Table Of Contents

What Is Annuity Formula?

The term “annuity” refers to the series of periodic payments to be received either at the beginning of each period or at the end of the period in the future. The formula for annuity payment and annuity due is calculated based on PV of an annuity due, effective interest rate and a number of periods.

The annuity payment is one of the applications of the time value of money, which is further indicated by the difference between annuity payments based on ordinary annuity and annuity due. The lower annuity payment for an annuity is that the money is received at the start of each period. It is believed that the funds will be invested in the market, and interest will be earned during that period.

Key Takeaways

- The annuity formula calculates an annuity's periodic payment amount or present/future value, a series of regular cash flows received or paid at equal intervals over a specific period.

- The annuity formula considers factors such as the interest rate, the number of periods, and the initial investment or payment amount to determine the desired output

- The annuity formula is a mathematical equation that simplifies the calculation process and helps individuals and businesses determine the appropriate payment amounts or evaluate the value of an annuity.

- There are different variations of the annuity formula depending on whether the payments are made at the beginning or end of each period and whether the interest is compounded annually, semi-annually, quarterly, or continuously.

Annuity Formula Explained

The ordinary annuity formula is useful in calculating the amount of payment that is to be made periodically or calculating the present value of a series of equal cash flows that will occur at regular intervals of time.

The formula will depend on what is to be calculated, the present value or the future value. The future value will determine the amount of a series of cash flows that will happen at a future date, and the present value calculates the current amount of the future cash flows.

Whatever calculation is made, it is important to be sure of the fact that the rate of interest and the number of periods are expressed in the same units. In other words, if the calculation is made annually, then the interest rate and the number of periods should be also taken on an annual basis.

This particular ordinary annuity formula is used in various types of financial calculations. This includes finding out how much amount should be kept aside for retirement income, loan payments, or any other situations in which investment is made with a fixed cash outflow.

Formula

Let us find out how the formula is used for calculation in different financial scenarios.

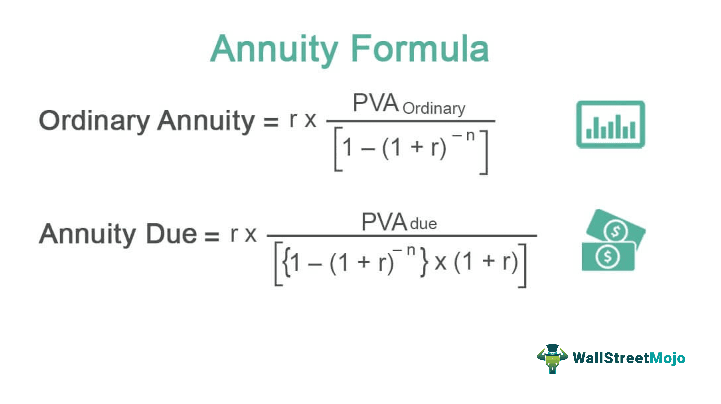

The formula based on an ordinary annuity is calculated based on PV of an ordinary annuity, effective interest rate, and several periods.

where,

- PVA Ordinary = Present value of an ordinary annuity

- r = Effective interest rate

- n = Number of periods

Mathematically, the equation for annuity due is represented as,

where,

- PVA Due = Present value of an annuity due

- r = Effective interest rate

- n = number of periods

From the above details, we get an idea about the formula and at the meaning of each element in the formula.

How To Calculate?

Now let us go through the steps used in simple annuity formula.

The calculation of annuity payment can be derived by using the PV of ordinary annuity in the following steps:

Firstly, determine the PV of the annuity and confirm that the payment will be made at the end of each period. It is denoted by PVA Ordinary.

Next, determine the interest rate based on the current market return. Then, the effective rate of interest is computed by dividing the annualized interest rate by the number of periodic payments in a year, and it is denoted by r. r = Annualized interest rate / Number regular payments in a year

Next, determine the number of periods by multiplying the number of periodic payments in a year and the number of years, and it is denoted by n. n = number of regular payments in a year * Number of years

Finally, the annuity payment based on PV of an ordinary annuity is calculated based on PV of an ordinary annuity (step 1), effective interest rate (step 2), and some periods (step 3), as shown above.

The calculation of annuity payment can also be derived by using the PV of an annuity due in the following steps:

Step 1: Firstly, determine the PV of the annuity and confirm that the payment will be made at the beginning of each period. It is denoted by PVA Due.

Step 2: Next, determine the interest rate based on the current market return. Then, the effective rate of interest is computed by dividing the annualized interest rate by the number of periodic payments in a year, and it is denoted by r. r = Annualized interest rate / Number regular payments in a year

Step 3: Next, determine the number of periods by multiplying the number of periodic payments in a year and the number of years, and it is denoted by n. n = number of regular payments in a year * Number of years

Step 4: Finally, the annuity payment based on PV of an annuity due is calculated based on PV of an annuity due (step 1), effective interest rate (step 2), and several periods (step 3), as shown above.

Examples

Example #1

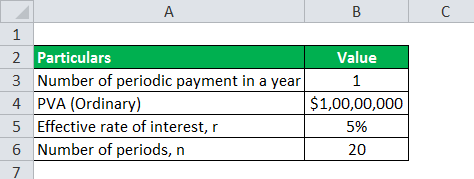

Let us take the example of David, who won a lottery worth $10,000,000. He has opted for an annuity payment at the end of each year for the next 20 years as a payout option. Determine the amount that David will be paid as annuity payment if the constant rate of interest in the market is 5%.

Given below is the data used in the simple annuity formula.

PVA Ordinary = $10,000,000 (since the annuity to be paid at the end of each year)

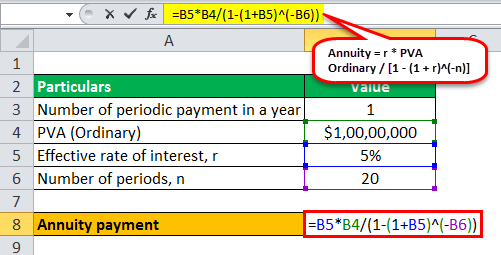

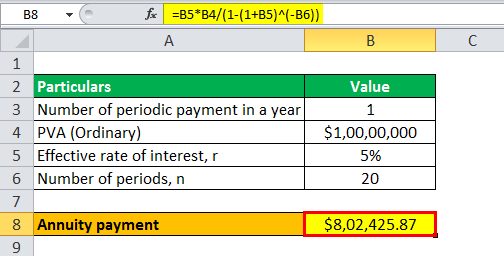

Therefore, the calculation of annuity payment can be done as follows -

- Annuity = 5% * $10,000,000 /

Calculation of Annuity Payment will be -

- Annuity = $802,425.87 ~ $802,426

Therefore, David will pay annuity payments of $802,426 for the next 20 years in case of ordinary annuity.

Example #2

Let us take the above example of David and determine the annuity payment if paid at the beginning of each year with all other conditions the same.

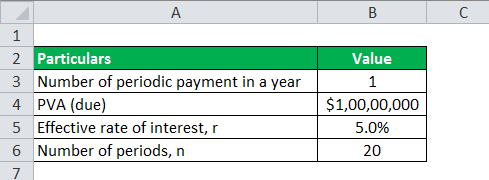

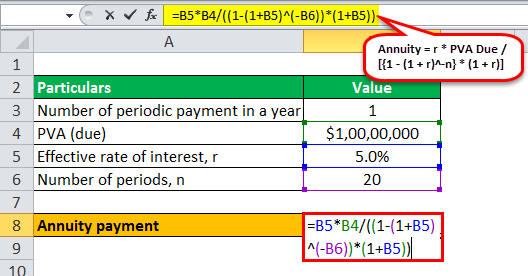

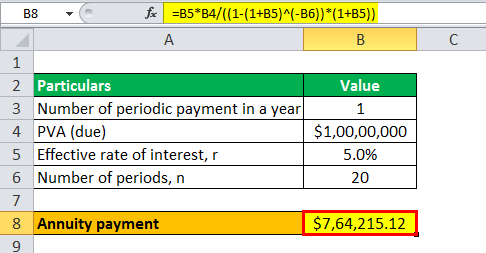

We will use the same data using annuity formula in excel as the above example for the calculation of Annuity payments.

Therefore, the calculation of annuity payment can be done as follows -

- Annuity = r * PVA Due /

- Annuity = 5% * $10,000,000 /

Calculation of annuity formula in excel will be -

- Annuity = $764,215.12 ~ $764,215

Therefore, David will pay annuity payments of $764,215 for the next 20 years in case of an annuity due.

Advantages

The formula has some advantages as given below:

- The annuity formula calculation a useful method that calculates the payment amount in situations where the cash flow is fixed and regular. If captures the annuity pattern very well such as payment for loans, lease, of retirement fund accumulation. This gives an idea about the periodic financial obligation that an individual of entity needs to follow and keep track.

- It can be used in various scenarios and different time periods like annual, monthly or quarterly. It is flexible and can chage as per the time period adopted. It can even be used in financial calculators.

- It accounts for the time value of money, recognizing the fact that the value of money changes with time due to the effect of inflation. It discounts the future cash flows to get the present value.

- It is very useful in making financial investment decisions where a certain portion of income or revenue is set aside for some future obligation or accumulate a particular amount to meet some future goal. It is useful for companies who can calculate the viability of a project based on the current value of the future cash flows.

Disadvantages

Apart from the advantages, there are also some disadvantages to the method, as follows:

- The annuity formula calculation only depend on the cash flows but does not consider other financial factors like taxes, external economic conditions, etc that influence the financial decisions.

- It is not suitable for complex financial scenarios where the cash flows are not regular or equal. There may be multiple interest payments or payment interval may vary. In such situations sophisticated and advanced model and calculation are required.

- It takes an interest rate that will be constant. There is no inflation adjustment in the rate. This affects the value of the future cash flows by reducing the purchasing power.

- It assumes a fixed cash flow through out the period. However, in the reak world, the cash flow amount may change and in such cases, this formula is not suitable.

Therefore, it is necessary to consider both pros and cons before using the formula for and financial context.