Table Of Contents

Annual Recurring Revenue (ARR) Definition

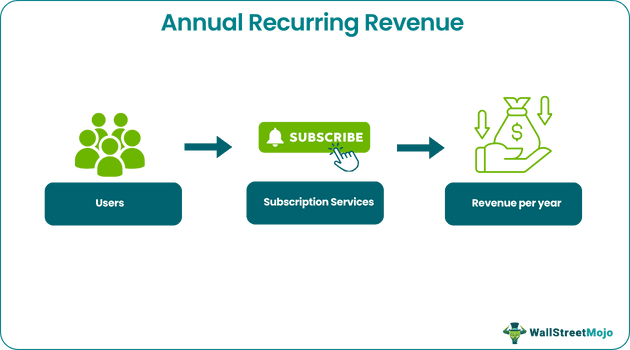

Annual Recurring Revenue (ARR) is a key metric used in subscription-based business models to measure the predictable and recurring revenue generated by a company's subscription services over one year. ARR is essential for Software as a Service (SaaS) companies. Still, it's also relevant for any business with subscription-based revenue streams, such as streaming platforms, membership services, and more.

ARR provides a more stable and predictable representation of a company's revenue stream than traditional methods focusing on one-time sales. This stability is essential for investors and stakeholders looking for consistent revenue generation. It is calculated by summing up customers' monthly or quarterly subscription fees and multiplying them by 12 (for an annual period). It excludes one-time fees, transactional charges, and other non-recurring revenue sources.

Key Takeaways

- Annual recurring revenue represents the consistent and recurring revenue generated by subscription-based services over a year. It provides a clear picture of the money a business can count on regularly.

- It is essential for subscription-based models like SaaS. It's a vital metric to measure growth, value, and sustainability in such businesses.

- Increasing ARR indicates growth in the customer base and overall revenue. A higher ARR demonstrates a successful customer acquisition and retention strategy.

- A strong and growing ARR can attract investors, demonstrating a dependable revenue stream and potential for future success.

Annual Recurring Revenue Explained

Annual Recurring Revenue (ARR) is the total amount of money the company expects to receive from its subscribers over a year. It is like the steady heartbeat of a subscription-based business. ARR helps businesses understand how much money they can rely on getting regularly from their customers.

ARR originated from subscription-based businesses, particularly in the software industry. As more companies shifted towards offering their products and services on a subscription basis, there arose a need for a metric that could accurately represent the predictable revenue generated from these subscriptions.

The term "ARR" became popular in the context of Software as a Service (SaaS) companies. These companies provide software applications through the Internet on a subscription basis. As traditional software sales models shifted to subscription models, ARR emerged as a vital metric to showcase these companies' financial health and growth prospects.

ARR's origin lies in the necessity to quantify the stability and sustainability of subscription revenue. It enables businesses to showcase their ongoing value to investors, stakeholders, and themselves, as they navigate the changing landscape of modern business models.

How To Calculate?

Calculating Annual Recurring Revenue (ARR) involves adding up the total subscription revenue one expects to receive from all subscribers over a year. Here's the formula and a step-by-step guide to help calculate ARR:

ARR = Total Monthly (or Quarterly) Subscription Revenue x 12

Step-by-Step Calculation:

- Determine Subscription Intervals: Decide whether one needs to calculate ARR monthly or quarterly. Most businesses use monthly intervals since it's the most common.

- Gather Subscriber Data: Collect data on the number of subscribers and the subscription fees they are paying. Let's say one has 100 subscribers, each paying $50 monthly.

- Calculate Total Monthly Subscription Revenue: Multiply the number of subscribers by the subscription fee. In this example, 100 subscribers * $50 per month = $5,000.

- Multiply Monthly Revenue by 12: Since one is calculating ARR for a year, multiply the total monthly subscription revenue by 12 (the number of months in a year). In this case, $5,000 per month * 12 = $60,000.

- Final Result: The calculated ARR for the business is $60,000. This means that based on current subscribers and their subscription fees, we can expect to earn $60,000 in recurring revenue over the next year.

Examples

Let us understand it better with the help of examples:

Example #1

Let's say Harry is running a SaaS company that offers project management software. He has two subscription tiers:

- Basic Plan: $20 per month per subscriber

- Premium Plan: $40 per month per subscriber

He has 500 subscribers on the Basic Plan and 300 subscribers on the Premium Plan.

1: Calculate the total monthly subscription revenue for each plan:

- Basic Plan: 500 subscribers * $20/month = $10,000/month

- Premium Plan: 300 subscribers * $40/month = $12,000/month

2: Calculate total monthly subscription revenue across both plans:

- Total Monthly Subscription Revenue = $10,000 + $12,000 = $22,000/month

3: Calculate Annual Recurring Revenue (ARR):

- ARR = Total Monthly Subscription Revenue * 12 months = $22,000 * 12 = $264,000

So, in this example, Harry’s ARR is $264,000.

Example #2

PayPal is an excellent example of a company that relies heavily on ARR. PayPal offers various subscription services, including merchant services and payment processing solutions. The company's ARR gives insight into the annual predictable revenue generated from these services.

For instance, in PayPal's Q2 2021 earnings report, the company reported an ARR of approximately $6.24 billion, indicating the projected annual revenue from its subscription-based services. This metric demonstrates PayPal's steady revenue stream and its ability to attract and retain customers in the competitive fintech landscape.

PayPal's ARR is used by investors, analysts, and stakeholders to assess the health of its subscription-based revenue model and to gauge its growth potential in the finance sector. It also influences how investors value the company and invest in its stock.

How To Increase?

Here are some practical ways to increase ARR:

- Attract More Customers:

- Marketing Efforts: Increase marketing efforts to reach a wider audience and attract new subscribers.

- Targeted Campaigns: Create targeted campaigns that highlight the unique value of subscription offerings.

- Improve Customer Retention:

- Enhance User Experience: Continuously improve product/service to give subscribers a better experience and value.

- Customer Support: Offer exceptional customer support to address issues promptly and retain satisfied customers.

- Personalization: Tailor offerings to individual customer needs, making them less likely to cancel.

- Expand Product Offerings:

- Introduce New Plans: Create new subscription plans with additional features or services to cater to customer segments.

- Upselling: Offer upgrades or premium plans to existing subscribers, providing them with more value and generating higher revenue.

- Pricing Strategies:

- Value-Based Pricing: Price subscription plans based on the value they deliver to customers, allowing them to charge more for higher-value projects.

- Tiered Pricing: Offer different pricing tiers with varying features, appealing to a broader range of customers.

- Discounts and Promotions:

- Limited-Time Offers: Run occasional promotions or discounts to incentivize new sign-ups and upgrades.

- Annual Payment Discounts: Offer discounts to customers who pay for the entire year upfront.

Benefits

Key benefits of using Annual Recurring Revenue (ARR) as a metric in business:

- Predictable Revenue: ARR represents the recurring revenue generated from subscription-based services. This predictability allows companies to plan and budget more effectively since they understand their expected income more clearly.

- Growth Tracking: By monitoring changes in ARR over time, businesses can gauge the success of their subscription offerings. Increasing ARR indicates growth in the customer base and overall revenue.

- Customer Insights: ARR helps companies identify which subscription plans drive the most revenue. This insight can guide decisions about product development, pricing strategies, and focusing resources on the most lucrative offerings.

- Investor Confidence: A higher and consistent ARR can attract investors and demonstrate the business has a reliable revenue stream. It shows that customers value the service enough to subscribe, making the company more appealing to potential investors.

- Valuation Impact: ARR can influence how a company is valued by investors, potential buyers, or during financial assessments. Higher ARR often leads to a higher valuation, reflecting the company's growth potential and stability.

Annual Recurring Revenue vs Revenue vs Revenue Run Rate

ARR focuses specifically on subscription-based revenue and provides insight into the predictability and sustainability of a subscription business model. At the same time, revenue encompasses all company income sources, including one-time sales, services, and other non-recurring revenue streams. On the other side, the revenue run rate is a projection of the annual revenue based on the current pace of revenue generation. It's often used for short-term forecasting.

A comparison of Annual Recurring Revenue, Revenue, and Revenue Run Rate is as follows:

| Metric | Definition | Focus and Application | Calculation Method |

|---|---|---|---|

| Annual Recurring Revenue (ARR) | Predictable and recurring revenue generated by subscription-based services over a year. | - Predicting future revenue - Measuring subscription growth- Valuing subscription businesses | Sum up all subscription fees from existing subscribers and multiply by 12 (months). |

| Revenue | Total income generated from all sales, products, and services. | - Overall business performance -Short-term financial snapshot | Multiply the current period's revenue (e.g., monthly) by 12. |

| Revenue Run Rate | Estimated annual revenue based on current run rate extrapolated over a year. | - Short-term revenue projection - Useful for start-ups or rapidly growing companies | Multiply current period's revenue (e.g., monthly) by 12. |

Frequently Asked Questions (FAQs)

Churn, representing lost customers or revenue due to cancellations, is generally not factored into ARR calculations. ARR assumes a constant customer base throughout the year. However, churn rate is still a critical metric to monitor, as it impacts one's business's ability to maintain or grow ARR.

No, it is a measure of positive revenue generated from subscriptions. If one is experiencing negative revenue, it might indicate issues with billing or calculations, and it should be investigated.

It is most relevant for subscription-based businesses, where customers pay on a recurring basis. If a business doesn't rely heavily on subscriptions, other revenue metrics like Total Revenue or Gross Revenue might be more appropriate.