Table Of Contents

Assessed Value Meaning

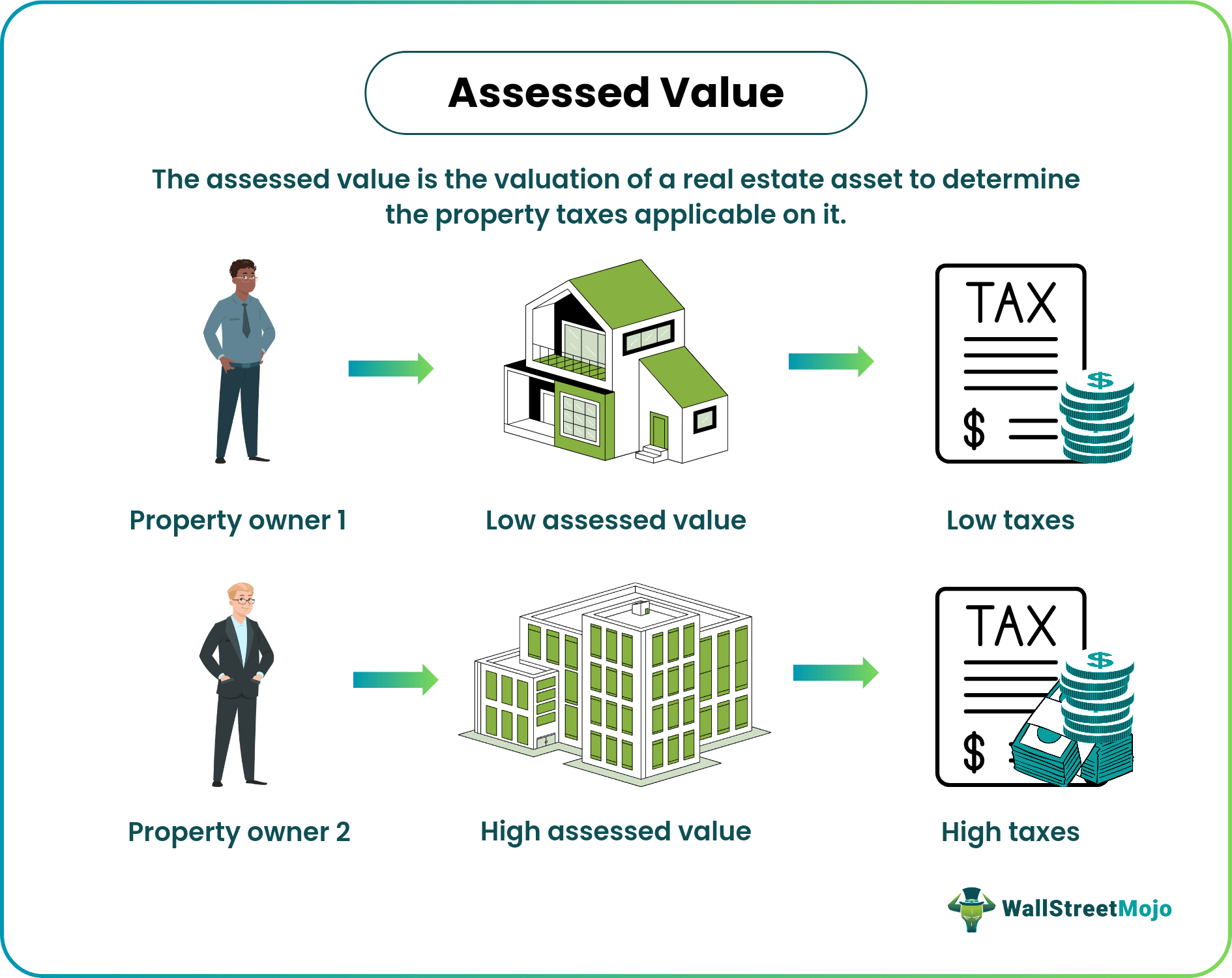

Assessed value is the price evaluation of a real estate asset based on which taxes are levied on it. Each property must contribute a justified share of tax to the local government for the growth and progress of its locality. Therefore, the government assigns an assessor to estimate a property’s worth to determine its taxable value.

The assessor considers the location of the property, its condition, comparative parameters, etc., to make an accurate assessment of its price. The estimated price is usually lower than the market value of the property. This is because the evaluation happens only annually, while market prices change many times during a year. Typically, the assessed value of a real estate asset is a percentage of its fair market value. Local tax rates are applied to it to ascertain the amount of property tax its owner needs to pay annually.

Table of contents

- What is Assessed Value?

- The assessed value is the valuation of a real estate asset to determine the property taxes applicable to it.

- It ensures that the tax rates imposed on a property are justified.

- A local government-appointed assessor exhaustively evaluates the real estate property.

- The valuation depends on the condition of the property, its location, the value of the properties in the locality, square footage, market conditions, etc.

- The assessment rates for valuation differ in different tax districts. Typically, it is a percentage of the fair market value of a property.

Assessed Value Explained

The assessed value of a real estate property is the annual estimation of the property's worth in dollars for the purpose of imposing taxes on it. The local municipality is responsible for collecting property taxes. Each property pays its share of tax every year based on its valuation. Taxes changes according to changes in the assessment value of the property.

The government appoints an assessor to ensure the tax rates imposed on a property are justified. The assessor, in turn, visits and evaluates the real estate thoroughly to figure out the most suitable value for the same. The valuation depends on the condition of the property, its location, sale history, neighboring property values, square footage, etc.

However, the assessed value is not the real or market value of the property that marks its selling price. Instead, it's a percentage of the fair market value of that real estate property. Each county or municipality has a different assessment rate (in percentage), which is below the market value.

The assessor applies the assessment rate to the market value of the property to derive its assessed value. After the assessor determines the value of the properties, the local government decides the tax rate depending on its yearly budget. This ensures that each property contributes to the budget equitably.

The assessor keeps on updating the value as per the evaluation of the properties from time to time, ensuring the taxes imposed are valid and justified in all respects. The local government uses the revenue generated from the property taxes to fund different services like education and medical services, infrastructure, etc.

Approaches to Assess Value

There are three approaches to real estate valuation:

- Sales comparison approach - It compares the selling price of residential properties with almost similar features to estimate the value of a property.

- Cost approach - It calculates the cost of constructing similar structure to determine a property's value. Assessors use this valuation approach for industrial or commercial properties with unique features.

- Income approach - It analyzes a property based on the income that it generates and then compares it to similar properties.

The calculation method is different in different tax districts, but the fundamentals remain the same. If owners are unsure or doubtful regarding the valuation of their property, they have the right to claim for the reassessment of the property.

How to Find Assessed Value of Property?

The formula for assessment is as follows:

Assessed Value = Market Value * (Assessment rate/100)

Let's consider the following assessed value example to understand the calculation part:

An assessor visits Peter's residential property worth $1,50,000. The assessment rate applied to the property is 80%. Here is the value of Peter's household for tax purposes.

Assessed value = 1,50,000 * (80/100)

= $1,20,000

After property value assessment, the government can easily calculate the tax payable on the property. Suppose the property tax rate is 1%. Then, Peter must pay the following amount as property tax on his home.

Property tax = $1,20,000* (1/100)

= $1,200

Importance

The local government assigns experts to evaluate properties for tax purposes. This comes as a huge relief for owners. The assessed value of the property assures the owners and the government that the taxes applicable on each property is on the basis of their respective features.

Besides being one of the best ways of evaluating the property taxes to be levied on the assets, there are other factors too that make it important:

- The assessed value of a property is a rough estimate of its real value. As a result, if owners think of reselling their real estate asset, they can consider it as the minimum amount to make a sale.

- As a buyer of a property, it acts as a reference to negotiate a deal at a lower price.

- It helps determine the insurance coverage that a property requires. The insurance is based on the assessed value instead of the market value of a property.

- It ensures that the taxes levied are justified and not much expensive.

Frequently Asked Questions (FAQs)

The assessed value is a real estate asset's price valuation used to calculate its property tax. The government appoints an assessor to ensure the tax rates imposed on a property are justified. The assessor closely evaluates the real estate asset to deduce the fairest price.

The assessed value of a property is ascertained primarily for tax purposes, while the market value is the price at which the property can be disposed of in the market, i.e., its selling price. Typically, the assessed value is a percentage of the property's fair market value and is less than it.

The assessed value is determined depending on the condition of the property, its location, the value of other properties in the locality, square footage, age, real estate market conditions, etc.

Recommended Articles

This has been a guide to what is Assessed Value. Here we discuss how to calculate the assessed value of a property for tax purposes, along with its formula & examples. You can learn more from the following articles –