Table Of Contents

Anchor Investor Meaning

An anchor investor is an institutional buyer who purchases a significant number of shares in a company at a fixed price before its initial public offering (IPO). This helps generate interest and attract other investors to the IPO.

Anchor investors typically make a minimum investment of a considerable amount and may be subject to a lock-in period of 30 to 180 days. Furthermore, the company sets the price at which shares are offered to anchor investors, and this price falls within the range of the IPO price band. The allotment process for anchor investors is usually completed a day before the IPO opening date. Overall, they are crucial in helping companies launch their IPOs effectively.

Key Takeaways

- An anchor investor is a qualified institutional buyer, such as a bank, mutual fund, pension fund, or other credible institution, that purchases a significant portion of a company's shares a day before its IPO opens at a fixed price within the company's price band.

- These investors are critical in attracting retail investors and increasing the company's IPO demand. However, they are restricted from selling their stock holdings for 30 days from the allotment date.

- This concept was introduced by the Securities and Exchange Board of India (SEBI) in 2009.

- SEBI allows companies to allocate up to 60% of the total IPO offering to qualified institutional buyers (QIBs), which includes anchor investors. Anchor investors must invest at least ₹10 crores in the IPO.

Anchor Investor Explained

An anchor investor is a type of qualified institutional buyer who purchases a significant portion of a company's shares before its initial public offering. They can be financial institutions, commercial banks, mutual fund houses, pension fund providers, foreign portfolio investors, etc. Their role is to provide credibility and attract retail investors to the IPO. In addition, by investing in the company before its IPO, such investors demonstrate confidence in its growth potential, which can increase demand for the IPO and potentially lead to a higher IPO price.

The Stock Exchange Board of India (SEBI) initiated the anchor quota concept in 2009. According to SEBI, every anchor investor has to apply for shares of at least ₹10 crores under this category. In addition, the total allocation to anchor investors cannot exceed 60% of the Qualified Institutional Buyer (QIB) category.

The allocation to anchor investors will be on a discretionary basis and subject to several conditions like a maximum of two anchor investors for allocation up to ₹10 crores, a minimum of two and a maximum of 15 anchor investors for allocation of more than ₹10 crores and up to ₹250 crores with a minimum allotment of ₹5 crores per anchor investor.

These investors are restricted from selling their shares for 30 days post-allotment. However, according to the revised guideline of SEBI, effective from April 1, 2022, they can sell up to 50% of their shareholding after 30 days of allotment and the remaining shares after the lock-in period of 90 days from the date of allotment.

Examples

Let's look into anchor investor examples for a better understanding:

Example #1

According to a Forbes article published in March 2022, anchor investors in Paytm's IPO were considered the biggest losers in the market decline. This is because they usually buy a large portion of a company's shares before its IPO opens at a fixed price, hoping to sell them at a higher price when the shares hit the market.

However, Paytm's IPO failed to meet expectations, with shares dropping significantly from their IPO price within a week of their listing. As a result, anchor investors who invested heavily in Paytm's IPO saw significant losses. According to reports, such investors, including mutual funds and insurance companies, lost a big amount due to the sharp decline in Paytm's share price. The poor performance of Paytm's shares has also led to concerns about the overall health of India's IPO market and the impact on investor sentiment.

Example #2

ABC plans to go public and has fixed the price band between ₹500 to ₹550 per share. An anchor investor, such as a mutual fund, pension fund, or bank, agrees to buy a significant number of shares at a fixed price of ₹550 per share. This commitment from the investor helps create demand and boosts investor confidence, making it more likely for other investors to subscribe to the IPO.

Anchor Investor vs QIB

According to SEBI, anchor investors and qualified institutional buyers are registered institutions such as commercial banks, mutual fund houses, pension fund providers, financial institutions, and foreign portfolio investors. However, there are some differences between the two, as discussed below:

| Basis | Anchor Investor | Qualified Institutional Buyer / Qualified Institutional Bidder (QIB) |

|---|---|---|

| Overview | It is a subset of QIB. | It is a SEBI-registered financial institution, FII, bank, mutual fund house, venture capital fund, insurance company, foreign investor, etc., that is eligible and knowledgeable to buy bulk securities in capital markets. |

| Qualification | Minimum investment of ₹10 crores | Minimum of $100 million investment in securities on an unrestricted basis and $25 million or higher net worth |

| Allocation Percentage | It is liable to receive 30% of the total IPO issue in a book-building process; or 60% of the shares allocated for the QIBs from the total issue size. | A QIB is liable to avail 50% of a book-build IPO's overall issue. |

| Exit | They cannot sell off their stocks after 30 days from the allotment date. | A QIB can exit at any time by selling its shareholdings. |

| Majority of Share Holdings | Such an investment doesn't provide major shareholding rights to the investor. | A QIB may enjoy a major stakeholding in the company. |

Frequently Asked Questions (FAQs)

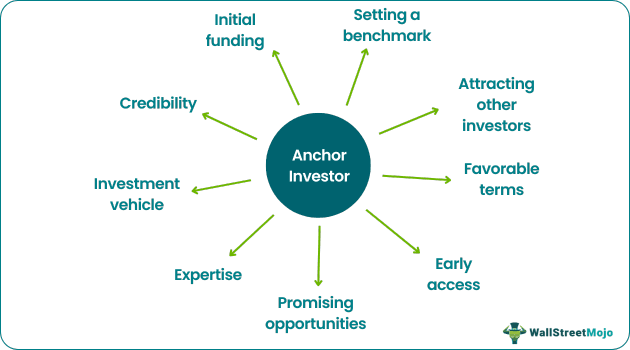

They benefit by gaining early access to promising investment opportunities and potentially receiving favorable terms for their investment. They may also benefit from the increased credibility and exposure that comes from being associated with a successful investment vehicle.

A cornerstone investor is a large institutional investor who agrees to purchase a significant portion of a company's shares during an initial public offering (IPO), providing a vote of confidence to potential investors. On the other hand, an anchor investor is typically a large investor who provides initial funding to a new fund or investment vehicle, attracting other investors and helping establish credibility.

An anchor investor typically refers to a large investor who provides initial funding to a new fund or investment vehicle, helping to establish credibility and attract other investors. In contrast, an angel investor is an individual who invests personal funds into a startup or early-stage company, often providing not only capital but also mentorship and expertise.