activities

The Association of Certified Fraud Examiners (ACFE) operates with the help of its local chapters that consist of dedicated members in certain geographical areas like cities, states, or countries. ACFE's chapters are small local units that represent the entire organization and continue to benefit members worldwide.

A specific process is followed to establish a local chapter in the region where one is yet to be established. It involves seeking approval from ACFE after a founding committee defines the structure, drafts relevant rules and bylaws, and enlists members, among other things, to set up a local chapter.

Joining a local chapter offers several advantages to anti-fraud professionals, including networking and education that promotes professional growth and community development. Let us discuss how activities benefit professionals.

- Networking opportunities: Collaboration with fellow fraud examiners and professionals in the region offers opportunities, builds connections, and helps increase awareness.

- Quality, affordable local CPE training: Professionals can meet Continuing Professional Education (CPE) requirements without leaving their cities or towns. Members plan chapter meetings and events regularly, which enables timely professional development that is practical and relevant.

- Timely and practical information: Members stay abreast of local issues and recent trends in anti-fraud with chapter communications, monthly meetings, workshops, seminars, and Association of Certified Fraud Examiners conferences on various topics like money laundering, terrorist financing, occupational fraud, contract fraud, etc.

- Diversified groups: Chapters accommodate and represent diversified groups based on age, from entry-level to senior professionals in anti-fraud work. This enhances the learning experiences of people entering the profession, and more experienced members can benefit by mentoring the new generation.

- Promoting fraud awareness across communities: The activities involve improving anti-fraud prevention and detection measures. Many chapters offer free seminars to educate their members about issues like financial elder abuse or identity theft. They also volunteer for activities like food drives or Habitat for Humanity projects.

CFE Exam Guidelines

A master database administers the Certified Fraud Examiner (CFE) Exam. The exam has four parts:

- Financial Transactions and Fraud Schemes

- Law

- Investigation

- Fraud Prevention and Deterrence

Each section must be completed within two hours. While it takes eight hours to complete all four sections, test-takers have the flexibility to tackle each section separately as long as all parts are completed within a 60-day timeframe. The CFE Exam is available in several formats:

- In Person at a CFE Exam Review Course: Candidates can take the exam onsite at an in-person review course.

- In Person at a Prometric Testing Center: Candidates have access to a global network of computer-based assessment centers for test taking.

- Online with a Remote Proctor: Using Prometric's ProProctor online platform, candidates can take the exam from home.

To appear for this test, scheduling an exam appointment online using the Prometric website is important. Each exam must be scheduled independently on the website. The scheduled exam is then administered via the chosen mode (as listed above). ACFE recommends taking one module or section at a time, but each exam must be completed in one sitting.

Steps to become a Certified Fraud Examiner (CFE)

1. ACFE Membership: The individual must become an Associate Member of the ACFE.

2. Eligibility Requirements:

- Accumulate a minimum of 40 points to qualify for the CFE Exam and 50 points for certification.

- Secure at least two years of relevant professional experience in fraud detection or deterrence.

3. Completion of CFE Exam:

- Candidates must clear the CFE Exam.

- Each section must be completed within a two-hour time frame, and they can be taken separately within 60 days.

4. Adherence to ACFE Ethics: Candidates must agree to comply with the ACFE's bylaws and Code of Professional Ethics.

5. Certification Maintenance: Candidates must comply with annual Continuing Professional Education (CPE) requirements, completing 20 credits with a focus on fraud detection and deterrence, including two credits in ethics.

6. After achieving CFE status: Certified Fraud Examiners generally earn 34% more than their non-certified counterparts.

The Association of Certified Fraud Examiners website gives comprehensive information about this.