Table of Contents

What Is Asset Earning Power (AEP)?

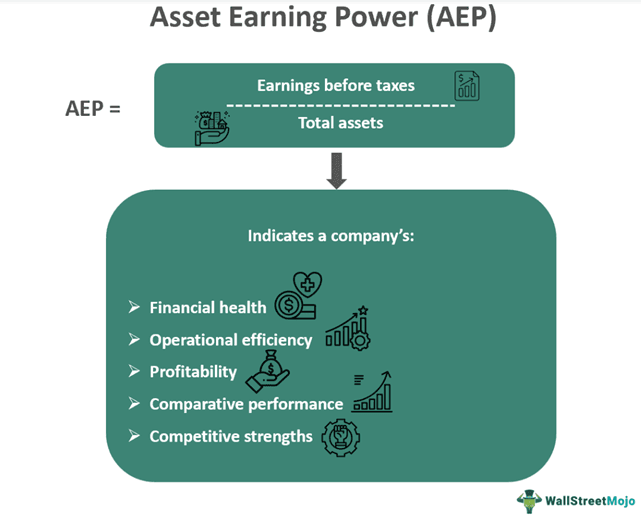

Asset Earning Power (AEP) is an accounting metric used to determine a company’s efficiency and effectiveness in using its assets and leveraging its operations to generate earnings. Earnings and taxes are two elements involved in its calculation. AEP is computed by dividing a company's earnings before taxes (EBT) by its total assets.

This gives a company’s profitability figure. A corporation's ability to generate cash flows from its assets is correlated with its AEP ratio. The higher the ratio, the more competitive the company is in its industry. A higher AEP ratio generally indicates that a company is efficiently leveraging its assets to earn profits, resulting in efficient cash flow generation.

Key Takeaways

- Asset Earning Power (AEP) is a profitability metric that measures a company's earnings capacity relative to its asset base.

- It helps investors evaluate the stability and profitability of ventures or enterprises, facilitating the comparison of investment options and offering insights into the capacity of assets to generate revenue.

- Earnings before tax (EBT) and total assets help compute AEP. EBT is a metric used to assess a business's profitability before accounting for its tax liability in a given period.

- Total assets are determined by adding the owner's equity to its accumulated liabilities.

Asset Earning Power Explained

Asset Earning Power (AEP) is a profitability ratio that expresses a company's earnings capacity in relation to its asset base. The earning power of its assets measures an organization's ability to generate revenue from its operations efficiently.

Certain businesses or sectors of the economy have distinct capital requirements. Exceptionally high asset-earning capacities can be achieved by businesses with high contribution margins that do not require heavy initial capital or fixed costs. This can be achieved through proper financial planning.

A business cannot thrive over the long term without profitability, which is the main objective of all business endeavors. Forecasting profitability for the future and assessing profitability in the past and present are essential. Profitability is a relative indicator of how profitable a company is once the raw absolute amounts of revenue, profit, and expenses are subtracted and expressed in percentage terms.

AEP aids managers and investors in evaluating the stability and profitability of ventures or enterprises. It facilitates the comparison of various investment options and offers insights into the capacity of assets to generate revenue. It also facilitates the assessment of the influence of variables such as operational modifications or market circumstances on the potential of assets to generate revenue.

AEP's importance stems from its capacity to evaluate financial performance and asset value. Hence, it supports well-informed decisions concerning capital investment, asset allocation, and portfolio management.

Asset Earning Power Elements

It helps compare companies with different tax situations since it takes earnings before taxes into account. In this section, let us study the elements it considers in detail.

#1 - Earnings Before Tax

Earnings before tax (EBT) shows a company’s earnings before taxes are deducted. It assesses a business's profitability before taxes are considered. EBT represents the earnings a business has been able to generate through its operations.

EBT = Total Revenue - Operating Expenses - Non-operating Expenses

It is a crucial metric that allows companies to evaluate operating performance, which is particularly important to attract investors. EBT also helps companies assess where they stand when compared with other companies in the same industry. Another significant aspect of EBT is its use in resource allocations and strategic financial planning.

#2 - Asset Values

A company's total assets are determined by adding its owner's equity to its accumulated liabilities, which is the total value of all its assets. Liabilities are the amount a firm owes, while equity is the company's value (derived from deducting liabilities from its assets).

Total Assets = Liabilities + Owner's Equity

Assets are bought with the expectation that their value will rise in the future. Businesses often buy assets like new machinery or real estate to improve operational efficiency and boost cash flows.

A company's total assets are used for analyzing cash flows, assessing expansion needs, and determining whether a company has enough funds to pay off debts. The total assets figure is also used in business planning.

By assessing the viability of investments based on projected cash flows, management can decide if investing in new projects is wise. If not, they might choose to wait until the company’s profitability increases and it produces more cash. It is essential for taxation, business valuation, and sale value estimation. This figure also guides investor decision-making and helps them assess a company more thoroughly.

Examples

In this section, we will study some examples to delve deeper into this concept.

Example #1

Suppose Daisy, an investor, is comparing two businesses, SteelWorks Corp. and MetalStrong Allied, to determine which one has a higher income-generating potential using the asset earning power formula. SteelWorks Corp. generates $500,000 in annual revenue with $200,000 in direct expenses, while MetalStrong Allied generates $400,000 with $150,000 in expenses. Daisy calculates the AEP for each business by subtracting expenses from revenue

She finds that SteelWorks Corp. has a higher income-generating potential, with $300,000 in earnings, indicating that it can generate more income from its assets compared to MetalStrong Allied. This decision to choose SteelWorks Corp. is based on the higher AEP, as it suggests higher long-term returns and more efficient utilization of assets.

Other factors like market conditions, growth prospects, and risk assessment also play a role in Daisy's decision. However, the higher AEP of SteelWorks Corp. indicates its profitability and income-generating capability, making it an attractive investment opportunity.

Example #2

A February 2024 news update shared Equinor's (an international energy company) financial performance and strategic outlook based on the outcomes of its 2023 fourth quarter. Projects forming part of the company's oil and gas portfolio seem to be the focus of growth initiatives, with onshore renewable power production not being far behind.

The numbers listed in the announcement clearly indicate how various metrics, including asset earning power, were evaluated to outline the company’s performance and communicate it to stakeholders. Here are some numbers to consider:

- Adjusted earnings = USD 8.68 billion

- Net income = USD 2.61 billion

- Production growth = 2.1%

- Expected total capital distribution in 2024 = USD 14 billion

These numbers indicate the following:

- A strong financial performance in 2023, which meant a strong AEP.

- The company optimized its oil & gas project portfolio.

- It focused on ensuring disciplined cost and capital management.

- The numbers indicate its focus on executing strategic plans in the near future.

Example #3

Suppose Stella, the finance manager at Starlight Ltd., was asked to calculate the company’s asset earning power for 2023. She had the following information:

- Total earnings before tax =$50000

- Total value of assets = $100000

To calculate the AEP of Starlight Ltd. for 2023, she used the formula of asset earning power.

AEP = Total Earnings Before Tax / Total Value of Assets

Given the following information:

- Total Earnings Before Tax = $50,000

- Total Value of Assets = $100,000

Hence, AEP = $50,000 / $100,000 = 0.5

The asset earning power of Starlight Ltd. for 2023 was 0.5. This indicates that the company generated earnings equivalent to 50% of the value of its assets in 2023. It suggests that Starlight Ltd. had a positive asset earning power in 2023. This means its assets generated income and contributed to the company's profitability in 2023.