Table Of Contents

Articles of Incorporation Meaning

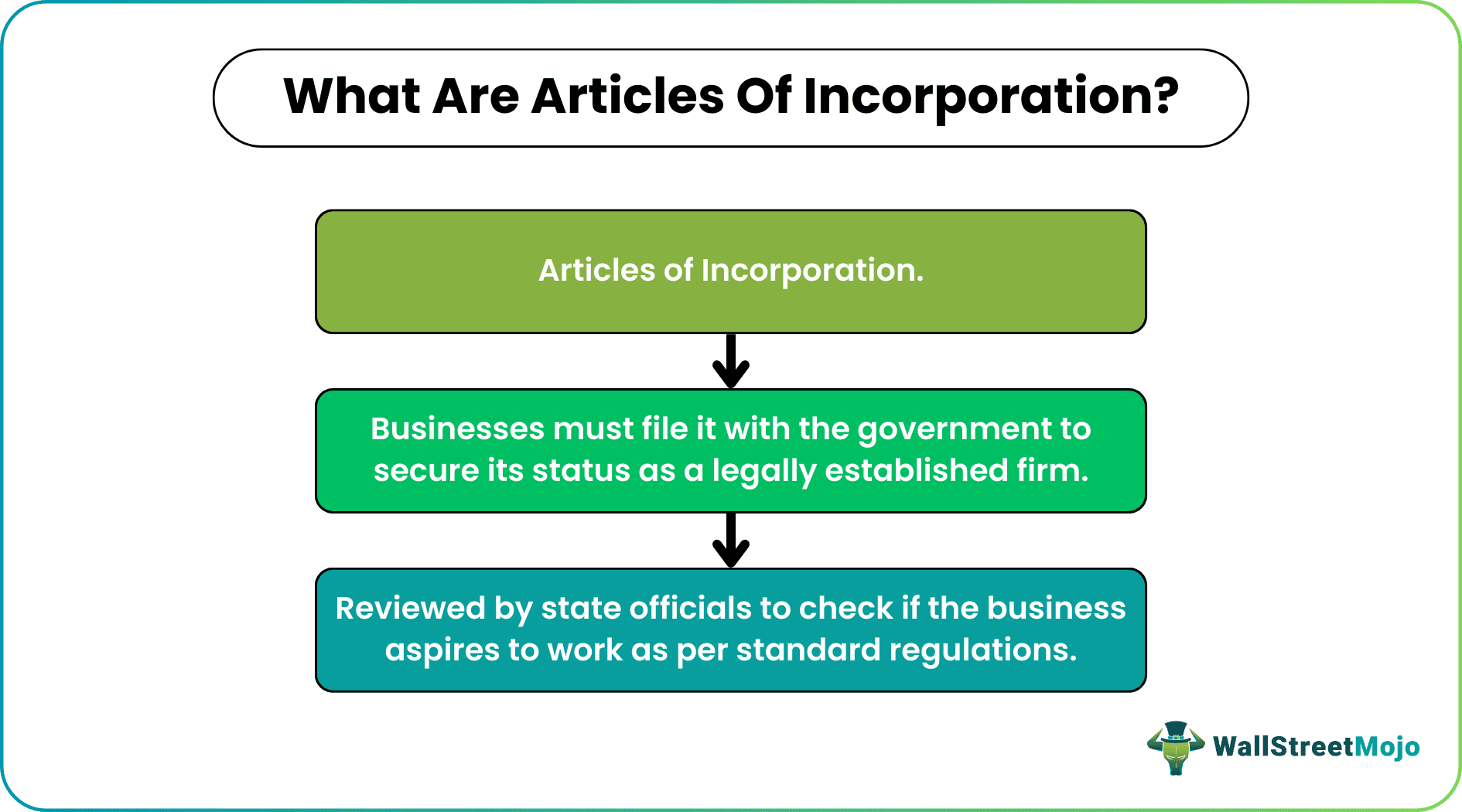

Articles of Incorporation refer to the legal documents that entities must submit to or file with the government to secure their status as a corporation, non-profit organization, or other business identity. The formalities vary from one state to another; hence, owners must be aware of the incorporation rules they should follow for their respective locations.

Also known as corporate charter or articles of association, these documents contain significant information about the businesses, including their name, type, nature, and address. As soon as a business applies for a license or receives it, it would require filing for the certificate of incorporation alongside. Platforms like ZenBusiness can help simplify the incorporation process and ensure compliance with state requirements.

Table of contents

- Articles of Incorporation Meaning

- Articles of Incorporation is a set of documents that secures business status for an entity that aspires to be one.

- A company files it for tax benefits, perpetual existence, liability protection, and enhancement of its corporate image.

- The incorporator must pay a mandatory filing fee to the registrar or the Secretary of the State.

- The company will legally be affirmed with a corporate status upon the approval of the Secretary of State.

Articles of Incorporation Explained

Articles of Incorporation make you a legally identified business entity. The requirement may vary from state to state, but the purpose is the same everywhere around the globe. These are sets of documents that elaborate the type, nature, and purpose of the business along with specifying its name, contact details, information on the stocks issued, etc.

The incorporator must apply along with the documents and pay the mandatory filing fee to the registrar or the Secretary of the State when applying for the company’s incorporation. The filing fee varies depending on the entity type and the country it is being incorporated in.

A corporate can either prepare Articles of Incorporation by itself or may contact a professional for the purpose. The documents must be accompanied with a set of all necessary credentials. However, this does not mean it must be extensive or highly complicated. A self-made filing is also acceptable but only if it has the required basic minimum information.

A company seeking to file its Articles of Incorporation will primarily need to choose a particular state in which it wishes to incorporate its business. For example, a company that performs its business operations in a single state can choose to incorporate in that state. On the other hand, if the company is willing to perform its activities in multiple states, they get considerable relaxation for the same.

The Secretary of the State takes care of the filings. Further, the documents are verified and reviewed by state authorities. Then, they check if the planned business operations are per the standard guidelines and regulations. Once the verification and validation process completes, the authorities notify the companies of their status.

Purpose

Filing the corporate charter with the government is a legal requirement, and owners must not forget to do it if they want to secure their status as a legally established business firm. They need to draft a complete portfolio defining the structure and nature of the business. Until the authorities accept it as a corporation, it cannot operate as an authorized entity.

The document helps your businesses to remain registered with the authorities for perpetual existence. This means even if the owners die or leave the business in the future, the business will keep running with new people taking charge. In addition, when an entity has a certificate of incorporation, it has the liberty to transfer ownership to another organization.

Registering the business allows tax cuts on operating costs. In short, when the corporate charter is filed, tax advantages are the major features, and hence, businesses file it to fulfill the purpose of receiving significant tax benefits.

Whether it is the Articles of Incorporation for a non-profit organization or a corporation, once a business has the certificate of association filed, it keeps owners protected from liabilities. As a business entity, the personal assets of the owners and executives get a separate identification, and hence, owners do not count them as resources to cover up business’s liabilities even in the worst scenarios.

Information Included

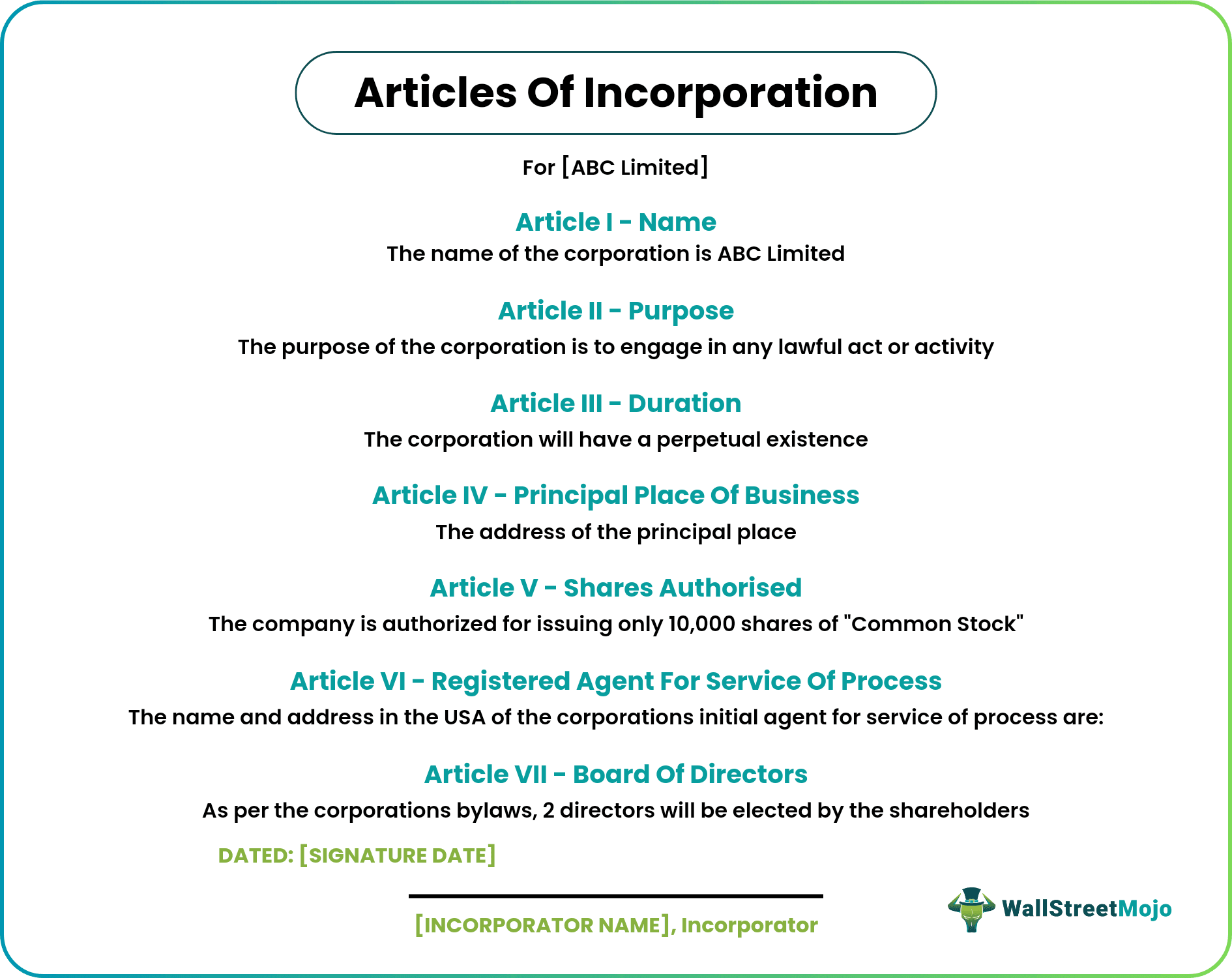

Looking at the Articles of Incorporation sample lets businesses come across the information that needs necessary mention. Here is a list of some of them:

- Name of the company

- Name of the registered agent

- Address of the registered agent

- Type of corporate structure (professional corporation, profit corporation, non-profit corporation, non-stock corporation, etc.)

- Corporate purpose

- Names of the first board of directors

- Addresses and other personal information of the first BOD

- If owners establish the corporation for a limited period, they must specify the duration of the same.

- Number of authorized equity shares

- Type of authorized equity shares

- Details of the incorporator such as name, address, and signature.

Example

Here is an Articles of Incorporation example that shows what the document looks like:

Articles of Incorporation vs Articles of Organization

Articles of Incorporation and Articles of Organization are terms that companies might use as substitutes. However, these words might be similar but not the same. While the former helps in the establishment of a corporation or non-profit organization, the latter enables the formation of a Limited Liability Company (LLC). Thus, it’s never an Articles of Incorporation for LLC rather an Articles of Organization for it.

Frequently Asked Questions (FAQs)

Articles of Incorporation are a set of documents filed with a government institution to legally document a company’s foundation. It is mandatory for the ones willing to incorporate a business. It is also known as a corporate charter or a certificate of incorporation.

The incorporator should start with collecting information, putting things in a sequence, filling out the form, reviewing the information, and signing it. One thing they need to emphasize is the state in which they plan to operate. Accordingly, they should file and make copies of the same for further distribution.

The amendment can only be done through a formal meeting where voting is conducted. If the shareholders approve the change, the amendment can be done as soon as the corporate Secretary or concerned authorities attest to the required documents.

Recommended Articles

This is a guide to what are Articles of Incorporation and their meaning. Here we explain their working, purpose and sample along with a suitable example. You can learn more about accounting from the following articles –