Table Of Contents

What is Asset Financing?

Asset Financing refers to an ailment of the loan based on the financial strength of the organization by mortgage or hypothecation of balance sheet assets which includes land & building, Vehicles, Machinery, Trade Receivables as well as short term investments where assets amount is decided into regular payment intervals of the unpaid portion of the asset along with interest.

Some of the companies prefer to finance the assets using the asset financing option instead of the traditional financing because the financing in case of asset financing option is based on assets themselves and not on the perception of the banks and other financial institutions about the creditworthiness and the future business prospects of the company.

Key Takeaways

- Asset financing means a loan condition depending on the organization's economic stability through mortgage or balance sheet assets hypothecation, which involves land & building, vehicles, machinery, trade receivables, and short-term investments.

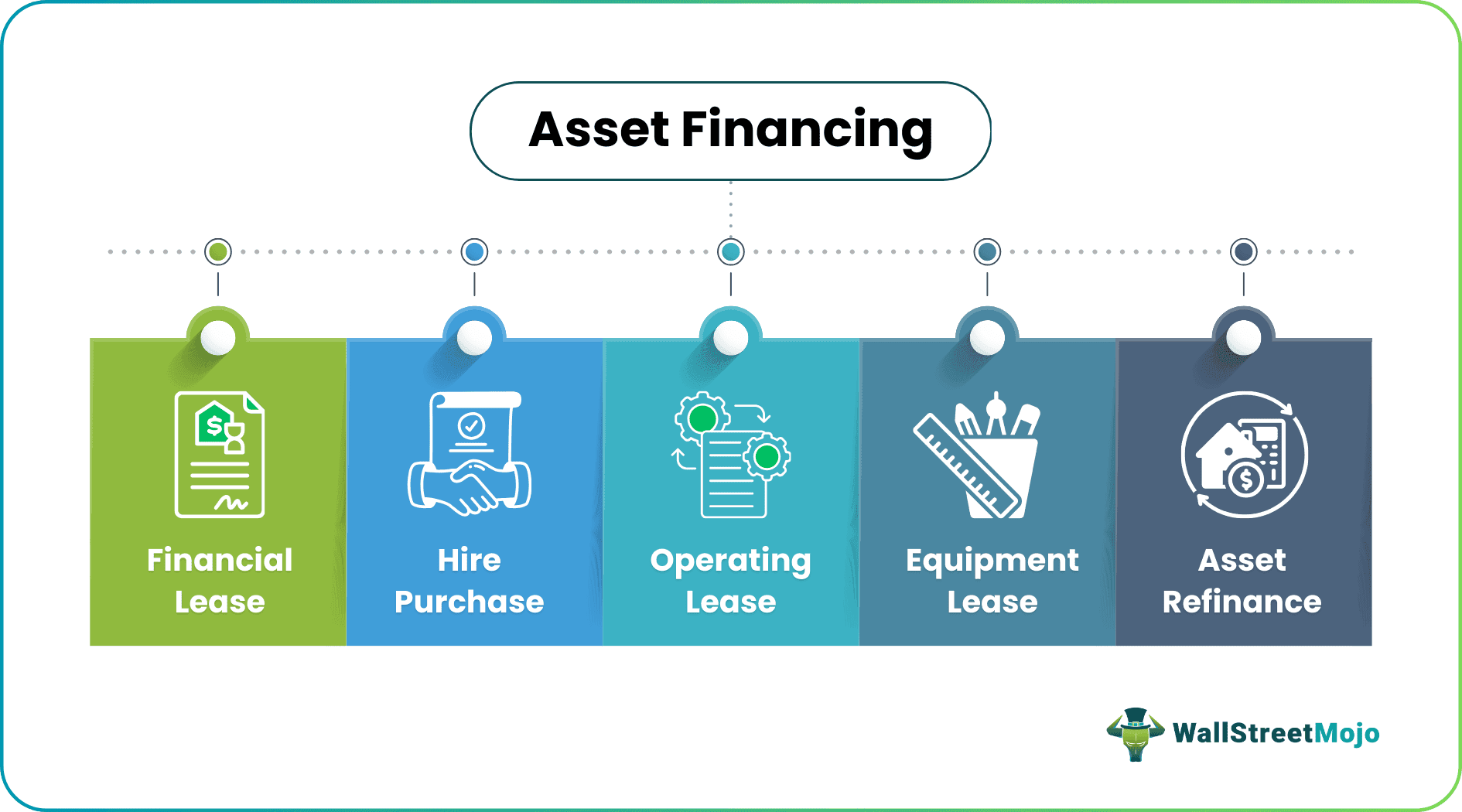

- Financial lease, higher purchase, operating lease, equipment lease, and asset refinance are the types of asset financing.

- Many companies often use it for short-term funding, such as paying employees and suppliers or financing growth.

Asset Financing Explained

Asset finance is often used by many companies as the solution for short-term funding, such as the payment to the employees, suppliers, or financing its growth. The loan using asset financing is easy to obtain and more flexible when compared with traditional bank loans. It is of special importance for startups and other growing businesses, as it provides them an easy way to increase their working capital. Still, before using it, the company should ensure that this financing option is right and best suits its business model.

Business asset financing helps the company get the loan by pledging its balance sheet assets.

Types

Let us understand the types of financing solutions provided by asset financing companies through the discussion below.

#1 - Financial Lease

In Financial Lease, all rights and the obligations of the owners are transferred to (the business) Lessee and for any duration. Lessee is wholly responsible for the maintenance of the asset during the agreement period. The asset's value is shown on the lessee's balance sheet as a liability or an asset during the agreement period. In contrast, the rent is treated as an expense and debited to the Profit and loss account.

#2 - Hire Purchase

In Hire Purchase, a finance company here called lessor purchases the asset on behalf of Lessee (the business). In this option, the asset is owned by the lessor till the last payment is made, and during the final payment, the lessee is given the option of purchasing the equipment at a nominal rate. The asset's value is shown on the lessee's balance sheet as a liability or an asset during the agreement period. In contrast, the rent is treated as an expense and debited to the Profit and loss account.

#3 - Operating Lease

Under this lease, the asset is taken for a short period, not for the entire working life. Here, the lessor will take back the asset at the end of the agreement, and maintenance responsibility in some cases lies with the lessor or otherwise, the lessee is responsible. The asset is not shown on a balance sheet for a nominated period, and the payment is charged in the profit and loss account.

#4 - Equipment Lease

Under equipment lease, there is a contractual agreement where the asset owner, i.e., the lessor, permits the lessee to use the asset for a contracted period for which regular rentals are to be paid. Here, the ownership of equipment remains with the lessor, and in case of infringement of any terms of the agreement, the lessor has the right to cancel the lease agreement.

#5 - Asset Refinance

Under asset refinancing, assets like vehicles, buildings, etc., are used to secure a loan. If the loans are not made, the lender takes the asset that was secured against the loan to cover up its given amount. The amount borrowed depends on the value of the asset. Sometimes, Asset-backed lending is used for debt consolidation.

Examples

Let us understand the intricate details of the concept of business asset financing with the help of a couple of examples.

Example #1

X ltd, running an agricultural business. Due to an increase in the use of the agricultural products produced by the company, the demand for the same increased in the market, which they could not meet in full. So, the management decided to increase its assets, including the new tractors and some other pieces of the farm machinery, to increase the production capacity.

As the business is a medium-sized business, they cannot afford the cost of purchasing new machinery with their existing amount of funds. After exploring several options for financing, they decided to go for the asset financing option. In that case, they are not required to provide the extra security because the asset financed can also act as the collateral required for the financing. Also, the rate of interest in the case of asset financing is significantly better than the rate of interest in the commercial loans available to them.

So, in this case, the business and the asset finance provider mutually decided and agreed that the asset finance provider would purchase the equipment the business requires. The company will take the assets from them on lease over the next 48 months, paying back $ 5000,000 of the purchase costs plus the interest rate at the rate of 8.5% per annum.

After deciding the terms and conditions, the asset finance provider purchased the assets and delivered the same to the business. Over the next 48 months the business made regular payments for the assets. After the end of the contract, the asset finance provider offered the company to purchase the assets under lease at the nominal value. Thus this is an example of asset finance.

Example #2

BluSmart, an Indian start-up that runs a fleet of 7,000 Electric Vehicles (EV) as cabs. In their series B round, they plan to raise $250 million out of which $50 million would be raised by investors and founders, while the remaining $200 million would be raised by new investors.

The Indian Renewable Energy Developmental Agency (IREDA) extended a Rs. 267 crore loan to purchase 3,000 EVs. Through this the company was able to raise asset financing and grow their fleet and increase business.

Advantages

Let us understand the advantages of asset financing companies extending loans to businesses against their assets through the discussion below.

- The loan using asset financing is easy to obtain compared to traditional bank loans.

- Most of the agreements in the case of asset financing have a fixed interest rate which is advantageous for the person borrowing the money.

- In the case of asset financing, the payment gets fixed, which makes it easy for the companies to prepare and manage their budgets and cash flows.

- If the person fails to repay the amount, it leads only to the loss of the assets and nothing more.

Disadvantages

Despite being a feasible source of cashflow, there are a few hurdles that prove to be disadvantages for companies. Let us discuss them in brief through the points below.

- In the case of asset financing, the companies even keep the important assets required for running the business for taking the loan, which puts them at the risk that they can lose important assets that they need for running their business.

- The value of assets against which the loan is secured can vary in the case of asset financing. There is a possibility that the asset kept as the security is valued at a lower amount.

- As the assets are kept as the security in asset financing, this method is not that effective for securing long-term funding by any business.