Table Of Contents

Associate Company Meaning

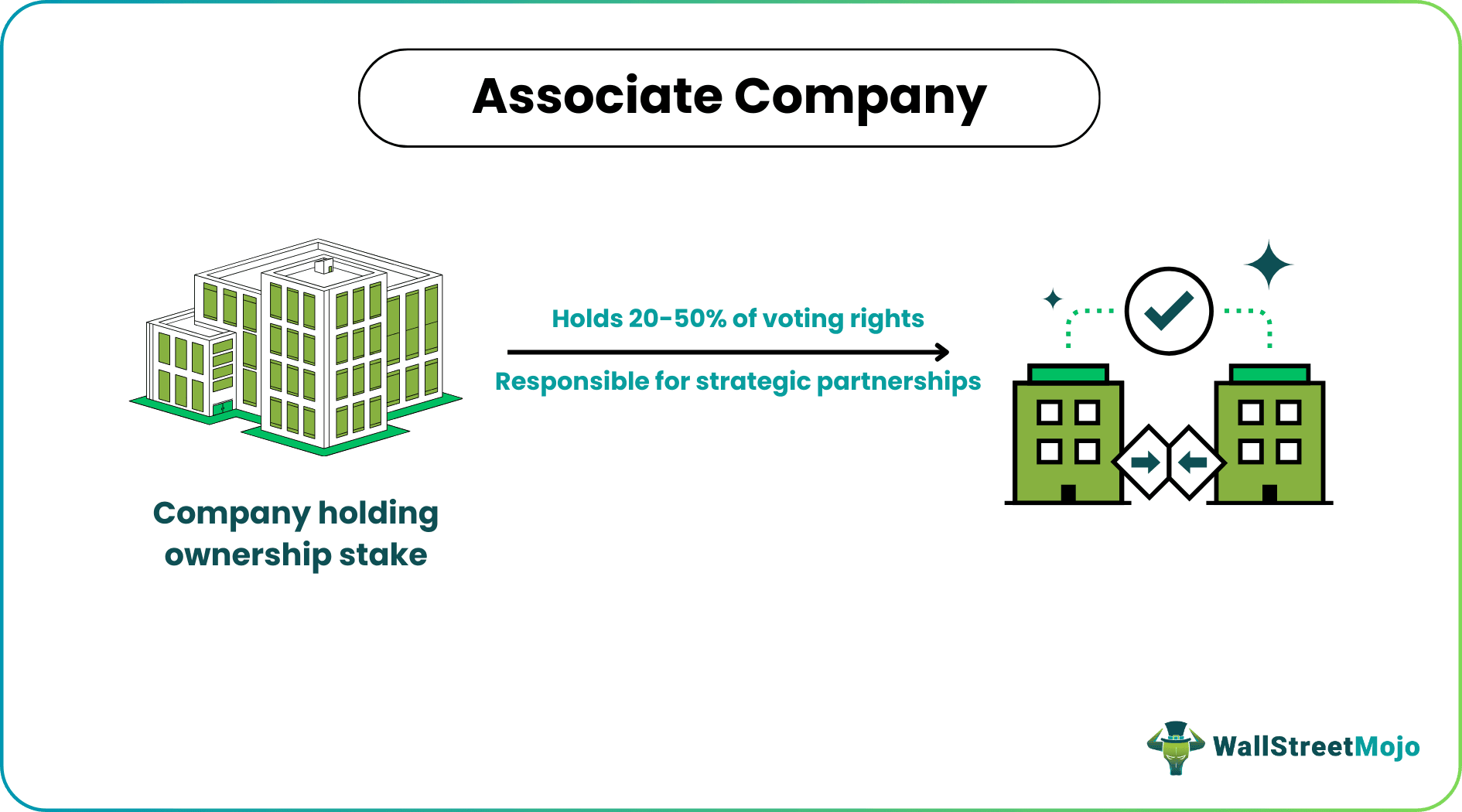

An Associate Company is a business in which another company holds a significant ownership stake, usually between 20% and 50% of the voting shares. The purpose is to establish a strategic partnership or collaboration that allows the investing company to benefit from the associate's expertise, resources, or market presence without fully acquiring or controlling it.

Associate companies provide a way to establish strategic alliances and partnerships without full ownership. This allows companies to leverage each other's strengths and resources to reap mutual benefits in business. It plays a crucial role in fostering business collaboration, enhancing competitiveness, and driving growth while maintaining a degree of independence and autonomy for each entity.

Key Takeaways

- An “associate company” refers to a business entity in which another company holds a significant degree of influence, control, or ownership but not necessarily full control.

- The criteria to classify a company as an associate company may vary depending on the legal jurisdiction and regulations.

- The concept of an associate company is relevant in various areas of business, including financial reporting and regulatory compliance.

- Associate companies offer strategic partnerships with shared influence, while companies falling under the subsidiary companies category hand over full control to the parent company.

- When a parent company takes over another company as its subsidiary, the subsidiary is fully integrated with the parent company.

Associate Company Explained

An associate company, also known as an “associate”, is a term used in accounting and business to describe a situation where one company (the investor) holds a significant ownership stake in another company (the associate) without taking over full control. This ownership stake typically ranges from 20% to 50% of the associate's voting shares, although specific thresholds or limits may vary based on accounting standards and regulations.

Key characteristics of an associate company:

- Ownership Stake: The investment company owns a substantial portion of the associate's shares, which gives it the right to participate in the associate's decision-making processes and receive a share of its profits.

- Significant Influence: The investor's ownership stake gives it the right to exert influence over the associate's strategic decisions and operations but not complete control.

- Equity Method of Accounting: Under the equity method, the investing company records its investment in the associate's financial statements as an asset and includes its share of the associate's profits and losses in its income statement. This is different from the consolidation method used for fully owned subsidiaries.

- Joint Ventures vs Associates: While both joint ventures and associates involve shared ownership, joint ventures often involve two or more companies forming a new entity to pursue a specific project or business, while associates typically involve one company investing in another existing company.

- Separate Legal Identities: The associate and the investing company remain legally separate entities, even though they collaborate closely. The associate maintains its management, operations, and financial independence.

Examples

Let us look at some examples to understand the concept better.

Example #1

Assume Company X, a leading beverage producer, recognizes the growing demand for eco-friendly packaging solutions. However, lacking the necessary expertise in sustainable materials, Company X decides to invest 25% in Company Y, a specialized packaging technology company. This investment grants Company X a significant say in Company Y's decisions and access to its processes and innovations. Company X benefits from innovative packaging for its products, and Company Y gains a strong partner. Both companies thrive while preserving their autonomy.

Example #2

A real-world example of an associate company is the business association between Toyota Motor Corporation and Subaru Corporation. Toyota acquired a 16.8% stake in Subaru in 2005, making Subaru an associate firm. This investment allowed Toyota to collaborate closely with Subaru on various projects, including the development of shared vehicle platforms and technology.

Subaru's expertise in all-wheel-drive technology and boxer engines complemented Toyota's focus on hybrid technology and global market presence. This partnership led to the co-development of vehicles like the Subaru BRZ and Toyota 86 sports cars, as well as the Subaru Crosstrek Hybrid. While Toyota's stake in Subaru is not a controlling interest, it has enabled both companies to leverage each other's strengths and expand their offerings while maintaining individual brand identities and independence. In 2021, Toyota increased its stake in Subaru from 16.8% to 20%, further strengthening the association. This collaboration showcases the benefits of partnering with an associate company in the automotive industry.

Advantages

Associate companies offer several advantages, such as:

- Collaboration and Expertise: Associates bring specialized skills, knowledge, and resources that typically complement the investing company’s existing strengths, leading to improved products or services.

- Market Access: Associates may provide access to new markets, customers, or distribution channels, helping the investor expand its reach.

- Risk Sharing: The investor shares risks with the associate, reducing exposure to potential losses or challenges in a particular market or industry.

- Cost Sharing: Joint projects and initiatives with associates can lead to cost savings through shared expenses and resources.

- Innovation: Associates can contribute fresh perspectives and ideas, fostering innovation and creativity within the investor's business.

- Diversification: Acquiring a stake in an associate company allows the investing company to diversify its portfolio without the complexities of full ownership.

- Resource Sharing: Associates can share technology, research, manufacturing facilities, and other resources, boosting operational efficiency.

Associate Company vs Subsidiary Company

The differences between the associate company and the subsidiary company are listed in the table below:

| Basis | Associate Company | Subsidiary Company |

|---|---|---|

| Ownership Stake | The investor typically holds a significant ownership stake ranging between 20% and 50% of the associate company's voting shares. | The investor owns more than 50% of the subsidiary company's voting shares, resulting in full control. |

| Control | The investor exerts significant influence over the associate's decisions and operations but does not have full control. | The investor has full control over the subsidiary's strategic decisions and operations. |

| Independence | The associate maintains its identity, management, operations, and financial structure, retaining its status as a separate legal entity. | The subsidiary is usually fully integrated into the investor's operations, and its identity may be subsumed under the investor's brand. |