Table Of Contents

Appraisal Rights Meaning

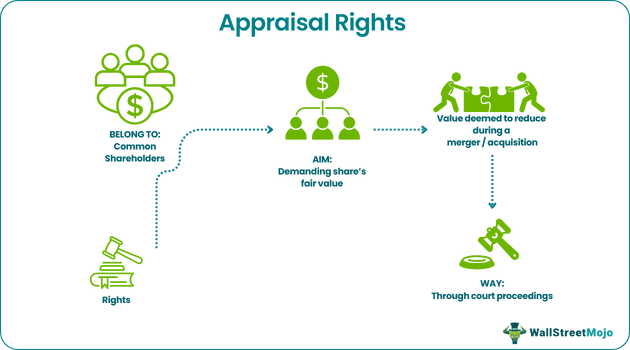

Appraisal rights, or dissent rights, are the statutory rights of a company's shareholders to hold court proceedings to determine the fair value of shares. These rights primarily aim to protect minority shareholders during major corporate decisions.

These rights act as a major advantage to the shareholders. It helps them to vote against any inappropriate decision, like a merger or acquisition. In addition, they can use it to find the company's true value using various models. Also, it protects the firm from being sold at a below-worth price. However, it can create hurdles while taking major decisions.

Key Takeaways

- Appraisal rights allow the corporation's shareholders to approach the court to get the fair value of their shares.

- The main intention is to safeguard the interest of the dissenting shareholders. Therefore, the shareholders can use their rights during the company's meeting to access it.

- The concept of dissent rights dates back to 1892. New York was the first state to approve the dissent rights statute.

- If the board agrees, the company will pay the fair value of its shares. On disagreement, the court can value the company using valuation models within 60 days of filing.

Appraisal Rights Explained

Appraisal rights allow the respective shareholders to vote against a wrong decision that could bring down the share price. For example, if the shareholders feel the share price falls after a merger or acquisition, they can use dissent and appraisal rights. It gives an incentive to the minority shareholders to raise their voices. However, it can bring disruption in the decision-making policy.

According to the common law, dissenting shareholders can paralyze any decision. As a result, the resulting decision falls under the veto power's majority. Therefore, the directors and the board must state the shareholder's dissent and appraisal rights in the corporate meeting. However, in their absence, they should write this right to the investors. If any shareholder uses their right, they can claim their payment of shares. Likewise, the company must provide in writing where to deposit the share certificates and get their payment.

They lose their dissent and appraisal rights if they don't receive the payment demand. On acceptance, along with the payment, the company will send the balance sheet to them. Also, the calculation on how the company estimated the fair value. However, if the shareholders are not satisfied with the fair value, they can write their estimates. The company can then access the shareholder's estimation and agree to them. But, if they do not respond or disagree, the shareholder can approach the court proceedings. Thus, the judiciary will determine the fair value of shares not less than 60 days. Or else the company must pay whatever estimated value to the shareholders.

History

Let us look at the history of appraisal rights statutes to get an overview of the concept. The concept of appraisal rights of dissenting shareholders dates back to the 19th century in the United States. Although the concept dates back to the 19th century, the real implication occurred in the 1890s. During the Industrial revolution and major events, the companies saw a boom in their stake holdings. As a result, it became difficult to manage the complex economy.

In 1892, the Supreme court of Illinois ruled a law that corporations must make decisions in the power of shareholders. Thus, the Wheeler V. Pullman Iron & Steel Co case paved the way for majority voting or veto power. However, there were differences between controlling and noncontrolling shareholders.

The majority did not convince the minority to control shareholders. As a result, the dissenting shareholders could only exit the company if their shares were publicly traded. Therefore, it gave rise to the appraisal rights statutes to protect the minority shareholder's interest. In 1890, New York got the first appraisal rights law. Later, states like Mexico, Virginia, and Florida also adopted it. By the 20th century, other states like Washington and California had also implemented the same in their corporations. Likewise, Japan adopted these rights in 1950.

Example

Let us look at the appraisal rights example to comprehend the concept better.

The most important court proceedings against the corporation were Delaware appraisal rights. In March 1941, the shareholders of the Delaware corporations signed for dissent rights against their merger. According to the merger plan, the company made unfair decisions between preferred and equity shareholders. Also, the former felt the latter had no equity in the corporation.

Thus, per the court proceedings, the preferred investors opted for dissent rights demanding share value. They demanded a price of $90 per share by delivering the stock certificates. Therefore, the Delaware appraisal rights case allowed them to assess the merger plan before approval.

Later, in July 2022, the Delaware court announced that every corporation has to include a dividend as a part of the merger. However, the Supreme court proceeding stated that the shareholders would receive the amount remaining after the pre-closing dividend.

Appraisal Rights And Business Valuation Methods

The fair price can be calculated using various valuation techniques, such as asset-based approaches, comparable market indicators, income or cash flow methods, hybrid methods, and formula methods. Hence, various methods exist for valuing a company and determining a reasonable stock price to satisfy shareholders. For example, a company's net asset value (NAV), the fair market value of all of its assets minus all of its liabilities, can be determined in one approach called an asset-based valuation.

In essence, this strategy calculates the price to reproduce the firm physically. However, some leeway is present in choosing the company's assets and liabilities to include in the valuation. The question of calculating their respective values exists too. For instance, using different inventory cost techniques such as LIFO or FIFO may value the company's inventory differently, changing how much the company's assets are worth overall.

In a case involving appraisal rights, independent appraisers may use the discounted cash flow (DCF) approach to determine a fair stock price. The DCF technique is viewed as an intrinsic method unrelated to competitors, as opposed to the comparables method, which is a relative valuation method. The DCF method's fundamental tenet is the projection of future cash flows. These are then modified to obtain the company's current market worth.

Waiver Of Appraisal Rights

Although shareholders have a prime right to dissent their rights, there are ways to waive them. The Delaware Court of Justice plays a significant role in waiving these rights. In 2008, a security protection firm, Authentix Acquisition Company, Inc, appealed to remove such rights. According to the agreement, the common shareholders can refrain from exercising these rights.

Later in 2017, when another company acquired Authentix, the shareholders appealed for a dividend. However, according to the prior agreement, they had refrained from doing so. Thus, the petitioners refused to accept and filed a case with the Court of Chancery. In conclusion, the judiciary stated that the common shareholders had used the word "refrain," which meant "waive."

Frequently Asked Questions (FAQs)

Dissent rights get triggered when the company forces the shareholders to give up their shares without consent. It mostly happens during a merger, acquisition, or significant business decision.

No, preferred shareholders cannot access such rights under the judiciary. Besides, they do not get the right to vote. However, in contrast, equity or common shareholders get to vote in a merger or acquisition.

Appraisal or dissent rights will not be available for shareholders of any class or series falling under section 18(b)(1)(A) or (B) of the Securities Act of 1933. This section includes New York Stock Exchange (NYSE), NYSE American, and Nasdaq.

The dissent rights are not available to investors of corporations having at least 2000 shareholders. Besides, if the board, senior executives, and directors hold more than 10% of the company's shares.