Table Of Contents

Arbitrage Pricing Theory Definition

The arbitrage pricing theory (APT)is an economic model for estimating an asset's price using the linear function between expected return and other macroeconomic factors associated with its risks. It offers a more effecient alternative to the traditional Capital Asset Pricing Model (CAPM)

APT is notably used to form a pricing model for the stocks. Compared to the CAPM, the arbitrage pricing model takes into account multiple factors of risk. The elements of risk can be hard to determine in some cases but will often give the investor a more accurate rate of return.

Key Takeaways

- The APT is an economic model for estimating the expected return of a particular asset, offering an efficient alternative to the capital asset pricing model (CAPM).

- The concept considers multiple factors of macro-economic risk such as inflation, gross domestic product (GDP), yield curve changes, and changes in interest rates. It estimates the price of an asset by holding a linear function between expected return and these factors.

- The APT offers more accurate, reliable, and complicated asset pricing results than CAPM.

Arbitrage Pricing Theory Explained

The arbitrage pricing theory model help exploit the short-term profit opportunities presented by the misaligned prices of securities. Individual investors and institutions alike can use the APT to determine the fair value of a particular financial asset, including:

- Stocks

- Bonds

- Derivatives

- Commodities

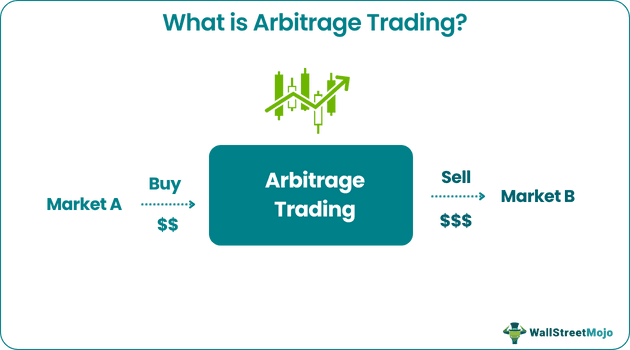

To understand APT, let us first take a look at the term arbitrage. In finance, arbitrage refers to the act of finding discrepancies in the value of an asset through two different markets and taking advantage of the price difference. For example, say an investor found out that Apple's stock is trading for $120 on the NASDAQ stock exchange and is trading on the Frankfurt stock exchange for $120.50. It offers investors an arbitrage opportunity of $0.50 profit for buying on the Frankfurt stock exchange and selling on the NASDAQ.

The APT was first developed in 1976 by former Wharton School of Business professor and economist Stephen Ross. He developed the concept as an alternative to the Capital Asset Pricing Model.

Ross built upon his predecessors' ideas and knowledge to build a model that considers multiple components of risk that can be used to explain the co-movements among stocks. According to the theory, risk components generate all the co-movements among the assets. Any slight differences can be attributed to the individual securities and not the system as a whole.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Elements of risk

For investors, the more critical risk factor will be the asset's sensitivity or exposure to risk components. The elements of risk can include:

- Changes in inflation

- Gross Domestic Product (GDP)

- Changes in interest rates

- Yield curve changes

- Market sentiments

- Exchange rates

The model was designed to calculate the fair value of an asset, and if the actual value is different, it can be considered either overvalued or undervalued. For example, suppose the arbitrage pricing model estimates the value of Apple's stock to be $200. But the actual price is $210, and therefore, the stock would be considered overvalued. According to the APT theory, it should correct itself, presenting an arbitrage opportunity.

Arbitrage Pricing Theory Formula

The formula for APT is as follows.

E(x) = Rf + β1 *(factor 1) + β2 *(factor 2) + …+ βn *(factor n)

where,

- E(x) = the expected return of an asset

- Rf = the expected return assuming zero systematic risk, or market risk

- β = the sensitivity the asset has to the risk factor (beta)

- n factor = risk premium

Example

Let us take a look at an arbitrage pricing theory example. For this example, let's consider our asset as a commodity stock called GOLD 123. The stock has two risk factors associated with it – inflation and the price of the U.S Dollar currency.

Rf (risk free rate) = 2%

Inflation – Risk premium = 2%, Beta = 0.2

U.S Dollar – Risk Premium =10%, Beta = 0.5

E(x) = Rf + β1 *(factor 1) + β2 *(factor 2) + …+ βn *(factor n)

E(x) = 0.02 + 0.2 * (0.02) + 0.5 * (0.10)

= 0.02 + 0.004 + 0.05

= 0.074, or 7.4%

In this arbitrage pricing theory example, the expected return of GOLD 123 is equivalent to 7.4%.

Assumptions of APT

The arbitrage pricing theory model is based on the following three assumptions.

- First, participants in a capital market execute trades to maximize profit.

- Second, the capital market is perfectly competitive and frictionless (free access to the markets, freely available information, and abundant traders.)

- Third, there are no arbitrage cases, and if one presents itself, investors will take advantage of it.

Arbitrage Pricing Theory vs. Capital Asset Pricing Model (CAPM)

Both APT and CAPM models produce the theoretical rate of return of an asset. Since market risk premium is the only factor considered in the case of CAPM, it is easier to calculate and takes up less time to produce results.

The formula for CAPM is: E(x) = Rf + βn *(E(r)- Rf)

Where:

- E(x)- expected return of an asset

- Rf- the risk-free rate of return

- β – beta coefficient related to the benchmark index

- E(r) – expected return of benchmark index

The two theories are very different in their approaches and assumptions regarding capital markets. Here is how they differ from one another.

- Factors Considered – The APT considers multiple macroeconomic risk factors. In contrast, the CAPM uses only one factor, i.e., expected market return (based on federal funds rate or the ten-year bond yield.)

- Accuracy – Since the APT is based on multiple factors, it is typically considered a more accurate model. However, the APT doesn't specify which factors are used, and hence one will have to establish which element should be used for a particular asset. This can determine how accurate the model is.

- Asset Relationship – Both the APT and CAPM models assume assets have a linear relationship or that assets move in relation to one another.

- Assumptions – Both the models assume that assets have unlimited demand and that investors have the same access to information, which may not always be true.

- Market portfolio- CAPM requires an efficient market portfolio and assumes that the returns are normally distributed. But APT makes no such assumption and does not require an efficient portfolio.

Which is better - APT vs CAPM?

The APT model provides better efficiency and more reliability. It gives an accurate estimation of long-term asset pricing. But in many cases, one can observe similar results with CAPM, which uses a much simpler means of risk assessment. APT is recommended for single assets while CAPM can be used on an asset portfolio to avoid complicated calculations. In most instances, one can ultimately go with either model determined by the risk factors they choose to involve with an asset.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The arbitrage pricing theory model holds the expected return of a financial asset as a linear relationship with various macroeconomic indices to estimate the asset price. A beta coefficient represents the change in sensitivity of the price to each factor. One can then leverage the arbitrage to make short-term profits that are free of risks.

The APT was first modeled by Stephen Ross in 1976 as an alternative to the capital asset pricing model(CAPM).

APT provides a better risk assessment model than its counterpart, the Capital asset pricing model. The APT uses lesser assumptions than CAPM and makes use of multiple factors instead of taking into account a single risk factor like CAPM. Therefore, the APT provides a more accurate model for long-term asset pricing than CAPM. While APT is more suited for single assets, CAPM can be useful for a portfolio of assets. It is best to choose a risk assessment model depending on the risks one chooses to involve with an asset.